Stock Market Today: S&P 500, Nasdaq Hit Record Highs on Pfizer Vaccine Approval

The Pfizer-BioNTech COVID-19 vaccine became the first to earn full FDA approval Monday, igniting a broad rally in stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The bulls came out Monday as the nation's fight against COVID-19 took a significant step.

The U.S. Food and Drug Administration today gave its full approval to the COVID-19 vaccine manufactured by Pfizer (PFE, +2.5%) and Germany's BioNTech (BNTX, +9.6%), making it the first shot to receive the designation. More than 200 million doses of the drug, which will now be marketed as Comirnaty, have already been administered under the FDA's emergency-use authorization.

"Considering the recent spike in cases and some of the disappointing economic data, this is another step in the right direction," says Ryan Detrick, chief market strategist for LPL Financial, "and it helps give confidence to those who might still be holding out on getting the vaccine."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"To the extent that the general public becomes more comfortable living with the virus – either because of increased vaccinations or natural immunity from recovered infections – the economy is likely to continue on its upward trajectory," says Chris Zaccarelli, chief investment officer for Independent Advisor Alliance. "The economic recovery is what is driving corporate earnings and the stock market to all-time highs, and we expect that to continue through 2021 and into 2022."

The energy sector (+3.8%) led the way, as U.S. crude oil futures snapped a seven-day losing streak with a 5.6% jump to $65.64 per barrel.

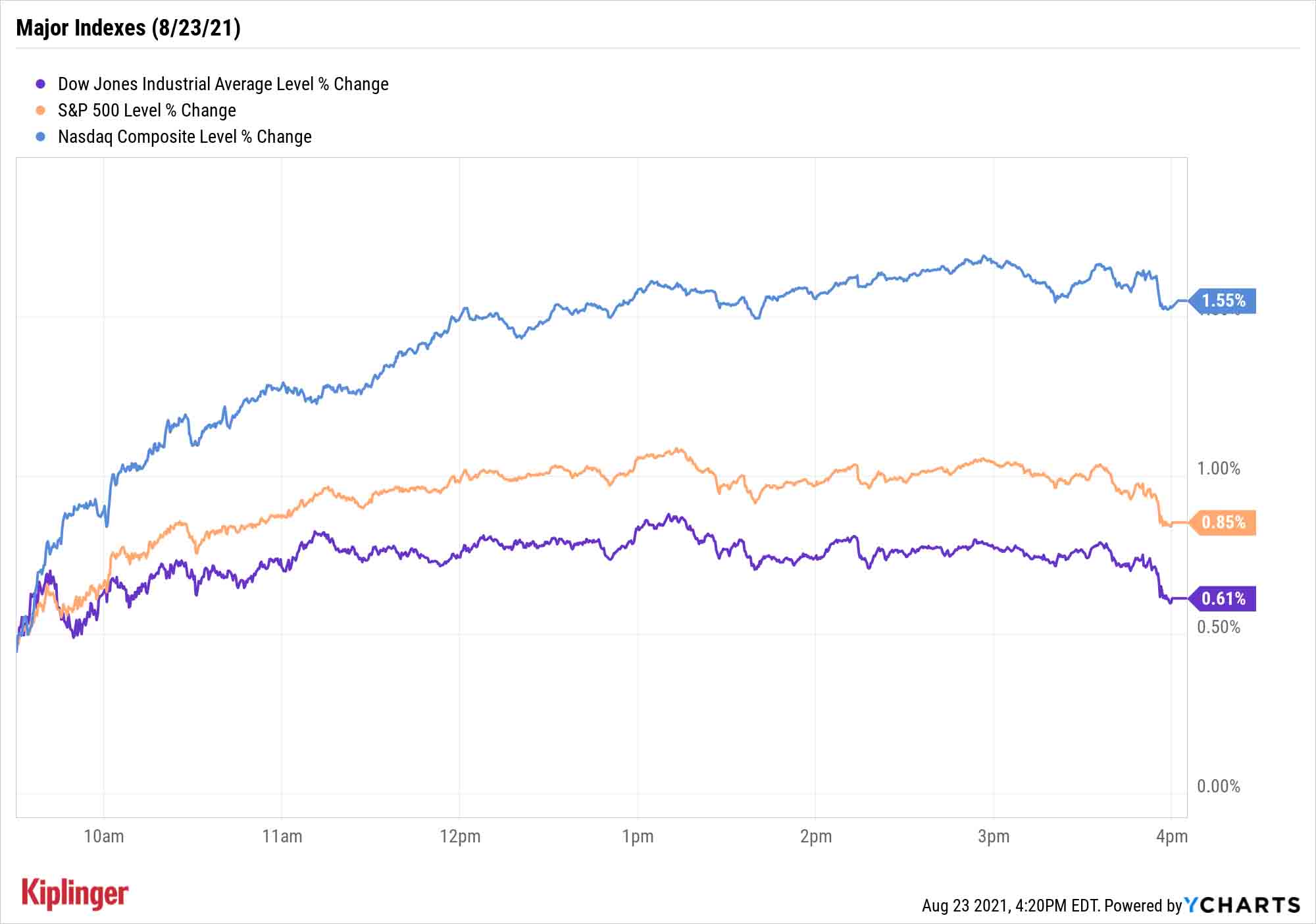

The Nasdaq Composite soared 1.6% higher to a record close of 14,942, putting it within reach of the nice, round 15,000 level. The S&P 500 also notched a record high, gaining 0.9% to 4,479. And the Dow Jones Industrial Average closed up 0.6% to 35,335.

Other news in the stock market today:

- The small-cap Russell 2000 advanced 1.9% to 2,208.

- Robinhood (HOOD, +6.2%) was a notable mover on Wall Street today after a number of analysts weighed in on the investing platform. Among them was Mizuho Securities analyst Dan Dolev, who initiated coverage with a Buy rating and a $68 price target. "With its 22.5 million active users and fetching 50% of all new retail U.S. accounts, we view Robinhood not as a meme stock phenomenon, but as a singularity that captures Generation Z's zeitgeist," Dolev says.

- Shares of Tesla (TSLA, +3.8%) also moved higher on the back of some analyst attention. In the wake of TSLA's artificial intelligence (AI) day last week, Deutsche Bank analyst Emmanuel Rosner reiterated his Buy rating on the electric vehicle (EV) maker. "We came away with greater appreciation for Tesla’s efforts in AI," Rosner says. "Tesla outlined a very ambitious effort to develop a high performance neural network with very scalable underlying compute and accurate+fast data labeling." Rosner believes this platform "could be sold 'as a service' to other machine learning (ML) use cases."

- Gold futures jumped 1.3% to settle at $1,806.30 an ounce as the U.S. dollar cooled.

- The CBOE Volatility Index (VIX) declined 7.9% to 17.09.

- Earlier this morning, Bitcoin prices eclipsed $50,000 for the first time since May. They retreated a bit to $49,297.32 by the afternoon, up 1.3% from Friday. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Vaccine Winners and Losers

As energy demonstrated, some sectors are more warmly greeting Monday's FDA decision than others.

Chris Zaccarelli, chief investment officer for Independent Advisor Alliance, notes that defensive sectors such as utilities (-1.3%) and consumer staples (-0.3%) are likely to underperform if the market's reopening trade continues; on Monday, at least, that was the case.

So what looks appealing? Consumer discretionary stocks (and retail companies in particular) are "likely to benefit from this announcement because increased consumer confidence as a result of additional vaccinations should lead to higher sales at those companies," he says. Indeed, discretionaries (+1.3%) were one of the session's best sectors.

Looking outside any one particular area of the market, our 21 best stocks to buy for the rest of 2021 were largely selected for their ability to benefit from continued rejuvenation in the U.S. economy. That's based on ongoing progress against the virus, sure – but also on spending elsewhere in the economy, be it a Washington plan for infrastructure, or corporate America upgrading its technological tools.

Kyle Woodley was long TSLA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks Extend Losing Streak After Fed Minutes: Stock Market Today

Stocks Extend Losing Streak After Fed Minutes: Stock Market TodayThe Santa Claus Rally is officially at risk after the S&P 500's third straight loss.