Stock Market Today: Relief Rally Fizzles Late

Treasury rates stabilized Wednesday, giving stocks some breathing room, but a modest comeback still wobbled into the finish.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

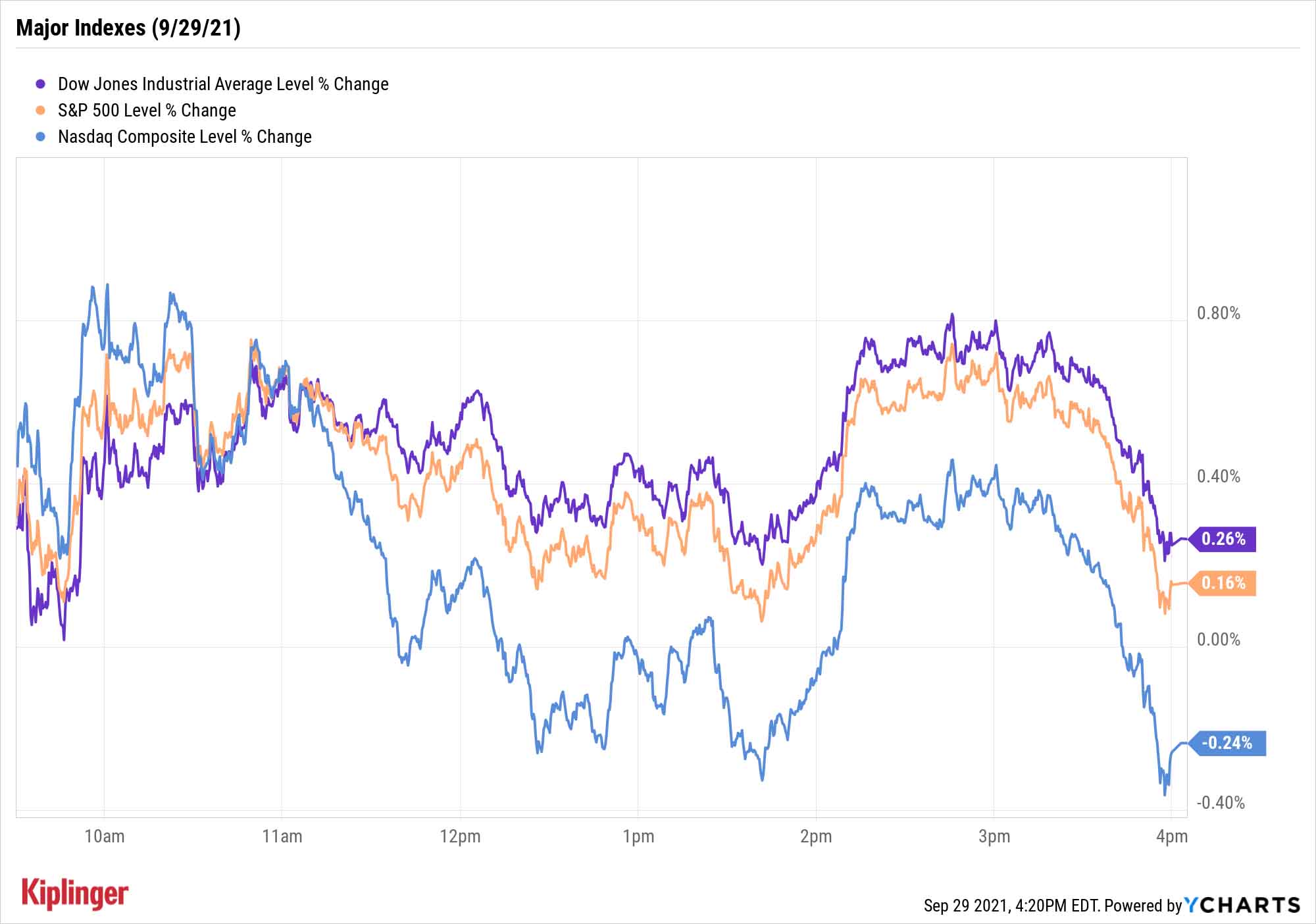

The markets staged a slim, shaky rebound on a Wednesday that was light on data, with the gravitational pull of U.S. Treasuries' rate revival in plain sight.

A day after the 10-year Treasury yield reached 1.567%, putting a scare into the major indexes, it retreated to roughly 1.5% early on in the session ... but clawed its way back to 1.54% by the afternoon.

What did that do to equities?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

It put a lid on technology stocks (-0.1%), which finished with the day's second-worst sector performance. Instead, investors were interested in defense. Utility stocks (+1.5%), consumer staples (+0.9%) and healthcare (+0.8%) led the markets higher, with notable gains coming from the likes of Eli Lilly (LLY, +4.0%), Sempra Energy (SRE, +3.1%) and ConAgra (CAG, +3.0%).

Even so, the major indices coughed up much of the day's progress during the session's final hour. The result was small gains for the Dow (+0.3% to 34,390) and S&P 500 (+0.2% to 4,359), while the tech-heavy Nasdaq finished with a 0.2% loss to 14,512.

Other news in the stock market today:

- The small-cap Russell 2000 also slid into the red shortly before the close, giving up 0.2% to 2,225.

- Dollar Tree (DLTR) surged 16.5% today after the discount retailer said it will begin offering products priced up to $5 in its Dollar Tree Plus stores and will test the $1+ price points in select legacy stores. DLTR also announced that its board of directors has authorized a $1.05 billion-boost to its share repurchase program, bringing the aggregate amount to $2.5 billion. Already in fiscal 2021, the company has repurchased $950 million of its shares, according to Michael Witynski, president and CEO of Dollar Tree.

- Eyewear startup Warby Parker (WRBY) made a splash in its market debut. WRBY went public via a direct listing, an alternative to traditional initial public offerings (IPOs). WRBY stock opened at $54.05 per share, more than 35% above its $40 reference point. Shares gained a little more ground from there, finishing the day up 36.2% to $54.49. There's still a host of companies set to go public over the next several months. Here's a running list of the most anticipated IPOs for the rest of 2021.

- U.S. crude oil futures slipped 0.6% to finish at $74.83 per share.

- Gold futures shed 0.8% to settle at $1,722.90 an ounce.

- The CBOE Volatility Index (VIX) pulled back 2.3% to 22.71.

- Bitcoin prices slid 1.0% to $41.178.28. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Can AI Really Pick Stocks?

We frequently keep tabs on the so-called smart money.

While even the most revered investors can get it wrong from time to time (just ask Warren Buffett about his 1993 purchase of Dexter Shoe), hedge funds, billionaires and institutional investors have access to invaluable insights and research that makes their high-conviction moves worth monitoring. That's why we provide the occasional look into billionaire buys, hedge-fund favorites and, of course, Buffett's Berkshire Hathaway portfolio.

But from time to time, it also pays to see what the robots have to say.

Financial advice firm Danelfin (formerly Danel Capital) has developed an analytics platform that analyzes fundamental, technical and sentiment data for hundreds of U.S. stocks to determine which have the best setup for market outperformance over the next 90 days.

We've recently caught up with Danelfin, whose system continues to beat the market in 2021, and reviewed its 10 top stocks to watch at the moment. Check them out!

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

'Humbug!' Say Consumers, Despite Hot GDP: Stock Market Today

'Humbug!' Say Consumers, Despite Hot GDP: Stock Market Today"The stock market is not the economy," they say, but both things are up. Yet one survey says people are still feeling down in the middle of this complex season.

-

Stocks Struggle Ahead of November Jobs Report: Stock Market Today

Stocks Struggle Ahead of November Jobs Report: Stock Market TodayOracle and Broadcom continued to fall, while market participants looked ahead to Tuesday's jobs report.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.