Stock Market Today: Markets Coast as COVID Variant Cases Climb

Growing signs that the COVID-19 delta variant could be hindering the global economy weighed on oil Monday, but the major indexes finished mixed.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The new trading week kicked off on a tranquil note, with the markets barely budging Monday despite signs worldwide that the COVID-19 delta variant could throw a wrench into the recovery.

Here in the U.S., COVID cases have reached six-month highs, averaging 100,000 cases for three consecutive days, according to Reuters – up 35% week-over-week, with hospitalizations up 40%. Spending on airline travel slowed by nearly 20% from a mid-July peak, as well, according to JPMorgan analysts.

Meanwhile, China, Indonesia and other Asian countries, as well as Australia, have stepped up COVID-related lockdowns in response to delta-variant outbreaks.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

U.S. crude oil futures felt the pinch, slipping 2.6% to $66.48 per barrel Monday on fears of falling demand. Meanwhile, Pfizer (PFE, +2.0%) vaccine partner BioNTech (BNTX, +15.0%) soared after beating second-quarter earnings expectations by 43%; rival Moderna (MRNA, +17.1%) rose in sympathy, also sparked by a provisional authorization for its vaccine to be used in Australia.

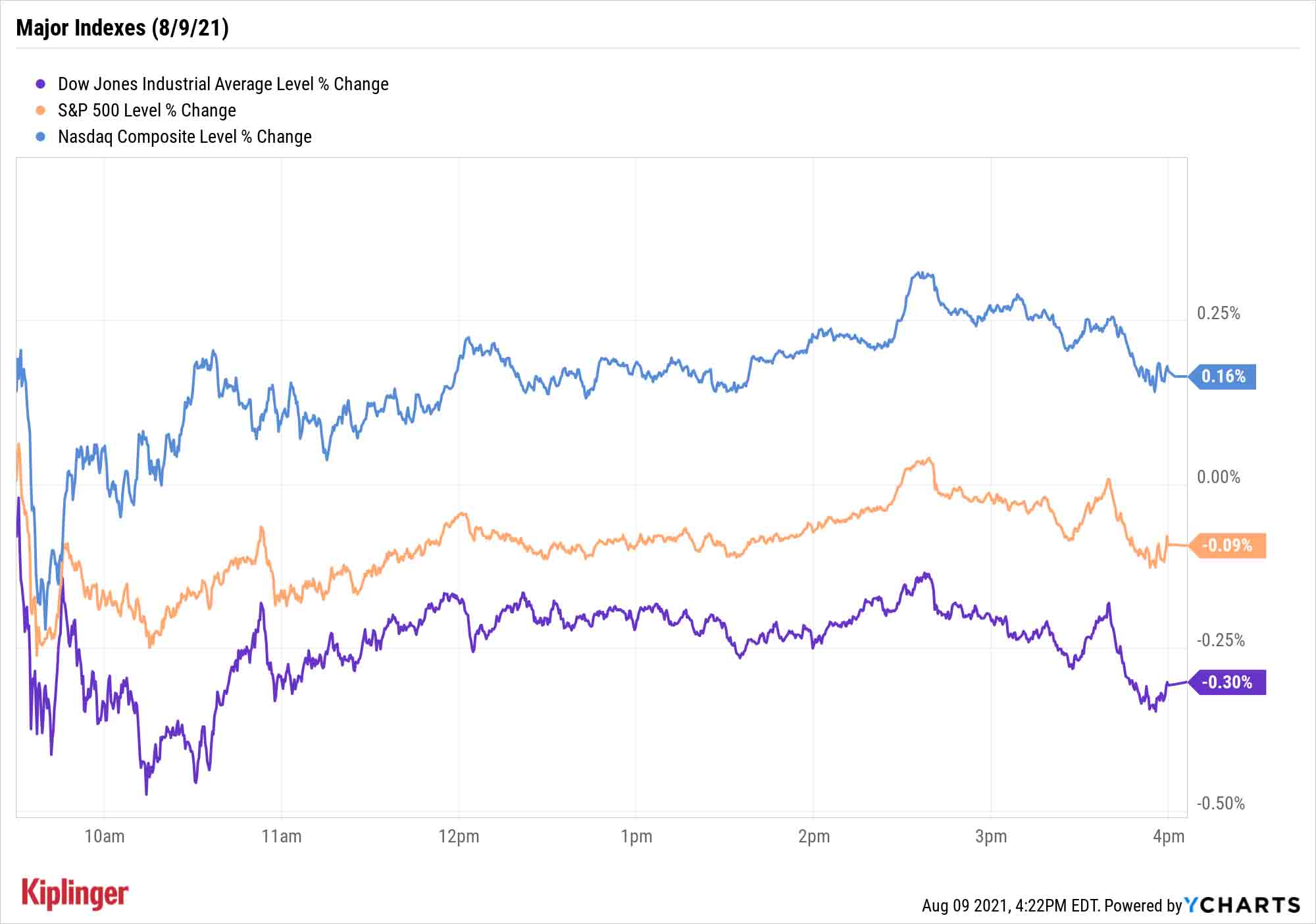

The broader markets were largely unchanged, however; the Dow Jones Industrial Average (-0.3% to 35,101) and S&P 500 (down marginally to 4,432) backed away from Friday's all-time highs, while the Nasdaq Composite eked out a 0.2% gain to 14,860.

Other news in the stock market today:

- The small-cap Russell 2000 declined 0.6% to 2,234.

- Tesla (TSLA) was one of the best mega-cap performers on Monday, gaining 2.1% after Jefferies analysts upgraded it, as well as Ford (F, -0.4%) and Lithia Motors (LAD, -0.5%), on electric-vehicle hopes. "We believe auto [manufacturers] can transition into an EV-driven industry of connected products while also operating with less and better allocated capital," they write. "We think this could lead to a re-rating of Auto OEMs' valuation multiples."

- Air Products & Chemicals (APD, -5.2%) was one of the few big names on the earnings calendar Monday, struggling after fiscal Q3 earnings missed analyst expectations. The company also lowered its full-year profit guidance.

- Gold futures slid 1.2% to $1,742.10 per ounce thanks in part to a stronger U.S. dollar.

- The CBOE Volatility Index (VIX) gained 3.6% to 16.73.

- Bitcoin surged 7.3% over the weekend to $45,985.31. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Keep It Simple

For the past couple weeks, we've discussed continued warnings of late-summer volatility – and the ways you can position yourself to protect against a dip or protect against it.

But for many investors whose plans can be measured in decades, not just years or even months, the best move you can make might be the easiest move of all: just keep strengthening your "core."

We've long extolled the virtues of building the backbone of your retirement portfolio with inexpensive funds – one of the inspirations behind recommendations such as our Kip 25 mutual funds and our Kip ETF 20. But even just one fund – if it's the right fund – could do the trick for many investors.

To investing icon Warren Buffett, the path for most people is simple: buy an S&P 500 fund.

"I recommend the S&P 500 index fund and have for a long, long time," he says, the same sentiment he has expressed for years. The famed stock picker has even put his money where his mouth is, purchasing two S&P 500 funds for the Berkshire Hathaway equity portfolio in 2019.

But what's the best way to play the index? Read on as we explore seven S&P 500 ETFs – including several funds that directly track the 500-company index, as well as a few ETFs that provide unique twists for tactical investors and even traders.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks Extend Losing Streak After Fed Minutes: Stock Market Today

Stocks Extend Losing Streak After Fed Minutes: Stock Market TodayThe Santa Claus Rally is officially at risk after the S&P 500's third straight loss.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.