Stock Market Today: New Week, New Highs for Stocks

The passage of a $1.2 trillion infrastructure bill kept the stock market rally moving Monday, albeit with modest gains.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A downright persistent market rally kept its mojo into a new week, with the major indexes again making a slow grind upward to all-time highs Monday.

Helping fuel the optimism was a final push in Washington to get an infrastructure bill across the finish line. Late Friday, the House sent the $1.2 trillion piece of legislation to President Joe Biden, who is expected to sign it into law soon.

"[The bill] represents the largest public works investment in the U.S. in nearly a decade, and would bring about an additional $555 billion in new infrastructure projects that were not planned for by states and municipalities," says Jeff Spiegel, head of U.S. iShares Megatrend and International ETFs.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A few other pieces of news moved the needle, too. The U.S. ended its international travel ban, providing a lift to a number of travel stocks. Also, chipmaker Advanced Micro Devices (AMD, +10.1%) broke out to new highs after landing Facebook parent Meta Platforms (FB, -0.7%) as a customer; that move sent most of the semiconductor industry higher in sympathy, including rival Nvidia (NVDA, +3.6%).

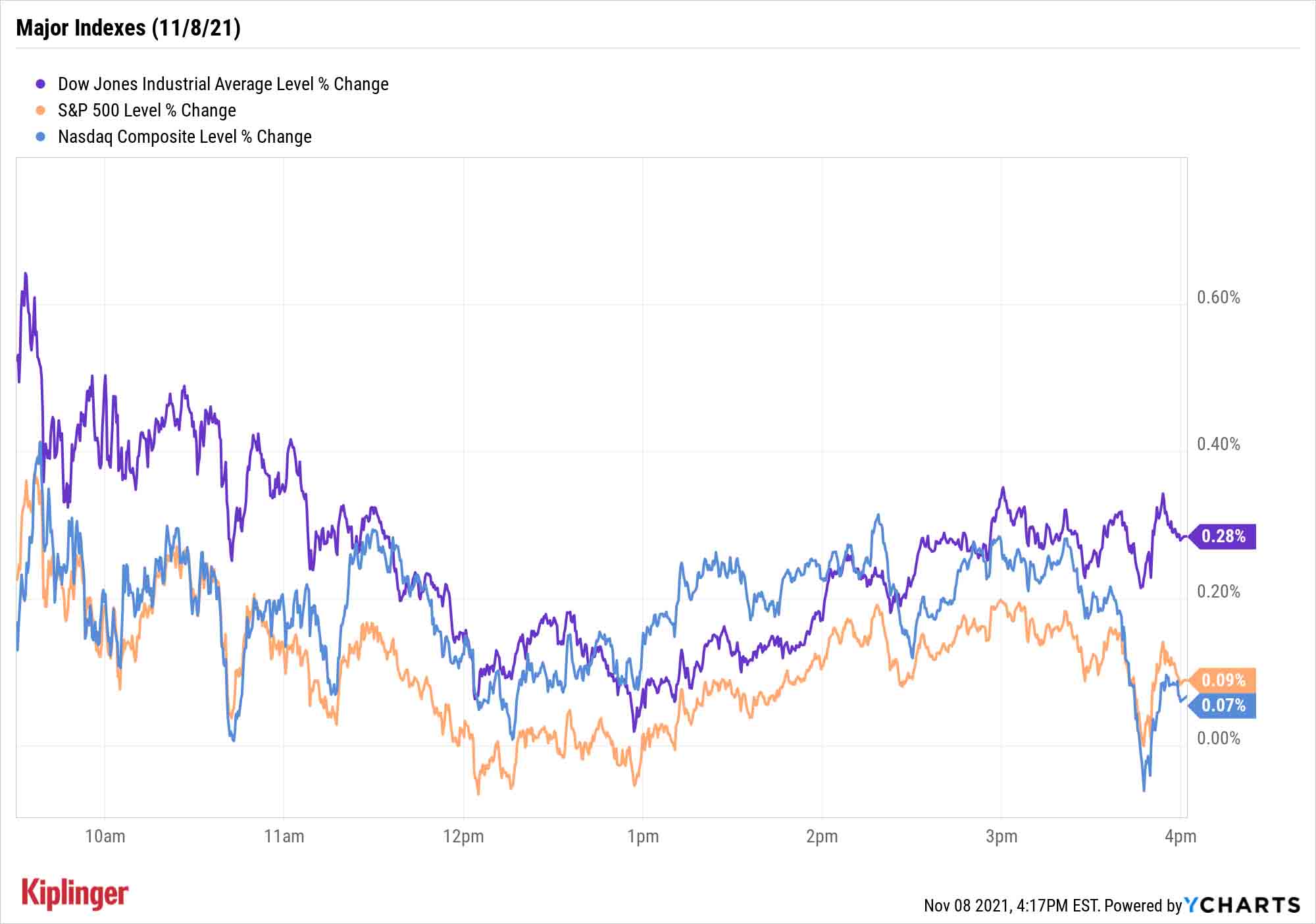

The major indexes didn't move much – the Dow Jones Industrial Average gained 0.3% to 36,432, the Russell 2000 improved 0.2% to 2,442, and the S&P 500 (4,701) and Nasdaq Composite (15,982) made marginal advances. However, they all managed to scratch out fresh record closing highs.

Other news in the stock market today:

- Following a down week, U.S. crude futures kicked off Monday with a 0.8% improvement to $81.93.

- Gold futures were also higher, settling up 1.3% to $1,816.80 per ounce.

- The CBOE Volatility Index (VIX) improved to start the week, gaining 4.3% to 17.20.

- Bitcoin surged 8.1% over the weekend to $66,093.98, nearing its all-time high of 66,974.77. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Tesla (TSLA, -4.9%) was on the decline after CEO Elon Musk seemingly committed to selling a hefty sum of shares. This weekend, in response to a Democratic billionaire tax proposal on unrealized gains (one that didn't make it into a bill), Musk conducted a poll asking his followers whether he should sell 10% of his TSLA shares, and a majority of his followers said he should. "Either way, it was well known that Musk had a big tax bill coming due from his 23 million stock options awarded in 2012 that have vested and expire in August 2022 and he was going to sell some stock before year-end," says Wedbush analyst Dan Ives, who rates TSLA at Outperform. But it might be much ado about nothing. Ives called it a "digestible number we are not overly concerned about, but added that "holding a Twitter poll to sell 10% of his stock is another bizarre soap opera that can only happen to one company and one CEO in the world: Musk."

- Ford (F) shares improved by another 4.5% on no particular news, extending its year-to-date rally to roughly 130%. The automaker is now trading above $20 per share for the first time in more than 20 years. Jefferies analysts Philippe Houchois and Himanshu Agarwal (Buy) recently sounded off on the stock, saying, "Presenting good numbers helped of course, but we found Ford management on the call more in control of operations and strategy than any time in the past two years despite industry uncertainty. Ford is early in an intense cycle of replacing and reviving key product franchise and playing to brand strengths with FordPro."

How to Play the Infrastructure Deal

While Wall Street has largely bet on an infrastructure bill passing at some point, at some time, opportunities still abound – including in not-so-traditional infrastructure plays.

"The bipartisan infrastructure bill will be a huge boost to the ongoing renewable energy and 5G revolutions," says Josh Duitz, deputy head of equities and manager of the Aberdeen Standard Global Infrastructure Income Fund (ASGI). "We expect both these areas to create investment opportunities moving forward as we transition toward a carbon-neutral economy and enhance our broadband capabilities."

That could mean a new burst of excitement for 5G-related stocks, not to mention continued business uptake for clean energy stocks.

But largely speaking, this is a win for infrastructure stocks of all types, including traditional industrial and materials plays.

"The infrastructure package includes $579 billion of future incremental federal spending, which amounts to $974 billion of total infrastructure spending over five years and $1.2 trillion over eight years," says a team of Stifel analysts. "Of the incremental $579 billion, $312 billion is expected to be spent on transportation of which $109B is earmarked for roads, bridges and major projects. Other transportation spending includes public transit, rail, EV infrastructure (half EV chargers), airports and ports, among other categories.

"There is also $266 billion of other infrastructure spending including investments in water, broadband and the grid."

For a wide variety of ways to invest in this new spending glut, check out our updated list of infrastructure stocks poised to benefit.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.