Stock Market Today: S&P 500 Snaps Seven-Month Win Streak

The Dow and Nasdaq also closed out September in the red.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

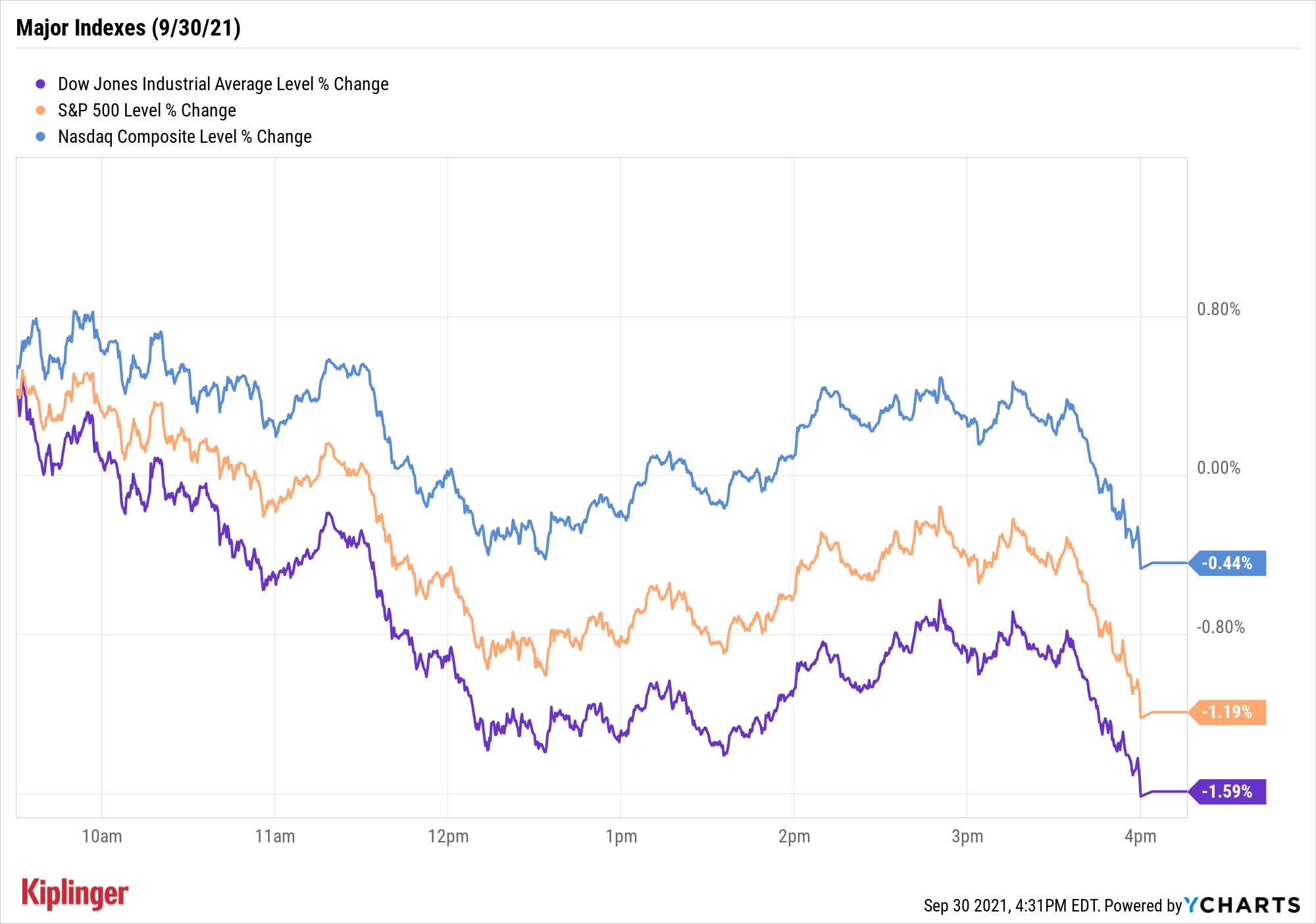

It was a volatile day of trading to end a tough month for stocks as investors digested an onslaught of headlines.

In economic news, weekly jobless claims came in higher than expected (362,000 actual vs. 335,000 estimate), while the final reading on second-quarter gross domestic product (GDP) was upwardly revised to 6.7% from 6.6%.

Additionally, the House and Senate passed a temporary spending bill that will fund the government through Dec. 3. The bill is expected to be signed by President Biden in order to avoid a government shutdown beginning at midnight tonight.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The measure does not address the debt ceiling, which Congress will need to either raise or suspend by Oct. 18 in order for the U.S. to avoid defaulting on its financial obligations.

After opening in positive territory, the Dow Jones Industrial Average was down 1.6% to 33,843 by the close, while the S&P 500 Index gave back 1.2% to 4,307. The Nasdaq Composite slipped 0.4% to 14,448.

For September, the Dow was down 4.3%, its worst month since October 2020. The S&P 500 was off 4.8% – snapping its seven-month winning streak and marking its biggest monthly loss since March 2020 – and the Nasdaq shed 5.3%.

And for the quarter, the Dow was off 1.9% and the Nasdaq slipped 0.4%. The S&P 500 eked out a 0.2% quarterly gain.

Other news in the stock market today:

- The small-cap Russell 2000 slumped 0.9% to 2,204.

- Bed Bath & Beyond (BBBY) stock plunged 22.1% in the wake of the homegoods retailer's second-quarter earnings report. BBBY reported adjusted earnings per share and revenue well below consensus estimates (4 cents, $1.99 billion actual vs. 52 cents, $2.06 billion expected) and cut its current-quarter and full-year guidance. CEO Mark Tritton cited slowing traffic, the Delta variant of COVID-19 and supply chain issues as "disruptive forces" that impacted the results. CFRA analyst Kenneth Leon downgraded BBBY stock to Hold from Buy, saying "We think the three-year transformation plan is likely to take longer before we see major uptrend in performance."

- CarMax (KMX, -12.6%) was another post-earnings loser. While the used car retailer beat on the top line ($7.99 billion actual vs. $6.91 billion expected), its adjusted earnings of $1.72 per share fell short of the $1.88 per share analysts were expecting. KMX also said pre-owned car sales rose a slimmer-than-anticipated 6.2% in the three-month period. The results prompted CFRA analyst Garrett Nelson to cut his rating on the stock to Hold from Buy, explaining "Cost pressures lead us to a more cautious recommendation on the shares."

- U.S. crude oil futures rose 0.3% to end at $75.03 per barrel.

- Gold futures jumped 2% to settle at $1,757.00 an ounce.

- The CBOE Volatility Index (VIX) rose 2.6% to 23.14.

- Bitcoin prices jumped 5.7% to $43,534.56. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

What to Do About Rising Rates

It's certainly been a September to remember for stocks. One major headline investors had to contend with was a big spike in the 10-year Treasury yield, which ended the month hovering near its highest level since June.

"The big jump in yields happened after the Federal Reserve meeting where Jay Powell made the case for a taper announcement to happen this fall – most likely at the November meeting," says Chris Zaccarelli, chief investment officer for Independent Advisor Alliance. "It seems likely that yields will move higher between now and year end."

If that's the case, there are several options for investors looking to position their portfolios for higher interest rates – including with value stocks and financials.

And for a broader list of the best stocks for rising rates, check out this list of 10 names we put together for you.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.