Stock Market Today: S&P, Nasdaq Score New Highs Ahead of Jobs Day

Weekly jobless claims arrived in line with expectations ahead of tomorrow's nonfarm payrolls report.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks gained ground on Thursday as Wall Street digested the latest round of economic and earnings reports.

Ahead of tomorrow's highly anticipated nonfarm payrolls report, data showed weekly jobless claims fell to 385,000 last week – in line with expectations – while continuing claims dropped below 3 million for the first time since March 2020.

"The Fed has made it clear that it wants to see further progress in the labor market before it begins tweaking monetary policy," says Michael Reinking, senior market strategist for the New York Stock Exchange.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Earlier this week Federal Reserve Governor Christopher Waller put some numbers around that," Reinking adds, "saying that if he saw the next two jobs reports between 800,000 - 1 million, he'd be ready to move on tapering."

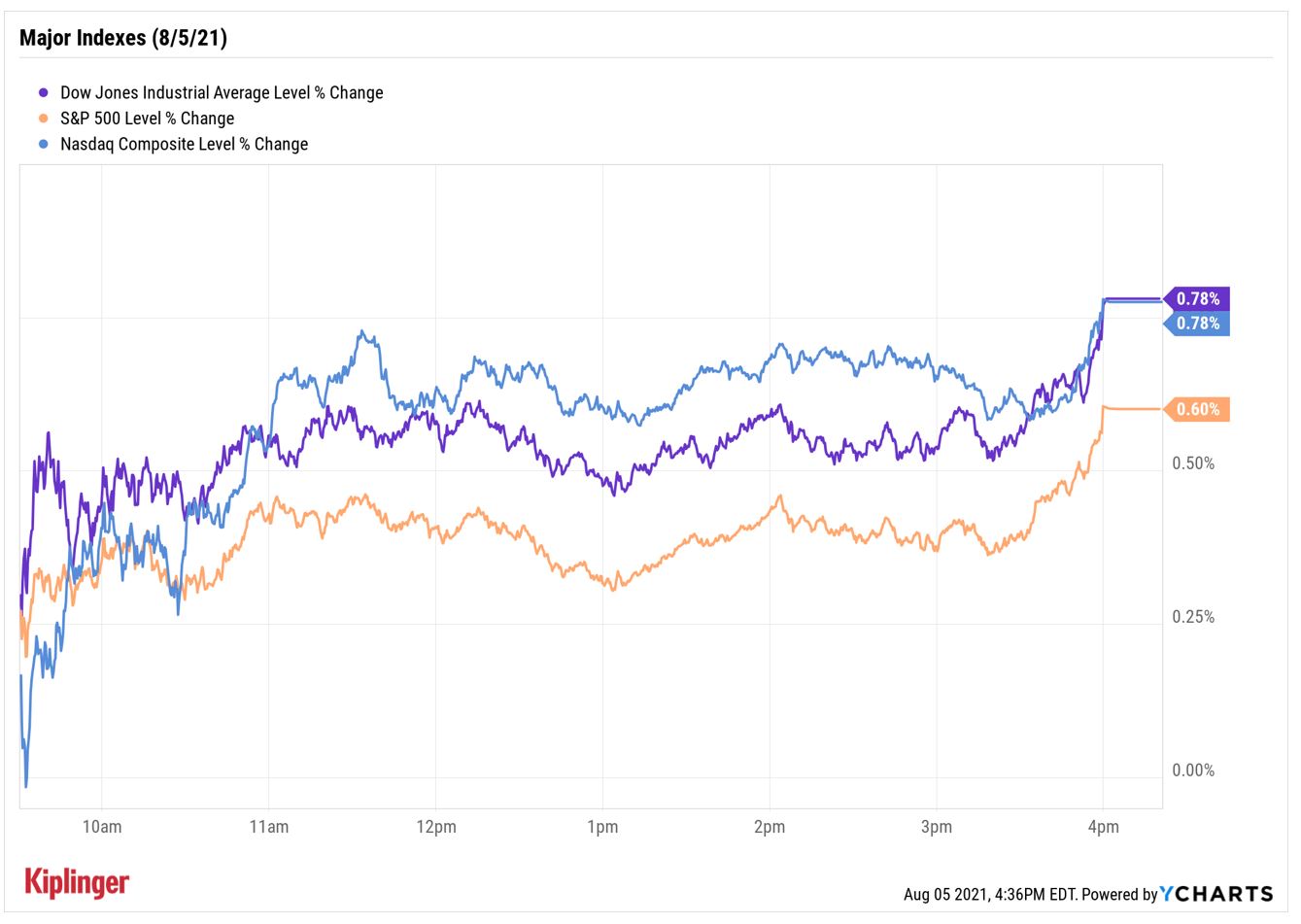

And on the earnings front, a big revenue beat from online travel agent Booking Holdings (BKNG, +5.9%) helped push the Nasdaq Composite up 0.8% to 14,895 and the S&P 500 Index up 0.6% to 4,429.10 – new record highs. The Dow Jones Industrial Average jumped 0.8% to 35,064.

Other news in the stock market today:

- Etsy (ETSY) got knocked after earnings, finishing the session down 9.7%. The online marketplace reported higher-than-anticipated earnings of 68 cents per share and revenue of $528.9 million for its second quarter, but gave current-quarter revenue guidance below analysts' consensus estimate.

- Fastly (FSLY) was another post-earnings loser, shedding 10.4%. The cloud services provider said the fallout from an early June outage negatively impacted its top line in the second quarter, with the $85.1 million it brought in falling short of the consensus estimate. "We expect to see a downstream impact on revenue from the outage in the near-to medium-term as we work with our customers to bring back their traffic to normal levels," wrote Fastly CEO Joshua Bixby in a note to shareholders. However, FSLY did report a slimmer-than-anticipated per-share loss of 15 cents for the three-month period.

- U.S. crude oil futures gained 1.4% to settle at $69.09 per barrel, snapping their three-day losing streak.

- Gold futures ended the day down 0.3% at $1,808.90 an ounce.

- The CBOE Volatility Index (VIX) fell 3.8% to 17.28.

- Bitcoin jumped 7.1% to $40,687.15. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Don't Give Up on Small Caps

Small caps were the big winners today, with the Russell 2000 climbing 1.8% to 2,236.

The benchmark has lagged its larger-cap peers in recent weeks as concerns over the delta variant of COVID-19, rising inflation and supply-chain worries led many investors to reduce exposure to riskier assets.

However, Ken Johson, investment strategy analyst at Wells Fargo Investment Institute, sees many of these uncertainties being ironed out as vaccination rates progress and both labor supply constraints and supply-chain disruptions ease. As such, "We view recent underperformance as an opportunity for investors and remain favorable to small-cap equities," says Johnson.

Those looking to add value plays to their portfolio may want to consider these high-potential small-cap stocks. Or, these 11 top-rated Russell 2000 stocks could fit the bill. All of the names on this list are considered some of the best small-cap stocks to buy now, based on their high analyst ratings and bullish outlooks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.