Stock Market Today: Dour Disney Results Drag Down the Dow

Technology stocks enjoyed a relief rally Thursday amid the bond market's off day, but the Dow couldn't escape the effects of a weak Disney report.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The stock market was indeed open for Veterans Day, but perhaps just as importantly, the bond market was closed, allowing technology-sector equities and other rate-sensitive shares to catch their breath after Wednesday's downturn.

Unfortunately, a steep drop in Disney (DIS, -7.1%) on Thursday prevented the Dow Jones Industrial Average from ending its recent slide.

An otherwise light news day put the spotlight back on corporate earnings, which triggered several precipitous declines. Dating app creator Bumble (BMBL, -19.3%) announced its first quarter-over-quarter decline (2%) in user growth and missed earnings estimates, while Beyond Meat (BYND, -13.3%) tumbled after delivering weak Q3 results and a disappointing Q4 outlook.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The highest-profile miss, however, came from Disney, which fell short of expectations not just for the top and bottom lines, but also its number of Disney+ subscribers. That prompted a number of price-target downgrades, though analysts largely remained bullish on Disney's longer-term potential.

"We believe DIS's asset mix of both digital and physical assets maximizes its economic value capture over time … [but] DIS's FY4Q21 comments (our view) implied that share price catalysts won't begin until 2022's June quarter," says Needham analyst Laura Martin, who has a Hold rating on shares.

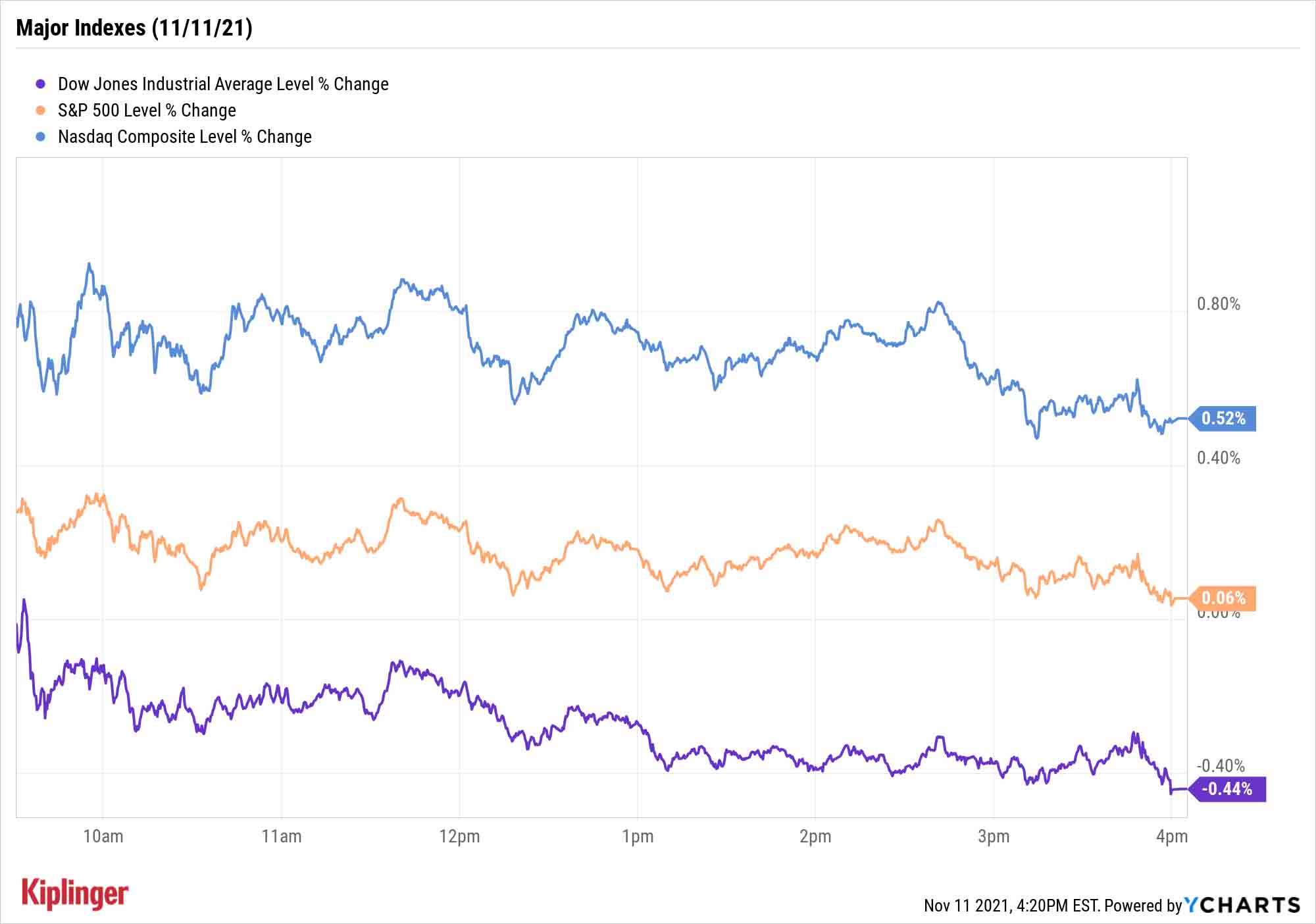

Disney's loss weighed on the Dow (-0.4% to 35,921), which suffered its third consecutive loss. But the S&P 500 (up marginally to 4,649) and Nasdaq Composite (+0.5% to 15,704) snapped their short skids thanks to rebounds in chipmakers such as Advanced Micro Devices (AMD, +4.4%) and Qualcomm (QCOM, +2.9%), as well as streaming stock Netflix (NFLX, +1.7%).

Other news in the stock market today:

- The small-cap Russell 2000 rebounded 0.8% to 2,409.

- U.S. crude futures were virtually flat, declining a mere 2 cents per share to $81.32 per barrel.

- Gold futures improved again, up 0.8% to $1,863.90 per ounce. Spot gold prices, meanwhile, neared five-month highs.

- The CBOE Volatility Index (VIX) lost all of the ground it gained Wednesday and then some, declining 5.4% to 17.72.

- Bitcoin declined again, by 1.2% to $64,820.64. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Electric vehicle makers Lordstown Motors (RIDE, +23.9%) and Fisker (FSR, +10.9%) were both up big Thursday, but for different reasons. The former jumped after Foxconn agreed to buy its Lordstown, Ohio, plant for $230 million. The Chinese electronics manufacturer also said it would seek a deal to help RIDE make its Endurance line of pickup trucks. And the latter a price-target upgrade, to $24 per share from $18, from BofA Securities analyst John Murphy. Murphy nonetheless maintained his Neutral stance on FSR.

Tesla's Tiny Loss: A Win for You?

One of the more important moves of the day was, in fact, practically a non-move. Electric vehicle maker Tesla (TSLA, -0.4%) finished Thursday with a modest loss.

However, that's a welcome stabilization in shares after a highly telegraphed stock sale by CEO Elon Musk sent TSLA shares plunging by as much as 19% between last Friday's close and yesterday's intraday lows.

It's clearly fantastic news for Tesla's shareholders, but it's still meaningful even if you don't hold the stock.

That's because TSLA is one of several mega-cap stocks that have an outsized amount of influence on major funds, representing 2% of the S&P 500, 4.5% of the popular Nasdaq-100 index, and roughly 19% of the market's largest consumer-discretionary ETF. This puts Tesla in company with the "FAANGs" – or the "FANGs," or the "FAAMGs," or whatever acronym comes next to encapsulate Wall Street's largest companies such as Apple (AAPL) and Microsoft (MSFT).

Tesla also is similar to several of the FAANGs in that its popularity has also led to a bloated valuation. Fortunately, there's more than one way to invest in these ubiquitous companies. We've recently put our microscope not just on the FAANGs and other mega-caps themselves, but companies that provide products and services to these behemoths, offering something of a backdoor way to share in the growth of these trillion-dollar firms.

Here are seven other ways to invest in the FAANGs.

Kyle Woodley was long AMD and TSLA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.