Stock Market Today: Another Dow Record as Core Inflation Starts to Ease

Headline inflation for July was on par with expectations, but lower-than-expected core CPI gains helped lift the Dow and S&P 500 to new highs Wednesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

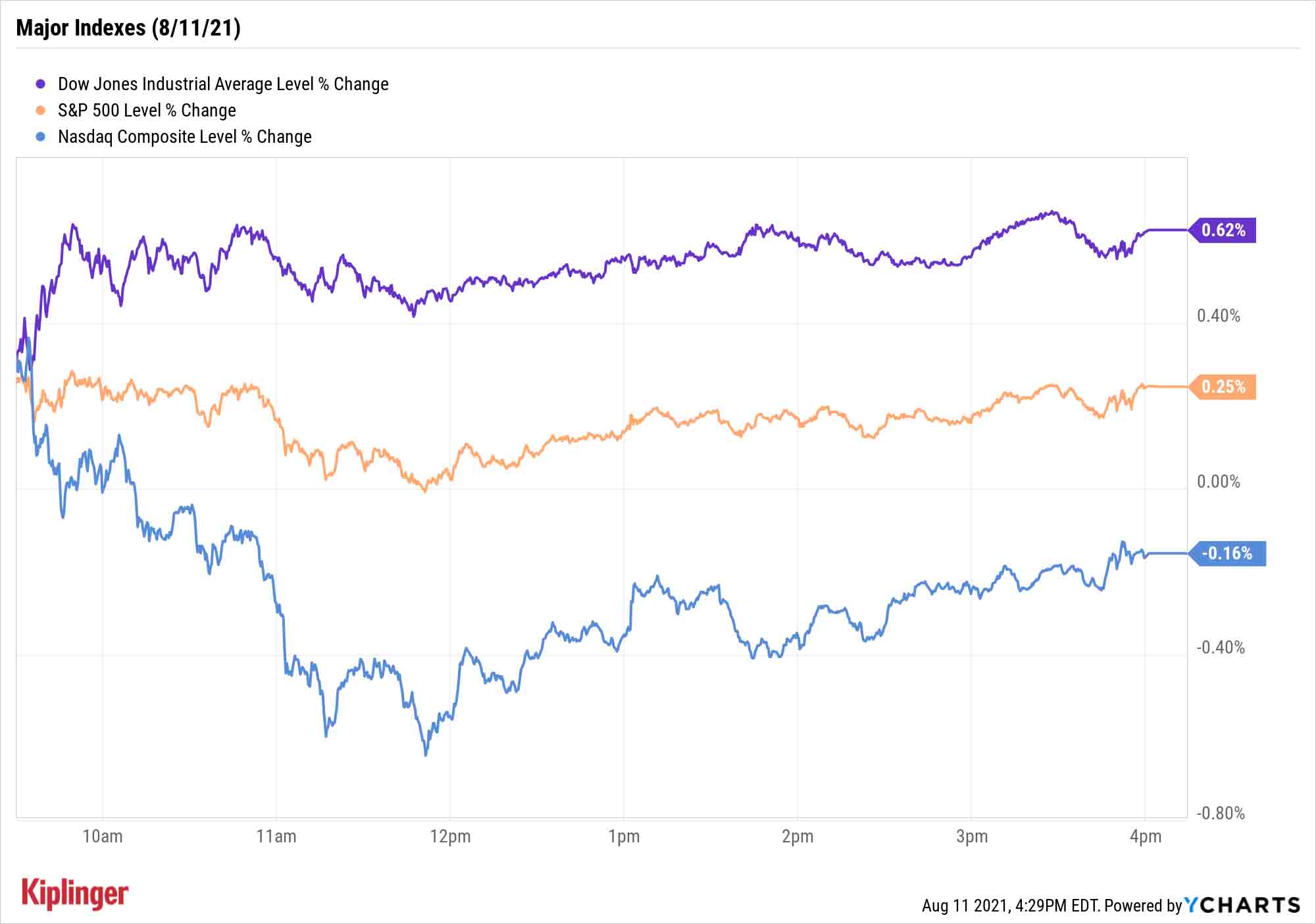

Wall Street expected red-hot inflation yet again in July, and they got it … but moderation in "core" consumer prices calmed some investor anxieties and helped the Dow and S&P 500 notch record highs for a second consecutive day.

The U.S. Bureau of Labor Statistics reported Wednesday that the headline consumer price index (CPI) grew 0.5% month-over-month and 5.4% year-over-year, largely in line with economists' projections.

However, core CPI, which excludes food and energy, rose by just 0.3% and 4.3%, respectively – lower than expectations.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"It is an interesting world where 5.4% year-over-year price increases are met with a sigh of relief," says Michael Reinking, senior market strategist for the New York Stock Exchange. "This data does feed some of the 'transitory' argument and since it was no worse than feared shouldn't shift Fed policy expectations."

"The more volatile components that are heavily tied to the economic reopening, as expected, have started to moderate," adds LPL Financial Fixed Income Strategist Lawrence Gillum. "This inflation release came in as expected, and so it doesn't really change our view that we think these higher prices we're seeing currently will subside over time."

Kiplinger Letter Economist David Payne, however, still believes "stronger inflation is likely to stay with us for a while."

Dow Jones Industrial Average component Caterpillar (CAT, +3.6%) had another strong day on the back of the Senate passing an infrastructure bill; Walgreens Boots Alliance (WBA, +2.7%) and Home Depot (HD, +1.7%) also chimed in to help the DJIA close up 0.6% to an all-time high 35,484.

The S&P 500 (+0.3% to 4,447) also scored a new record, while the Nasdaq (-0.2% to 14,765) lagged again.

Other news in the stock market today:

- The small-cap Russell 2000 improved by 0.5% to 2,250.

- Coinbase Global (COIN, +3.2%) was a notable mover today after the cryptocurrency exchange reported its second-quarter results. For the three-month period, COIN brought in higher-than-anticipated adjusted earnings of $3.45 per share and revenues of $2.23 billion. What's more, monthly transacting users (MTUs) surged 44% from the previous quarter to a record 8.8 million and trading volume increased 38% sequentially to $462 billion. David Trainer, CEO at investment research firm New Constructs, isn't terribly impressed. While the results were strong, they were not "good enough to justify the stock's very expensive valuation of roughly $56 billion," he says. "To justify its current valuation, Coinbase would need to attain higher revenue than established rivals like Nasdaq (NDAQ) and Intercontinental Exchange (ICE), which is a highly unlikely scenario. Even Coinbase's ideal future is already priced into the stock, leaving little upside for investors."

- It was an earnings whiff for WW International (WW), which plunged 24.6% in the wake of its earnings report. In the second quarter, the weight management specialist reported an adjusted profit of 48 cents per share on $311 million in revenues, both figures falling well short of what analysts were expecting. Additionally, the 4.9 million total subscribers WW had in the June quarter was down from the year prior. This prompted a downgrade to Hold from Buy at Jefferies, though analyst Stephanie Wissink says they still "see long-term areas of intrigue" on the name.

- U.S. crude oil futures rose 1.4% to finish at $69.25 per barrel. Today's gain came as data showed a decline in domestic crude inventories last week, which offset reports the White House is urging the Organization of the Petroleum Exporting Countries and its allies (OPEC+) to raise oil output by more than what was agreed upon at their July meeting.

- Gold futures jumped 1.2% to settle at $1,753.30 an ounce.

- The CBOE Volatility Index (VIX) declined by 4.5% to 16.03.

- Bitcoin prices gained 2.1% to hit $46,483.13 – a level it last saw in mid-May. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Aim for the Middle

A market doubler in about 17 months? We're close!

Howard Silverblatt, senior index analyst for S&P Dow Jones Indices, wrote late last night that the S&P 500 was 0.86% away from doubling on a pure price basis since the March 23, 2020, lows; as of today's close, the index is now just 0.61% away.

That's great for those of you holding S&P 500 funds, but don't get too smug – smaller stocks have rebounded even more. The S&P SmallCap 600 Index has roared far louder out of the bear-market trench, up 129% in the same time, following a well-worn historical pattern of small-cap stocks thriving in the early stages of an economic recovery.

Today, however, we want to give the spotlight to mid-cap stocks, which often get lost in the shuffle despite excellent risk-adjusted performance.

The S&P MidCap 400 has snapped back by 125% since last March – only slightly less than the small-cap index, but with noticeably less volatility. That's just what mid-cap stocks do.

These "Goldilocks" companies (typically between $2 billion and $10 billion in market value) can offer the best of two worlds: better financial stability and access to capital than their small-cap counterparts, but also more robust growth prospects than their large-cap contemporaries.

This group of 11 mid-cap stocks is exemplary of this dynamic.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks Extend Losing Streak After Fed Minutes: Stock Market Today

Stocks Extend Losing Streak After Fed Minutes: Stock Market TodayThe Santa Claus Rally is officially at risk after the S&P 500's third straight loss.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Santa Claus Rally at Risk as Tech Stocks Slump: Stock Market Today

Santa Claus Rally at Risk as Tech Stocks Slump: Stock Market TodayThe Nasdaq Composite and Dow Jones Industrial Average led today's declines as investors took profits on high-flying tech stocks.