Stock Market Today: Dow Jumps 482 Points on Promising Merck Data

The blue-chip drugmaker reported positive results for its oral COVID-19 treatment, developed alongside Ridgeback Biotherapeutics.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

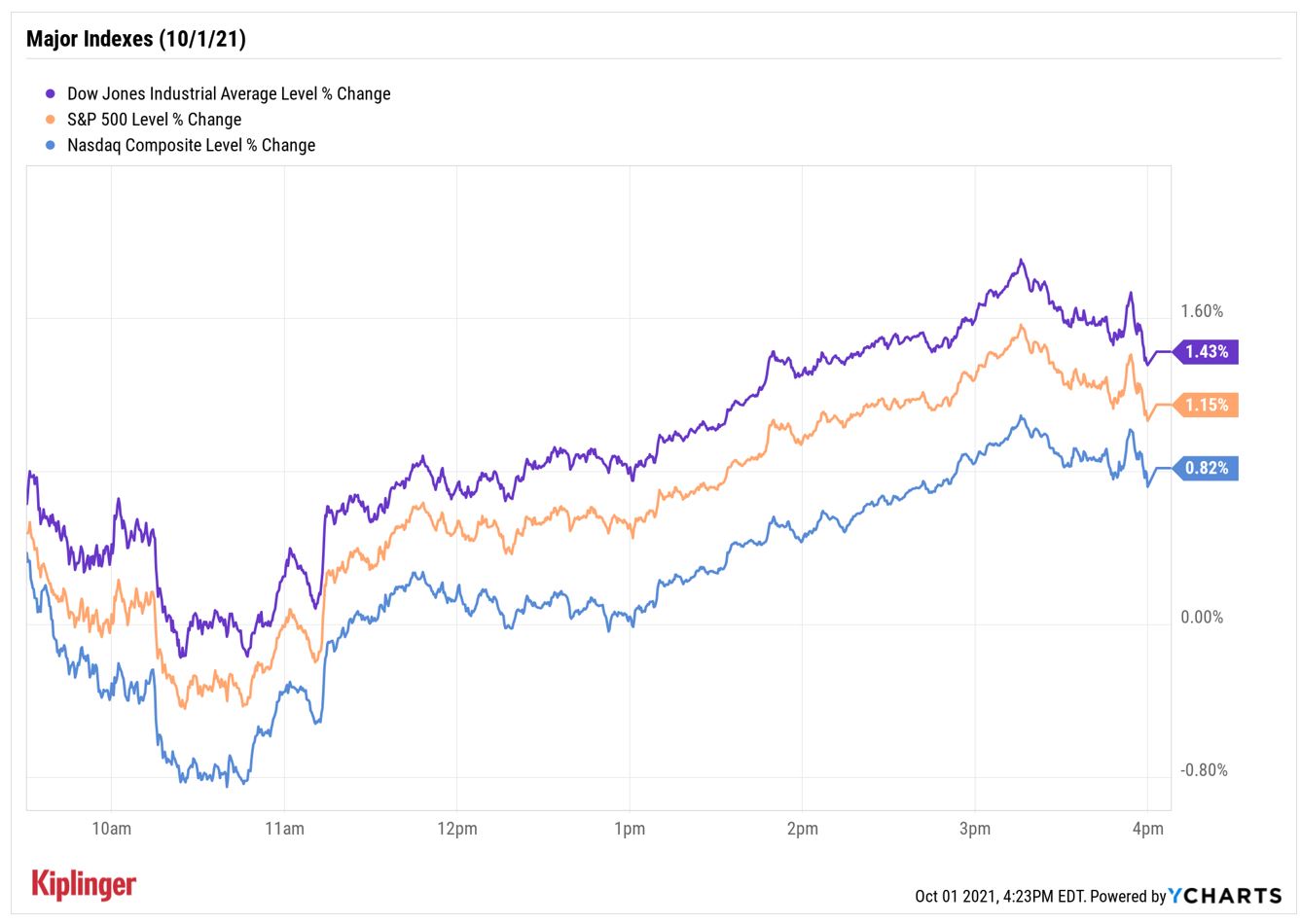

It was a choppy start to the first day of a new month and quarter, with stocks displaying weakness at the open.

However, the major market indexes turned higher after the Institute for Supply Management's (ISM) manufacturing index – a measure of factory activity – came in at a higher-than-anticipated 61.1 in September, and the University of Michigan's consumer sentiment index for the same month also beat the consensus estimate (72.8 actual vs. 71.0 expected).

The Dow Jones Industrial Average easily outperformed its peers, adding 1.4% to 34,326, on strength from Merck (MRK, +8.4%).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The drugmaker got a big boost after late-stage data showed its antiviral pill, co-developed with Ridgeback Biotherapeutics, reduced the chance of death or hospitalizations by around 50% in high-risk COVD-19 patients. The firms plan to submit the results to the Food and Drug Administration (FDA) for emergency authorization.

The S&P 500 Index gained 1.2% to 4,357 and the Nasdaq Composite rose 0.8% to 14,566.

Other news in the stock market today:

- The small-cap Russell 2000 surged 1.7% to 2,241.

- Several makers of COVID-19 vaccines fell in reaction to the promising data from Merck. Moderna (MRNA) gave back 11.4%, Regeneron Pharmaceutials (REGN) fell 5.7% and BioNTech (BNTX) slumped 6.7%.

- Lordstown Motors (RIDE) was also a notable decliner today, sliding 18.3%. This came after the electric vehicle (EV) maker late Thursday said it agreed in principle to sell its Ohio-based assembly plant to iPhone maker Foxconn for $230 million. As part of the deal, Foxconn will manufacture the vehicle maker's all-electric pickup truck and purchase roughly $50 million of RIDE common stock. Lordstown, meanwhile, will now be able to focus its efforts on bringing the vehicle to market, said CEO Daniel Ninivaggi in a statement.

- U.S. crude oil futures rose 1.1% to finish at $75.88 per barrel.

- Gold futures eked out a marginal gain to settle at $1,758.40 an ounce.

- The CBOE Volatility Index (VIX) spiraled 8.6% to 21.15.

- Bitcoin prices gained 10.4% to $48,071.09. "Today's spike is directly correlated to news out of Washington," says Charlie Silver, CEO of Permission.io, a cryptocurrency-enabled provider of e-commerce permission advertising. "Most importantly in direct opposition to recent Chinese announcements, Fed Chair Jerome Powell made it clear that the dollar can coexist with cryptocurrencies. In addition, all the discussion around eliminating the debt ceiling also fuels the animal spirits in crypto." (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Don't Let October Scare You

You wouldn't know it by today's action, but October can be pretty spooky for stocks.

"October is known for some spectacular crashes and many expect bad things to happen again this year," says Ryan Detrick, chief market strategist for LPL Financial. "No month has seen more 1% moves (up or down) than October, with some of the largest one-day moves (both up and down) taking place this month."

And with the S&P 500 failing to have a 5% pullback yet this year – it came close with its 4.8% September decline – it's understandable if investors are skittish.

However, Detrick notes that the fourth quarter is historically bullish for stocks, so if we do see any more weakness, it should be used as an opportunity "to add to core positions."

There are plenty of options for investors who may want to put together their wish list now, including these high dividend payers or these sturdy blue chips. There's also our Kiplinger 25, which is perfect for investors looking to build a core portfolio. This list of 25 mutual funds offer easy diversification across a wide range of issues, and they all have solid long-term records with attractively low fees. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market Today

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market TodayOracle stock boosted the tech sector on Friday after the company became co-owner of TikTok's U.S. operations.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

Risk Is Off Again, Dow Falls 397 Points: Stock Market Today

Risk Is Off Again, Dow Falls 397 Points: Stock Market TodayMarket participants are weighing still-solid earnings against both expectations and an increasingly opaque economic picture.