4 Shipping Stocks That Could Sail Higher

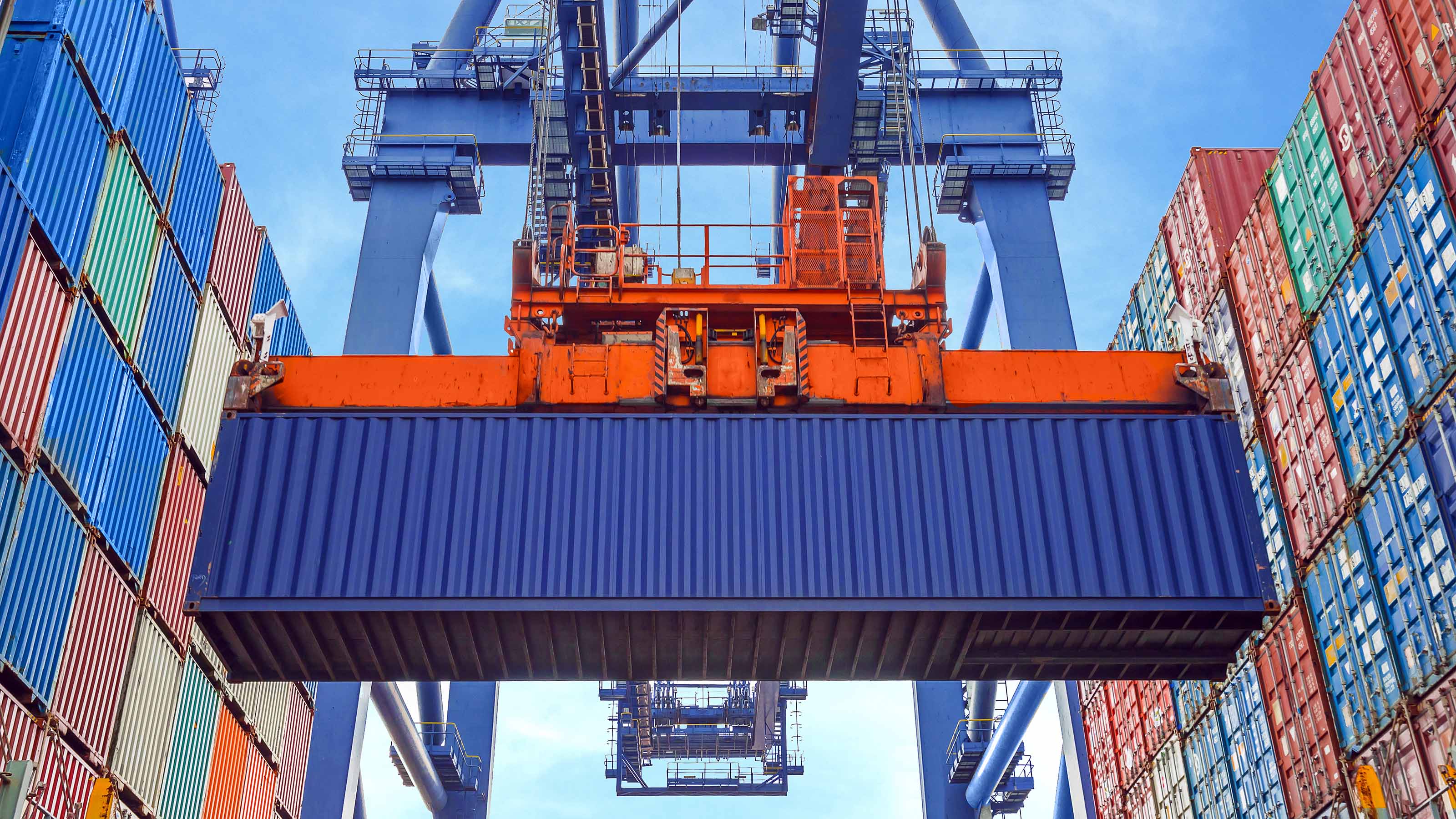

Amid global supply chain disruptions and surging freight costs, shipping stocks look attractive right now. Here are four names to watch.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

While normally floating along behind the scenes, marine shipping stocks have percolated up as a potentially stunning investment opportunity.

Disruption in global supply chains, shortages in containers, surges in worldwide trade and a global emphasis on infrastructure spending are all disrupting the market in ways that are playing into the hands of companies involved in marine shipping.

The shipping market at large is broken down across tankers, containers and dry bulk shippers of commodities such as grains, metals and coal.

With lackluster energy markets, the action is in bulk dry shipping and containers. The latter is linked to the demand for consumer goods which have surged, while dry bulk is linked to the global trade of commodities, which are cyclical to begin with, but bolstered by existing and planned infrastructure spending.

As far as dry bulk shipping stocks go, there are plenty of these, but most are small with market capitalizations below $1 billion – and many less than $500 million. The container shipping industry, meanwhile, has few publicly traded options to choose from.

So, in addition to container shipping, investors might consider the opportunity presented by the containers themselves. While trends in dry bulk shipping are driven by supply and demand, the opportunity in containers is driven largely by chaos at shipping ports caused by closures, delays and shortages. Many experts feel rich container pricing will persist as ports continue to manage lengthy backlogs due in part to the pandemic, but also an increase in vessel capacity.

In shipping stocks, there's a lot of chaff, but the four opportunities below offer up some wheat for investors.

Data is as of Aug. 31. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price.

Textainer Group Holdings

- Industry: Rental and leasing services

- Market value: $1.6 billion

- Dividend yield: N/A

Other than speeding past them on interstates, nobody thinks much about containers. But they carry most of the world's consumer goods to and from ports around the world, and port delays, supply chain glitches and increases in shipping on the heels of global gross domestic product (GDP) spikes have made for interesting times in containers.

Textainer Group Holdings (TGH, $33.22) owns, manages, leases and sells its fleet of 4.1 million containers, and is well-positioned to benefit from current container market dynamics.

Textainer's top-line growth is solid, with second-quarter lease rental income of $187 million – up handsomely from the year-ago tally of $145 million, and notably higher than the first-quarter's $169 million.

But revenue growth would be expected in this environment, and a more skeptical investor might wonder why it's not higher. The action, it turns out, shows up on the bottom line. For instance, adjusted net income per share for the second quarter was up 428% from a year ago. Sequentially, earnings per share (EPS) were up almost 28%.

A couple of key metrics make this performance possible. First, better pricing for containers has driven down the impact of expenses. For instance, direct container costs as a percent of rental income – which spiked at 18% four years ago – is now below 3%. Further, the fleet utilization rate, which was near 95% at this time last year, is now at 99.8%. Every 1% increase in utilization represents about 40,000 containers which are now being leased at premium rates.

Textainer has made investments to capitalize on growing demand for containers, with orders totaling $1.1 billion. Some of these have been delivered, with the rest coming online in the third quarter. The company also claims "virtually all" containers are either on, or committed to, long-term leases.

A look at Textainer's financials reveals that it's not a container company per se, but a finance company. This is, on balance, good news for investors of shipping stocks. In addition to the underlying trends driving container demand, the optimization in matching the duration of long-term leases with debt financing, and the ability to materially lower costs with astute financial management offers another lever for improving earnings.

Star Bulk Carriers

- Industry: Marine shipping

- Market value: $2.4 billion

- Dividend yield: 4.2%

The primary driver of growth for Star Bulk Carriers (SBLK, $23.07) is rising shipping costs. While these are bad for companies that make goods, they are manna for companies that ship them. Given the surge in the Baltic Exchange Dry Index, which measures the cost to ship commodities across various routes, Star Bulk can potentially earn $41,000 a day, versus about $15,000 a year ago.

Among the many dry bulk shipping stocks, Star Bulk, with 128 vessels, is one of the largest, best capitalized and most profitable with a high dividend payout to boot.

Shipping rates have played well for Star Bulk. For the second quarter, revenues were about $311 million, up from $146 million a year ago. Moreover, the company swung from a GAAP (generally accepted accounting principles) loss of 46 cents per share in Q2 2020 to a gain of $1.22 per share one year later.

Clearly, the company is feeling its oats with a dividend increase to 70 cents per share, a significant jump from the first-quarter dividend payment of 30 cents per share. However, investors should note that Star Bulk is an inconsistent dividend payer and ceased paying a dividend for most of 2020.

But in another sign of confidence, management announced the authorization of a $50 million share buyback program with the second-quarter report. Notably, this authorization occured after the shares advanced from about $9 to the current level of about $23 for the year to date.

The question now becomes: If the company has signaled its willingness to buy shares at this level, should investors jump on board, too?

Danaos

- Industry: Marine shipping

- Market value: $1.7 billion

- Dividend yield: 2.4%

While Star Bulk provides entrée to dry bulk shipping stocks, Danaos (DAC, $83.52) offers access to container shipping where growth in rates is equally frothy.

To see the froth, investors need to look no further than the Freightos Baltic Global Container Index, or FBX, which measures the average price to ship 40-foot containers along various routes. Over the past year, the rate has risen from $1,950 to the current rate of about $10,000.

DAC's bottom-line for six months ended June 30, seems to reflect some of the froth, coming in at $6.17 per share on an adjusted basis – double the $3.06 per share from the year-ago period. It should be noted, though, that some of the per share gain came from a reduction of shares outstanding from 24.8 million to 20.5 million.

The "adjusted" earnings at Danaos are actually lower – much lower – than the GAAP earnings, which totaled nearly $670 million for the six months ended June 30. Many companies use adjustments in their reporting to make the financial performance look better. Accordingly, Danaos gets points for not trumpeting the GAAP earnings and what looks like a nearly 10x increase in earnings by taking out a $444 million gain on an investment and another $112 million adjustment associated with a debt refinancing, which are clearly non-recurring.

Adjustments aside, Danaos is throwing off a lot of cash now, with free cash flow (FCF) – the cash remaining after a company has paid its expenses, interest on debt, taxes and long-term investments to grow its business – of $109 million for the six months ended June 30. This is an increase of three times FCF from the first six months of last year.

Despite a tremendous run-up in shares from $22 to their current perch near $85, the company still trades at a discount to its net asset value of $144 per share. To put this into perspective, a company such as Apple (AAPL) trades at a multiple of about 39 times its book value (often synonymous with net asset value, but there can be differences), while Danaos is trading at 0.6x its net asset value. Premiums to book value are often related to growth and the composition of assets. Apple, clearly a grower, owns a lot of intellectual property assets, which are often valued more richly than hard assets such as a ship.

But right now, ships are valuable assets and shipping is a growth business. Net, net, the steep discount indicates there might be yet more room to run in Danaos shares.

Breakwave Dry Bulk Shipping ETF

- Assets under management: $87.2 million

- Expenses: 3.3%

John Kartsonas, founder and managing partner at Breakwave Advisors – which is the advisor for the Breakwave Dry Bulk Shipping ETF (BDRY, $30.00) – aptly notes that that while demand for dry bulk shipping can change rapidly, the supply of ships is less flexible, with lead times of up to two years.

With dry bulk shipping tonnage growing and fleets remaining relatively stable, the Baltic Exchange Dry Index has grown from $1,500 at this time last year to the current rate of about $41,000. In other words, the cost to ship dry bulk goods is now $41,000 per day.

The Breakwave Dry Bulk Shipping Index aims to capitalize on these trends, with a portfolio of near-dated freight futures contracts on dry bulk indices. This fund has been on fire, with a year-to-date change in the net asset value at an eye popping 229% through the end of July.

While this performance is compelling and the underlying market dynamics look like they will continue, investors should be cautious and somewhat agile with respect to BDRY. Despite a stellar return so far this year, the total return since its March 2018 inception is about 4.3%.

The fund's expense ratio, at 3.3%, is bulk-sized, too. This is driven in part by the idiosyncrasies of the dry bulk market, which is still a voice-based system with brokers, phone in each ear, lining up trades. As shipping is perhaps one of the world's oldest industries, this holdover seems appropriate, albeit costly.

Learn more about BDRY at the Breakwave Advisors provider site.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.

-

What Happens When the Retirement Honeymoon Phase Is Over?

What Happens When the Retirement Honeymoon Phase Is Over?In the early days, all is fun and exciting, but after a while, it may seem to some like they’ve lost as much as they’ve gained. What then?

-

5 Top-Rated Housing Stocks With Long-Term Growth Potential

5 Top-Rated Housing Stocks With Long-Term Growth Potentialstocks Housing stocks have struggled as a red-hot market cools, but these Buy-rated picks could be worth a closer look.