Stock Market Today: Dow Slips for a Third Straight Session

Federal Reserve taper conjecture and concerns about a hiccup in the economic recovery pulled on the stock market Wednesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks got off on the wrong foot Wednesday and never quite recovered as investors continued to weigh the Federal Reserve's signals about pulling back on stimulus, as well as the state of the economy.

In an interview with the Financial Times, St. Louis Fed president James Bullard said that the central bank shouldn't waver on plans to taper its asset purchases before the end of the year despite last Friday's surprisingly disappointing August jobs report.

"There is plenty of demand for workers and there are more job openings than there are unemployed workers," he told FT.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Later in the day, the Fed's "Beige Book" – a regular report of anecdotal economic information – acknowledged that "economic growth downshifted slightly to a moderate pace in early July through August." But investors seemingly shrugged it off, with stocks broadly maintaining their levels after the release.

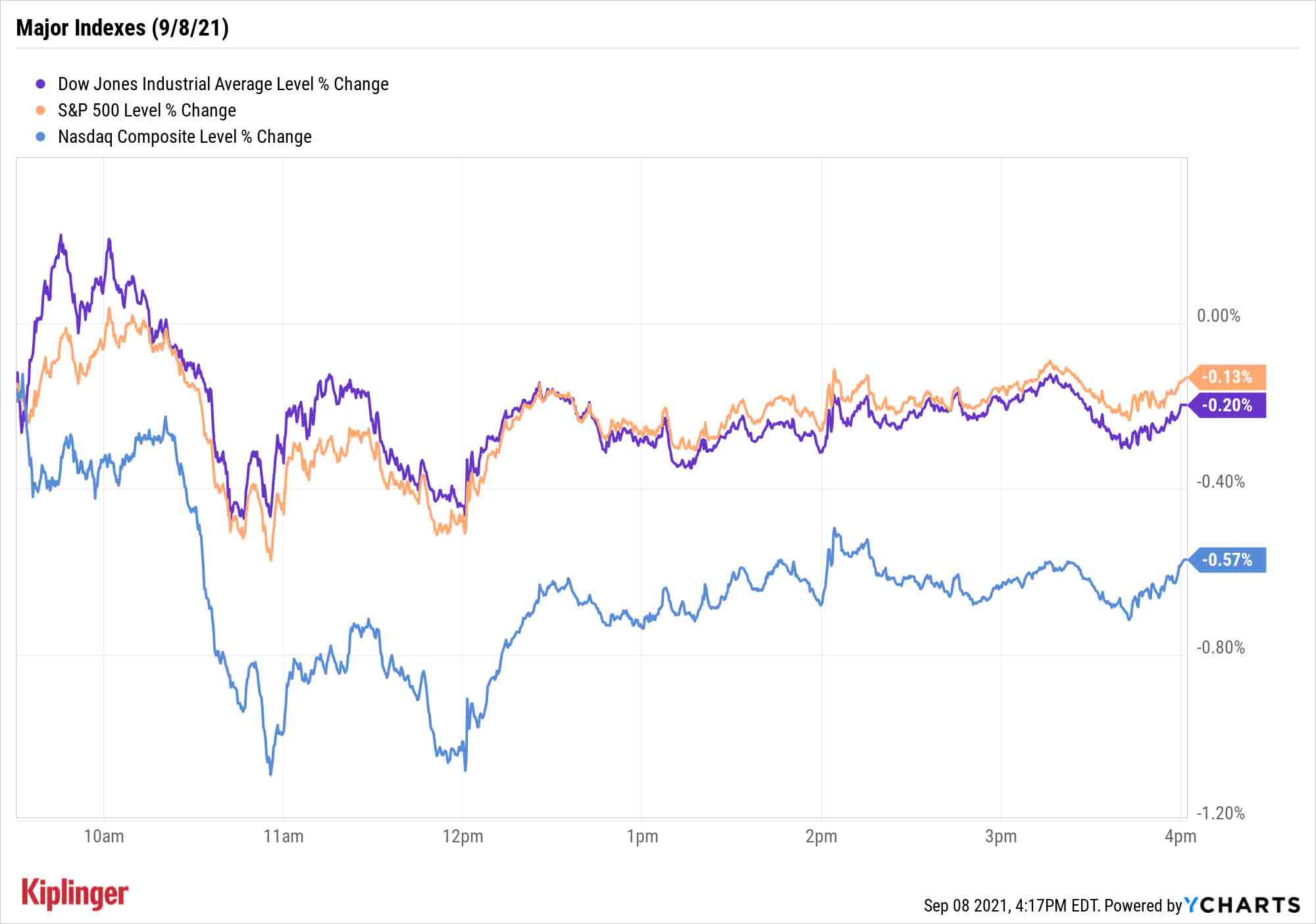

Declines in Dow Inc. (DOW, -1.9%) and UnitedHealth Group (UNH, -1.4%) sent the Dow Jones Industrial Average to its third straight decline – a modest 0.2% retreat to 35,031. The S&P 500 (-0.1% to 4,514) and Nasdaq Composite (-0.6% to 15,286) also finished in the red.

When investors were buying, they were buying safety, with the utility (+1.8%) and consumer staples (+0.9%) sectors coming out on top Wednesday.

Other news in the stock market today:

- The small-cap Russell 2000 dropped 1.1% to 2,249.

- Cryptocurrency exchange operator Coinbase (COIN, -3.2%) saw its shares decline after the company revealed that it had received a notice of possible enforcement action from the Securities and Exchange Commission. "Last Wednesday, after months of effort by Coinbase to engage productively, the SEC gave us what's called a Wells notice about our planned Coinbase Lend program," Chief Legal Officer Paul Grewal wrote in a Tuesday night blog post. The Coinbase Lend program would allow users to contribute to a lending pool centered around the stablecoin USD Coin, and receive a 4% interest rate in return.

- U.S. crude futures improved by 1.4% to $69.30 per barrel as Gulf Coast production struggles to get back online in the wake of Hurricane Ida.

- Gold futures slid yet again, off 0.3% to $1,793.50, as the U.S. dollar strengthened.

- The CBOE Volatility Index (VIX) slipped 1.0% to 17.96.

- Bitcoin pulled back by 0.5% to $46,453.95. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Commodities Aren't Feeling the Pinch

What else did the Beige Book tell us?

"The lack of market reaction today shows that much of these concerns are priced in," says Chris Zaccarelli, chief investment officer for Independent Advisor Alliance. "But a larger market pullback – which may materialize this fall either as a result of tapering announcements or other, potentially unexpected news – should provide an opportunity to re-enter positions in travel, leisure and hospitality as the recovery is most likely delayed and not cancelled completely."

That dovetails with our thoughts yesterday that the road travel stocks and other recovery picks are following looks rocky (but could ultimately be rewarding).

But one area of the market that still appears strong is commodity prices.

"Most districts noted substantial escalation in the cost of metals and metal-based products, freight and transportation services, and construction materials," the Fed says – and that's good news for commodity stocks and the broader materials sector. Companies dealing in steel, aluminum, copper and other commodities can go through nauseating boom-and-bust cycles, but the current environment continues to be in their favor.

Here, we look at seven commodity stocks that should have plenty more potency once the recovery gets back on steadier legs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow Hits New High Then Falls 466 Points: Stock Market Today

Dow Hits New High Then Falls 466 Points: Stock Market TodayThe Nasdaq Composite, with a little help from tech's friends, rises to within 300 points of its own new all-time high.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.