Stock Market Today: Dow Ekes Out a Win Despite Nike Miss

Nike shares plunged after a quarterly revenue miss and downwardly revised guidance.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

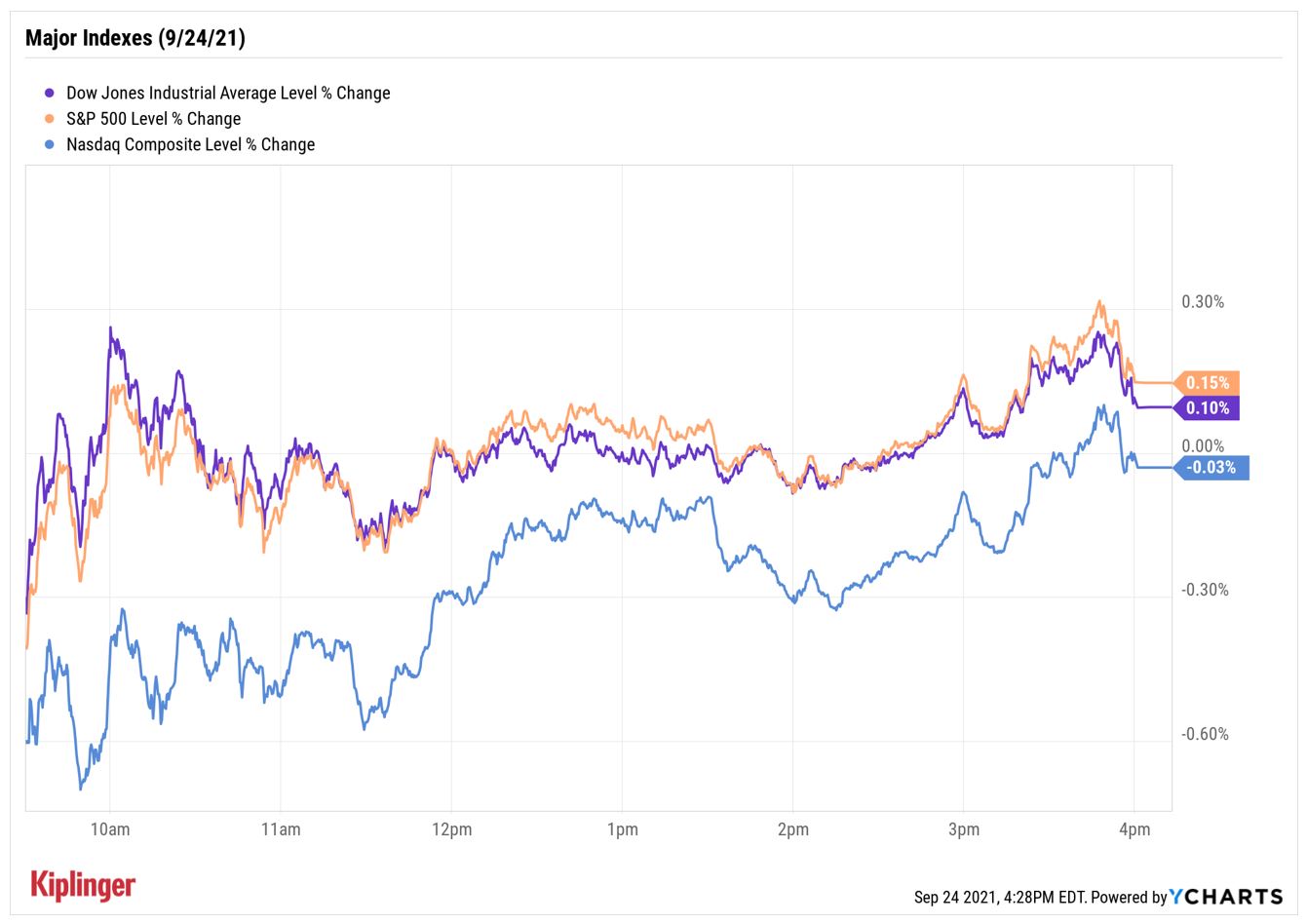

It was a choppy day of trading as the major market indexes took time to catch their breath after a volatile week.

The Dow Jones Industrial Average fell more than 116 points out of the gate as Nike (NKE, -6.3%) stock plunged on the heels of the athletic apparel retailer's fiscal first-quarter revenue miss, announced Thursday after the markets closed. Nike also cut its fiscal 2022 forecast amid supply chain issues and production shutdowns in Vietnam.

In the wake of Nike's report, CFRA analyst Garrett Nelson downgraded the stock to Hold from Strong Buy. "With one of the strongest global brands and a strong balance sheet, we believe the company will eventually recover," he says. "It will just take time."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, the blue-chip index closed up 0.1% at 34,798, thanks to cloud stock Salesforce.com (CRM, +2.8%), which continued to gain ground following yesterday's updated guidance.

The S&P 500 Index also finished in positive territory, adding 0.2% to 4,455, on strength in the financial (+0.5%) and energy (+0.8%) sectors.

And while the Nasdaq Composite slipped 0.03% to 15,047, it did finish well off its session lows.

Other news in the stock market today:

- The small-cap Russell 2000 gave back 0.5% to 2,248.

- Costco Wholesale (COST) was a post-earnings winner, gaining 3.3% in the wake of its fiscal fourth-quarter report. For the three-month period, COST reported adjusted earnings of $3.90 per share on $62.7 billion in revenues, above the $3.57 per share and $61.3 billion analysts were expecting. Despite the beat, CFRA analyst Arun Sundaram kept a Hold rating on the retailer. "Going forward, inflationary pressures are expected to intensify, mostly driven by higher product, labor and freight costs," he says. "Like other club stores, COST will absorb some cost inflation, which will likely lead to some margin pressure over the next few quarters."

- Roku (ROKU, -3.8%) took a notable slide today after Wells Fargo downgraded the streaming stock to Equal Weight from Overweight (the equivalents of Hold and Buy, respectively). The research firm cited increasing competition from the likes of Amazon.com (AMZN) and Comcast (CMCSA), which has made "ROKU's valuation more constrained." And while they like the stock's story, "its ability to outperform requires results that exceed already high expectations."

- U.S. crude oil futures gained 0.9% to settle at $73.98 per barrel, marking their fourth win in a row.

- Gold futures rose 0.1% to end at $1,751.70 an ounce.

- The CBOE Volatility Index (VIX) slid 4.7% to 17.75.

One Big Headline Today: Bitcoin

"Bloomberg reported that China's central bank declared crypto transactions were illicit financial activities and that non-fiat cryptocurrencies were not to be circulated," says Richard Repetto, managing director at Piper Sandler.

"The news this morning comes approximately three months after China cracked down on cryptocurrency mining, which also triggered a global sell-off in crypto markets."

Bitcoin was down 9.2% at one point, but finished the regular trading session off a slimmer 5.3% at $42,409.05 (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day).

Today's price action underscores how volatile cryptocurrency can be – and that the high-risk investment must be approached with extreme care. For those wanting an introduction – or possibly a refresher course – to digital currencies, here's a breakdown of the biggest players in the space.

And for more risk-averse investors who are still crypto-curious, consider these larger, established companies that have exposure to this technology. Read on as we highlight seven stocks (and one fund) that have embraced the cryptocurrency space.

Karee Venema was long NKE as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

4 Estate Planning Documents Every High-Net-Worth Family Needs

4 Estate Planning Documents Every High-Net-Worth Family NeedsThe key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares in This Situation

How to Get the Fair Value for Your Shares in This SituationWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks End Volatile Year on a Down Note: Stock Market Today

Stocks End Volatile Year on a Down Note: Stock Market TodayAfter nearing bear-market territory in the spring, the main market indexes closed out the year with impressive gains.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

The Santa Claus Rally Officially Begins: Stock Market Today

The Santa Claus Rally Officially Begins: Stock Market TodayThe Santa Claus Rally is officially on as of Wednesday's closing bell, and initial returns are positive.

-

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market Today

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market TodayOracle stock boosted the tech sector on Friday after the company became co-owner of TikTok's U.S. operations.

-

Dow Rises 497 Points on December Rate Cut: Stock Market Today

Dow Rises 497 Points on December Rate Cut: Stock Market TodayThe basic questions for market participants and policymakers remain the same after a widely expected Fed rate cut.