Stock Market Today: Tesla Snips S&P, Nasdaq Win Streaks

Another big drop in Tesla (TSLA) put an end to the Nasdaq's 11 consecutive advances, and the S&P 500's eight-session run.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A tenacious stock market rally finally stumbled on a light-news Tuesday.

The day's core piece of economic data was focused on inflation: The Labor Department said October's producer price index (PPI) was up 0.6% month-over-month, and 8.6% year-over-year – the fastest rate of growth in wholesale prices in more than a decade (though inline with economists' expectations).

"The October report showed continued strength in goods prices, which highlights persisting supply bottleneck issues, despite signs that supply has improved in some sectors," say Barclays economists Pooja Sriram and Blerina Uruçi. "Energy (+4.8%) and core goods (ex food & energy; +0.5%) rose at a strong pace. On the other hand, services PPI increased at a modest 0.2% m/m, similar to September, led by a sharp rebound in transportation and warehousing costs after September's decline. In particular, truck and air transportation costs jumped in October."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The October report signals that pipeline price pressures remain firm, especially for goods, which will likely remain a significant driving force for core goods (consumer price index) and (personal consumption expenditures price index) inflation this year," they add.

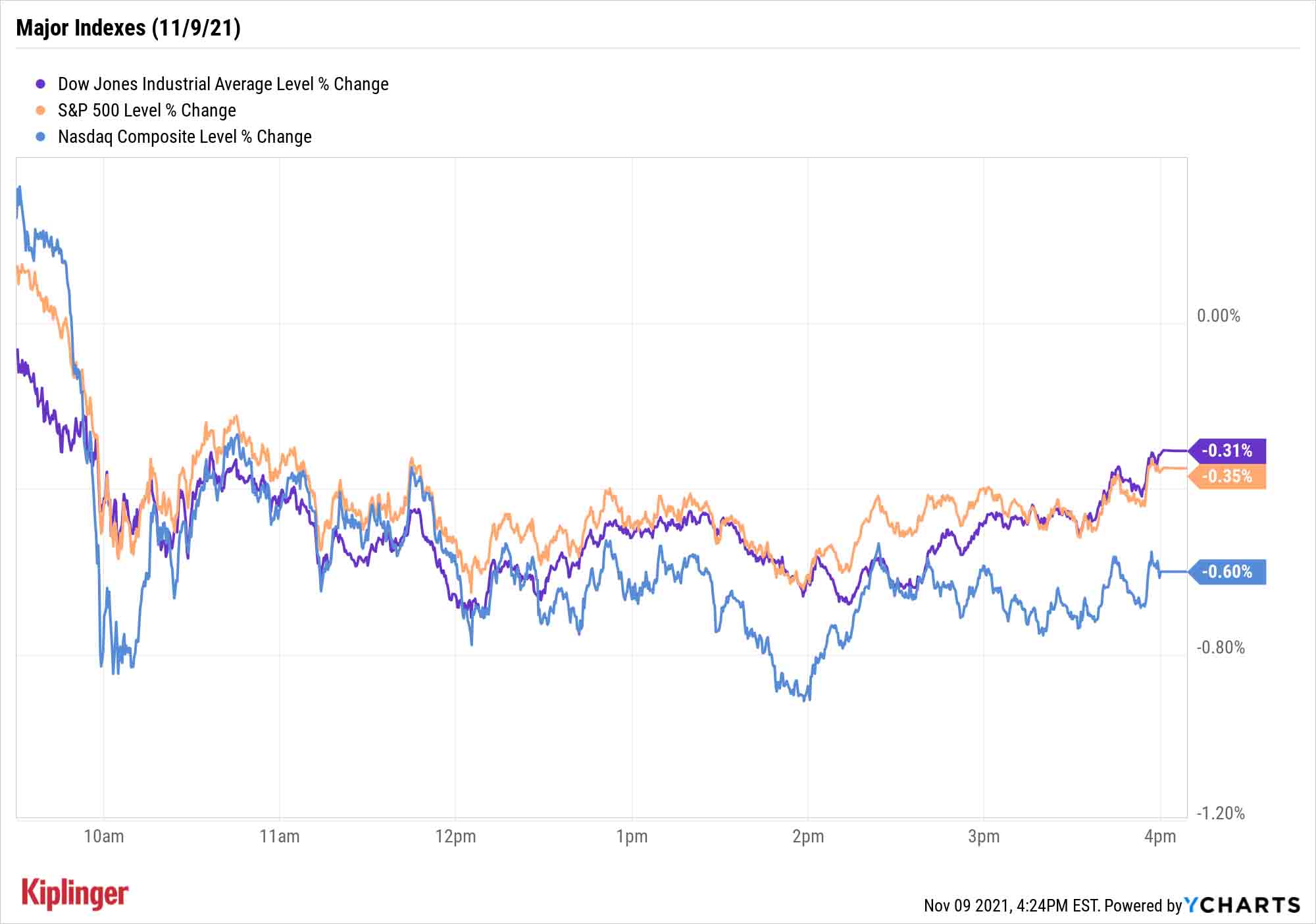

The Dow Jones Industrial Average suffered a mild setback, declining 0.3% to 36,319 as components including Visa (V, -3.2%) and International Business Machines (IBM, -1.7%) retreated.

Tesla (TSLA, -12.0%) – whose declines accelerated Tuesday after CEO Elon Musk's weekend poll asking whether he should sell 10% of his hefty stock position – proved a significant drag on the other major indexes. The Nasdaq Composite (-0.6% to 15,886) saw its 11-session win streak come to an end, while the S&P 500 (-0.4% to 4,685) was stopped at eight consecutive gains.

Other news in the stock market today:

- The small-cap Russell 2000 also dropped, by 0.6% to 2,427.

- U.S. crude futures improved by another 2.7% to hit $84.25 per barrel.

- Gold futures were higher by 0.2% to settle at $1,830.80.

- The CBOE Volatility Index (VIX) was up 3.5% to 17.82.

- Bitcoin's charge continued, with the cryptocurrency surpassing its previous high of $66,974.77 and rushing above $68,500 before pulling back to $67,313.50 by the afternoon. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- PayPal Holdings (PYPL) sank 10.5% following its Monday-evening quarterly report. The company earned an adjusted $1.11 per share that topped expectations for $1.07 per share, but revenues of $6.18 billion were slightly behind the pros' projections for $6.23 billion. More worrisome, however, was fourth-quarter guidance for $6.85 billion to $6.95 billion in revenues and $1.12 per share in adjusted profits, both of which fell under Wall Street's bar. That overshadowed an announcement that its Venmo service could be used as a checkout option on Amazon.com (AMZN) beginning in 2022.

A Bumper Year for ETFs

The exchange-traded fund (ETF) industry is guaranteed to finish 2021 in record fashion.

An all-time high $500 billion was poured into U.S. ETFs in 2020, but ETF inflows this year eclipsed that mark – in July – and have since gone on to hit $720 billion as of the end of October.

Kiplinger highly values actively managed mutual funds that can go above and beyond basic benchmarks, but there's no questioning the core driver behind ETFs' ever-growing popularity. While a few ETFs are actively managed, most are tied to an index, providing simple and typically inexpensive exposure to just about any corner of the market you can think of – from stocks and bonds to commodities and even cryptocurrencies.

However, even within the seemingly straightforward realm of index ETFs, similar-sounding funds can indeed be quite different from one another. Here, we try to separate the wheat from the chaff, highlighting 14 index funds across several categories that stand out thanks to their low fees, smart strategies and ability to outdo their peers.

Kyle Woodley was long PYPL as of this writing and initiated a position in TSLA during Tuesday's session.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Visa Stamps the Dow's 398-Point Slide: Stock Market Today

Visa Stamps the Dow's 398-Point Slide: Stock Market TodayIt's as clear as ever that President Donald Trump and his administration can't (or won't) keep their hands off financial markets.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.