Stock Market Today: Dow Regains Its Footing, Snaps Five-Session Skid

Reasons for optimism on the COVID front helped lift the Dow Jones Industrial Average and S&P 500 out of their recent funks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

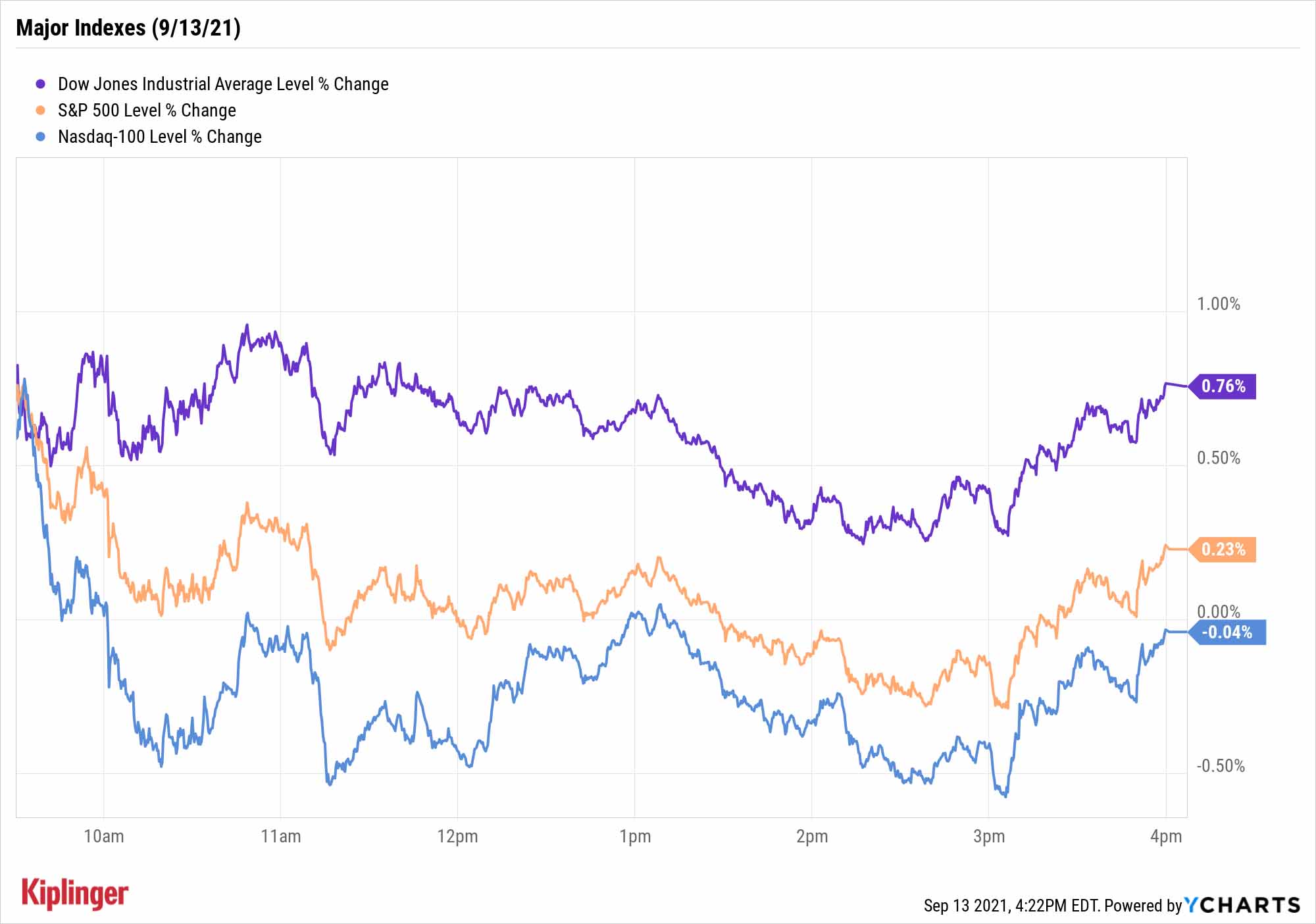

Another morning rally lost its energy midway through the session ... but this time, stocks mustered a second wind.

For the first time in a while, COVID-19 news took a turn for the better, with the CDC reporting a seven-day moving average of 136,558 daily new cases, down nearly 13% from the prior average of 156,341.

Wall Street also digested some new tax proposals that Congress released over the weekend. House Democrats proposed plans to raise the top tax rate on corporations and wealthy individuals, hike the top capital-gains rate to 25% from 20%, and add a 3% surcharge on any taxable income over $5 million.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Dow Jones Industrial Average (+0.8% to 34,869) kept its head above water thanks to UnitedHealth Group (UNH, +2.6%) and Chevron (CVX, +2.0%), with the latter benefiting from a 1.1% rise in U.S. crude oil futures, to $70.45 per barrel, on continued supply issues caused by Hurricane Ida. The Dow snapped a five-day losing streak, as did the S&P 500, which managed to climb out of the red and score a modest 0.2% gain, to 4,468.

However, weakness in stocks such as Adobe (ADBE, -2.1%) and Nvidia (NVDA, -1.5%) sent the Nasdaq Composite (off marginally to 15,105) to its fourth consecutive decline.

Other news in the stock market today:

- The small-cap Russell 2000 also finished in positive territory, improving by 0.6% to 2,240.

- Apple (AAPL) finished near the middle of the pack among its fellow Dow stocks, gaining 0.4% on the day. The tech giant will be in focus tomorrow, however, with the Apple launch event slated to kick off at 1 p.m. ET. Among the expected reveals: the iPhone 13.

- COVID-19 vaccine maker Moderna (MRNA) was a notable decliner, shedding 6.6%. Today's drop came after an article – written by a group of scientists, including a pair of Food and Drug Administration (FDA) officials, and published in peer-reviewed medical journal The Lancet – said most people will not need vaccine boosters at this time. While booster shots could be beneficial to those with weakened immune systems, the authors wrote, broader efforts should be focused on getting shots to those that are currently unvaccinated.

- Gold futures settled up 0.1% at $1,794.40 an ounce.

- The CBOE Volatility Index (VIX) dipped 7.5% to 19.37.

- Bitcoin's struggles continued, with the cryptocurrency declining 1.9% over the weekend to $44,759.94. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

A Way to Smooth Out Your September?

Stocks remain down in September, but will the month continue living up to its mopey billing?

"September is historically a tough month, and the first week was not a good sign," says Anthony Denier, CEO of trading platform Webull. "Fears of rising inflation contributed to last week's losses and tomorrow the CPI comes out. Wall Street economists expect a 5.3% rise in August. On Friday, the Fed will release data on wholesales prices. If those two reports come out negative, I think there may be rough waters ahead."

Of course, it's volatility – not a bloodbath – that most market strategists foresee.

For instance, Richard Saperstein, chief investment officer of wealth advisory Treasury Partners, says "The next six weeks tend to be seasonally weak for stocks, which is an additional worry for a stock market that is already facing elevated valuations and a lack of near-term upside catalysts." But he adds that despite expecting increased stock market volatility in the near term, "long-term investors should use pullbacks to add to stock exposure."

Happily, investors have ample tools at their disposal to cope with moody markets. For example, the Dividend Aristocrats and their decades of uninterrupted payout growth tend to provide stability amid bouts of volatility. Or for those who’d prefer to get a larger chunk of their returns through dividends, these high-quality high-yielders might be more appealing.

Investors can even go a step further in tamping down risk by owning a bundle of well-respected dividend payers in a single fund. These 11 exchange-traded funds (ETFs) have but one thing in common: They all hold dividend stocks. Past that, each ETF represents a vastly different approach to equity income generation – meaning there's something on this list for just about every type of investor.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.