Stock Market Today: Dow Extends Slide After Rally Attempt Fizzles

A decline in initial jobless claims to a pandemic-era low wasn't enough stop the Dow's skid Thursday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

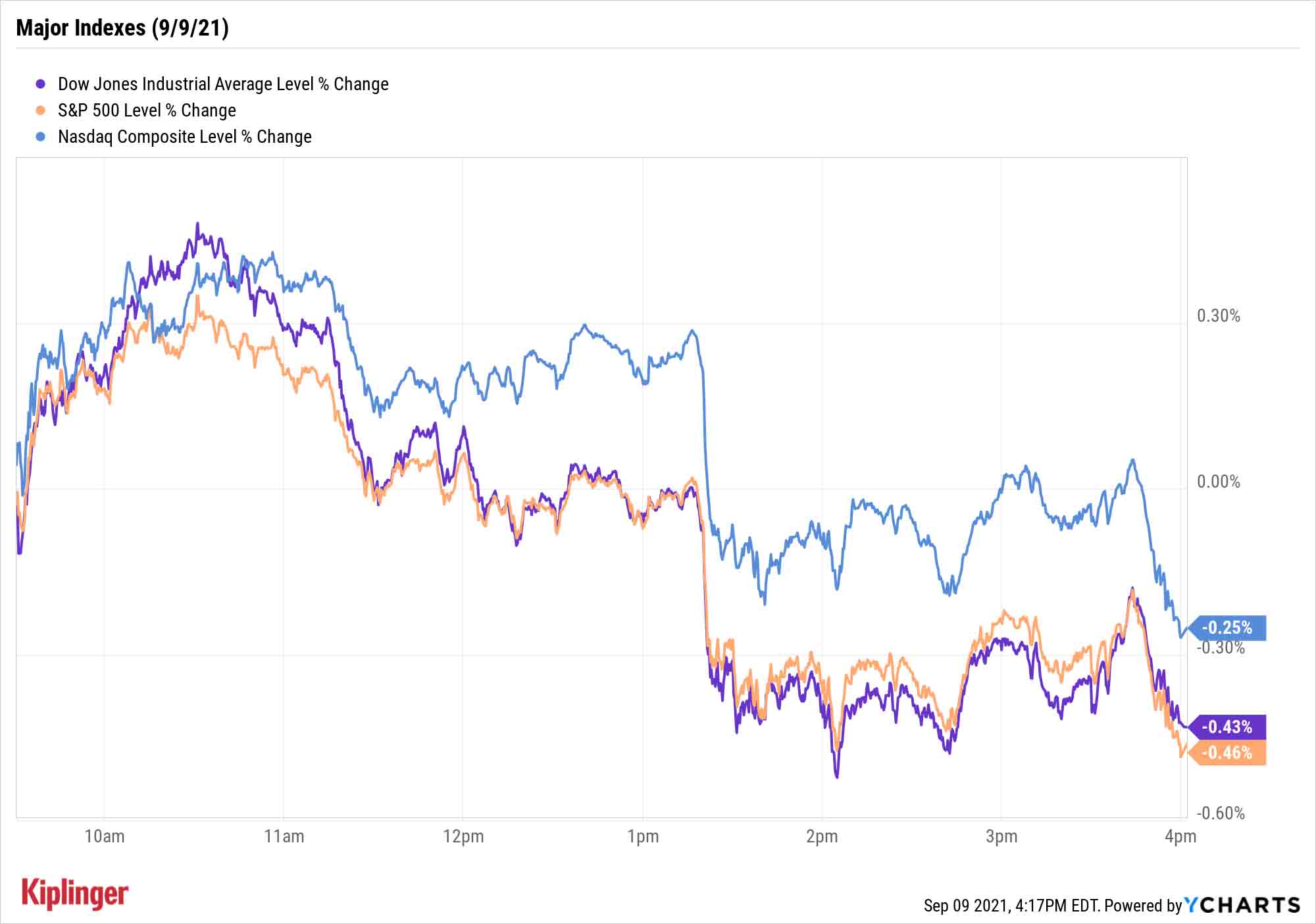

The major indexes looked ready to put an end to their recent mini-slump Thursday, but early gains turned to ash despite some good news on the jobs front.

The Labor Department said that initial filings for unemployment benefits during the week ended Sept. 4 declined by 35,000 to a pandemic-low 310,000 – below expectations for 335,000 claims.

Nonetheless, the Dow Jones Industrial Average, ahead by as much as 169 points (roughly 0.5%) in morning trade, swung to a 151-point, 0.4% loss to 34,879 for its fourth consecutive decline. The S&P 500 (-0.5% to 4,493) and Nasdaq Composite (-0.3% to 15,248) similarly flipped from green to red.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The potential of an earlier slowing of Federal Reserve stimulus might still be on investors' minds, as the European Central Bank said today that it will pare back a similar asset-purchasing mechanism.

"Based on a joint assessment of financing conditions and the inflation outlook, the Governing Council judges that favorable financing conditions can be maintained with a moderately lower pace of net asset purchases under the (pandemic emergency purchase program) than in the previous two quarters," the ECB said.

"The Fed has to taper regardless of labor markets," says Tony Roth, chief investment officer of wealth services firm Wilmington Trust. "There is so much wage pricing pressure that the Fed needs the option to raise rates. They can't do that if they have not moved far into tapering, but we will see it by the end of the year and the equities markets have already priced this in."

Also of note: Several carriers, including United Airlines (UAL, +2.3%) and American Airlines (AAL, +5.6%), revised their quarterly forecasts lower Thursday, saying that growing COVID cases had weighed on bookings. While the industry's stocks actually rose in response, the news could serve as an economic red flag.

Other news in the stock market today:

- The small-cap Russell 2000 held onto gains until the final minutes of the day, eventually sustaining a marginal loss to 2,249.

- Lululemon Athletica (LULU, +10.5%) shares took off in response to a beat-and-raise second-quarter earnings report. LULU said Q2 revenues grew 61% to $1.45 billion and adjusted earnings popped 123% to $1.65 per share – those figures beat respective expectations for $1.34 billion and $1.19 per share. Lululemon also raised its forecast for Q3 2021, expecting revenues between $1.40 billion and $1.43 billion, and adjusted earnings per share (EPS) of $1.33 to $1.38. William Blair analysts were among the pros chiming in with praise Thursday, reiterating their Outperform (Buy) rating "given continued upside potential to estimates alongside the brand's long-term growth runway, exceptional connection with consumers and tangential opportunities to broaden lululemon's global TAM to $3 trillion."

- GameStop (GME, +0.2%) looked like it was going to be in for a long day after it reported growing Q2 sales but a steeper-than-expected loss and provided a disappointing post-earnings call. "As the board lays groundwork to transform GameStop into a 'technology' company that delights gamers, many details still remain a mystery, particularly as the shift toward game downloads, streaming and cloud services picks up steam," says Baird analyst Colin Sebastian, who does not have a rating on GME shares. "We appreciate more details on infrastructure build-out, filling management roles, and expanding the product catalog, but it looks more like the strategy is to create a slimmed-down, omni-channel version of Best Buy. We encourage Mr. Cohen to be a little more transparent with his plans if he wants support from longer-term oriented investors." Nonetheless, GME erased early losses of more than 10% by the close.

- U.S. crude futures dropped by 2.0% to $67.87 per barrel after China announced plans to tap state oil reserves.

- Gold futures bounced back a little, gaining 0.4% to $1,799.50.

- The CBOE Volatility Index (VIX) climbed 4.3% to 18.74.

- Bitcoin made a slight 0.3% improvement to $46,573.60. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Make the Most of a Difficult Road Ahead

The market has its work cut out for it.

A team of Bank of America Securities analysts, for instance, says it believes the S&P 500 will hit 4,250 by year's end, and 4,600 by the end of 2022 – that's a respective 5.4% decline and 2.4% improvement from current levels.

"Sentiment is all but euphoric with our Sell Side Indicator closer to a sell signal than at any point since 2007," BofA's team says. "Wage/input cost inflation and supply chain shifts are starting to weigh on margins. Interest rate risk is at a record high … and valuations leave no margin for error."

Not exactly an ideal situation for picking stocks.

BofA suggests inflation-protected yield, which you can find among these inflation-fighting funds, as well as small-cap stocks, given more attractive valuations at present and a tighter tether to U.S. GDP growth.

However, if you're looking for stock picks on the road typically more traveled, consider taking a gander at investors who are plunking down tens and even hundreds of millions of dollars into their best ideas.

Institutional investors, hedge funds and billionaires have unique access to research and insights that most of us simply don't, and that alone makes their choices worth a closer examination. Read on as we explore 25 of their highest-conviction stock picks – bets that all grew to some extent during the most recent quarter.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Cooler Inflation Supports a Relief Rally: Stock Market Today

Cooler Inflation Supports a Relief Rally: Stock Market TodayInvestors, traders and speculators welcome much-better-than-hoped-for core CPI data on top of optimism-renewing AI earnings.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.