Best Stocks for Rising Interest Rates

The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

After pausing rate hikes at its June meeting, the Federal Reserve in July raised its benchmark interest rate by a quarter percentage point to a target range of 5.25% to 5.5% – the highest level since early 2001. That has left investors scrambling to scrape up the best stocks for rising interest rates.

And the central bank may not be done lifting rates just yet. The market is currently pricing in a 20% to 30% chance of another 25 basis point rate hike (0.25%) at one of the remaining three Fed meetings scheduled for 2023, according to CME Group.

Plus, regardless of whether it hikes rates again, the central bank intends "to keep policy restrictive" until it's "confident inflation is coming down," Federal Reserve Chair Jerome Powell said at his press conference following the July meeting.

While there is undoubtedly some pain that comes from these aggressive rate hikes, including increased borrowing costs for consumers and businesses, there are some stocks that actually benefit from higher interest rates. Furthermore, there are other investments that appear resilient and reasonably insulated from any rate-related disruptions on Wall Street.

With this in mind, here are eight of the best stocks for rising interest rates. The potential options featured among this list of the best stocks to buy for higher rates offer different ways to sidestep the challenges that come with tighter monetary policy. They can also prepare investors for the prospect of additional increases if and when they occur in the remainder of 2023.

Data is as of July 26. Dividend yields represent the trailing 12-month yield, which is a standard measure for equity funds.

First Solar

- Sector: Technology

- Market value: $21.1 billion

- Dividend yield: N/A

One of the largest players in the alternative energy space, First Solar (FSLR, $197.41) is a riskier play than some of the other stocks on this list, but still looks like it has upside in 2023. And most importantly, the value proposition of FSLR stock is largely independent of the interest-rate environment.

As a major provider of photovoltaic solar energy solutions to the U.S., Europe and Asia, First Solar is at the center of the clean energy revolution and the global response to climate change. In the short term, FSLR also is making waves as a potential shock absorber for the energy supply disruptions that gripped Europe in the wake of Russia's aggression in Ukraine.

Historically, solar stocks have experienced plenty of ups and downs. That's not just because of the challenge with demand and adoption trends, but also because of more practical concerns like supply-chain disruptions and input costs that are important for any manufacturer. But with shares of FSLR stock more doubling over the last 12 months, including a run of more than 30% in 2023 alone, it's hard to argue that the sun isn't shining on the sector right now.

In late May, Argus Research analyst Kristina Ruggeri reiterated a Buy rating on FSLR. "First Solar has been targeting markets, such as India, that provide manufacturing subsidies to help it compete against other solar panel producers, especially those in China," Ruggeri wrote in a note to clients. Additionally, the company is positioned to receive federal tax credits thanks to the Inflation Reduction Act, which should help boost demand and margins, the analyst said.

Looking ahead, fiscal 2023 forecasts for this solar giant include more than 30% revenue expansion on the year. For investors worried about how to navigate rising rates and related challenges in the stock market, FSLR may be one of the best growth stocks to consider.

Fair Isaac

- Sector: Technology

- Market value: $20.9 billion

- Dividend yield: N/A

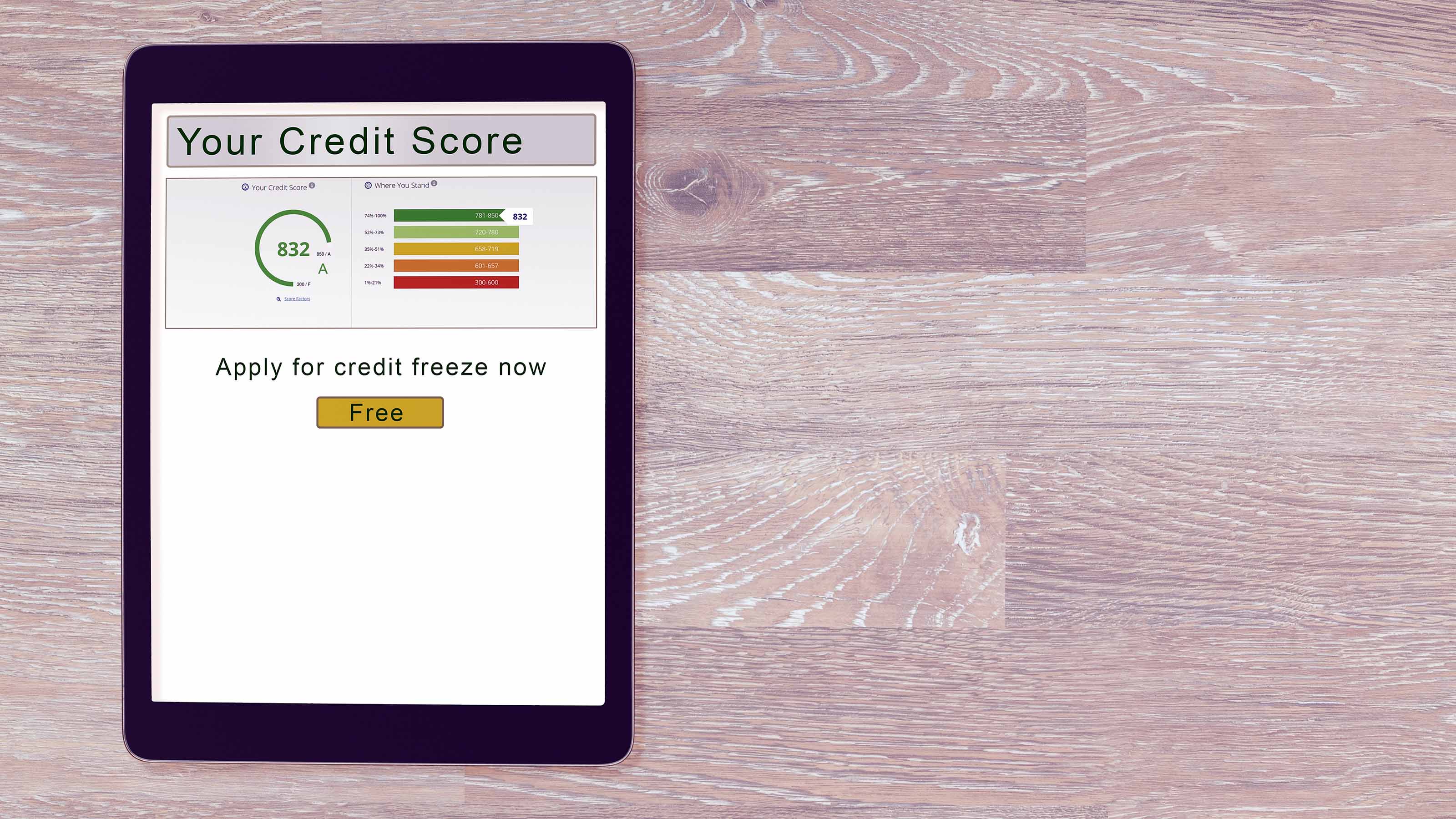

You may recognize Fair Isaac (FICO, $834.75) from its ticker symbol, which is the shorthand for consumer credit scores nationwide. The firm was founded back in the 1950s as a data and analytics company, and eventually developed a way to compile credit histories and "score" the spending and borrowing history of consumers and businesses. Its now-popular FICO scores help determine not just whether someone qualifies for a credit card or a mortgage or auto loan, but how much interest they will pay.

Needless to say, FICO is one of the best stocks for rising interest rates because, in this type of environment, there is more attention paid to these credit scores. What used to be a modest increase in borrowing costs for less-than-perfect borrowers can now become an onerous burden, and parties on both sides of loans are looking to assess and manage their credit risks. That's ultimately a very good thing for Fair Isaac.

It's also worth noting that while one division of FICO is focused on this scoring business, it also provides other analytics and decision-management solutions for businesses to help them run more efficiently. As one example, in December, one of its AI-driven tools won an industry award for its ability to detect payments fraud.

Profits and sales for FICO are both marching steadily higher. Plus, shares are up nearly 40% for the year-to-date.

Wall Street pros are upbeat toward FICO too. Of the nine analysts following the stock tracked by S&P Global Market Intelligence, two say it's a Strong Buy, three call it a Buy, three have it at Hold and one has it Sell. This works out to a consensus recommendation of Buy.

McKesson

- Sector: Healthcare

- Market value: $54.7 billion

- Dividend yield: 0.6%

McKesson (MCK, $403.79) provides healthcare services worldwide, including technology and financial solutions to medical facilities, as well as pharmaceutical distribution and wholesale medical supply sales.

This diversified operation has helped MCK stock largely sidestep any of the broader disruptions we've seen in the economy related to commodity inflation and rising interest rates. The services it provides, including software for pharmacies to help manage prescriptions and the regular delivery of gloves, bandages and other staples to medical offices, have incredibly reliable sales and profits.

In addition, this reliability has helped MCK steadily set aside resources to return capital to shareholders. That includes a new $4 billion buyback plan that began in 2022, as well as a quarterly dividend that has more than tripled in the last 10 years from 20 cents per share in mid-2013 to 62 cents per share after its latest 15% boost to payouts in July.

There's a lot of uncertainty in the global economy right now, but healthcare generally is a recession-proof sector. And with the solid operations of a company like McKesson, investors looking for the best stocks for rising interest rates can have confidence that their money will be safe regardless of the ups and downs in the economy.

Affiliated Managers Group

- Sector: Financial services

- Market value: $5.1 billion

- Dividend yield: 0.02%

As you may have been able to guess by the name, Affiliated Managers Group (AMG, $141.57) is a group of affiliated asset managers that offer access to mutual funds, hedge funds, institutional services and white-glove financial advice to high-net-worth individuals.

At present, AMG is one of the top 10 publicly traded asset managers with a massive portfolio of $673 billion collectively under management. Its specialty is to identify and partner with investment firms around the world specializing in actively managed investment strategies for aggressive, ultra-rich investors, rather than participate in the "race to the bottom" on low-cost index funds built for hands-off retirees.

What also makes AMG interesting is that it is truly a network of affiliates. Its suite of 14 different "boutiques" include offices with expertise in different areas, independent staff and strong brands in their local markets. This allows it to separate itself from the one-size-fits-all approach that many mega-managers like Vanguard or Fidelity deploy.

And aside from the competitive advantage of its specific operations, rising interest rates generally means rising returns on firms sitting on a lot of capital.

Analysts are upbeat toward Affiliated Managers Group too. The average rating among the seven analysts covering the financial stock tracked by S&P Global Market Intelligence is a Buy.

Lamb Weston Holdings

- Sector: Consumer staples

- Market value: $14.8 billion

- Dividend yield: 1.1%

Lamb Weston Holdings (LW, $101.76) probably isn't a household name for most Americans. It's based in Idaho, and produces and distributes frozen potato products, vegetables and dairy goods worldwide.

The largest Lamb Weston customer is fast food giant McDonald's (MCD), which accounts for about 10% of net sales. It also provides other foodservice businesses, as well as "private label" frozen foods sold at grocery stores and other retailers.

Now, this is not a particularly dynamic business. Unless we see some magical study that French fries are suddenly healthy for you, it's unlikely we'll see a rapid boom in LW sales anytime soon. However, this kind of boring "risk-off" stock has been decidedly in favor lately as many investors are looking to insulate themselves from volatility in the equities market generally and the impact of rising rates in particular.

As proof of how LW can hang tough, the consumer staples stock is up an amazing 38% in the last 12 months, compared to a slimmer 17.5% return for the S&P 500. That's in part because of what is expected to be a nearly 30% increase in revenue this fiscal year as the foodservice business normalizes after pandemic-related disruptions. However, it's also because investors know they can rely on this profitable operation regardless of any short-term pain for the economy, which makes LW one of the best stocks for rising interest rates.

CFRA Research analyst Arun Sundaram recently lifted his rating on LW stock to Buy from Hold. "We expect fiscal 2024 to be another strong year of robust organic sales growth and margin expansion, which can't be said of many other packaged food companies," Sundaram wrote in a note to clients. "We expect global fry demand to remain resilient, noting fry attachment rates continue to be above pre-pandemic levels."

PennyMac Financial Services

- Sector: Financial services

- Market value: $4.1 billion

- Dividend yield: 1.0%

PennyMac Financial Services (PFSI, $81.71) is a mortgage lender that originates and services home loans to Americans. And as interest rates rise, the firm can command bigger margins from homebuyers as a result.

There is a bit of risk here, to be sure. If rates get too high, the cost of borrowing can hold back overall lending activity. Additionally, any broader economic downturn that weighs on the housing market could impact demand. In fact, revenue is predicted to roll back in the year ahead thanks to moderation in housing.

However, it's worth noting that shares have surged more than 44% this year as the company's "new normal" is priced in.

On top of this core mortgage business, PFSI also has an investment management segment, which will also see a tailwind from rising interest rates.

Jefferies analyst Kyle Joseph recently initiated coverage on PFSI with a Buy rating. "Core to our thesis is PFSI's balanced model between originations/servicing and our medium-term scenario that both segments will be substantially profitable, driving ROE back to historical levels," Joseph wrote in a note to clients.

And many economists believe that the nation's overall housing supply remains limited so prices for real estate will stay elevated as the sector is focused on quality over quantity. That could bode well for PennyMac as it may not be swamped with buyers, but it can depend on high-quality and high-margin loans as rates stay high.

When you add all of that up, it's easy to see why PFSI is one of the best stocks for rising interest rates.

Principal Financial Group

- Sector: Financial services

- Market value: $20.4 billion

- Dividend yield: 3.1%

Insurance and investment management giant Principal Financial Group (PFG, $84.10) is another example of a big financial firm being one of the best stocks for rising interest rates. But PFG is separate from similar names on this list because it has bigger scale and more stable operations.

To begin with, its retirement and pension solutions rely on the management of fixed-benefit pension plans worldwide and employer 401(k) plans – a very reliable business line when compared with the ebb and flow of more active investment management strategies. Furthermore, its insurance solutions segments, which include a brisk life insurance business, are the definition of a steady income stream as Principal cashes in the premiums paid by policyholders each month.

What's more, PFG is getting even bigger to take advantage of the current environment. Recently, it closed a deal to take over millions of U.S. clients from the retirement services arm of Wells Fargo (WFC). Due in part to that roll-up, Principal's financial services arm had north of $630 billion in assets under management at the end of the first quarter, and an even more impressive $1.5 trillion in assets under administration when you count the institutional money of clients that it services on their behalf.

Shares are up nearly 32% in the last year, while the S&P 500 is up a slimmer 17.5%. That's in large part because rising rates are sure to lift a company like this with a huge stockpile of cash.

Enbridge

- Sector: Energy

- Market value: $95.6 billion

- Dividend yield: 6.9%

The largest name on this list of the best stocks for rising interest rates – and by a fairly significant margin – is Enbridge (ENB, $37.36). Though a mainstay of the oil and gas industry, it's important to point out that this isn't an explorer drilling for crude oil. Rather ENB is an energy infrastructure MLP, or master limited partnership.

This is a special class of corporation structured as a partnership in part to help finance the capital-intensive nature of building pipelines, terminals and storage facilities.

This business model makes the company less volatile than many other energy stocks that are sensitive to market prices for petroleum products. Case in point: While some drillers soared in 2022, ENB was left in the dust with a mostly flat calendar-year return.

But that lack of volatility cuts both ways, and the appeal of this stock to many investors is, in fact, this slow-and-steady performance. Stability, not rapid share price appreciation, is the name of the game.

In recent years, Enbridge has tightened its grip through acquisitions of firms like Spectra Energy, which has only widened its moat. That has helped to fuel its current dividend yield of 6.9%, and continue 28 years of consecutive annual dividend growth.

If you want to make a swing trade on oil prices, ENB is not for you. But if you're looking to invest in a low-risk, income-oriented fashion, then this energy infrastructure player might fit in your portfolio.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jeff Reeves writes about equity markets and exchange-traded funds for Kiplinger. A veteran journalist with extensive capital markets experience, Jeff has written about Wall Street and investing since 2008. His work has appeared in numerous respected finance outlets, including CNBC, the Fox Business Network, the Wall Street Journal digital network, USA Today and CNN Money.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

How Can Investors Profit From AI's Energy Use?

How Can Investors Profit From AI's Energy Use?Global energy demand is expected to grow by leaps and bounds over the next several years as AI usage accelerates. Here's how to get a piece of the pie.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

The Best Tech Stocks to Buy

The Best Tech Stocks to BuyTech stocks are the market's engine of growth. But what defines a tech stock? How do you find the best ones to buy? We take a look here.

-

Bond Ratings and What They Mean

Bond Ratings and What They Meaninvesting Bond ratings measure the creditworthiness of your bond issuer. Understanding bond ratings can help you limit your risk and maximize your yield.

-

Bond Basics: Treasuries

Bond Basics: Treasuriesinvesting Understand the different types of U.S. treasuries and how they work.

-

Bond Basics: Ownership

Bond Basics: Ownershipinvesting Bonds come in a variety of forms, but they all share these basic traits.

-

Bond Basics: Pick Your Type

Bond Basics: Pick Your Typeinvesting Bonds offer a variety of ways to grow wealth and fortify your portfolio. Learn about the types of bonds and how they work.

-

Silicon Valley Bank, Signature Bank Failures Send Bank Stocks Reeling

Silicon Valley Bank, Signature Bank Failures Send Bank Stocks ReelingFinancial stocks continued to sell off following the collapse of regional lenders SVB and Signature Bank.