Stock Market Today: Jobless Claims Drop, Energy Stocks Pop

Pandemic-low unemployment claims Thursday lit a fire under energy stocks and helped the S&P 500 and Nasdaq squeeze out new highs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The major indexes made a tidy little jump out of the gate Thursday in response to fresh, encouraging data on the employment front a day after a weak August ADP payrolls reading ruffled some feathers.

The Labor Department reported that jobless-benefits claims for the week ended Aug. 28 dipped to 340,000 – the lowest tally since March 2020, and 5,000 claims fewer than what economists expected – brighter news than yesterday's weak payroll report from payroll firm ADP.

U.S. crude oil futures rose 2.0% in response, to $69.99 per barrel, helping ConocoPhillips (COP, +3.6%), Exxon Mobil (XOM, +2.4%) and others benefited most from this early pop.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

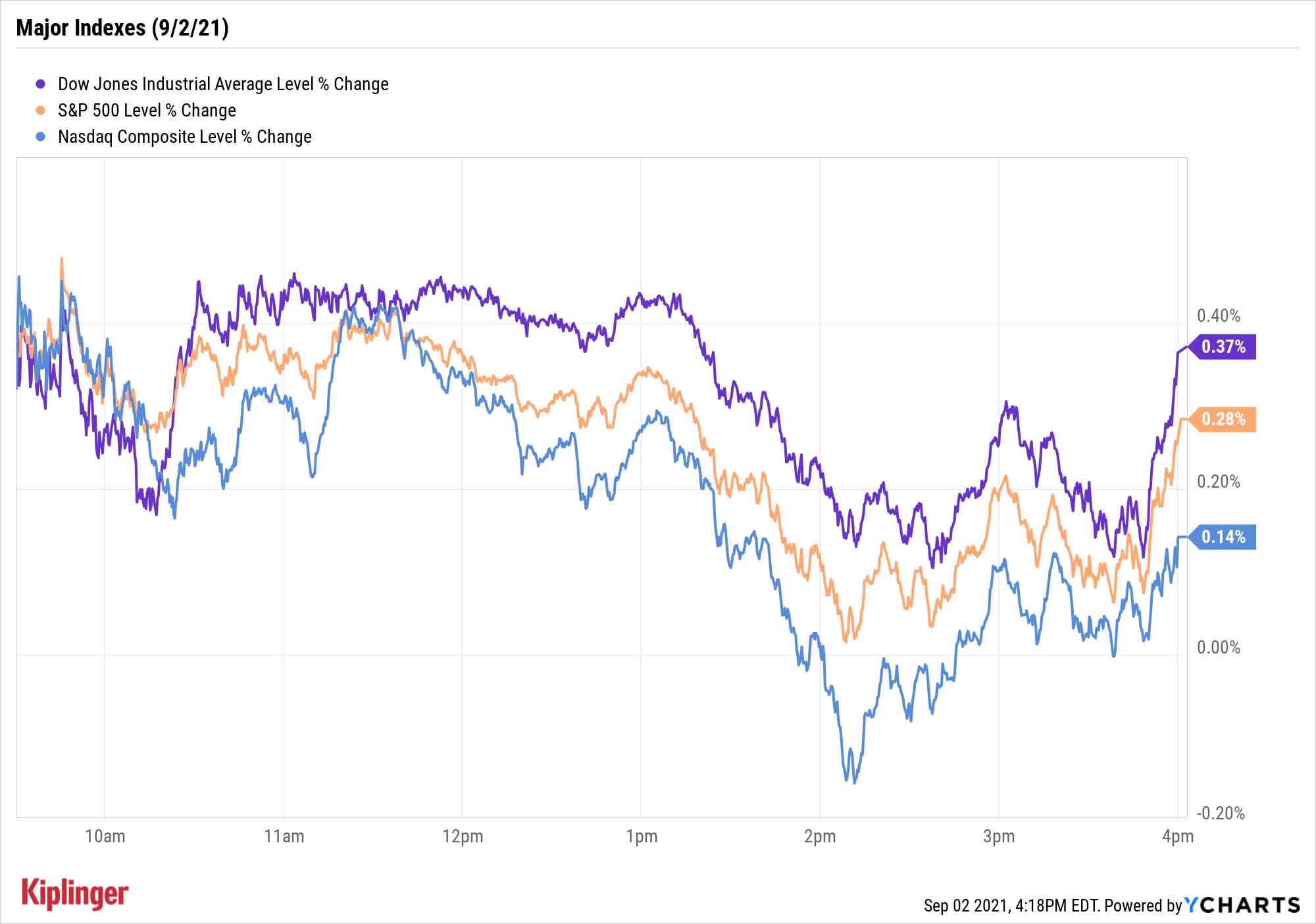

Stocks, however, broadly finished below their intraday highs. The S&P 500 (+0.3% to 4,536) and Nasdaq Composite (+0.1% to 15,331) both managed to scratch out fresh highs. The Dow Jones Industrial Average closed 0.4% higher to 35,443, and the small-cap Russell 2000 (+0.7% to 2,304) recorded its third consecutive improvement.

From here, attention shifts to tomorrow morning's August jobs report. "It feels like the market is set up for a 'Goldilocks' number after yesterday's ADP miss. ADP has not been a good indicator for the official data over the past year," says Michael Reinking, senior market strategist for the New York Stock Exchange. "Given the positioning, it feels like there is a little more risk if the number were to surprise to the upside. If nonfarm payrolls are above the estimate (~750k), this could very well push the Fed to move in September. Anything below 500k would provide some additional cover."

Steve Sosnick, chief strategist at Interactive Brokers, provides additional insight into why the ADP report might not be indicative of what's to come tomorrow.

"It would be logical to think ADP payrolls offer an excellent guide to the nonfarm payroll numbers that follow. Unfortunately, the data shows otherwise," he says, noting that the correlation "stinks" over the past 20 years. "I believe that most of the differences stem from the different types of data that are collected. ADP data is collected from their customers, who skew larger, while (Bureau of Labor Statistics) data specifically attempts to reach smaller businesses."

Other news in the stock market today:

- Online pet-goods retailer Chewy (CHWY, -9.3%) sank after announcing quarterly sales of $2.16 billion – up a robust 27% year-over-year but just shy of analysts' estimates. The company's net loss of 4 cents per share also came in deeper than expected (-2 cents), and Q3 sales guidance of $2.20 billion to $2.22 billion also disappointed the pros ($2.23 billion).

- After plunging nearly 17% on Tuesday in the wake of a disappointing earnings report, Zoom Video Communications (ZM) shares have stabilized, adding 1.5% today. Zoom's latest quarterly results and subsequent stumble don't have Wall Street pros throwing in the towel, though. The majority maintain a Buy recommendation on ZM, and ARK Invest CEO Cathie Wood took the opportunity to buy the dip. You can read more about ZM stock's recent movements here.

- Analysts are staying bullish on Five Below (FIVE), too, even as shares spiraled 13.0% following the discount retailer's turn in the earnings confessional. For its second quarter, FIVE reported better-than-expected earnings of $1.15 per share, but revenue of $646.6 million fell short of the consensus estimate. BofA Global Research analysts reiterated their Buy rating on the stock. FIVE's "diverse assortment and strong value proposition resonates with consumers seeking value and we see a long runway for growth," they wrote in a note. Meanwhile, Jefferies analysts say to "buy the dip" as "new store growth remains high ... and cash flow generation is strong."

- Gold futures shed 2.5% to settle at $1,811.50 an ounce.

- The CBOE Volatility Index (VIX) advanced 1.4% to 16.34.

- Bitcoin enjoyed another up-day, climbing 2.3% to $49,329.97. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Healthcare: The Market's Steady Eddie Sector This Year

Healthcare stocks keep threading the needle in 2021.

The sector has delivered a 20.5% return so far this year – smack-dab in the middle of the market's 11 sectors, and just 28 basis points behind the S&P 500 itself, with exceedingly low volatility along the way. (A basis point is one one-hundredth of a percentage point.)

That performance illustrates the sector's two-pronged appeal: the potential for growth thanks to long-term spending trends as well as the development of blockbuster pharmaceutical and biotechnology treatments, and the defensive, income-minded production of established pharma firms whose products are a necessary expenditure for millions of Americans.

While you certainly have your pick of the litter with individual stocks, you might be among the investors who would prefer to simply grab a large portion of the sector and call it a day. We've explored several ways you can do that with top-notch healthcare exchange-traded funds (ETFs), which allow investors to get exactly the type of sector exposure they want.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.