Stock Market Today: Stocks Recoil as Retail Sales Retreat

The major indexes all took a step back Tuesday in the wake of a disappointing July retail sales report.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

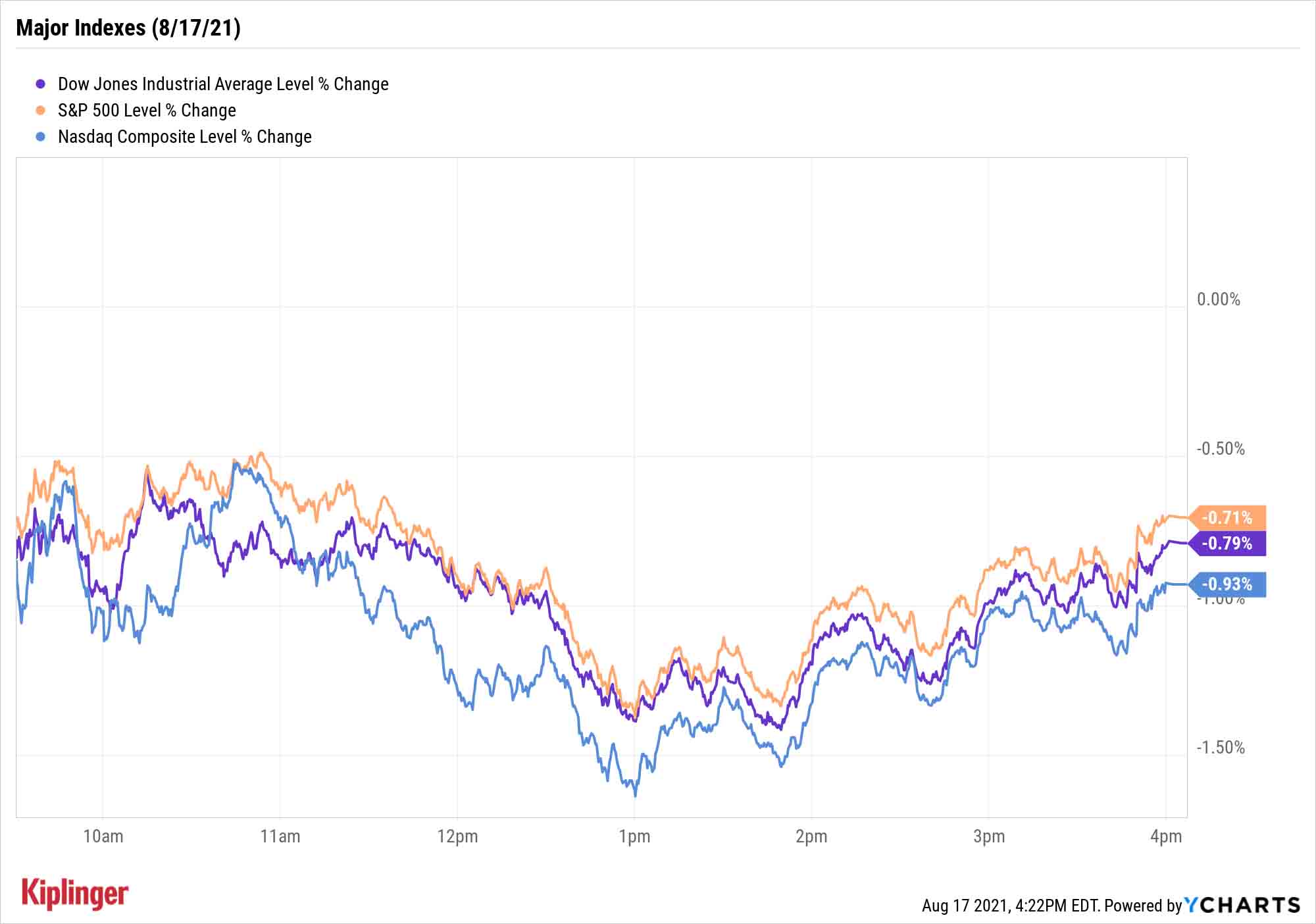

Tuesday's discouraging U.S. retail sales report did what yesterday's global headlines couldn't: knock down stocks early and keep them down through the close.

Investors learned before the opening bell that July retail sales declined 1.1% month-over-month, a far worse reading than the 0.3% dip economists expected. Core retail sales, which exclude gasoline, autos and a few other categories, also missed expectations, retreating 1.0% vs. June.

"Retail sales have experienced large swings this year, led by the timing of various pandemic-relief stimulus measures," says Barclays economist Pooja Sriram. "Sales have typically surged in the months that households received rebate checks, followed by sharp declines in the subsequent months. Therefore, a part of the decline in July sales likely reflects fading stimulus effects, with the bulk of the stimulus payout under the American Rescue Plan having been distributed in the first half of this year."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The poor data made for a rough day across the board.

The Nasdaq Composite dipped 0.9% to 14,656, and the S&P 500 lost 0.7% to 4,448. The Dow Jones Industrial Average closed off 0.8% to 35,343, also hurt by a 4.3% decline in Home Depot (HD), which beat quarterly earnings estimates but delivered disappointing same-store sales.

What today's damage signals, however, is up for debate.

"Tuesday's stock market decline is a trader's tantrum and nothing more," says George Ball, chairman of investment firm Sanders Morris Harris. "The move is a one-day overdone reaction to some disappointing retail sales data and continued geopolitical tensions in Afghanistan."

Chris Zaccarelli, chief investment officer for registered investment advisor Independent Advisor Alliance, hints that it could be something more, saying "the summer swoon that everyone has talked about appears to be beginning, but we still believe the strong fundamentals in the economy will allow stocks to end the year higher from here."

Other news in the stock market today:

- The Russell 2000 was hit hard, declining 1.2% to 2,177.

- Kroger (KR, +4.6%) had a solid day after Warren Buffett revealed that the grocer was the focal point of Berkshire Hathaway’s most bullish bet during the second quarter. Specifically, Berkshire added 10.7 million shares, or about 21%, to its stake – the largest of the three buys Buffett made in Q2.

- DXC Technology (DXC, -11.8%) was the S&P 500’s biggest loser Tuesday thanks to a bearish note from JPMorgan. Analyst Tien-tsin Huan downgraded the stock to Underweight (equivalent of Sell) from Neutral (equivalent of hold), saying that the technology consultant’s legacy business is declining at a “fast clip” and is weighing on performance.

- Apple (AAPL, -0.6%) declined despite Wedbush reiterating its bullish call on AAPL stock ahead of the iPhone 13 launch.

- U.S. crude oil futures declined 0.6% to $66.91 per barrel.

- Gold futures improved for a fifth consecutive day, rising 0.4% to $1,796.00 per ounce.

- The CBOE Volatility Index (VIX) jumped 10.5% to 17.81.

- Bitcoin shed 1.1% to $45,505.48. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

A Healthy Showing From Healthcare

One sector did appear fit Tuesday, even as the rest of the market floundered.

Healthcare (+1.2%) was a rare spot of green in a sea of red, led by biotechs Vertex Pharmaceuticals (VRTX, +3.9%) and Regeneron Pharmaceuticals (REGN, +3.0%). Big Pharma firm Pfizer (PFE, +3.1%) also chipped in with gains.

Healthcare continues to give its investors a little bit of everything.

As with food or basic utilities, people are hard-pressed to cut back on life-saving medicines and related care, giving the sector defensive characteristics. That helps support consistent and sometimes high dividends among a number of healthcare stocks.

Meanwhile, the biotech industry can deliver bursts of seriously outsized growth through the discovery of blockbuster drugs. And more recently, some healthcare stocks have allowed investors to profit from the battle against COVID through the development of vaccines and treatments.

Indeed, the sector's ability to benefit from both short-term events and secular trends guided our look at the best healthcare stocks for the rest of 2021. That is, although we were certainly keen on these stocks' potential for tactical outperformance, most of them also stood out because of their long-term promise. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.