Stock Market Today: The Taper Is On, And Stocks Take Off

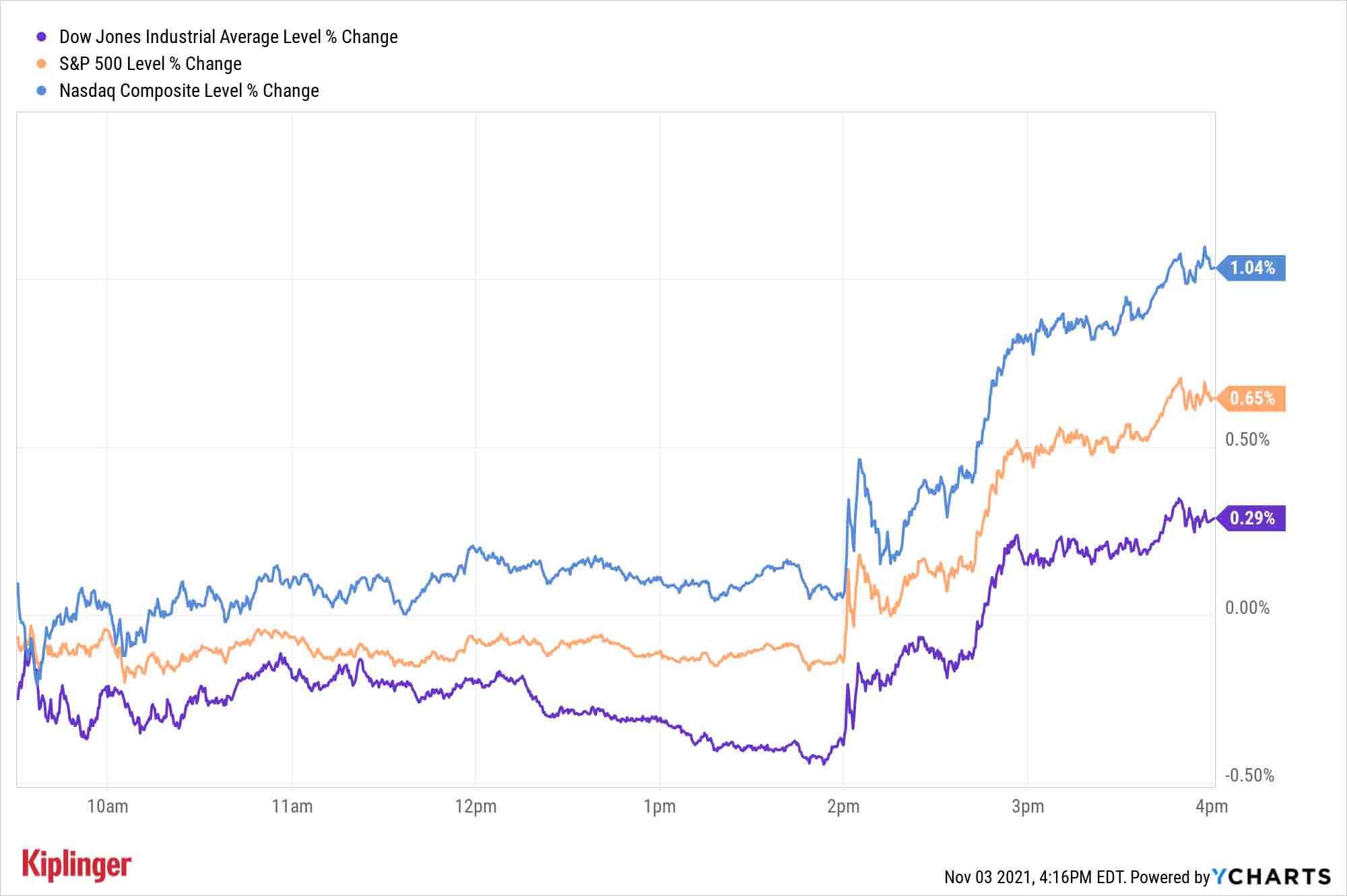

The Federal Reserve made its long-awaited taper announcement Wednesday, and the bulls didn't miss a beat, driving stocks to record highs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

An encouraging employment indicator wasn't enough to rouse investors Wednesday, but Chair Jerome Powell and the Federal Reserve managed to coax more record territory from stocks by doing … well, exactly what market pundits said they would.

ADP reported that October's private payrolls improved by 571,000 – led by a surge in leisure and hospitality hiring (185,000 positions) – to trounce expectations for 400,000 jobs added. That data was met with apathy from the major indexes, but the market perked up in the afternoon once the Fed released its post-FOMC statement.

As many expected, the central bank said it would taper its monthly pace of asset purchases, by $10 billion for Treasuries, and $5 billion for agency mortgage-backed securities, though it only provided the guidance for November and December.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Markets were prepared for a far more aggressive taper than what was ultimately delivered," says Jamie Cox, managing partner for wealth management firm Harris Financial Group. "The Fed has zero intentions of draining liquidity too quickly and derailing the recovery."

"Much of the bond tapering announcement was already priced into markets and shouldn't have come as a surprise to anyone that was paying attention to what the Fed has been indicating for most of this year, but the markets are already turning their attention to how soon the Fed will begin raising interest rates and how quickly they will raise them,” says Chris Zaccarelli, chief investment officer for Independent Advisor Alliance. “According to the Fed's interest rate expectations forecast (i.e. the Dot plot), many Fed governors expect to begin raising interest rates in the second half of next year, and Chairman Powell acknowledged that if the economy continues to run hot and inflation continues to stay well above 2%, then it is likely that they will raise interest rates at least once by the end of 2022.

“However, he again asserted that there is a lot of uncertainty in the path of inflation and that a lot of the factors contributing to inflation are not persistent ones (e.g. supply chain issues and other complications resulting from restarting the economy after the peak of the Covid crisis)."

The result was a broad upturn in stocks: The Nasdaq Composite (+1.0% to 15,811), S&P 500 (+0.7% to 4,660) and Dow Jones Industrial Average (+0.3% to 36,157) all took the ol' editing pen to the record books.

Other news in the stock market today:

- U.S. crude futures plunged 3.6% to settle at $80.86 after data from the Energy Information Administration showed a second straight rise in domestic crude inventories.

- Gold futures fell 1.4% to finish at $1,763.90 an ounce.

- The CBOE Volatility Index (VIX) declined again, off 5.1% to 15.21.

- Bitcoin sharply dropped to under $61,000 briefly on Wednesday, but recovered for a modest 1.2% decline to $62,837.40. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- It was a down day for Activision Blizzard (ATVI) which gave back 14.1% after its earnings report. The videogame maker reported higher-than-expected earnings of 72 cents per share, inline revenues of $1.88 billion and a 6% year-over-year improvement in bookings, but it also forecast fourth-quarter guidance below consensus estimates and said in the earnings call that it is planning for a "later launch" of its Overwatch 2 and Diablo IV games "than originally envisaged." CEO Bobby Kotick also acknowledged that ATVI fired more than 20 employees in the third quarter due to allegations of sexual harassment and discrimination.

- Zillow (ZG) was a notable loser again today, shedding 22.9% in the wake of its quarterly results. In its third quarter, the online real estate firm reported a per-share adjusted loss of 95 cents and revenues of $1.74 billion. For the sake of comparison, analysts, on average, were estimating earnings of 16 cents per share on $2.01 billion in sales. The company also said it is eliminating Offers division, which buys and flips homes, and slashing 25% of its workforce. "We've determined the unpredictability in forecasting home prices far exceeds what we anticipated," CEO Rich Barton said in the company's earnings release. "Continuing to scale Zillow Offers would result in too much earnings and balance-sheet volatility." Several analysts chimed in on Zillow today, including CFRA Research, which lowered its outlook to Hold from Buy. "We got this rating wrong, not anticipating that a pre-announcement a month ago slowing its Zillow Offer unit would lead to the complete shutdown of ZG's largest revenue business," CFRA analyst Kenneth Leon wrote in a note. "In the third quarter of 2021, ZG pricing models to buy and sell homes were no longer working effectively."

Small Caps Are Off to the Races

But smaller companies spilled the most green ink. A day after finally breaking through its old highs, the small-cap Russell 2000 outpaced its larger-cap brethren with a 1.8% gain to a record 2,404.

There might be more where that came from.

"We noted last week that small-cap benchmarks like the Russell 2000 and Small-Cap 600 looked to be gearing up for bigger moves ahead," says Dan Wantrobski, technical strategist at Janney Montgomery Scott, "and now it would appear that seasonal forces remain strong enough to push this area to new secular highs before the year is out."

A reminder that there's more than one way to peel the orange with small caps – if hyper-growth gambles are a little too aggressive for you, there are plenty of values in the small-company space, not to mention proven dividend payers.

On the flip side, if you do enjoy living life on the edge, you can peruse some of the smaller companies that have gone completely ignored by the analyst set.

But it does help to have Wall Street's analysts on your side sometimes, as they can provide vital research and insights about these smaller firms that rarely catch the media's attention. These 11 small-cap stocks are very much on the pros' radar – and on the whole, Wall Street likes what it sees.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.