Stock Market Today: Tech Helps Nasdaq, S&P 500 Extend Streaks

Chipmakers including Qualcomm, Nvidia and Advanced Micro Devices helped spark new index highs Thursday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

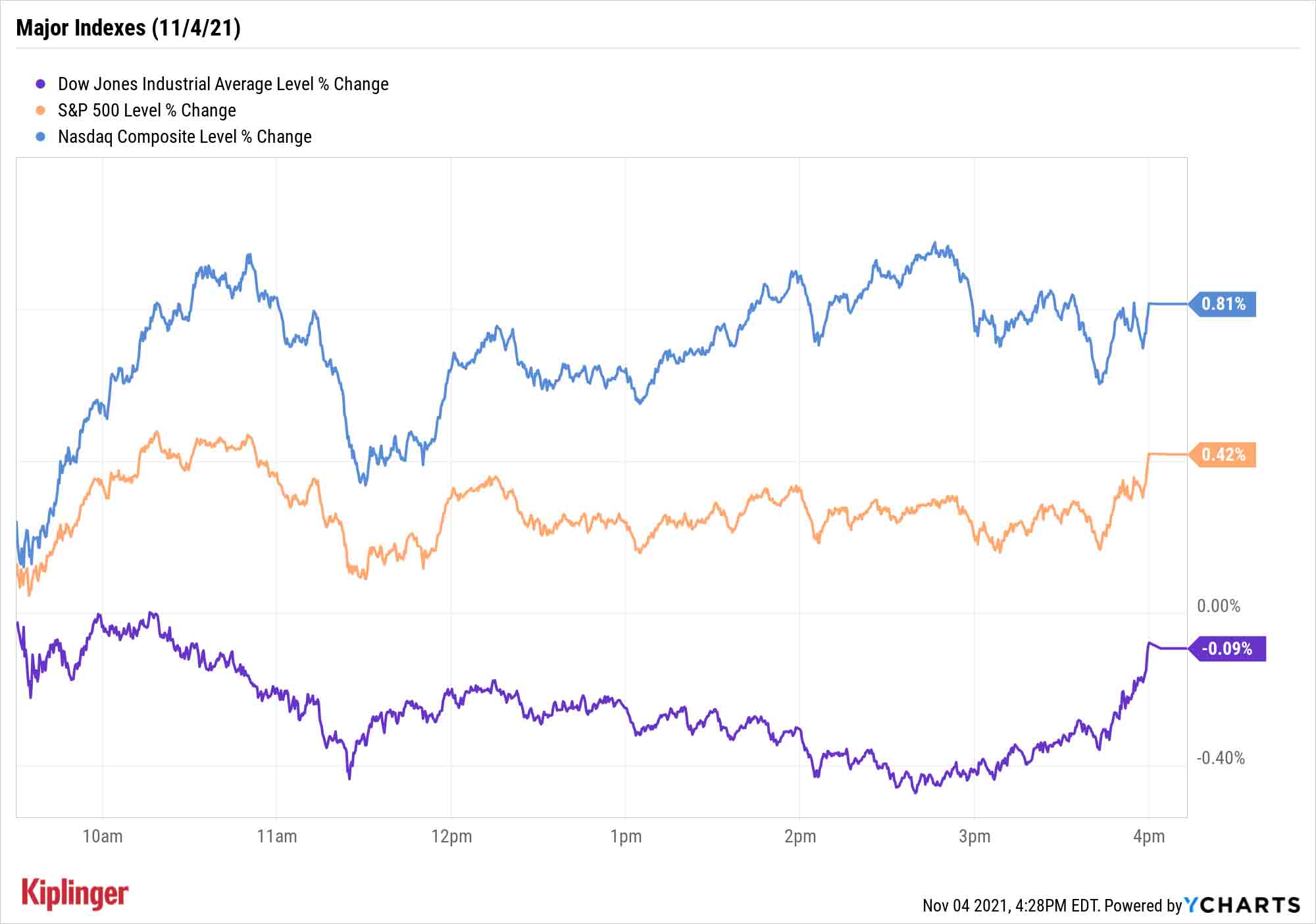

The stock market rally continued Thursday – though not for all indexes – as investors continued to process yesterday's Federal Reserve decision to taper as well as mixed messages about the economy. The result was a ninth straight day of gains for the Nasdaq Composite, while the S&P 500 ripped off its sixth consecutive advance.

Yet again, the Labor Department reported pandemic-low weekly unemployment data, with 269,000 initial claims for the week ended Oct. 30 ducking under estimates for 275,000 filings and the prior week's revised 283,000.

Wilmington Trust Senior Economist Rhea Thomas anticipates a robust October jobs report tomorrow morning, telling Kiplinger that "high-frequency measures of small business employment suggest a solid employment gain in October. We look for 500,000-550,000, slightly stronger than consensus, which is at 450,000."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

On the less encouraging side, however, unit labor costs jumped 8.3% quarter-over-quarter in Q3; during the same period, U.S. labor productivity suffered its largest drop (5%) since 1981.

While the market has been rising in unison of late, it put on a more stratified performance Thursday. Technology (+1.6%) shone on the back of big advances in chip stocks. Qualcomm (QCOM, +12.7%), for one, rocketed higher thanks to an earnings beat and pleasantly surprising guidance.

"In addition to as-expected growth from Apple thin modems, a key revenue driver in the quarter was Qualcomm’s Snapdragon integrated SoC solution for Android devices, where it is the dominant player," says Argus analyst Jim Kelleher (Buy), who adds that "QCOM has underperformed peers and the market in 2021 and appears to represent exceptional value."

Also heading higher were Nvidia (NVDA, +12.0%) and Advanced Micro Devices (AMD, +5.3%). The former's boost came on another bullish note involving the "metaverse," this time by Wells Fargo analysts, who raised their price target on NVDA to $320 from $245.

"We see NVIDIA Omniverse as a key enabler/platform for the development of the metaverse across a wide range of vertical apps," the analysts say. They also believe Nvidia could capture up to $10 billion of the metaverse market over the next five years.

Amazon.com (AMZN, +2.8%) also finished strong to help the Nasdaq (+0.8% to 15,940) set another record and close near the 16,000 mark. The S&P 500 also benefited, improving by 0.4% to a new high of 4,680.

However, a slump in financials (-1.3%) hampered the Dow Jones Industrial Average (off marginally to 36,124). Banks suffered as another international central bank indicated that looser policy might not be as quick to arrive as many hope.

"Central bank commentary is once again driving much of today's action as rates move lower in response to the BOE," says Michael Reinking, senior market strategist for the New York Stock Exchange. "While the analyst views were split whether the central bank would raise rates either today or in December, markets were pricing nearly a 100% probability of a 15-basis-point rate increase today." (A basis point is one one-hundredth of a percentage point.)

"Not only did the central bank not raise rates today, but BOE Governor Andrew Bailey pushed back hard against December as well, and when asked about market expectations for the benchmark rate to rise to 1% next year, he said he would 'caution against' that view."

The small-cap Russell 2000 (-0.2% to 2,400) also cooled off two days after cracking through record highs set back in March.

Other news in the stock market today:

- U.S. crude futures fell 2.5% to finish at $78.81 per barrel, their lowest settlement since early October, after OPEC+ left its production target unchanged.

- Gold futures rose 1.7% to end at $1,793.50 an ounce.

- The CBOE Volatility Index (VIX) rebounded by 2.3% to 15.4.

- Bitcoin cooled off by 2.6% to $61,217.40. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Penn National Gaming (PENN, -21.1%) was one of the worst stocks on the S&P 500 today after the casino company reported earnings. In its third quarter, PENN reported revenue of $1.51 billion, in line with what analysts were expecting, but earnings of 52 cents per share came in well below the consensus estimate of 85 cents per share. In its earnings call, Penn National Gaming CEO Jay Snowden said "momentum slowed" starting in mid-August due to Hurricane Ida and "regional flare ups of the Delta variant." Accelerating the stock's slide was a Business Insider article alleging sexual violence by Barstool Sports founder Dave Portnoy, who has denied accusers' recounting of the events in the story. Penn owns a large stake in Barstool.

Next Up in Our 401(k) Series: T. Rowe Price

The pause in both the blue-chip Dow and the small-cap Russell could very well just be a breather. But regardless of what's coming, at least one fund provider appears positioned to help investors traverse the market's terrain.

Our annual exploration into the most popular mutual funds offered in 401(k) plans – which so far has included options from Vanguard and Fidelity – brings us to T. Rowe Price.

Says Kiplinger's Nellie Huang: "T. Rowe Price's corporate symbol is the bighorn sheep: a sure-footed and agile climber, even in the roughest terrain. It was chosen to reflect investors' ability to rely on the firm's investment expertise to navigate all types of markets."

And several of its mutual funds have long proven up to the task.

Today, we delve into a dozen T. Rowe Price mutual funds that American workers are likeliest to find in their workplace retirement plans. We rate each one a Buy, Hold or Sell, including T. Rowe's target-date retirement funds, which we appraise as a single unit.

Kyle Woodley was long AMD, AMZN and NVDA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.