Stock Market Today: Stocks Shake Off Delta Doubts, S&P 500 Tags New High

The S&P 500 set yet another new all-time high Tuesday as investors refused to hit the panic button over resurgent COVID caseloads.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

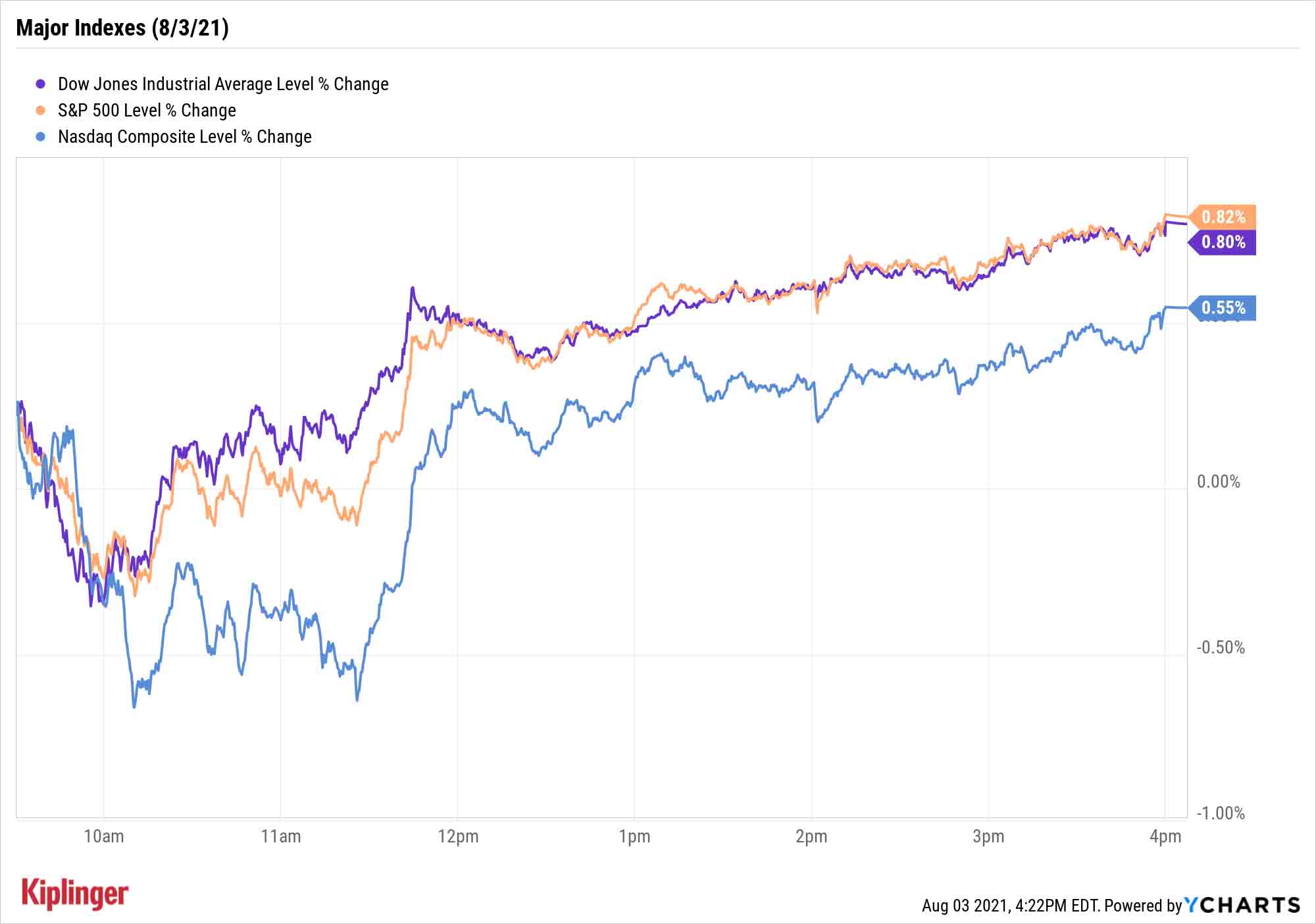

Tuesday's trading session looked like Monday's in reverse, with stocks stumbling out of the blocks before regaining their footing and closing out the day in the green.

The market's resilience comes in the face of rising concern about the COVID-19 delta variant as it spreads nationwide, with particularly large outbreaks across the South. New York City said it would mandate proof of vaccination for many indoor activities, and Tyson Foods (TSN) joined a growing list of companies requiring their workforces to be inoculated against COVID-19.

Still, the market is hardly flinching.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The delta variant has emerged as a credible downside risk to market performance, but one that we expect to slow, not derail, the recovery," says Lauren Goodwin, economist and portfolio strategist at New York Life Investments. "Consumers have learned to live with the virus, and the widespread availability of vaccines makes renewed shutdowns politically difficult."

Second-quarter earnings were also in focus Tuesday.

Under Armour (UAA, +7.5%) jumped as its plan to prioritize branded stores and online sales over department stores and discounters bore fruit; Q2 sales and profits beat expectations, and the athletic apparel retailer lifted its 2021 revenue outlook. Eli Lilly (LLY, +3.8%) missed on Q2 profits but exceeded estimates for sales, and mall operator Simon Property Group (SPG, +2.6%) announced a rebound in revenues to pre-pandemic levels.

The Dow Jones Industrial Average (+0.8% to 35,116) and Nasdaq Composite (+0.6% to 14,761) advanced to within close reach of their all-time highs, while the S&P 500 (+0.8% to 4,423) set a fresh record close.

Other news in the stock market today:

- The small-cap Russell 2000 gained 0.4% to 2,223.

- Take-Two Interactive (TTWO) was a big earnings loser, slumping 7.7% in the wake of its quarterly results. The video game maker reported higher-than-expected fiscal first-quarter earnings of $1.30 per share and revenue of $813.3 million. However, it expects current-quarter earnings per share to arrive between 35 cents and 45 cents on $740 million to $790 million in sales – below analyst estimates. TTWO also gave weaker-than-anticipated full-year guidance.

- It had been a lackluster market debut for Robinhood (HOOD), which went public last Thursday. HOOD spent its first few trading sessions churning below its $38 initial public offering (IPO) price, but today shot up 24.2% to close at $46.80. Wall Street was busy speculating as to what the catalyst for today's surge may have been, with some pointing to the financial services platform emerging as Fidelity's "top traded stock" to being mentioned on Reddit's WallStreetBets (WSB) – the community that has sparked insanely volatile moves in meme stocks this year.

- U.S. crude oil futures fell 1% to end at $70.56 per barrel.

- Gold futures gave back 0.4% to settle at $1,814.10 an ounce.

- The CBOE Volatility Index (VIX) dropped by 7.5% to 18.01.

- Bitcoin declined by 3.0% to $37,989.75. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Rocky Times Ahead?

As August gets started, several experts continue to warn about the potential for turbulence going forward.

Lindsey Bell, chief investment strategist for Ally Invest, notes that the S&P 500 has avoided a 3%-or-greater fall since May (a rare occurrence), "but the tide may be changing."

"August is the third worst performing month of the year, and it typically comes with increased volatility," she says. "Add to that the probability of lower volumes with people eager to take vacations before school starts back up."

But if a summer shake-up is in the cards, it won't just be because of weak seasonality.

"The Delta variant presents and the potential for policy angst from the Fed's upcoming Jackson Hole meeting could lead to volatility showing up as the summer comes to a close," Bell says.

If you're the type to reach for the Mylanta whenever the market's waters get choppy, we gently remind you that stocks with sizable yields can help smooth out returns over time by providing another source of performance (dividends) than just straight price. You can find plenty of generous payers in market niches such as real estate investment trusts (REITs) and master limited partnerships (MLPs).

But if you like big, blue-chip and boring, consider the burly yields in these large-cap healthcare plays. There's little shock value in these five widely beloved stocks – just large dividends, solid fundamentals and a positive outlook from Wall Street's "smart money."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

These Were the Hottest S&P 500 Stocks of the Year

These Were the Hottest S&P 500 Stocks of the YearAI winners lead the list of the S&P 500's top 25 stocks of 2025, but some of the names might surprise you.

-

'Humbug!' Say Consumers, Despite Hot GDP: Stock Market Today

'Humbug!' Say Consumers, Despite Hot GDP: Stock Market Today"The stock market is not the economy," they say, but both things are up. Yet one survey says people are still feeling down in the middle of this complex season.

-

Stocks Struggle Ahead of November Jobs Report: Stock Market Today

Stocks Struggle Ahead of November Jobs Report: Stock Market TodayOracle and Broadcom continued to fall, while market participants looked ahead to Tuesday's jobs report.