Stock Market Today: Nasdaq Lifted by Amazon, Apple and … Meta?

A gaggle of post-earnings jumps (and pre-earnings gains by Amazon and Apple) helped lift the major indexes Thursday. So did a new moniker by one of Wall Street's biggest stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks enjoyed a busy but bountiful session for stocks Thursday, fueled by corporate earnings and, for one iconic company, a name change.

The day kicked off with a disappointing third-quarter GDP reading of 2.0% growth, which was well under expectations for 2.8%, and well below Q2's 6.7% expansion.

"This marks a meaningful deceleration in the ongoing economic recovery, with GDP growth falling to its slowest rate since the COVID-19 recession," says Michael Reynolds, Vice President of Investment Strategy at wealth management firm Glenmede. "However, this need not disrupt the longer-term recovery trajectory of the U.S. economy, as producers continue to shake the dust off of global supply chains."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Initial unemployment claims plumbed another pandemic-era low, however, reaching 281,000 for the week ended Oct. 23 – 10,000 filings under the prior week and 8,000 fewer than expected.

Wall Street offered up plenty to like on the earnings front, too.

Merck (MRK, +6.1%), which is awaiting FDA approval for its COVID-19 antiviral molnupiravir, delivered Q3 revenues and earnings that whizzed past analysts' estimates. The same was true at Caterpillar (CAT, +4.1%) where construction-machinery revenues jumped by 30% from the year-ago period.

Ford (F, +8.7%) topped earnings expectations, raised its full-year guidance and thrilled income investors by restoring its quarterly payout at 10 cents per share, representing a 2.4% yield at current prices.

Also contributing to the day's gains were Amazon.com (AMZN, +1.6%) and Apple (AAPL, +2.5%), which ran up heading into their earnings reports, due out after Thursday's close.

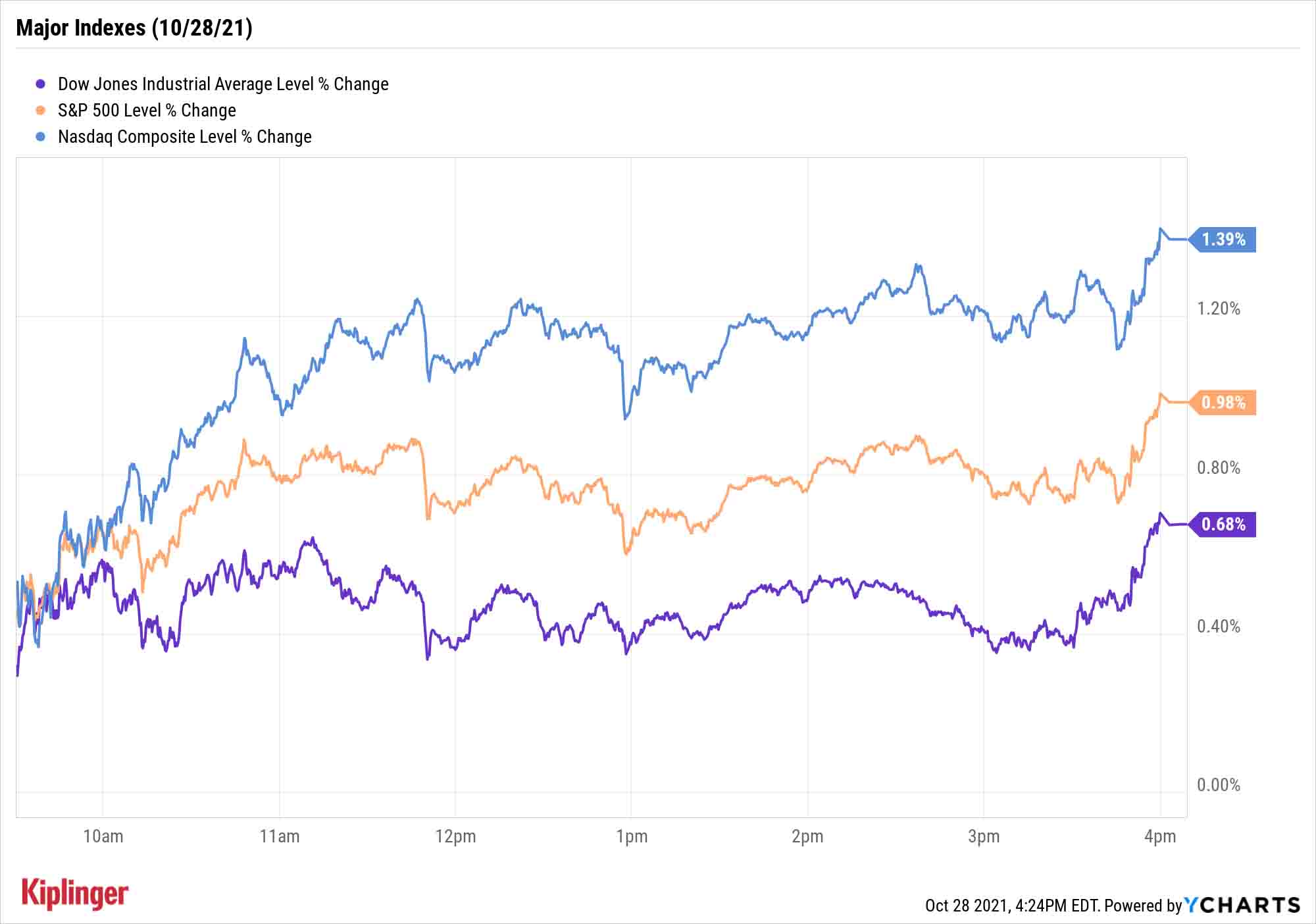

The Nasdaq Composite advanced 1.4% to 15,448, surpassing its previous record close from early September, while the S&P 500 (+1.0% to 4,596) also notched a new all-time high. The Dow Jones Industrial Average (+0.7% to 35,730) finished in the green, too.

Other news in the stock market today:

- The small-cap Russell 2000 rebounded aggressively from yesterday's losses, jumping 2.0% to 2,297.

- U.S. crude oil futures rose 0.2% to finish at $82.81 per barrel.

- Gold futures gained 0.2% to settle at $1,802.60 an ounce.

- The CBOE Volatility Index (VIX) was off by 4.3% to 16.25.

- Bitcoin stemmed its recent losses with a 3.7% advance to $61,307.73. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- eBay (EBAY) slumped 6.8% after the online marketplace reported earnings. While EBAY's adjusted earnings of 90 cents per share on $2.5 billion in revenue beat analysts' consensus estimates, gross merchandise value was down 10% from the year-ago period and the company forecast lower-than-expected revenue for the fourth quarter. Stifel analysts kept a Buy rating on EBAY, saying volume in focus categories continues to outperform. Additionally, "The company upped its 2021 share buyback by $2 billion with plans to repurchase $7 billion this year," the analysts wrote.

- Twilio (TWLO, -17.6%) was another post-earnings loser. The cloud communications platform reported adjusted third-quarter earnings of 1 cent per share on $740 million in revenue – more than analysts were anticipating. However, it also guided for a fourth-quarter loss between 23 cents per share and 26 cents per share – wider than the 7-cents-per-share loss analysts, on average, are calling for – and said George Hu is stepping down as chief operating officer. Argus Research analyst Jim Kelleher still thinks TWLO is a Buy. "Twilio, via its text, email and other platforms, provides businesses with an opportunity to directly engage with their customers," he says. "We see this as a competitive advantage, given that restrictions on digital privacy are only likely to increase."

Meet "Meta"

And as for the name change? Well … "Facebook" is no more.

Sort of.

While the social network will retain its moniker from back when CEO Mark Zuckerberg co-created it in college, the parent company's name will become "Meta Platforms, Inc.," or just "Meta" for short, to reflect the "metaverse" – effectively a blending of the physical and digital/virtual worlds.

A few more things will be changing, too, including how Meta reports its financials.

"Starting with our results for the fourth quarter of 2021, we plan to report on two operating segments: Family of Apps and Reality Labs," the company says. (Remember, Facebook – ahem, Meta – is more than the flagship platform: It also owns Instagram, global messaging giant WhatsApp and Oculus virtual-reality gear, though the latter will also be rebranded as Meta.)

And FB shares, which were up 1.5% in reaction, will trade as MVRS starting on Dec. 1.

While Meta is taking a deep, deep dive into this emerging technology, it's hardly the only company that's positioned to profit if and when the metaverse truly takes off. Here, we look at seven stocks that could harness the power of a metaverse market that some estimate could explode to $800 billion in roughly three years.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.