Stock Market Today: COVID, China Rattle the Rally

Fallout from a Chinese crackdown on private businesses, as well as reports the CDC would recommend mask usage indoors, pulled stocks from their recent highs Tuesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A second day of global fears over China's regulatory crackdown, as well as rising COVID concerns back home, were enough to knock U.S. stocks off their lofty perch Tuesday.

Rattling domestic stocks today were reports that the Centers for Disease Control and Prevention were prepared to suggest that Americans in COVID hot spots wear masks indoors to combat the spread of the highly transmissible delta variant.

Also, Chinese markets resumed their recent selloff this morning as Beijing continued to tighten its grip on technology and education firms. Selling in stocks such as Alibaba (BABA, -3.0%) and Tencent (TCEHY, -2.3%) bled into the U.S. tech and communications sectors, where names such as Apple (AAPL, -1.5%), Alphabet (GOOGL, -1.6%) and Facebook (FB, -1.3%) declined.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

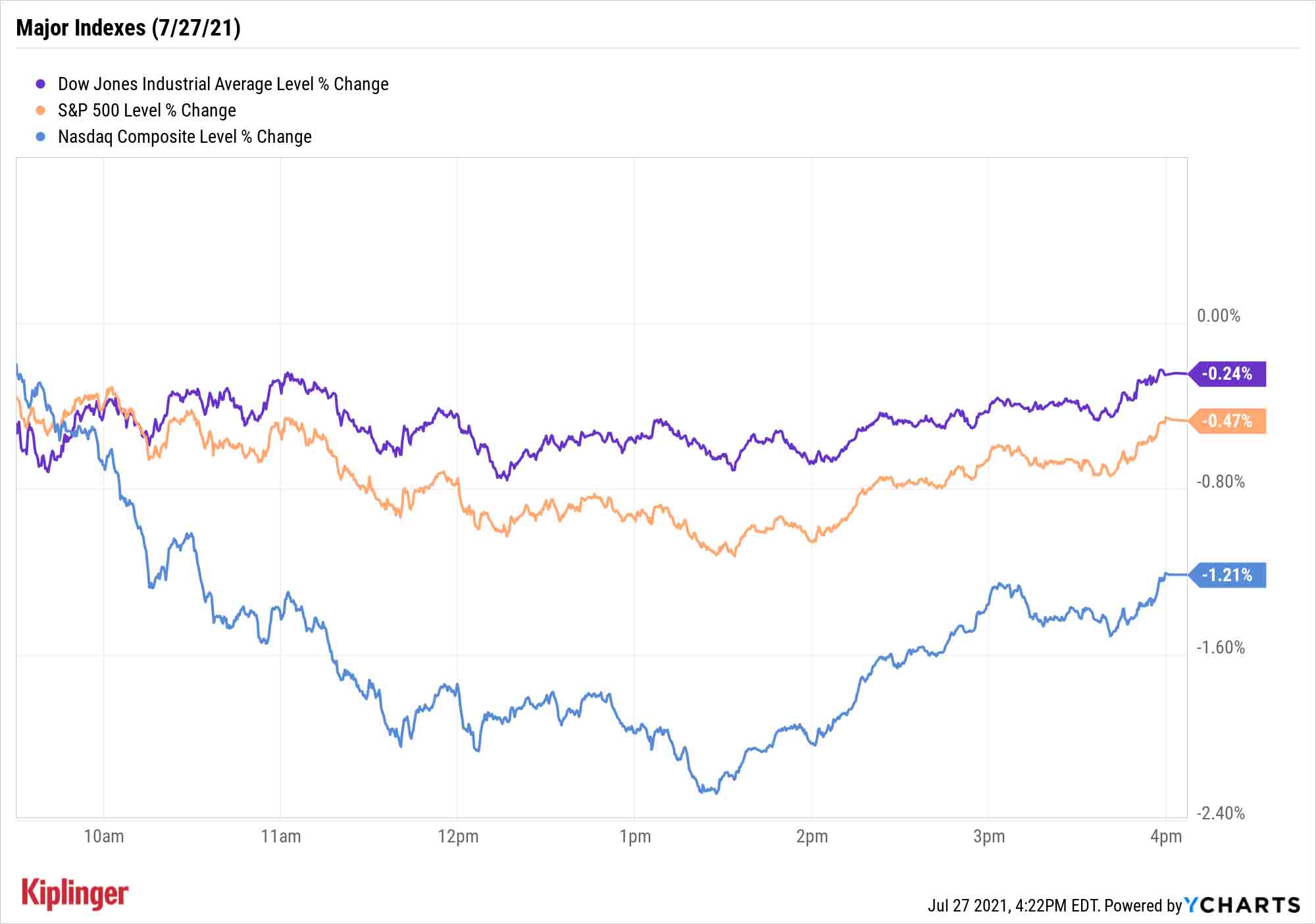

This pressure on the "FAANGs" was felt most by the Nasdaq Composite, which declined 1.2% off yesterday's all-time high to 14,660. The tech-heavy index snapped a five-session win streak, as did the Dow Jones Industrial Average (-0.2% to 35,058) and S&P 500 (-0.5% to 4,401).

And a reminder: Tomorrow afternoon, markets will have to contend with the conclusion of the Federal Reserve's latest policy meeting.

"We're not expecting fireworks at this Fed meeting," says LPL Financial Fixed Income Strategist Lawrence Gillum. "But we are expecting the committee to go further down the road in discussing the when and how to start removing the emergency level monetary accommodation it has been providing markets."

"The biggest unknown that could complicate matters for the Fed is a drop in spending from consumers who spent less early on during the economic reopening because they didn't feel safe even with a relaxation of mask mandates for vaccinated individuals," adds Danielle DiMartino Booth, CEO and chief strategist of Quill Intelligence. "If this cohort is discouraged by the increasing numbers of Covid-19 cases among those who have been doubly-vaccinated, spending could be in for a slowdown."

Other news in the stock market today:

- The small-cap Russell 2000 declined 1.1% to 2,191.

- Tesla (TSLA) fell 2.0% after the electric vehicle (EV) maker unveiled its second-quarter earnings results. Tesla reported an adjusted profit of $1.45 per share – a roughly 230% improvement from its year-ago results – while revenue arrived at $11.96 billion (+98% year-over-year). Both figures exceeded analysts' estimates. However, in a subsequent call, Tesla CEO Elon Musk warned that the global semiconductor shortage "remains quite serious," adding that chips are "fundamentally the governing factor on our output." Musk also said he would only participate in future earnings calls if "there's something important" to say. Despite the earnings reaction, Argus analyst Bill Selesky reiterated his Buy rating on the stock, calling TSLA "the undisputed leader" in the EV space.

- United Parcel Service (UPS) was another name that took a post-earnings dive today, ending the session down 7.0%. While the delivery giant reported stronger-than-expected adjusted Q2 earnings of $3.06 per share on $23.42 billion in revenue (up 44% and 14% YoY, respectively), domestic package volume was down around 3%. CFRA analyst Colin Scarola kept his Strong Buy rating on UPS, however, saying the shares are "highly undervalued."

- U.S. crude oil futures shed 0.4% to close at $71.65 per barrel.

- Gold futures eked out a marginal gain to settle at $1,799.80 an ounce.

- The CBOE Volatility Index (VIX) jumped 10.1% to 19.36.

- Bitcoin prices cooled off after the weekend's hot run, declining 4.8% to $37,916.27. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Safety First! (And Second, And Third ...)

Let's look at the market's pain points, and where investors felt relief.

While we did see a selloff in tech, which in 2020 was effectively COVID-proof, the threat of renewed mask guidance clearly spooked cyclical recovery picks as well, with energy (-1.0%) and consumer discretionary (-1.0%) among the hardest-hit sectors.

Tuesday instead belonged to stereotypical safety plays – typically yield-bearing hidey-holes where investors can wait out a COVID resurgence while leaning on income to pad returns.

Healthcare stocks, for instance, provide both some level of protection from stricter coronavirus measures while also being able to capitalize on renewed demand for vaccinations and treatments.

Performing even better were real estate investment trusts (REITs) and utility stocks, thanks to a decline in Treasury yields – after all, lower rates on bonds help make their already above-average yields look all that much more attractive.

Investors should note that even utilities – the first name in safety plays – aren't immune to COVID pressures, and did sell off with the rest of the market in 2020. Nonetheless, their typically stable businesses make them a favorite of investors looking to get through short-term bouts of volatility. Read on as we look at nine of the utility sector's best opportunities through the rest of this year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.