Stock Market Today: Inflation Data, Fed Minutes Fail to Budge Dow Much

September's CPI print came in a little hotter than expected Wednesday, while the Fed's latest minutes show tapering could begin as soon as November.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors bored by a drought of news earlier this week had their prayers answered Wednesday with a mess of headlines – yet none of it really gave the market much impetus.

Today's early headline was September's CPI reading, which showed a 5.4% year-over-year in consumer prices that was slightly hotter than the 5.3% expected.

“Some of the transitory components are already moderating, such as airlines, apparels, and used autos. Disruptions due to supply chains not being able to keep up with the spike in demand may take longer but will eventually be fixed,” says Anu Gaggar, Global Investment Strategist for Commonwealth Financial Network. “However, higher rents and wages could prove to be stickier and eat into corporate margins.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

BofA Global Research similarly warns about non-transitory risks. "While one month does not make a trend, this is an early signal of stronger persistent inflation pressures materializing, ultimately supporting continued above-target inflation over the medium term," a team of BofA economists says.

Later Wednesday, minutes of the Sept. 21-22 Federal Reserve meeting showed that it could begin a "gradual tapering process" starting as early as mid-November and ending by mid-2022.

“In our view, the bar to get moving on asset purchase tapering is very low for the Fed, and in terms of the likely composition of tapering, there appears to be considerable agreement,” says Bob Miller, BlackRock’s head of Americas Fundamental Fixed Income. “Indeed, we already had the impression in July that the reduction in Treasury securities and MBS would occur at the same time, and assuming a November to June 2022 tapering timeline, this would imply a $15 billion reduction in the purchase pace per month, or a faster meeting-by-meeting adjustment schedule.”

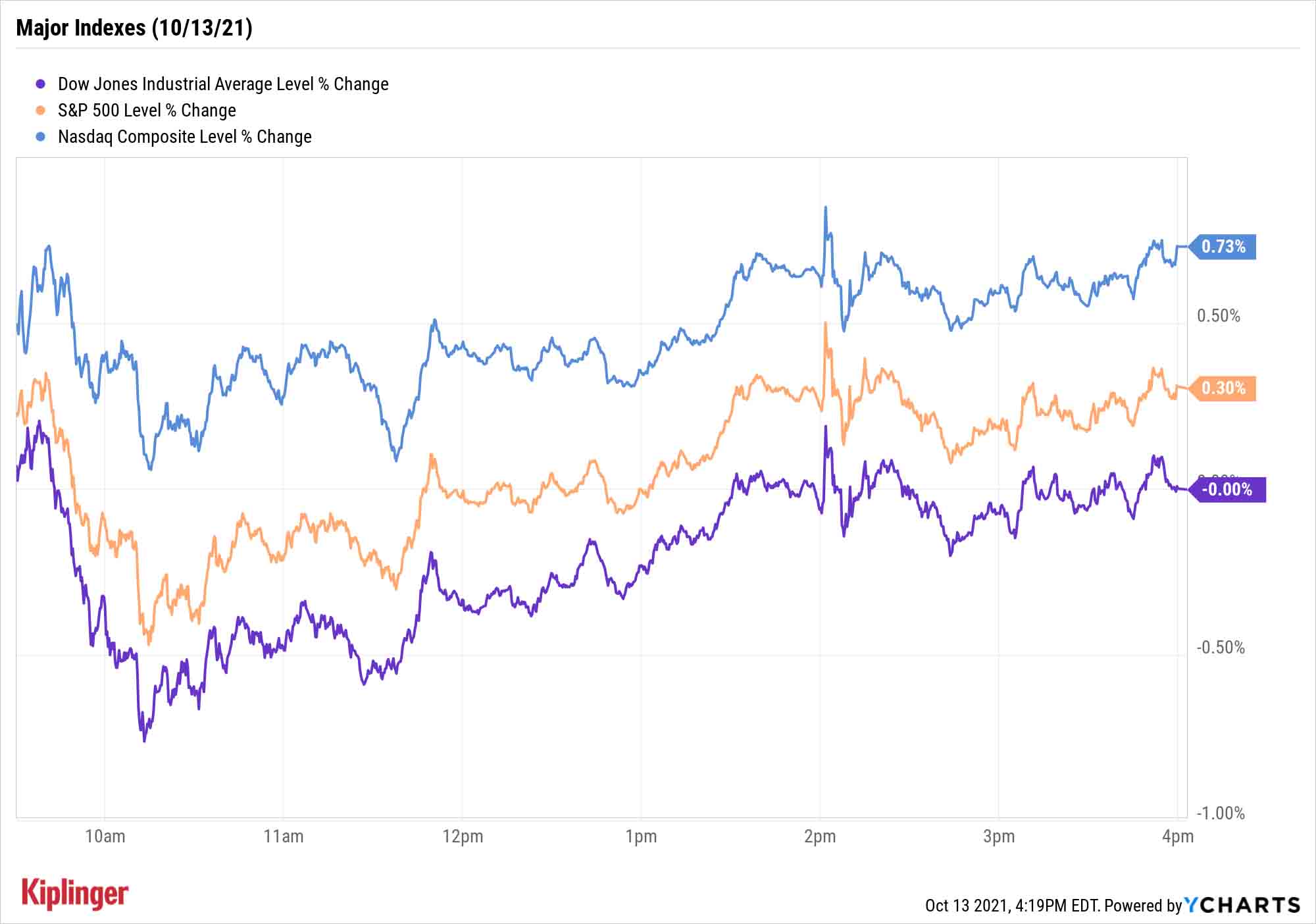

The Dow Jones Industrial Average suffered a marginal loss to 34,377. The S&P 500 fared a bit better, up 0.3% to 4,363, while the Nasdaq Composite closed 0.7% higher to 14,571.

Financials (-0.6%) were Wednesday's worst sector. The Dow's performance was hampered by declines in components American Express (AXP, -3.5%), Visa (V, -0.7%) and JPMorgan Chase (JPM, -2.6%) – the latter of which fell despite announcing Street-beating revenues and profits to kick off the Q3 earnings season.

"JPM's pullback today in the face of a fairly positive earnings report does not suggest optimism for banks reporting through the remainder of this week," says David Keller, chief market strategist at StockCharts.com.

Speaking to the charts, Keller adds, "After peaking just above $170, the stock has now rotated below $165 yet again, completing a 'failed breakout' pattern that implies a lack of investor confidence. I would expect further backing and filling for stocks like JPM before any further upside is likely."

Other news in the stock market today:

- The small-cap Russell 2000 climbed 0.3% to 2,241.

- BlackRock (BLK, +3.8%) shares enjoyed a post-earnings lift today. In the third quarter, the world's largest asset manager – with $9.46 trillion in assets under management – reported earnings of $10.95 per share on $5 billion in revenues. Analysts, on average, were expecting earnings per share of $9.35 on $4.9 billion in revenues. CFRA analyst Catherine Seifert kept her Strong Buy rating on BlackRock: "Despite some tough year-to-year comparisons, we view BLK as a best-in-class asset manager with above-peer growth and profitability metrics set to support the shares' above-peer valuation," she says.

- Delta Air Lines (DAL, -5.8%) was also in focus after earnings. While the airline reported higher-than-expected adjusted profits of 30 cents per share on $9.15 billion in revenues, its results were still below 2019 levels. DAL also warned that higher fuel costs could weigh on its bottom line in the current quarter. Nevertheless, CFRA analyst Colin Scarola maintained his Strong Buy rating on Delta. "The current stock sell-off is hyperfocused on today's challenges (high oil prices and limited business and international travel), but investors will be better served to think about a year from now, by which time we expect lower fuel prices and a near full recovery for business/international," he wrote in a note.

- U.S. crude futures shed 0.2% to end at $80.44 per barrel, snapping a five-day winning streak.

- Gold futures gained 2% to settle at $1,794.70 an ounce.

- The CBOE Volatility Index (VIX) declined 6.8% to 18.50.

- Bitcoin prices firmed up by 3.6% to $57,272.90. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

What's in Your 401(k)?

If you're like many workplace savers, you might have checked what funds you were holding once, and only once – when you started contributing to your 401(k) and set your initial allocations.

If that sounds like you, consider taking a fresh look, for any number of reasons. Your investment goals might have changed. You might be due for a rebalancing. Or you simply might understand your investment options better now. Importantly, you don't have to go it alone.

Kiplinger has begun its annual look at the market's most popular 401(k) funds – a list of 100 products that are commonly found in company 401(k) plans nationwide. And naturally, we've started this year's exploration with one of the most popular names among thrifty investors: Vanguard.

Vanguard funds account for a whopping one-third of the 401(k) world's top products, so chances are your plan offers up at least a couple of its funds. We look at each of the fund provider's actively managed and target-date products that rank in the 100 most popular 401(k) funds, rating them Buy, Hold or Sell – and explaining what you get out of each one.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Visa Stamps the Dow's 398-Point Slide: Stock Market Today

Visa Stamps the Dow's 398-Point Slide: Stock Market TodayIt's as clear as ever that President Donald Trump and his administration can't (or won't) keep their hands off financial markets.

-

Stocks Climb Wall of Worry to Hit New Highs: Stock Market Today

Stocks Climb Wall of Worry to Hit New Highs: Stock Market TodayThe Trump administration's threats to Fed independence and bank profitability did little to stop the bulls on Monday.

-

Dow Hits a Record High After December Jobs Report: Stock Market Today

Dow Hits a Record High After December Jobs Report: Stock Market TodayThe S&P 500 also closed the week at its highest level on record, thanks to strong gains for Intel and Vistra.

-

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market Today

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market TodayThe Dow Jones Industrial Average outperformed on strength in cyclical stocks.