Stock Market Today: The S&P Squeaks Out a Record Close

Shrinking unemployment claims and a pop in Tesla on Thursday contributed to a new high for the S&P 500 and gains for the Nasdaq.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

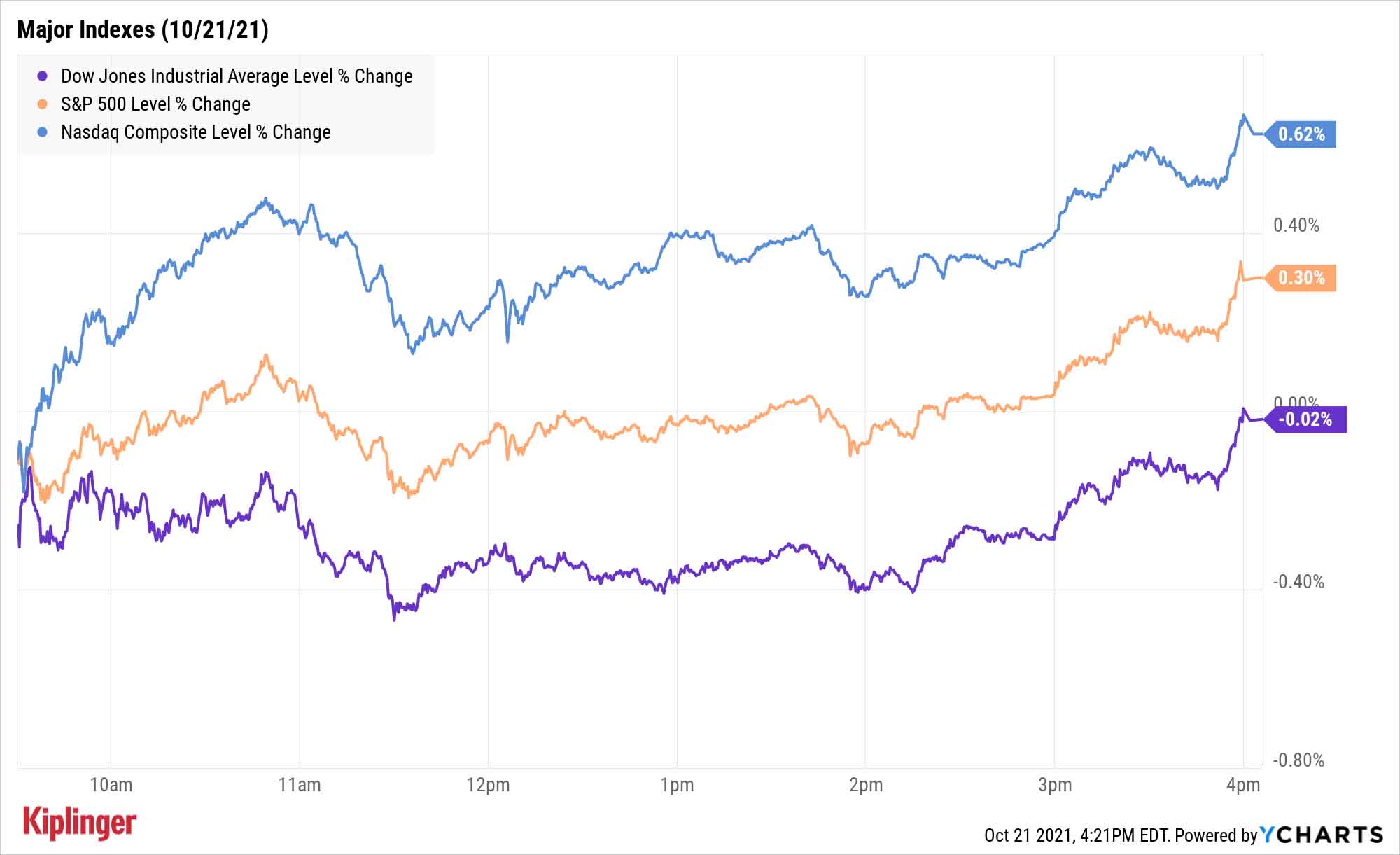

Thursday's session was much like yesterday's in that none of the major indexes made a strong move in either direction. But instead of Wednesday's bent toward cyclicals sectors, buyers instead opted for tech-esque and defensive stocks.

Unemployment filings continued to move in the right direction; the Labor Department said that initial claims for the week ending Oct. 16 came to 290,000, which was below estimates for 300,000, and 6,000 claims fewer than the prior week.

And September U.S. existing-home sales topped expectations, perking up by 7.0% to 6.3 million units annualized, to their highest point since the start of 2021.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"[Levels are] still below year-ago levels but those are 'base effects' ... everyone moving out to the burbs or to cheaper locales while doing the same job," says Jennifer Lee, Senior Economist for BMO Capital Markets.

The Dow Jones Industrial Average nonetheless finished marginally in the red, to 35,603, hindered by a steep 9.6% drop in International Business Machines (IBM), which missed analysts' expectations for third-quarter revenues and reported a 33% decline in profits.

The S&P 500, however, was able to claw out a new record close, improving by 0.3% to 4,549, and the Nasdaq Composite did even better with a 0.6% gain to 15,215. They were helped in part by a 3.3% advance in Tesla (TSLA), which reported record sales, profits and gross margins for Q3.

"We are raising our price target on Tesla from $1,000 to $1,100 as the green tidal wave hits its next gear into 2022, with Tesla leading the charge," says Wedbush analyst Daniel Ives, who rates the stock at Outperform (equivalent of Buy).

Those indexes also received help from Netflix (NFLX, +4.5%) and Nvidia (NVDA, +2.7%), among others.

Other news in the stock market today:

- The small-cap Russell 2000 climbed 0.3% to 2,296.

- U.S. crude futures gave back 1.1% to settle at $82.50 per barrel – snapping a five-session winning streak.

- Gold futures slipped 0.2% to finish at $1,781.90 an ounce.

- The CBOE Volatility Index (VIX) was down 3.2% to 14.99.

- Bitcoin prices cooled off from their all-time highs, slipping 5.4% to $62,832.43. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Shares of Crocs (CROX) surged 9.3% today after the plastic shoemaker's third-quarter results blew past analysts' estimates. Over the three-month period, CROX brought in adjusted earnings of $2.47 per share – up 162.7% year-over-year – on $626 million in revenues, a 73% improvement over the year-ago period. Analysts, by contrast, were expecting earnings of $1.88 per share on $610 million in sales. "We see best-in-class brand momentum driven by product innovation, personalization, powerful social and digital marketing campaigns, and a digital first route to market," CFRA Research analyst Zachary Warring says. "We initiate Crocs as a Strong Buy and our top pick in footwear."

- Tenet Healthcare (THC) was another post-earnings mover, jumping 7.3%. In its third quarter, the hospital operator reported adjusted earnings of $1.99 per share (+210.9% YoY) on $4.9 billion in revenues, up 7.4% from Q3 2020. Credit Suisse analysts maintained their Outperform rating – the equivalent of a Buy – on THC after last night's report, saying hospital results reflect a continuation of rebounding volume and strong pricing.

One of the Biggest ETF Launches of All Time

If you heard a "whoosh" yesterday afternoon, that was the sound of a long-held record going bye-bye.

On Oct. 19, ProShares launched the first Bitcoin futures exchange-traded fund in the U.S., the ProShares Bitcoin Strategy ETF (BITO), and investors greeted it by pouring roughly $570 million into the fund. By the Oct. 20 close, it had accumulated $1.1 billion in assets under management, making it the quickest an ETF has ever reached the $1 billion asset mark.

The previous record holder? The ubiquitous gold ETF, the SPDR Gold Shares (GLD), which accomplished the feat in three days 18 years ago.

So … why did Wall Street gobble up BITO with such gusto?

For years, retail and institutional investors who prefer or are bound to traditional accounts have been limited in the ways they can access Bitcoin and other cryptocurrencies. For the most part, if you had, say, a brokerage or an IRA, you could only invest in companies that fit somewhere into the crypto ecosphere, or funds that either invest in those companies or provide imperfect tracking of Bitcoin prices.

This new ProShares fund, however, is the first of a new breed that can invest in Bitcoin futures, which offers more direct exposure than stock-centric Bitcoin funds. We've just taken a deep dive into BITO that answers a lot of questions: What's the big deal? What does it do? And is this a good way to take a dive into Bitcoin? Check out our look at BITO.

Kyle Woodley was long NVDA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.