7 Better Ways to Make Money Off the FAANGs

No matter which acronym you use, FAANGs have a huge impact on the broad market. Here are seven better ways to make money off the mega-cap stocks than playing them directly.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Five of the largest and best-known companies in the world are the FAANG stocks.

Or the FAAMNGs. Or the FANTAMANs. Whatever the acronym of the day is.

The original "FANGs" – Facebook, Apple, Netflix and Google – was a clever way to refer to four mega-cap tech stocks. But as other companies grew, and some of the original names changed, this alphabet soup evolved. FANGs became the FAANGs, then morphed into other less popular iterations.

The reason these acronyms stick around is because they collectively have a massive impact on the major U.S. stock market indexes thanks to their size. In fact, seven technology or tech-adjacent mega-caps – Apple (AAPL), Microsoft (MSFT), Amazon.com (AMZN), Facebook parent Meta Platforms (FB), Google parent Alphabet (GOOGL), Netflix (NFLX) and Tesla (TSLA) – account for roughly half of the weight of the Nasdaq-100 index and more than a fifth of the S&P 500.

However, for several of these stocks, their prominence has also resulted in rich valuations and share price gains that have outstripped profit growth, making them difficult for value-minded investors to swallow.

Fortunately, you can partake in the impressive business models of these mega-cap stocks without necessarily paying an exorbitant share price. The strategy is simple: Buy shares of businesses that provide products or services to these companies and thus benefit peripherally from the group's phenomenal growth. FAANG stocks and other giant tech firms drive outsized revenue and profit gains for their value-added resellers (VARs), software developers, component manufacturers, landlords and dozens of other business partners.

Here are seven better ways to make money off FAANG stocks. The names featured here are riding the coattails of their mega-cap partners to outsized top- and bottom-line growth. Better still, most are valued at cheaper price-to-earnings (P/E) multiples than the FAANGs they partner with, suggesting these names may still have room to run.

Data is as of Nov. 9.

Zynga

- FAANG/Mega-cap relationship: Meta Platforms

- Market value: $8.5 billion

Zynga (ZNGA, $7.65) is an industry leader in mobile game development. The company initially built market share by partnering with Meta to launch mobile games like Zynga Poker, Words with Friends and Farmville that are multi-generational franchises.

It has since established download partnerships with FAANG stocks AAPL and GOOGL and, most recently, teamed up with social media firm Snap's (SNAP) Snapchat. The company's portfolio of gaming titles has been downloaded more than 4 billion times on mobile devices and reaches customers in over 175 countries.

In March, Zynga acquired cross-platform game developer Echtra Games, a move that should help extend its reach from mobile devices into PCs and consoles and expand its addressable market. And in August, the company bought Chartboost, a mobile advertising firm. Combining Chartboost's advertising and monetization platform that has an audience of roughly 700 million monthly users with Zynga's games should be a catalyst for revenue growth.

More good news for Zynga arrived in September when a California judge ruled that Apple cannot prevent game developers from bypassing its App Store and the 15%-30% commissions the tech giant charges on app purchases. This ruling enables gaming companies to reduce costs and retain a higher percentage of revenues.

In the third quarter, Zynga's bookings rose 6.4% year-over-year to $668 million and revenues surged 40.2% to $705 million. The company also reported $1.3 billion in cash and investments, up 76.8% from Q3 2020, which it says it will use to fund future acquisitions.

Over the last three years, Zynga has grown revenues 45% annually and has more than doubled normalized net income and levered free cash flow – the amount of cash a company has on hand after meeting its financial obligations – on an annual basis.

Wall Street analysts are bullish on ZNGA, too. Of the 19 following the stock that are tracked by S&P Global Market Intelligence, 13 say it's a Strong Buy, five call it a Buy and one rates it at Sell. Plus, the pros' consensus price target of $11.12 represents implied upside of 45.4% over the next 12 months or so.

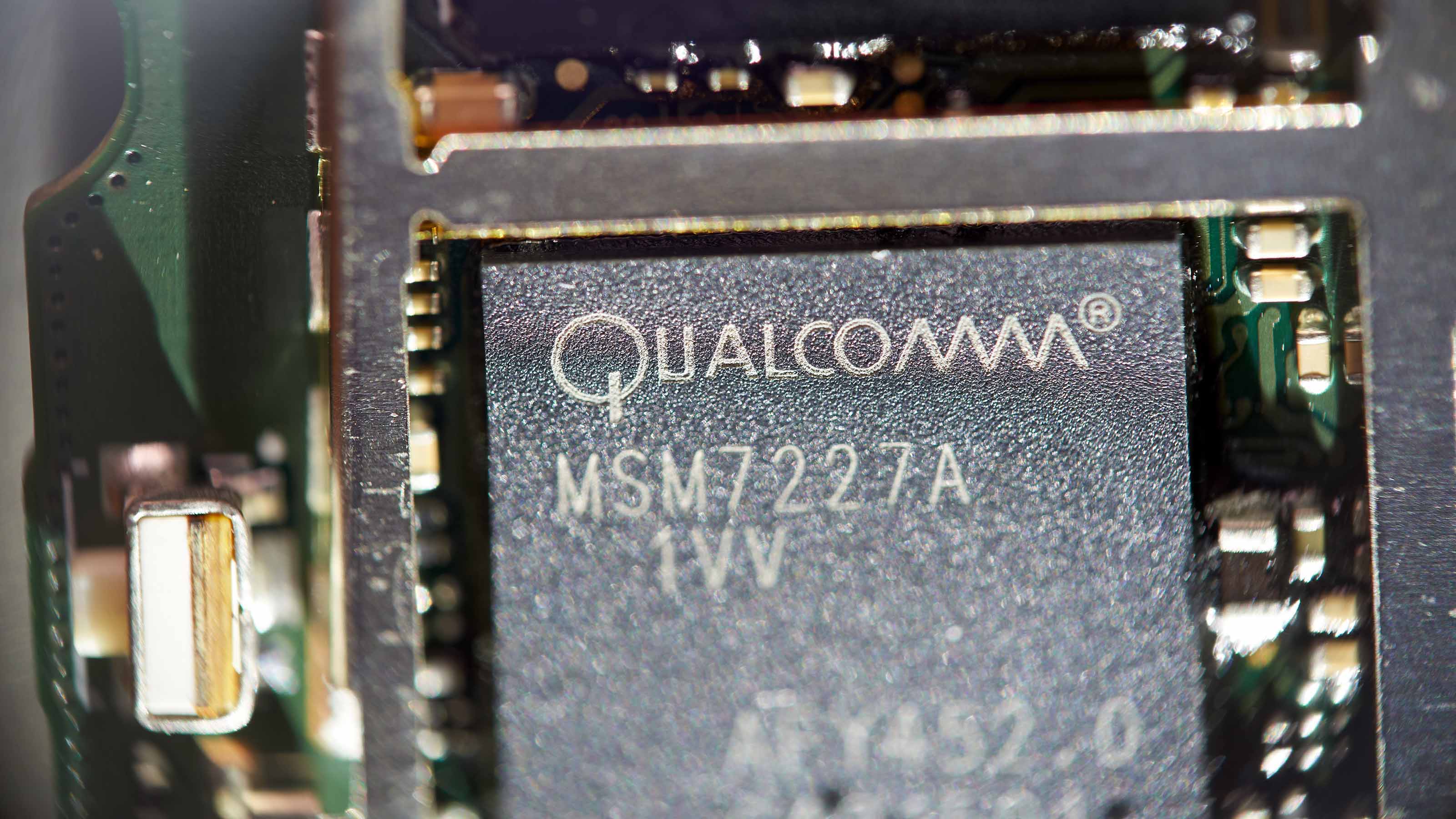

Qualcomm

- FAANG/Mega-cap relationship: Apple

- Market value: $187.7 billion

Qualcomm (QCOM, $166.74) has benefitted from its long – not always amicable – relationship with Apple and remains a key chip supplier for new iPhone models. Apple's 5G enabled iPhone 12 uses QCOM chips and teardowns of the recently launched iPhone 13 show it contains Qualcomm modems.

Apple is starting to design its own chips, but Qualcomm should continue to be at the forefront of the transition to 5G technology. According to QCOM, its Snapdragon processors offer the fastest 5G speeds available, with devices powered by these chips downloading content roughly 67% faster than the next largest competitor. Over 225 million 5G enabled smartphones shipped in 2020 and J.P. Morgan Research estimates this volume will more than double to 525 million this year and hit 725 million in 2022.

QCOM is further hedging its bets by making big investments in the Internet-of-Things (IoT) and in connected cars. During this year's September quarter, Qualcomm's IoT revenues rose 66% year-over-year to $1.5 billion. The global industrial IoT market was valued at $216 billion in 2020, according to market research firm Grand View Research, and is projected to grow 23% annually through 2028.

Qualcomm's product offerings for connected cars range from telematics to connectivity platforms and digital cockpits. Two years ago, less than 50% of new cars incorporated internet connectivity, but that percentage is expected to rise to 70% by 2025. QCOM's automotive revenues increased 44% during the September quarter to $270 million and reached $975 million for all of fiscal 2021.

Supporting this growth is the company's recent acquisition of Arriver whose driver assistance assets will be integrated into Qualcomm's own ADAS (advanced driver assistance systems) platform.

QCOM's revenues increased 43% year-over-year to $9.3 billion during the September quarter and adjusted earnings per share of $2.55 were up 76%. In its fiscal first quarter, the company is guiding for revenues of $10.0 billion to $10.8 billion and adjusted EPS to arrive between $2.90 and $3.10.

Of the 32 analysts covering the shares tracked by S&P Global Market Intelligence, 16 call it a Strong Buy, six say Buy and 10 have it at Hold. QCOM shares trade at a reasonable 15.8 times forward earnings – well below AAPL's forward P/E ratio of 27.

Roblox

- FAANG/Mega-cap relationship: Netflix

- Market value: $63.0 billion

Roblox (RBLX, $109.52) develops on-line gaming platforms that offer users an immersive, virtual 3D experience. Last year's pandemic-induced lockdown fueled a surge in new players and was a major growth catalyst for the company. The number of daily active users on its platforms is up 31% from one year ago to 47.3 million. Although not yet profitable, revenues for RBLX more than doubled in the September quarter to $509.3 million and free cash flow rose 7% to $170.6 million.

The company is poised for even stronger growth in the second half of this year thanks to the recent launch of its 3D game that mimics "Squid Game" – Netflix's hugely popular new TV series. Since its mid-September release, the South Korean horror/drama about players in a deadly tournament of children's games has become Netflix's most-watched series to date, with interest already exceeding previous hits like "Stranger Things," which was also the theme of a sponsored Roblox event.

Netflix is not Roblox's only partner. The company teamed up with Sony Music Entertainment in July to build metaverse music experiences around Sony artists and create new revenue streams tied to virtual entertainment.

Analysts forecast 47% revenue growth for RBLX this year, followed by 20% annual growth over the next two years.

Of the 10 analysts following RBLX stock tracked by S&P Global Market Intelligence, four call it a Strong Buy, three say Buy, two believe it's a Hold and one deems it a Sell. CFRA Research analyst John Freeman is one of those with a Strong Buy rating on RBLX, calling the company's third-quarter results "outstanding" and projecting "even stronger preliminary numbers" for the start of the fourth quarter.

The stock surged more than 40% in the wake of its solid third-quarter earnings report, so this may be one to watch for an entry point on price weakness.

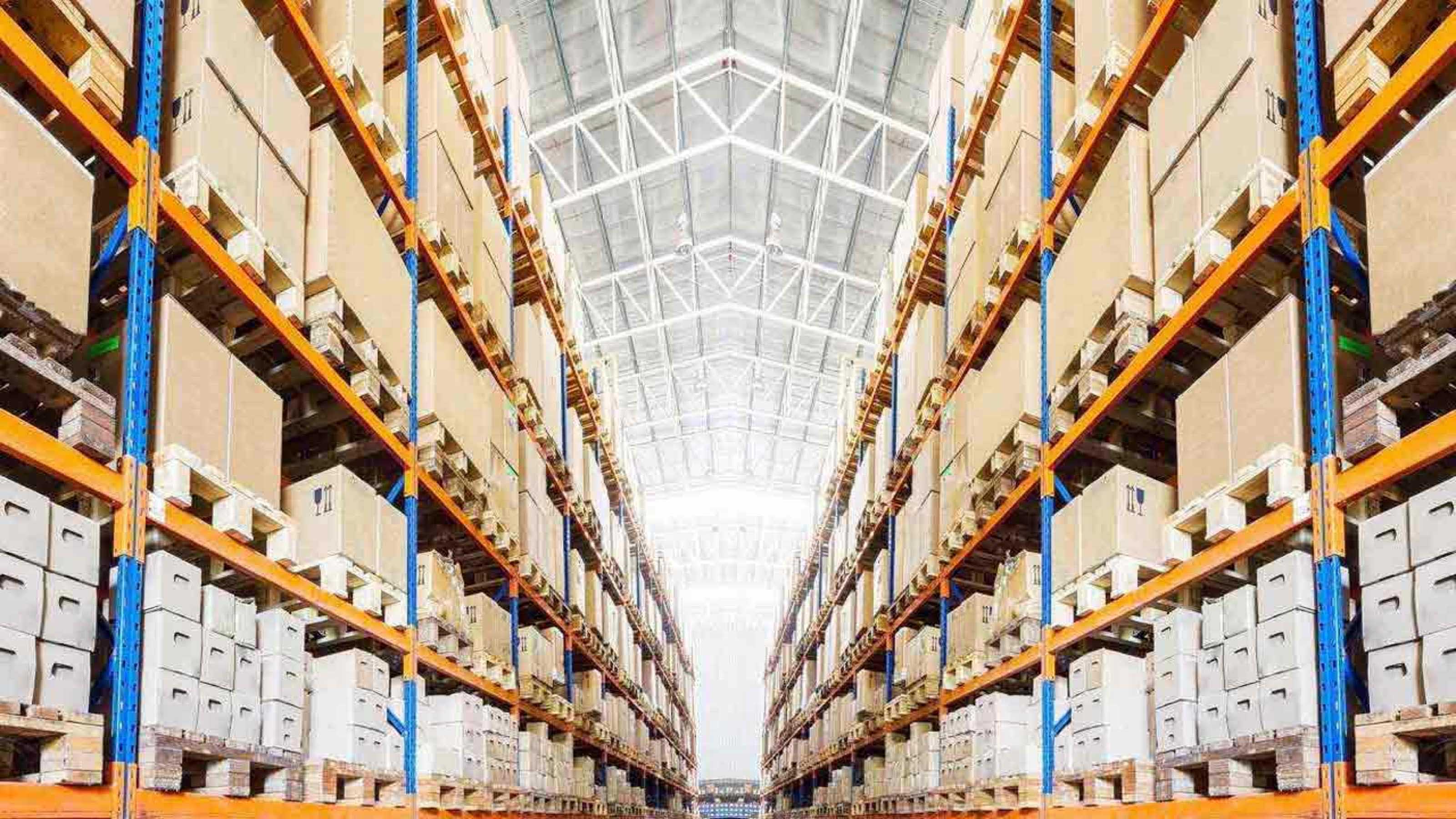

Prologis

- FAANG/Mega-cap relationship: Amazon

- Market value: $109.8 billion

A simple and safe way to capitalize on Amazon's stellar growth is to own shares of its largest landlord, Prologis (PLD, $148.45). This preferred partner of most leading e-commerce and logistics businesses is also the world's largest warehouse real estate investment trust (REIT). Prologis owns roughly 4,700 properties totaling nearly 1 billion square feet of leasable space and has operations across 19 countries.

The FAANG member is PLD's largest tenant by far, accounting for roughly 22 million square feet of leasing space and 6.1% of net rents. Prologis' next largest tenants are Home Depot (HD, FedEx (FDX), UPS (UPS) and XPO Logistics (XPO). Together these four firms contribute 6.1% of annual rents.

The e-commerce tailwinds that help Prologis show no signs of slowing. During the pandemic, customers increasingly shopped online and that trend continues to build. According to market research firm eMarketer, online purchases in the U.S. are forecast to rise from approximately $709.8 billion – or 14.5% of all retail sales – currently to $1.0 trillion, or 18.1% of retail sales, in three years. And this trend could fuel demand for an additional 1.0 billion square feet of warehouse space by 2025, says global commercial real estate services firm JLL.

According to Prologis, every $1 billion increase in e-commerce sales creates demand for another 1.2 million square feet of warehouse space. Amazon alone added $49.4 billion to sales in the third quarter.

Prologis has consistently ranked among the best-performing REITs in the warehouse sector. On an annual basis, core FFO (funds from operations, a key REIT earnings metric) per share has risen 10% and dividends have risen 9% over the past five years.

During the September quarter, Prologis CEO Hamid R. Moghadam said vacancies were at unprecedented lows and that "space in our markets is effectively sold out." The REIT is guiding for roughly 7% core FFO per share growth in 2021, supported by an industry-leading balance sheet and a land portfolio with an estimated $21 billion buildout potential.

Barclays analyst Anthony Powell initiated coverage of PLD with an Overweight (Buy) rating in September, saying industrial is his favorite REIT subsector. CFRA Research analyst Stewart Glickman recently said "fundamentals point to an enviable supply-demand situation heading into 2022," but lowered his rating from Strong Buy to Hold recently due to price gains on PLD stock that have outpaced its REIT peers so far this year.

Workday

- FAANG/Mega-cap relationship: Alphabet (Google)

- Market value: $72.8 billion

Workday (WDAY, $293.48) hit the ground running ahead of its October 2012 initial public offering (IPO) by signing search giant Google as one of its first customers. Google replaced parts of its internally developed human resources (HR) software with Workday software. Since then, WDAY has become the industry leader in cloud-based software that helps companies manage finance, HR and strategic planning functions.

Workday has grown to more than 55 million users worldwide and claims over 50% of Fortune 500 companies as customers.

The company delivered a stellar June quarter with revenues up nearly 19% year-over-year to $1.26 billion, fueled by a 20% rise in subscription revenues. Workday's adjusted EPS came in at $1.23, more than 46% higher than the year prior, and the company raised its full-year guidance for subscription revenues and operating margins.

Workday's new strategic partnership with Google Cloud is expected to spur growth for both companies by enabling customers to deploy Workday finance, HR and strategic planning software on Google Cloud. The multi-year partnership also includes co-marketing and cross-selling programs to increase new business opportunities across the U.S. In addition, the two companies plan to explore opportunities to co-develop cloud-based applications for customers in the retail, healthcare and financial services industries.

Google subscribed to additional products in September – Workday Adaptive Planning, Workday Extend, Workday Prism Analytics and Workday Strategic Sourcing – and expanded its use of WDAY human resources tools by adding new applications.

Barclays analyst Raimo Lenschow upgraded WDAY shares to Overweight in August based on his expectations of increased IT spending in the second half of 2021. Most analysts are bullish on Workday. Of the 34 covering the stock tracked by S&P Global Market Intelligence, 19 say it's a Strong Buy, 9 believe it's a Buy, five deem it Hold and one calls it a Sell.

Plus, the company is forecast to grow EPS 26% annually over the next three-to-five years, or nearly twice the anticipated growth rate of the overall IT sector.

Arrow Electronics

- FAANG/Mega-cap relationship: Microsoft

- Market value: $8.5 billion

Arrow Electronics (ARW, $119.98) built its business supplying semiconductors to original equipment and contract manufacturers. The company has been a Microsoft partner for over a decade, providing electronics and services that are directly integrated into MSFT portals for service provisioning and configuration. In 2019, Microsoft named the company its Indirect Provider of the Year.

More recently the company began offering enterprise computing software for data center, cloud, security and analytics services. Already a Microsoft Cloud Service Provider, Arrow is partnering with MSFT to deploy tools on its Azure platform that speed development of IoT solutions. By participating in the IoT space, Arrow benefits from an expected surge in global IoT spending.

Earlier this year, Arrow expanded its relationship with one of the original FAANG stocks: Amazon.com. Per its agreement with Amazon Web Services (AWS), Arrow will be able to resell, manage, service, support and bill AWS accounts on behalf of their customers. Arrow is also working with AWS to support OEM customers that are building smart devices incorporating the cloud technology.

Thanks to its massive scale, Arrow was able to secure semiconductor inventories in 2021 that many competitors could not. As a result, the company's September quarter sales improved 18% year-over-year and EPS rose 94%. Analysts think Arrow will improve on its impressive EPS growth rate by delivering 17% annual EPS gains over the next three to five years.

ARW shares are cheap, too, trading at 6.8 times forward earnings. For the sake of comparison, Microsoft's forward P/E ratio is 36.8 and Amazon's is 55.9.

Modine Manufacturing

- FAANG/Mega-cap relationship: Tesla

- Market value: $603.1 million

Modine Manufacturing (MOD, $11.63) designs, manufactures and sells heat transfer products used by customers in the HVAC systems, commercial and industrial, heavy-duty equipment and automotive markets.

The company has long been a key supplier of battery chilling technologies to Tesla, the world's largest manufacturer of electric vehicles (EVs). In the first nine months of 2021, TSLA produced nearly 625,000 vehicles – up almost 88% from the year prior.

Demand for electric vehicles is forecast to rise nearly 22% annually to 233.9 million units by 2027 – valuing the market at nearly $2.5 trillion by 2027 – according to market research firm Meticulous Research. Wisconsin-based Modine's established relationship with Tesla could become a major growth catalyst, particularly if worsening trade relationships with China cause Tesla to shift more of its business to reliable U.S. suppliers.

Modine recently sold its traditional automotive business and plans to focus more resources on computer data center cooling products, industrial HVAC and electric vehicles. Expanding in more profitable niches will enable Modine to increase operating margins and free cash flow and to accelerate repayment of debt.

In September, Modine said it is creating a separate business unit focused exclusively on cooling technologies for electric vehicles. The company is in discussions with 30 customers, has commenced production on three programs and won five additional contracts that will launch over the next 12 months.

Modine achieved double-digit sales growth in three out of four of its business units during the September quarter, though total year-over-year revenue growth came to a more modest 4% amid supply chain issues, a global semiconductor shortage and a loss associated with the sale of its air-cooled automotive segment.

Modine has Strong Buy ratings from both of the Wall Street analysts tracking the stock. It also looks bargain-priced at 7.5 times forward earnings – especially when compared to TSLA's forward P/E ratio of 26.7.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Lisa currently serves as an equity research analyst for Singular Research covering small-cap healthcare, medical device and broadcast media stocks.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.