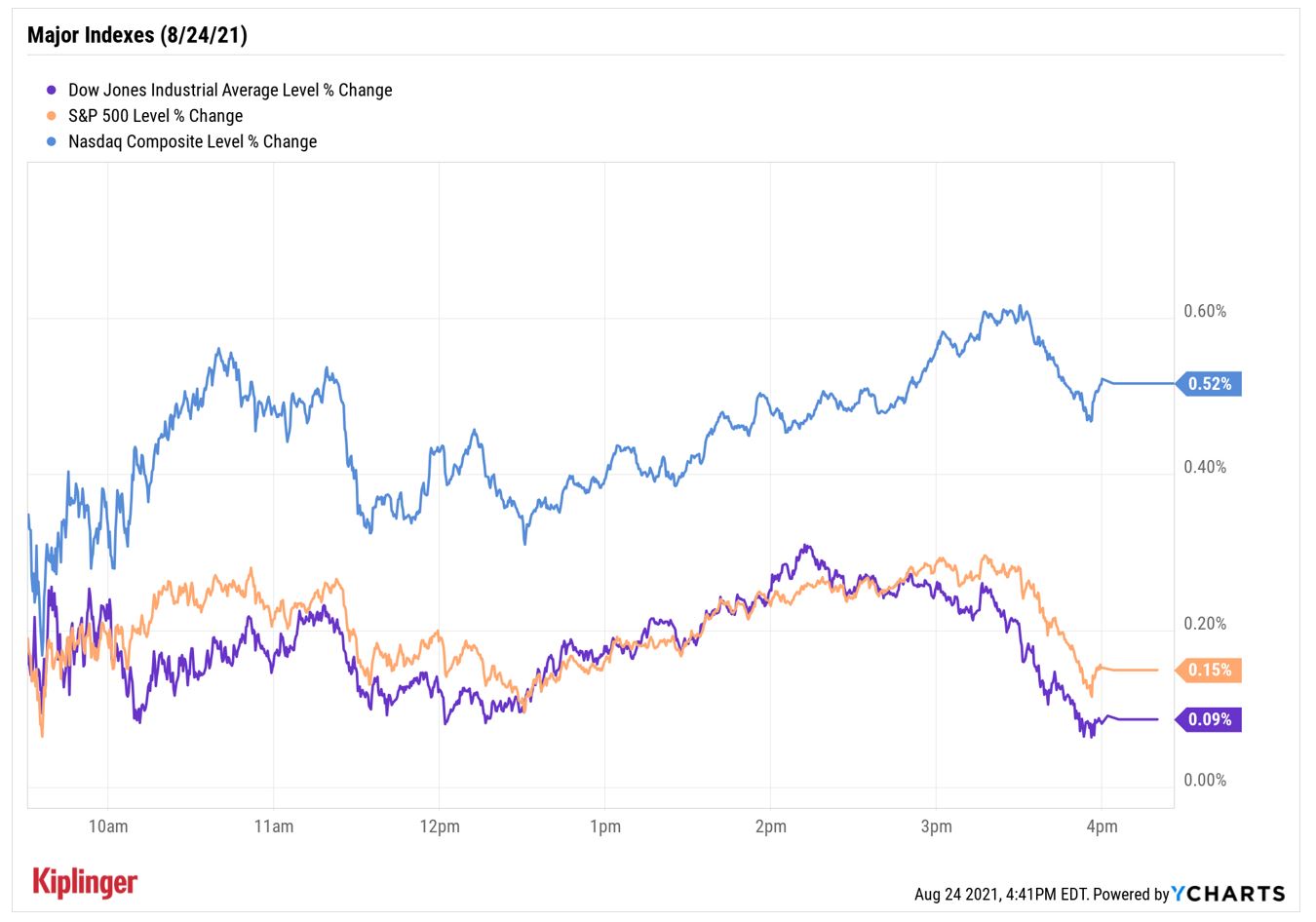

Stock Market Today: S&P 500, Nasdaq Continue to Carve Out New Highs

Cyclical and reopening plays helped boost the broader markets.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks built on Monday's big gains, as investors continued to cheer the U.S. Food and Drug Administration's (FDA) full approval of the COVID-19 vaccine co-developed by Pfizer (PFE, -3.1%) and BioNTech (BNTX, -3.6%).

Sentiment was also lifted by quarterly earnings beats from electronics retailer Best Buy (BBY, +8.3%), Chinese e-commerce name JD.com (JD, +14.4%) and cybersecurity firm Palo Alto Networks (PANW, +18.6%).

A higher-than-expected reading on new home sales provided some optimism on the economic front, with data from the Census Bureau showing that sales of new single-family homes increased 1% month-over-month in July to an annual rate of 708,000 units.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

At the close, the S&P 500 Index (+0.2% at 4,486) and Nasdaq Composite (+0.5% at 15,019) were sitting at new record highs, while the Dow Jones Industrial Average was up 0.1% at 35,366.

Other news in the stock market today:

- The small-cap Russell 2000 jumped 1% to 2,230.

- Tuesday was a big day for meme stocks. GameStop (GME, +27.5%), AMC Entertainment (AMC, +20.3%) and BlackBerry (BB, +9.5%) – among several other names that made headlines earlier this year for enjoying massive gains on the back of short squeezes – bolted ahead on no significant news.

- JD.com wasn't the only Chinese tech-related name on the rise today. Alibaba (BABA, +6.6%), Tencent (TCEHY, +9.5%) and Pinduoduo (PDD, +22.3%) were among several such stocks to enjoy a much-needed relief rally after a prolonged slump. Many Chinese tech and communications equities have spent 2021 cooling off from 2020’s gains, and tighter Chinese governmental regulation in more recent months has further rattled shares. To wit, the KraneShares CSI China Internet ETF (KWEB), which finished 11.0% higher Tuesday, remains down by more than 50% from its February highs.

- U.S. crude futures jumped 2.9% to settle at $67.54 per barrel.

- Gold futures eked out a marginal gain to finish at $1,808.50 an ounce.

- The CBOE Volatility Index (VIX) ticked up 0.4% to 17.22.

- Bitcoin prices fell 2% to $48,272.60. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

The Delta Variant: A Risk Investors Can Fade

That's what Darrell Cronk, president of Wells Fargo Investment Institute, believes.

"From a health perspective, the delta variant has spread fast and is a growing concern," Cronk says. "However, we believe the economic consequences are likely to be contained." He also points to cases in India and the U.K., which declined as quickly as they surged.

This trend is being seen in the U.S., too, with data from the Centers for Disease Control and Prevention (CDC) yesterday showing the seven-day average of COVID-19 cases in Arkansas and Missouri – delta variant hotspots – are down 12% from their recent peak.

And it was likely this data point, along with the FDA's vaccine approval, that continued to boost cyclical and reopening stocks today, with energy (+1.7%), materials (+0.6%) and financials (+0.6%) all outperforming.

For investors looking to add more recovery-themed plays to their portfolio, may we suggest this list of recovery stocks. Many of the names here slipped as the delta variant spiked, but stand to benefit as the pandemic recedes. What's more, they're all highly rated by the pros on Wall Street.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Stocks Chop as the Unemployment Rate Jumps: Stock Market Today

Stocks Chop as the Unemployment Rate Jumps: Stock Market TodayNovember job growth was stronger than expected, but sharp losses in October and a rising unemployment rate are worrying market participants.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

Nasdaq Rises 2.7% as Musk Tweets TSLA Higher: Stock Market Today

Nasdaq Rises 2.7% as Musk Tweets TSLA Higher: Stock Market TodayMarkets follow through on Friday's reversal rally with even bigger moves on Monday.