The Single-Best Trading Week of the Year Starts Now

The strongest five-session stretch for stock market returns is upon us, says LPL Financial Chief Market Strategist Ryan Detrick. November as a whole isn't bad, either.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

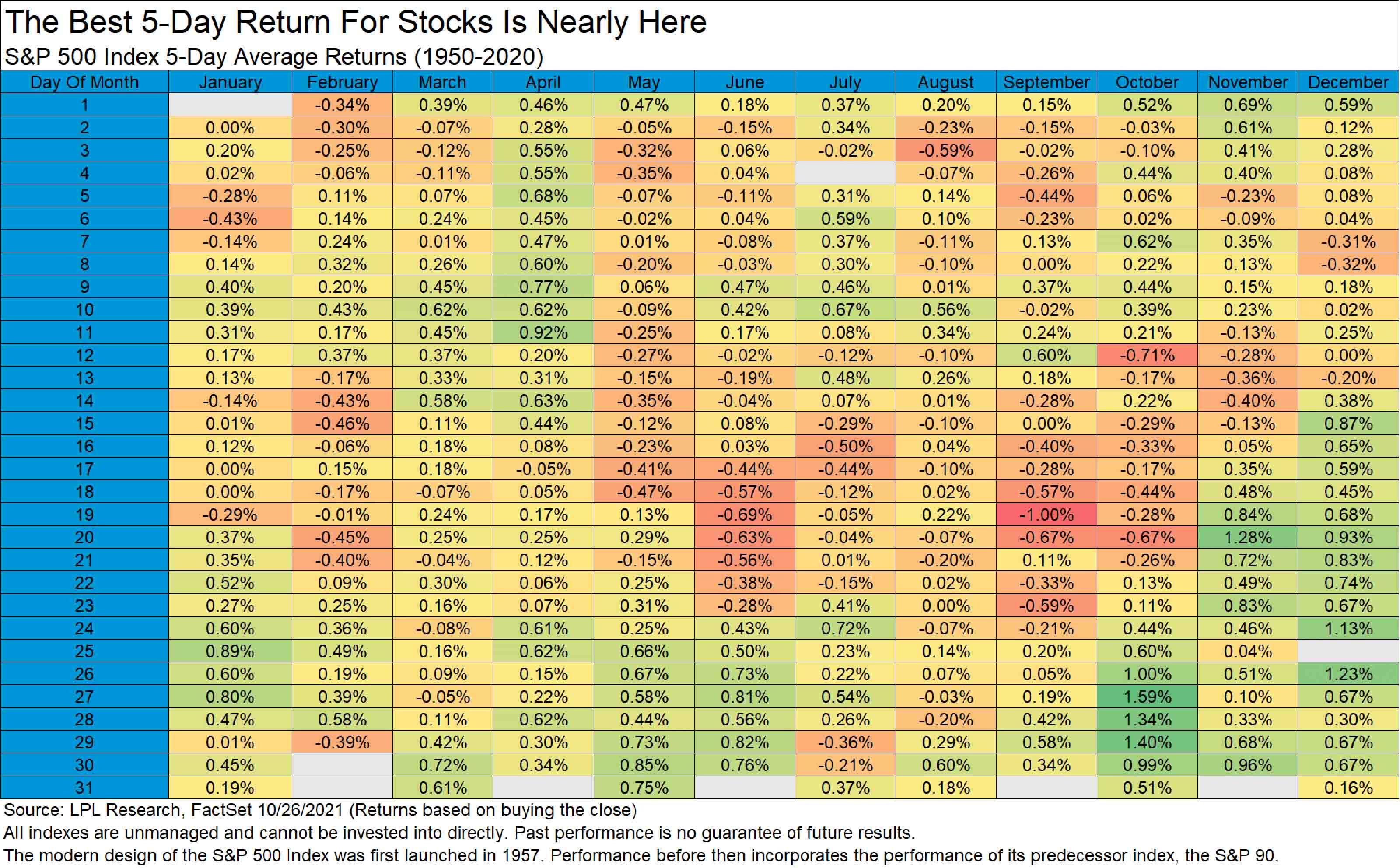

Long-term investors can sleep through what follows, but tactical investors and traders might want to perk up. That's because we're at the start of the single-best trading week of the year for stocks – at least, historically speaking.

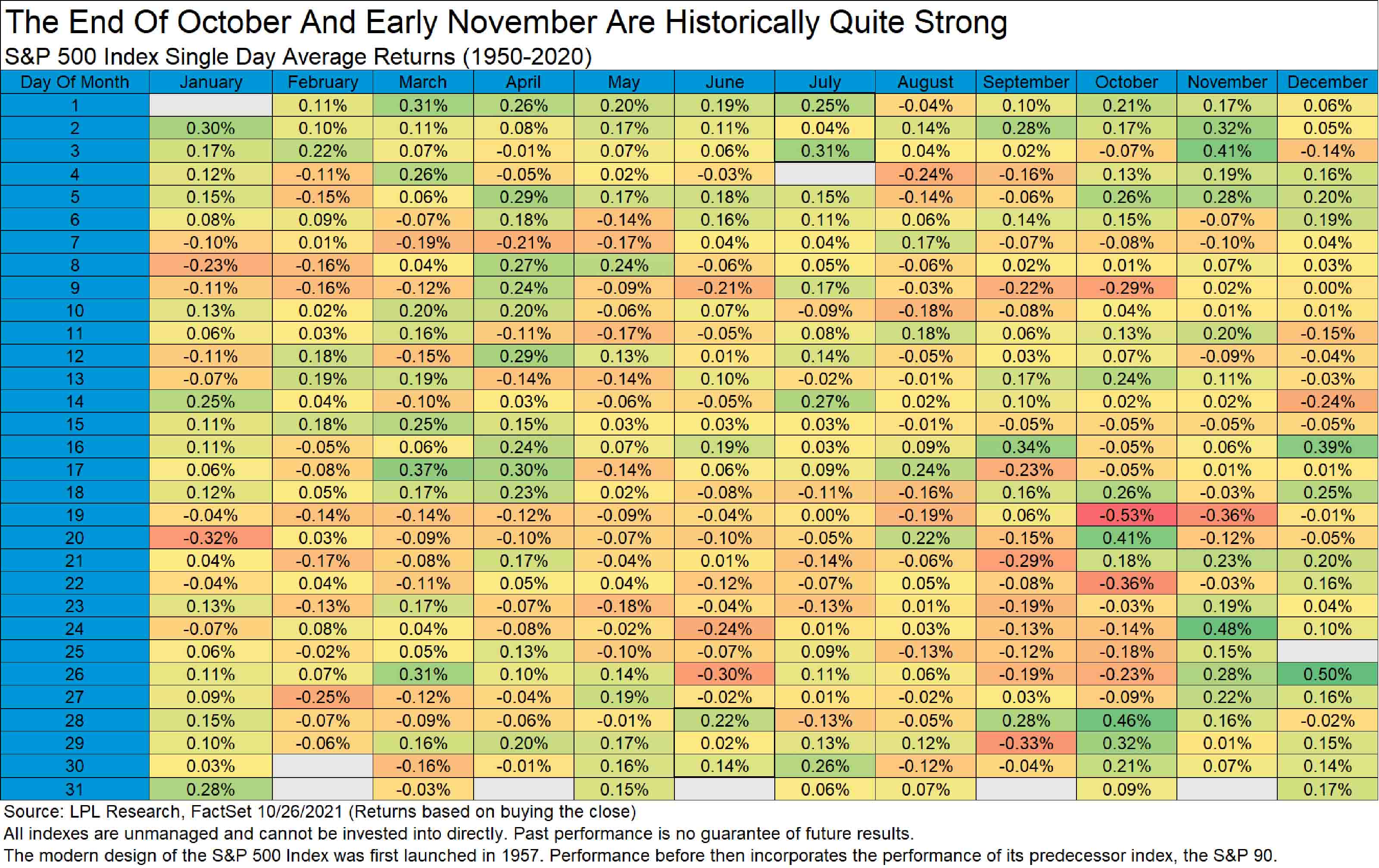

Everyone knows that October and November are two of the market's favorite months. But it just so happens they also contain some short bursts of absolutely tip-top returns, says LPL Financial Chief Market Strategist Ryan Detrick.

Oct. 28 was the longtime champ for single-day performance – that is until it face-planted more than 3% in 2020. As a result, it ceded its reign as king of the day-trading hill to Oct. 27.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But don't feel too bad for Oct. 28. It's still a great day for stocks, explains Detrick, as are Oct. 29, Nov. 2 and Nov. 3.

"I'd like to think it has something to do with my birthday being on Oct. 28, but the truth is bulls should be aware that the coming days are historically some of the best of the year," Detrick says.

Autumn Is a Great Time for Stocks

Indeed, the strategist says the single best day to buy at the close and hold for the next five trading days is today, Oct. 27.

"Yes, these five days were lower last year by 0.6%, but you have to go back to the late 1960s to see the last time they were down two years in a row," adds Detrick.

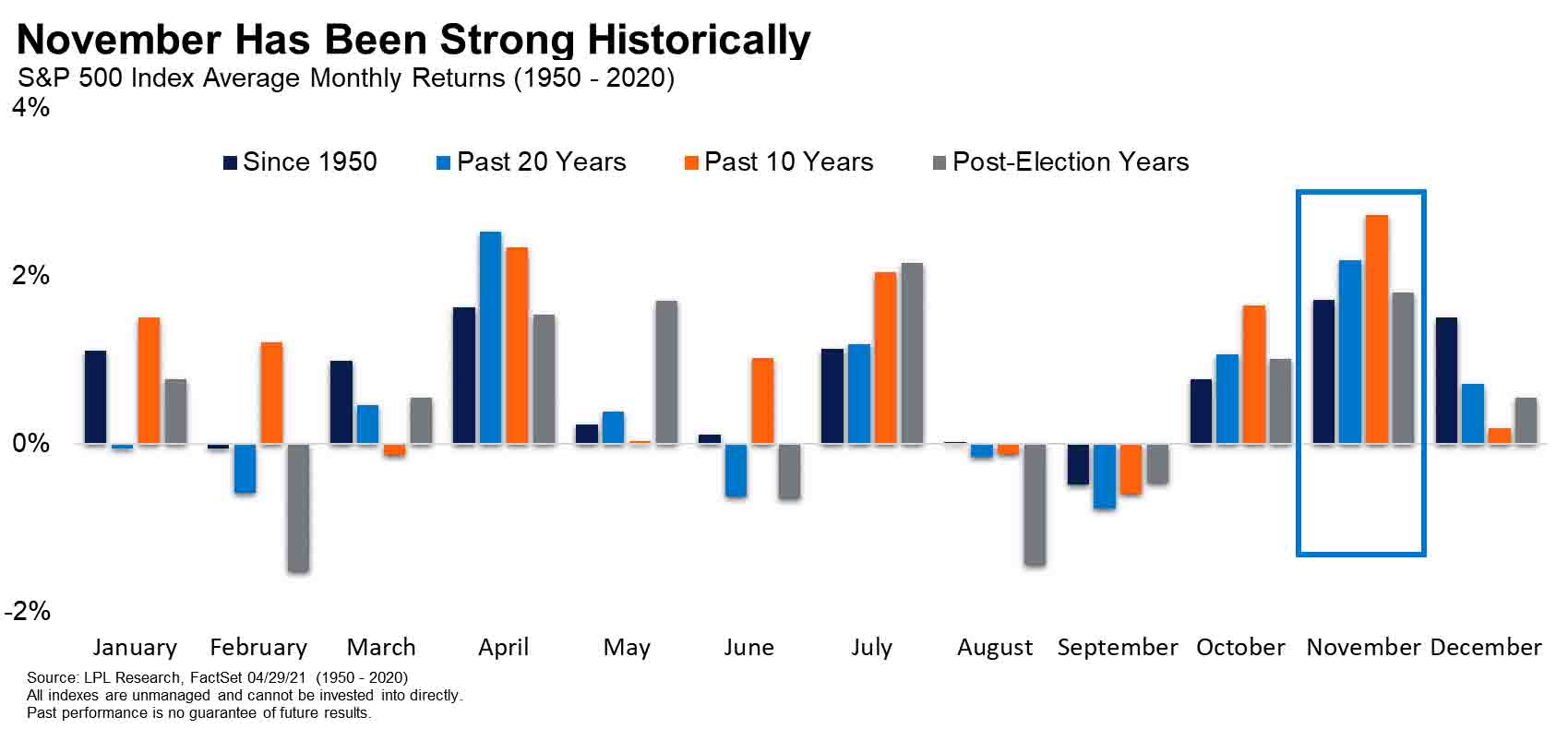

Which brings us to November. Since 1950 – and over the past 10 years – it has been the top month for market returns.

"November is the best month of the year, but it doesn't seem to get nearly as much love as you'd think," Detrick says. "We all assume December is the best month, but November is actually better and gets very little fanfare. Maybe it should be a month for the bulls, not for turkeys."

As good as November has been for investors since 1950, it's actually not that big a deal when we delve much farther into the past. Since 1928, November's average price change comes to just +0.9%, according to Yardeni Research. That ranks it as only the fifth best month for the S&P 500.

December – so beloved by investors – has done a better job, but it's still merely the market's third best month since 1928. The final month of the year boasts an average price change of +1.3%.

If we're talking about really long investing horizons – in this case over the past 93 years – the market's top month is July, hands down. Maybe it's because the dog days have yet to set in, but everyone's favorite summer span sports an average price change of +1.6% since 1928.

It's not clear why July has historically been so good to the market. Perhaps it just likes to troll those who sell in May.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

5 Big Tech Stocks That Are Bargains Now

5 Big Tech Stocks That Are Bargains Nowtech stocks Few corners of Wall Street have been spared from this year's selloff, creating a buying opportunity in some of the most sought-after tech stocks.

-

How to Invest for a Recession

How to Invest for a Recessioninvesting During a recession, dividends are especially important because they give you a cushion even if the stock price falls.

-

10 Stocks to Buy When They're Down

10 Stocks to Buy When They're Downstocks When the market drops sharply, it creates an opportunity to buy quality stocks at a bargain.

-

How Many Stocks Should You Have in Your Portfolio?

How Many Stocks Should You Have in Your Portfolio?stocks It’s been a volatile year for equities. One of the best ways for investors to smooth the ride is with a diverse selection of stocks and stock funds. But diversification can have its own perils.

-

An Urgent Need for Cybersecurity Stocks

An Urgent Need for Cybersecurity Stocksstocks Many cybersecurity stocks are still unprofitable, but what they're selling is an absolute necessity going forward.

-

Why Bonds Belong in Your Portfolio

Why Bonds Belong in Your Portfoliobonds Intermediate rates will probably rise another two or three points in the next few years, making bond yields more attractive.

-

140 Companies That Have Pulled Out of Russia

140 Companies That Have Pulled Out of Russiastocks The list of private businesses announcing partial or full halts to operations in Russia is ballooning, increasing economic pressure on the country.

-

How to Win With Game Stocks

How to Win With Game Stocksstocks Game stocks are the backbone of the metaverse, the "next big thing" in consumer technology.