Stock Market Today: Persistent Inflation Gut-Punches Tech Stocks

The highest jump for consumer prices in 30-plus years stole headlines Wednesday, but evidence of persistent inflation was the real worry for markets.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stock-market bears got a bit more aggressive Wednesday after a worrisome October inflation report revealed relentlessly rising prices, triggering a spike in bond yields.

The Bureau of Labor Statistics said October's headline consumer price index (CPI) jumped 6.2% over last year's depressed levels – the swiftest such move since 1990 – but more importantly, at a higher-than-expected 0.9% month-over-month, which was its quickest pace since 2008.

Particularly worrisome were signs that climbing consumer costs couldn't just be chalked up to temporary causes such as supply-chain woes.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The details within the report signaled strengthening persistent pressures, though transitory forces also picked up," says BofA Securities. "[Rent equivalents] and rent inflation were a big focus for this month: They printed a 0.4%+ MoM clip for a second time, providing additional confirmation of a reset to a higher trend."

BofA notes that rents are the biggest cyclical driver of inflation and "therefore the most crucial component to monitor for persistent price pressures."

However, some – including Rick Rieder, BlackRock's chief investment officer of global fixed income – remain slightly more optimistic that most of the currently inflationary pressures are temporary.

"It is likely that in time pandemic distortions and extreme base effects will ease, pulling aggregate prices back toward a 2% rate of growth and allowing quantities to continue expanding once supply pressures alleviate," says Rieder, though he concedes "this will take time."

Bond yields immediately responded, jumping roughly 10 basis points to as high as 1.592%. (A basis point is one one-hundredth of a percentage point.) That weighed heaviest on technology and tech-related shares, where higher interest rates can sharply dig into future growth.

"FAANGs" such as Amazon.com (AMZN, -2.6%) and Google parent Alphabet (GOOGL, -2.0%) struggled, and red-hot semiconductor shares including Advanced Micro Devices (AMD, -6.1%) and Nvidia (NVDA, -3.9%) were put on ice.

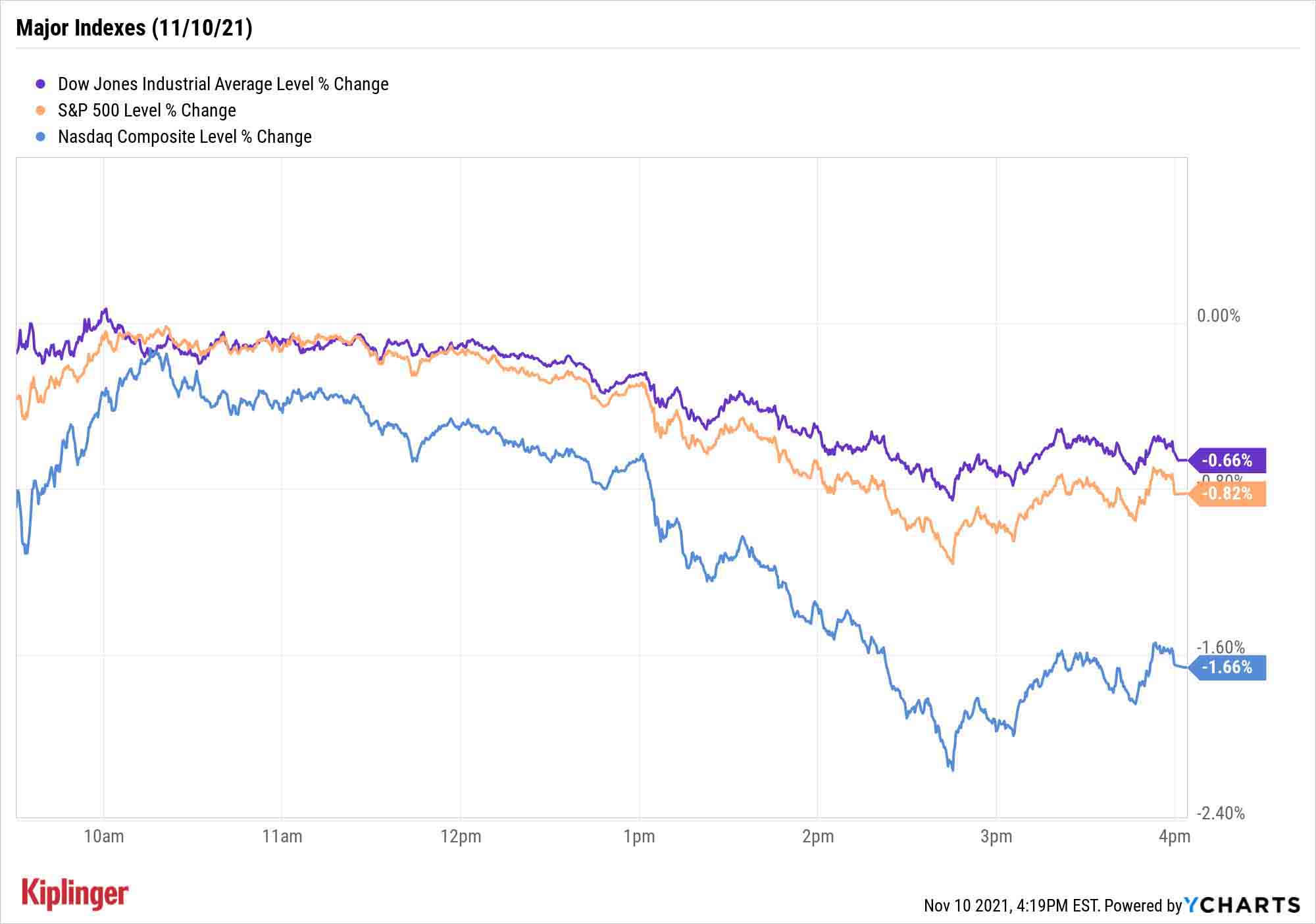

The result? The Nasdaq Composite retreated by 1.7% to 15,622, while the S&P 500 (-0.8% to 4,646) and the Dow Jones Industrial Average (-0.7% to 36,079) sustained somewhat lesser declines.

And a reminder: the stock market is open for Veterans Day.

Other news in the stock market today:

- The small-cap Russell 2000 declined 1.6% to 2,389.

- U.S. crude futures slumped 3.3% to settle at $81.34 per barrel, snapping their three-day winning streak.

- Gold futures gained 1.0% to finish at $1,848.30 an ounce.

- The CBOE Volatility Index (VIX) popped 5.7% to 18.79.

- Bitcoin made another run higher Wednesday, flirting with the $69,000 level today before being repelled. As of the afternoon, the cryptocurrency was off 2.5% from yesterday's prices to $65,622.00. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Electric vehicle maker Rivian Automotive (RIVN), which is backed by the likes of Amazon.com and Ford (F), pulled off the largest U.S. initial public offering (IPO) since 2014. The company raised $11.9 billion, topping every other offering since Alibaba Group (BABA). The EV play priced its shares at $78 and jumped as high as $106.75, eclipsing $100 billion in market value – this, despite that Rivian expects to generate less than $1 million in third-quarter revenue. RIVN closed 29.1% higher to $100.73, at a market value of more than $98 million, which is larger than U.S. giants General Motors (GM) and Ford.

- Mastercard (MA, +3.9%) flashed some green ink amid a sea of red after delivering encouraging projections during an investor-day event. The company said that for 2022-24, it expected to grow net revenues in the high teens (from low teens in 2019-21) and earnings per share in the low 20s (from high teens). The company says it sees "significant untapped opportunity" in the $255 trillion total addressable market for payments. Piper Sandler analyst Christopher Donat maintained his Neutral stance on shares, however, saying that "While we believe that MA has significant opportunities in front of it, many of these opportunities have been available for years."

Protect Yourself From Inflation

The latest CPI report doesn't signal doom for stocks, but it's certainly a hurdle to overcome.

"The bond market is telling you that the [Federal Reserve] is way behind the curve on policy, as short rates rocketed while long rates have taken the release in stride," says Cliff Hodge, chief investment officer for Cornerstone Wealth, who adds that "a flattening curve does not portend well for risk assets into next year."

Chris Zaccarelli, CIO for Independent Advisor Alliance, agrees the Fed might need to speed up their tightening of fiscal policy.

As for stocks?

"We have already been positioning for higher inflation in our investments by using energy companies and higher-quality companies – those with strong balance sheets, a competitive moat around their business and pricing power – as a way to lessen any impact that higher prices will have on profit margins."

Investors have other ways to protect themselves from rising prices – these five mutual funds represent traditional ways to hedge against inflation, though this new ETF with a fresh strategy is worth exploring, too.

Indeed, you might have more options than you think. Our look at how to shield yourself from inflation contains a variety of ideas, including stocks, ETFs, mutual funds and even commodities. Check it out.

Kyle Woodley was long AMD, AMZN and NVDA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.