Stock Market Today: S&P 500, Nasdaq Nab Fifth Straight Win

A solid round of blue-chip earnings lifted the collective mood on Wall Street.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks closed higher Tuesday as investors looked past a lackluster update on housing to instead focus on a solid round of corporate earnings.

The Census Bureau this morning revealed that housing starts unexpectedly fell 1.6% month-over-month in September to a seasonally adjusted annual rate of 1.555 million units – the lowest since April. Building permits plunged 7.7% to 1.589 million units annualized, the fewest since August 2020.

But Jennifer Lee, senior economist at BMO, isn't concerned with the shortfalls. "A number of homebuilders recently cited 'unprecedented supply-chain challenges,' and shortages of building materials and labor market tightness," she says. "All the things that are needed to build a good solid roof over one's head."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

On the earnings front, supply-chain woes prompted Procter & Gamble (PG, -1.2%) to announce price hikes on a number of household items, including razors, which it will use to offset higher freight costs. The consumer goods giant did however report better-than-expected revenue and income, as did fellow Dow stock Travelers (TRV, +1.6%). And while Johnson & Johnson's (JNJ, +2.3%) revenue fell just shy of the Street's consensus estimate, the Dow component's earnings beat expectations.

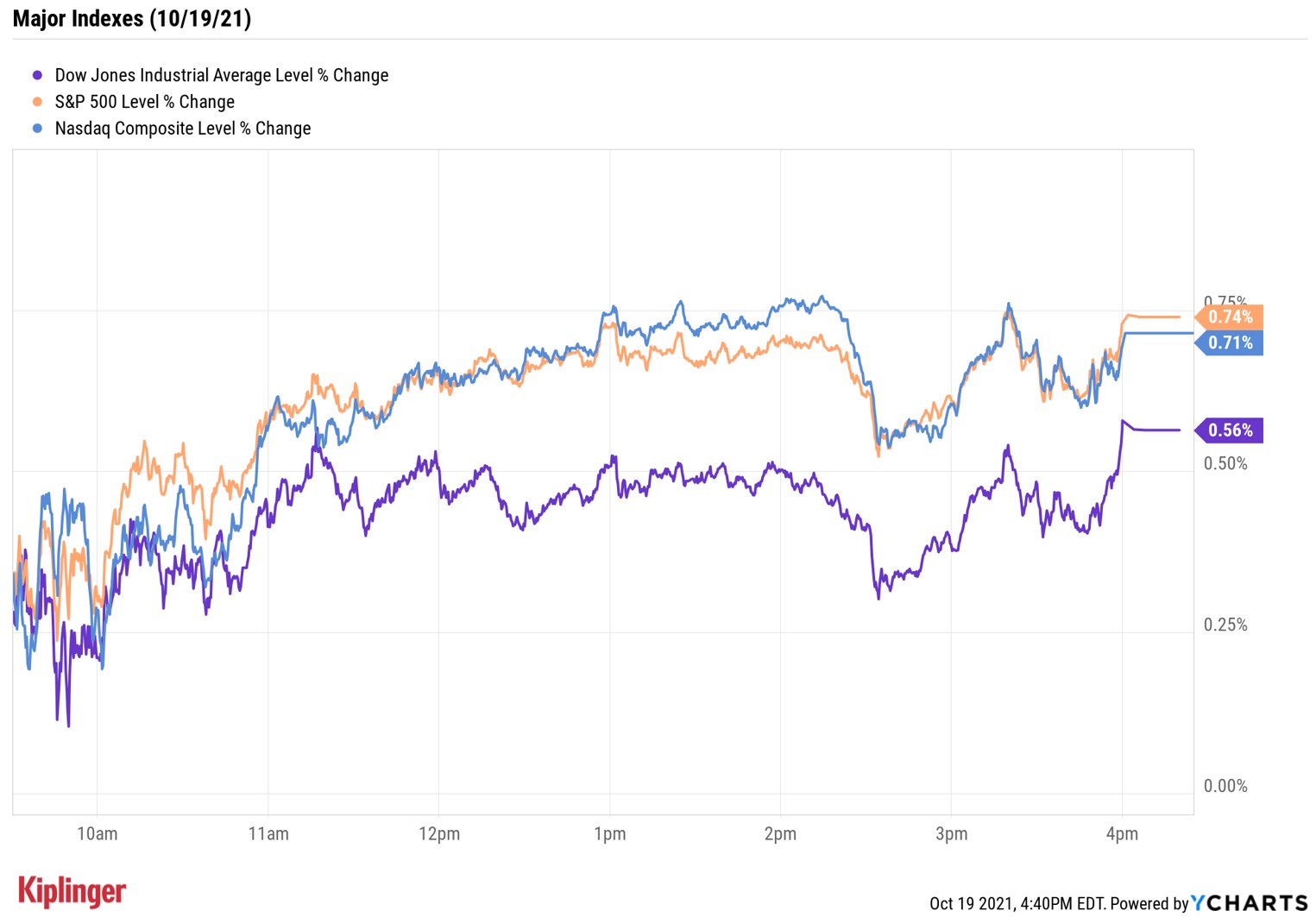

The blue-chip Dow Jones Industrial Average closed up 0.6% at 35,457, while the broader S&P 500 Index added 0.7% to 4,519 and the tech-heavy Nasdaq Composite rose 0.7% to 15,129. The latter two major indexes both marked their fifth straight day of gains.

Other news in the stock market today:

- The small-cap Russell 2000 added 0.4% to 2,275.

- Ulta Beauty (ULTA) slid 10.6% after the cosmetics retailer unveiled new financial targets at its annual investor day. ULTA guided for compound annual growth rates (using 2019 as the base year) of 5% to 7% for total net sales and low double-digits for diluted earnings per share from fiscal 2022 through fiscal 2024. The company also said it expects to open 50 new stores per year over that same time frame and sees comparable sales growing 3% to 5% annually. Even with today's pullback, ULTA stock is up 26.5% for the year-to-date and CFRA analyst Zachary Warring still believes it's a Buy. "The company announced long-term strategic priorities and financial targets in line with our expectations," he wrote in a note.

- Tobacco giant Philip Morris International (PM, -1.7%) was another name reporting earnings today. In its third quarter, the company reported an 11.3% year-over-year rise in adjusted earnings per share to $1.58, while revenues increased 9.1% to $8.1 billion. "PM said it confirms its confidence in its 2021-2023 growth targets, despite device constraints that could persist into the first half of 2022, with temporarily lower IQOS user growth rates," CFRA analyst Garrett Nelson said after the results. "We maintain a Buy, liking the stock's generous cash returns to shareholders including the current 5.1% dividend yield. We also like PM's IQOS growth potential and lack of U.S. exposure."

- U.S. crude futures edged up 0.6% to settle at $82.96 per barrel.

- Gold futures tacked on 0.3% to finish at $1,770.50 an ounce.

- The CBOE Volatility Index (VIX) retreated 3.7% to 15.70.

- Bitcoin prices jumped 4.4% to $64,099.00 amid excitement over the first Bitcoin futures ETF. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.) Meanwhile, on its first day of trading, the ProShares Bitcoin Strategy ETF (BITO) spiked 4.9%.

An Under-the-Radar Inflation Play

Inflation: It might be one of Wall Street's buzzwords at the moment, but it's also one of the market's most underappreciated risks. At least, that's what a team of BlackRock strategists say.

The surge in price pressures – driven by a "major supply shock," i.e. an economic restart in the wake of pandemic-induced shutdowns – marks "a sea change from the environment many of today's investors know best: decades of low inflation on the back of deepening globalization and technological advances," says the BlackRock team.

And while they see higher inflation persisting into next year before eventually subsiding, they remain "tactically pro-risk."

For investors looking to protect their portfolios against ongoing price pressures, turn your attention to real estate investment trusts (REITs) or healthcare stocks – both of which are considered to be more defensive in nature.

You’ll also want to put transportation stocks on your radar. True, transports aren't necessarily the first thing that comes to mind when flipping through a rolodex of inflation hedges. But these companies will play a pivotal role in reducing the supply-chain disruptions that are keeping prices aloft, thus making them worth a closer look.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market Today

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market TodayWall Street continues to cheer easing geopolitical tensions and President Trump's assurances that there will be no new tariffs on Europe.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Dow Rises 497 Points on December Rate Cut: Stock Market Today

Dow Rises 497 Points on December Rate Cut: Stock Market TodayThe basic questions for market participants and policymakers remain the same after a widely expected Fed rate cut.

-

Stocks Keep Climbing as Fed Meeting Nears: Stock Market Today

Stocks Keep Climbing as Fed Meeting Nears: Stock Market TodayA stale inflation report and improving consumer sentiment did little to shift expectations for a rate cut next week.