Stock Market Today: Debt-Ceiling Band-Aid Gets Stocks Into the Green

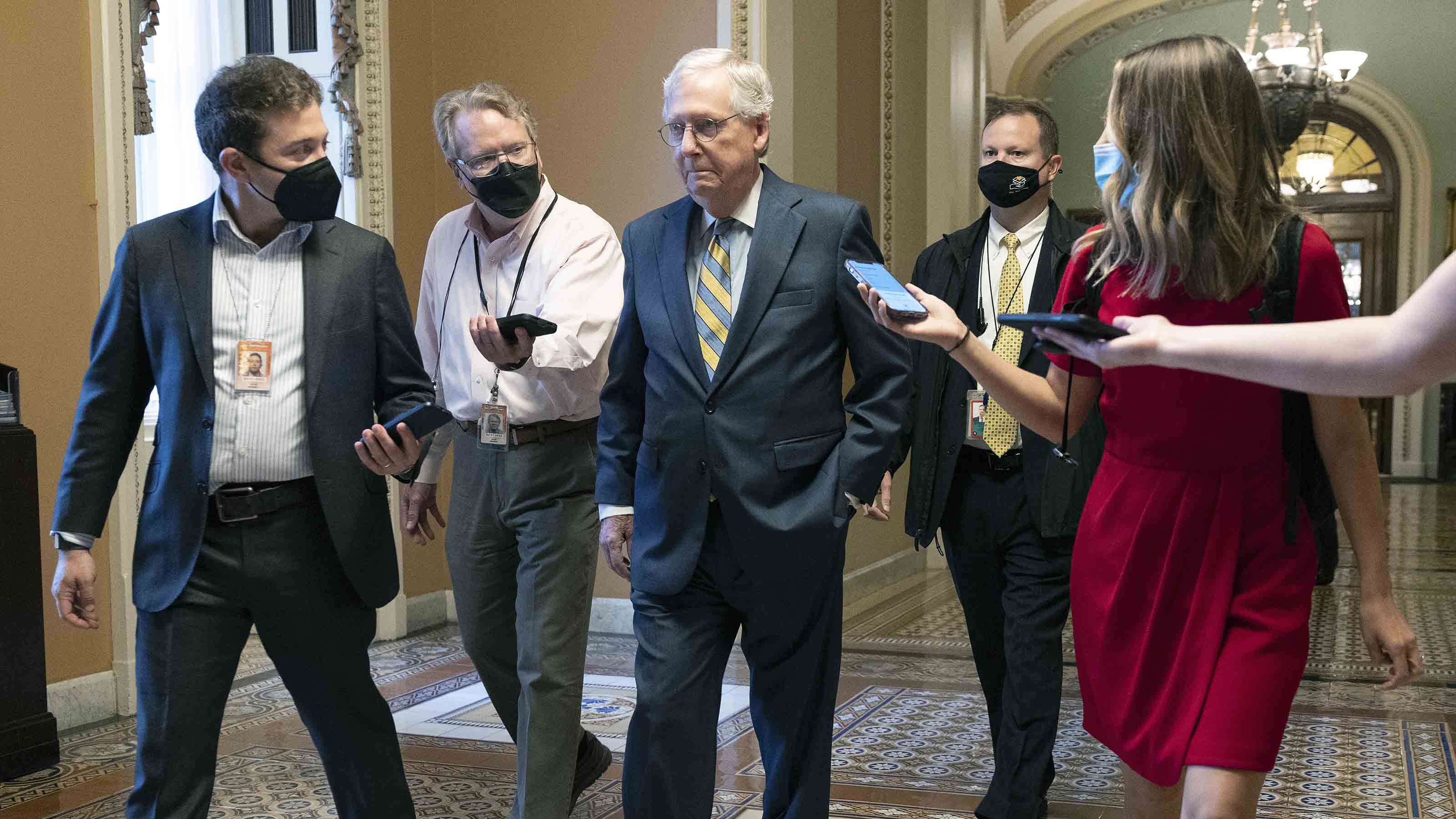

Equities perked up into positive territory Wednesday after Senate Minority Leader Mitch McConnell offered up a short-term debt-ceiling extension.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Another day, another change of direction for the stock market?

That looked to be the case early Wednesday, with stocks widely down following Tuesday's rally, which itself followed a lousy Monday for equities. But a turn of events in America's debt-crisis saga gave stocks an afternoon jolt.

Senate Minority Leader Mitch McConnell, in response to recent pressure from both his Democratic congressional peers and President Joe Biden, offered up a temporary fix, saying Republicans will "allow Democrats to use normal procedures to pass an emergency debt limit extension at a fixed dollar amount to cover current spending levels into December."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

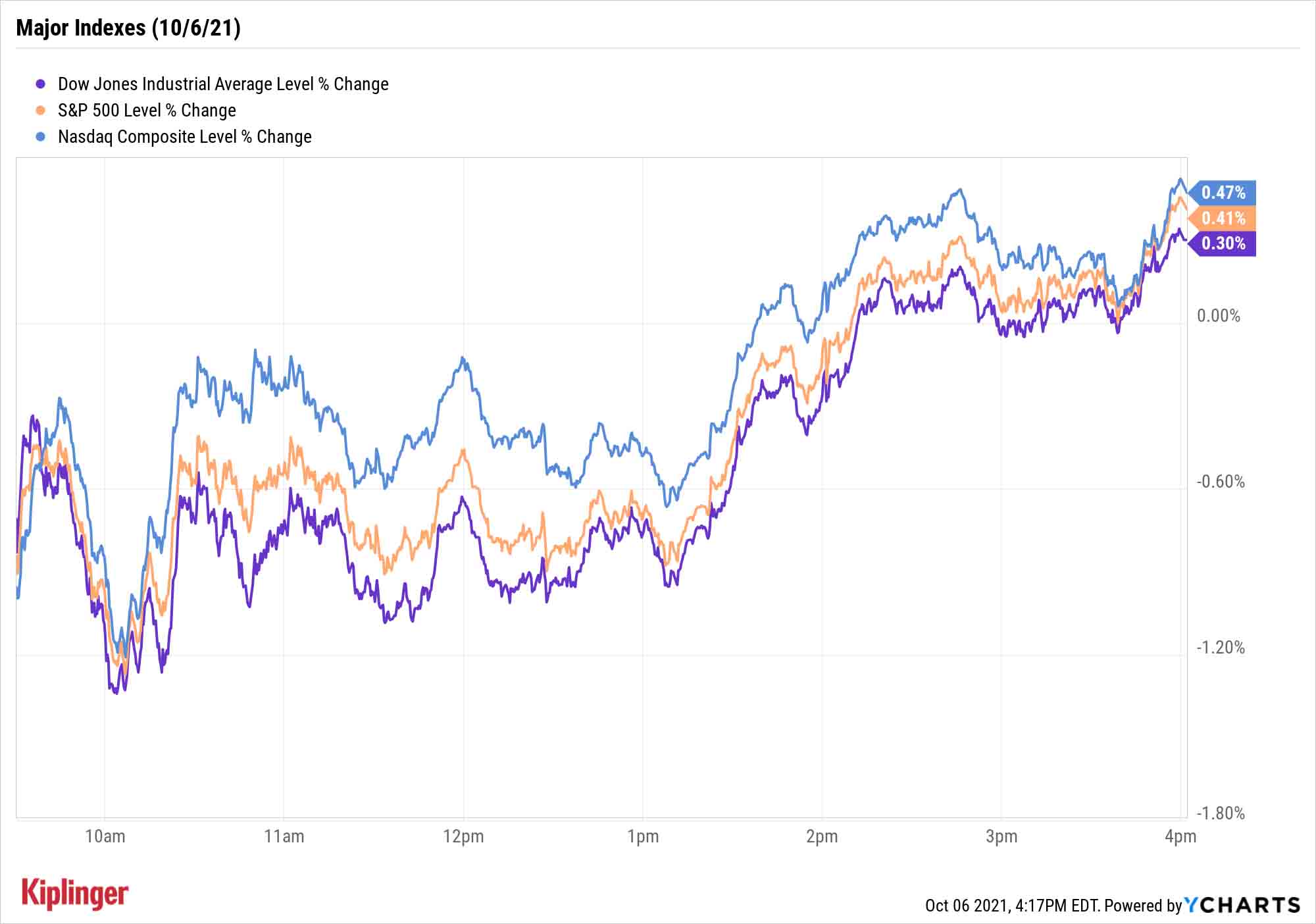

Temporary relief, yes, but it was enough to send equities into modest positive territory. The defensively minded utilities (+1.6%) and consumer staples (+1.0%) sectors improved the most, but technology and tech-esque mega-caps such as Microsoft (MSFT, +1.5%), Amazon.com (AMZN, +1.3%) and Google parent Alphabet (GOOGL, +1.1%) also enjoyed a decent updraft.

That helped lift the Nasdaq Composite 0.5% to 14,501; the S&P 500 (+0.4% to 4,363) and Dow Jones Industrial Average (+0.3% to 34,416) also finished in the green.

Other news in the stock market today:

- The small-cap Russell 2000 improved in the afternoon, too, but still finished down 0.6% to 2,215.

- Affirm Holdings (AFRM) surged 20.0% today after Target (TGT, -0.3%) unveiled a new partnership with the "buy now, pay later" company ahead of the holiday shopping season. "We know our guests want easy and affordable payment options that work within their family’s budget," said Gemma Kubat, Target's president of financial and retail services in the retailer's blog post. AFRM is now up roughly 180% since its May lows near $48.

- Dow Inc. (DOW, -3.3%) was the industrial average's worst stock today. The decline came after Chief Financial Officer Howard Ungerleider outlined plans at the chemical company's annual investor day for DOW to get carbon neutrality by 2050. Ungerleider also said these efforts, along cost-cutting efforts, will help the company realize $3 billion in EBITDA (earnings before interest, taxes, depreciation and amortization) growth.

- U.S. crude futures retreated 1.9% to $77.43 per barrel. The pullback from crude oil's highest level in six years – which also snapped a five-day winning streak – came amid reports suggesting Russian President Vladimir Putin is increasing gas supplies to Europe in order to stabilize the market.

- Gold futures eked out a 0.05% gain to settle at $1,761.80 an ounce.

- The CBOE Volatility Index (VIX) slipped 1.2% to 21.05.

- Bitcoin prices reached their highest point since May, rocketing 7.5% higher to $55,083.96. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Why You Shouldn't Fear a Correction

"Volatility is the price of admission."

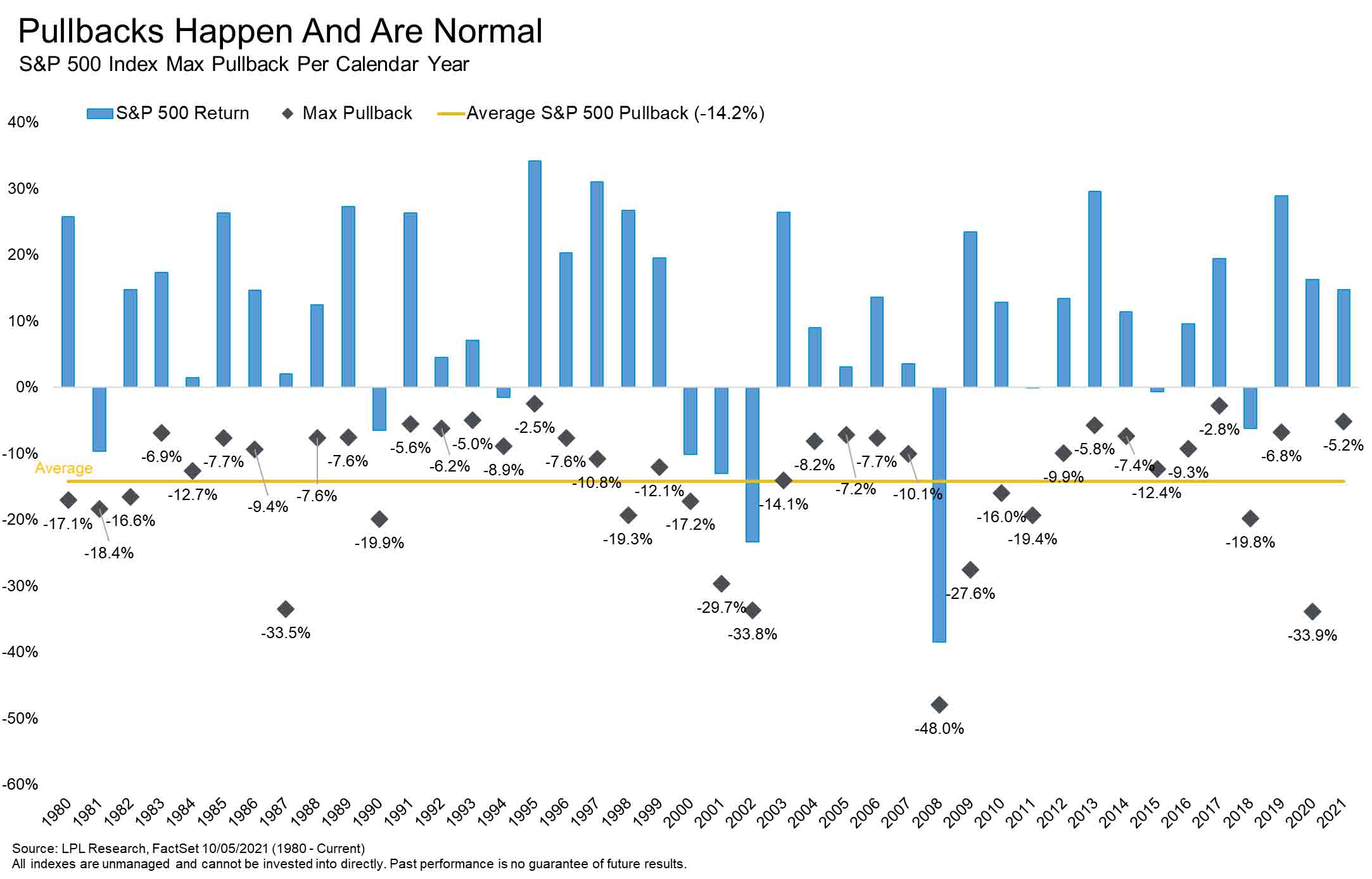

Those words come from LPL Financial Chief Market Strategist Ryan Detrick in the wake of the S&P 500's first 5% pullback of 2021. Investors would be wise to embrace that thought as numerous analysts float the idea of a deeper retreat before 2021 is through.

And remember: Corrections aren't a death sentence.

"As shown in the LPL Chart of the Day, since 1980, stocks experience a 14.2% peak-to-trough pullback on average during the year, putting the recent 5% pullback in perspective. In fact, 21 out of the past 41 years saw at least a 10% correction. Incredibly, 12 of those years finished in the green and those 12 years gained an average of 17.0%. … In other words, big pullbacks can happen even in years that see outsized gains."

The key to maintaining your sanity? Build a sturdy portfolio core that you're confident can grow steadily over the long-term, and use occasional corrections to go on the offensive.

For one, you could use any dips to invest in long-term mega-trends such as the rise of solar power and the global need for water solutions. Or just take the opportunity to secure growth plays at a more palatable price. You can start your wish list with these 11 fundamentally sound growth stocks, each of which appear positioned for big things once the market gets on steadier legs:

Kyle Woodley was long AMZN as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.