Stock Market Today: Stocks End Choppy Week With a Loss

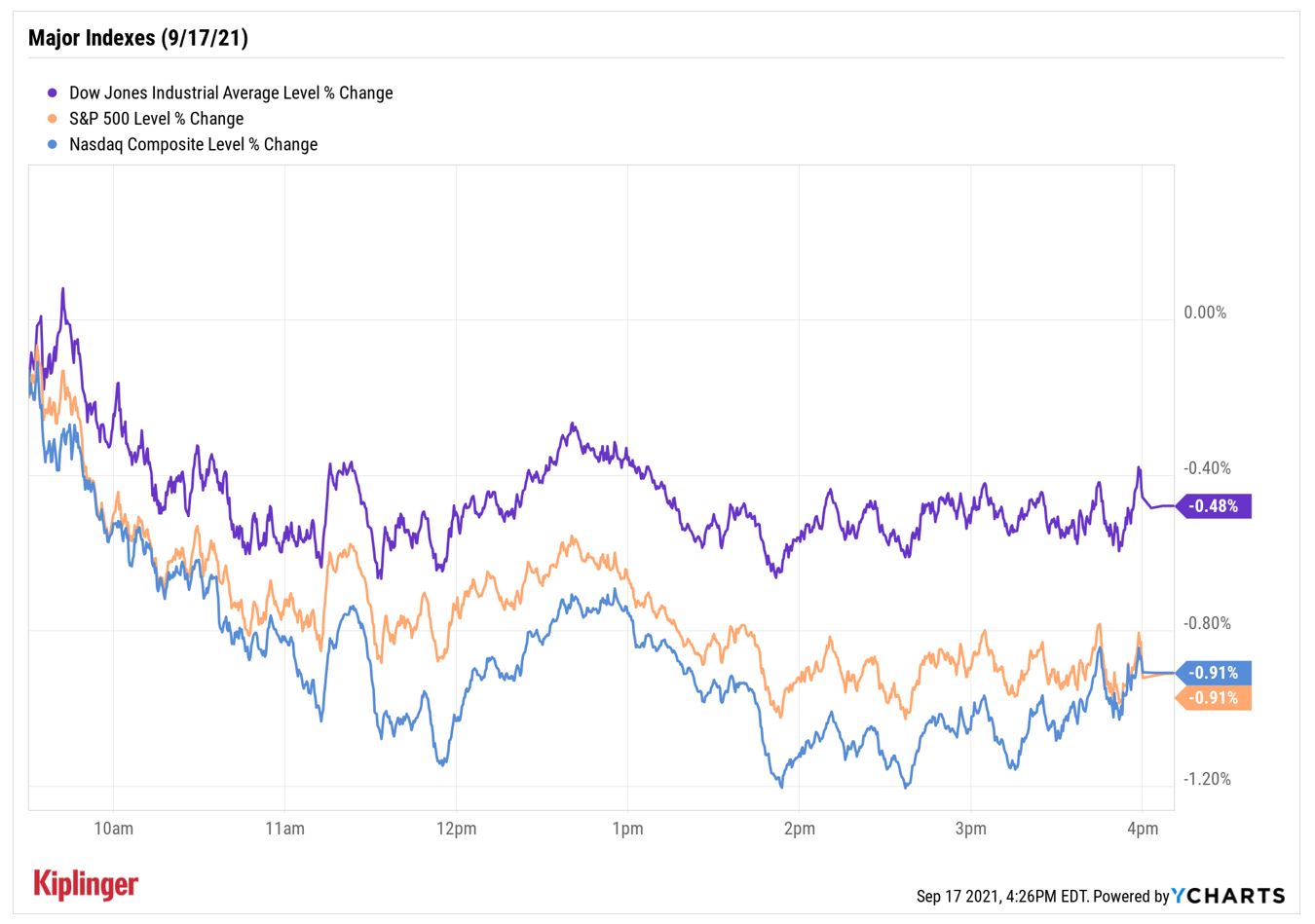

A lower-than-expected reading on consumer sentiment had the major indexes erasing weekly gains.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

U.S. stock markets turned lower in early trading, and stayed in negative territory as the day wore on.

In addition to a lower-than-anticipated preliminary reading on the University of Michigan's consumer sentiment survey (71.0 vs. 72.0 expected), investors also had to contend with a "quadruple-witching" day.

This occurs four times a year – March, June, September and December – and marks the simultaneous expiration of index futures, index options, stock options and individual futures. It can often lead to heavier-than-usual volume and erratic moves in all or parts of the market.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

By the close, the Dow Jones Industrial Average was down 0.5% at 34,584, the S&P 500 Index was off 0.9% at 4,432 and the Nasdaq Composite had given back 0.9% to 15,043 – with all three indexes erasing their weekly gains.

Next week, all eyes will be on the latest policy announcement from the Federal Reserve, due out on Wednesday afternoon.

Barclays economists "expect the committee to signal that it is prepared to reduce the pace of asset purchases 'later this year' conditional on further progress toward the dual mandate [of inflation and unemployment]." However, they do not believe a formal announcement will come until November or December.

Other news in the stock market today:

- The small-cap Russell 2000 ended 0.2% higher at 2,236.

- M&A buzz helped lift shares of Invesco (IVZ) 5.5% today. Specifically, a report in The Wall Street Journal suggested the financial firm is in talks to merge with State Street's (STT, -2.6%) asset-management division, according to people familiar with the matter. "We are not surprised that IVZ has entered another asset manager's crosshairs," CFRA analyst Catherine Seifert says. "We think the merger of these two firms makes sense, and would enhance STT's already strong exchange-traded fund (ETF) presence. We caution that a potential merger of the number four ETF provider (IVZ) with the third-largest ETF provider (STT), while potentially overtaking Vanguard and the second largest ETF provider, could also raise antitrust issues." Seifert has a Buy rating on Invesco.

- Thermo Fisher Scientific (TMO, +6.5%) got a lift after the medtech company issued upbeat guidance. TMO expects fiscal 2022 earnings of $21.16 per share on $40.3 billion in revenue, well above the $19.68 earnings per share and $34.3 billion in sales analysts, on average, are expecting.

- U.S. crude oil futures slipped 0.9% to $71.97 per barrel.

- Gold futures declined 0.3% to end at $1,751.40 an ounce, marking their third straight loss.

- The CBOE Volatility Index (VIX) jumped 11.3% to 20.81.

- Bitcoin edged up 0.1% to $47,505.29. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Stay the Course With Stocks

Don't let the daily headlines distract you from long-term fundamentals.

There are several reasons to be constructive on stocks, says Tony DeSpirito, CIO of BlackRock's U.S. Fundamental Active Equities, including the return to a more normal, shareholder-friendly distribution of capital. In addition to surging share buybacks – which are reaching 2018's record levels – many publicly traded companies are raising and reinstating dividends.

"Through July, 45% of dividend payers in the Russell 1000 have hiked," DeSpirito notes. "This compares to a full-year average of 61%. At this rate, we estimate over 75% of dividend payers in the index could raise their payout by year-end."

If you want to brush up on the best dividend payers, check out the generous yields in real estate investment trusts (REITs) and healthcare stocks. And there are always the beloved Dividend Aristocrats, companies with a track record of increasing shareholder payouts for the last 25 straight years.

Not sure where to start? Take a look at these five names. This elite list has received top-billing from Wall Street pros based on their current financial situation and future prospects.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.