Stock Market Today: Dow Hits Record on Rousing Jobs Report

Friday's better-than-expected July nonfarm payrolls release lifted some stocks, but hindered others, as investors wondered whether the Fed would begin tapering asset purchases.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

There were no ifs, ands or buts about it among Wall Street's experts – July's job report was good. But concerns about whether it was so good that it would affect Federal Reserve monetary policy kept a lid on parts of the market Friday.

Nonfarm payrolls jumped by 943,000 in July, topping estimates by 100,000 jobs, and the unemployment rate declined to 5.4% from 5.9% in June. Better still, June's count was revised higher by 88,000 jobs to 938,000.

Fed Chair Jerome Powell has said progress on the employment front is a key measuring stick for the central bank's decision about when to pare its massive monthly asset purchases.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Today's payroll numbers were significant since this was the final print before the long-awaited Jackson Hole Symposium," says Anu Gaggar, global investment strategist for Commonwealth Financial Network. "It is widely expected that the Fed will give a more concrete indication of tapering then provided it gets the 'substantial progress' it is looking for."

So, was July's report enough evidence?

"This number was really good, but the best part was it wasn't so strong that the Fed would have to change policy," says Ryan Detrick, chief market strategist for LPL Financial.

However, some, including Rick Rieder, BlackRock's chief investment officer of global fixed income, disagree.

"The Fed should move forward with its tapering program (especially in mortgages), as we appear to already be very close to maximum employment and, simultaneously, we may be at risk of witnessing an overheating in some areas," he says.

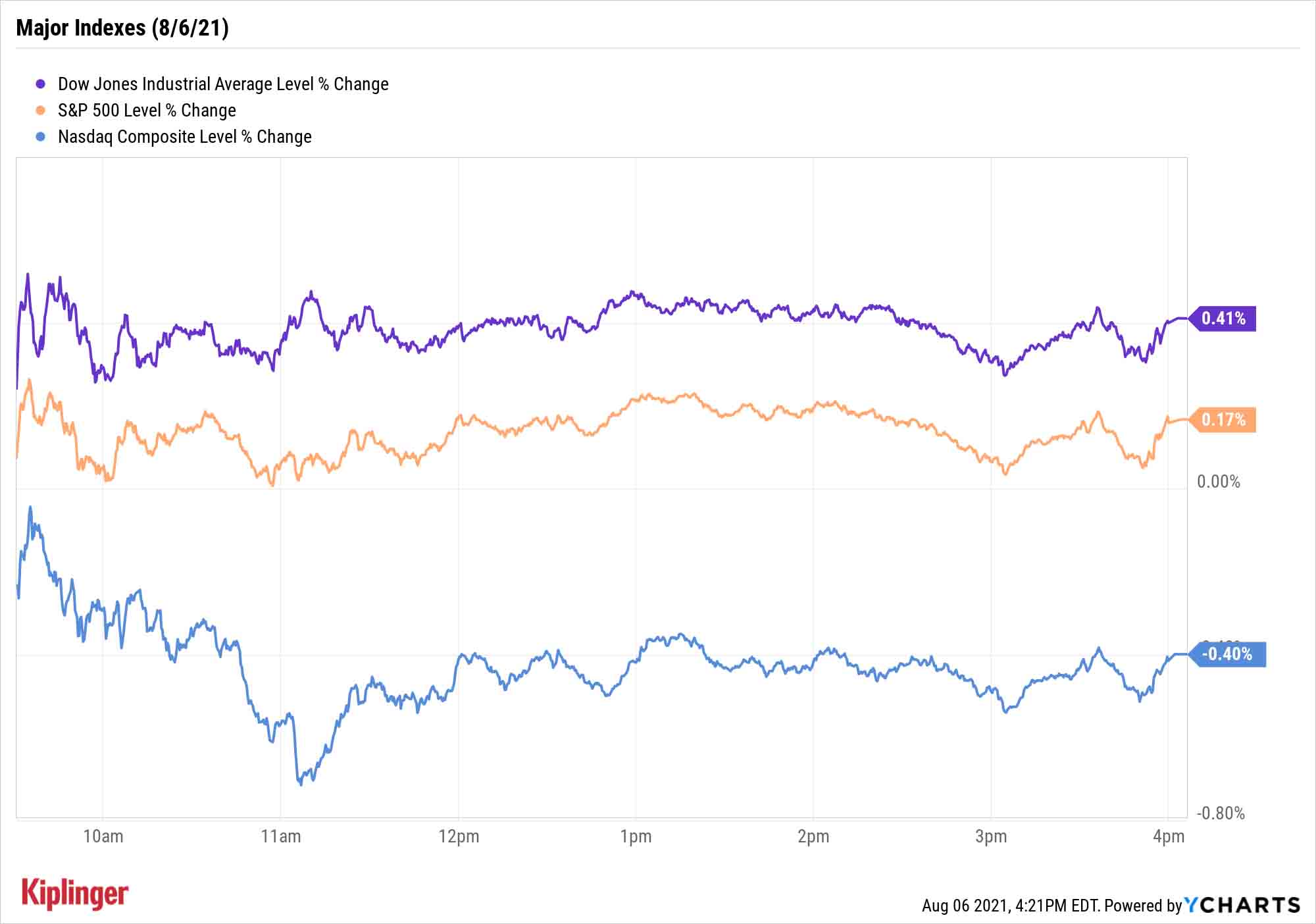

Sectors hinging strongly on the economic recovery, such as financials (+2.1%) and materials (+1.5%), helped lift both the Dow Jones Industrial Average (+0.4% to 35,208) and S&P 500 (+0.2% to 4,436) to new record highs. Relative weakness in consumer discretionary (-0.7%) and technology (-0.1%) sent the Nasdaq Composite 0.4% lower to 14,835.

Other news in the stock market today:

- The small-cap Russell 2000 bested its large-cap counterparts, improving 0.5% to 2,247.

- Zynga (ZNGA) ended the week on a sour note, plummeting 18.2% after earnings. The FarmVille creator reported higher-than-anticipated earnings of 2 cents per share and revenue of $720 million in its second quarter. However, the company's $711.9 million in bookings for the three-month period, as well as its current-quarter outlook, both fell short of analysts' estimates.

- Yelp (YELP, +5.2%) was a rosier post-earnings mover. The online review company posted an unexpected adjusted profit of 5 cents per share in Q2; revenues of $257.2 million also came in above the consensus estimate. Additionally, YELP raised its full-year guidance.

- U.S. crude oil futures gave back 1.2% today to end at $68.28 per barrel. On a weekly basis, black gold shed 7.7%, marking its biggest week-over-week decline since October.

- Gold futures fell 2.5% to settle at $1,763.10 an ounce.

- The CBOE Volatility Index (VIX) declined 6.1% to 16.23.

- Bitcoin prices jumped to their highest levels since May, gaining 5.3% to $42,844.28. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

The Best Picks for 2021's Second Half

The way forward is hardly dreary, but it certainly doesn't get easier from here.

FactSet Senior Earnings Analyst John Butters' latest Earnings Insight reveals that the S&P 500 is on pace to report its highest quarterly revenue growth since FactSet started tracking the metric in 2008. Between actual sales and those estimated from companies still to report in the second quarter, the S&P 500 is signaling 24.7% revenue growth over Q2 2020 – the depths of the COVID 19 pandemic – which would shatter the 12.7% expansion recorded in Q2 2011.

But more difficult comparisons for the rest of the year will bring down that rate, says Butters: "The estimated revenue growth rate for Q3 2021 is 14.4%, while the estimated revenue growth for Q4 is 11.0%."

This environment is what you must consider when evaluating stocks for the next few months – and what we've kept in mind as we highlighted some of the top opportunities for the remainder of 2021.

We've sliced and diced the market, evaluating growth plays and value picks alike, and exploring sectors from energy to comms. But we cap our second-half lookahead with a wide range of stocks that, for numerous reasons, appear poised to outperform over the next few months.

While several of the best stocks for the rest of 2021 are piggybacking more specific trends, the overarching theme here is much the same as it was to start the year: the American economy finding its feet again.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.