Stock Market Today: Boeing, Tesla Spice Up a Bland Market Session

A lack of macro drivers kept the markets in neutral Monday, but earnings, economic data and a Buffett update could spark some excitement later this week.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

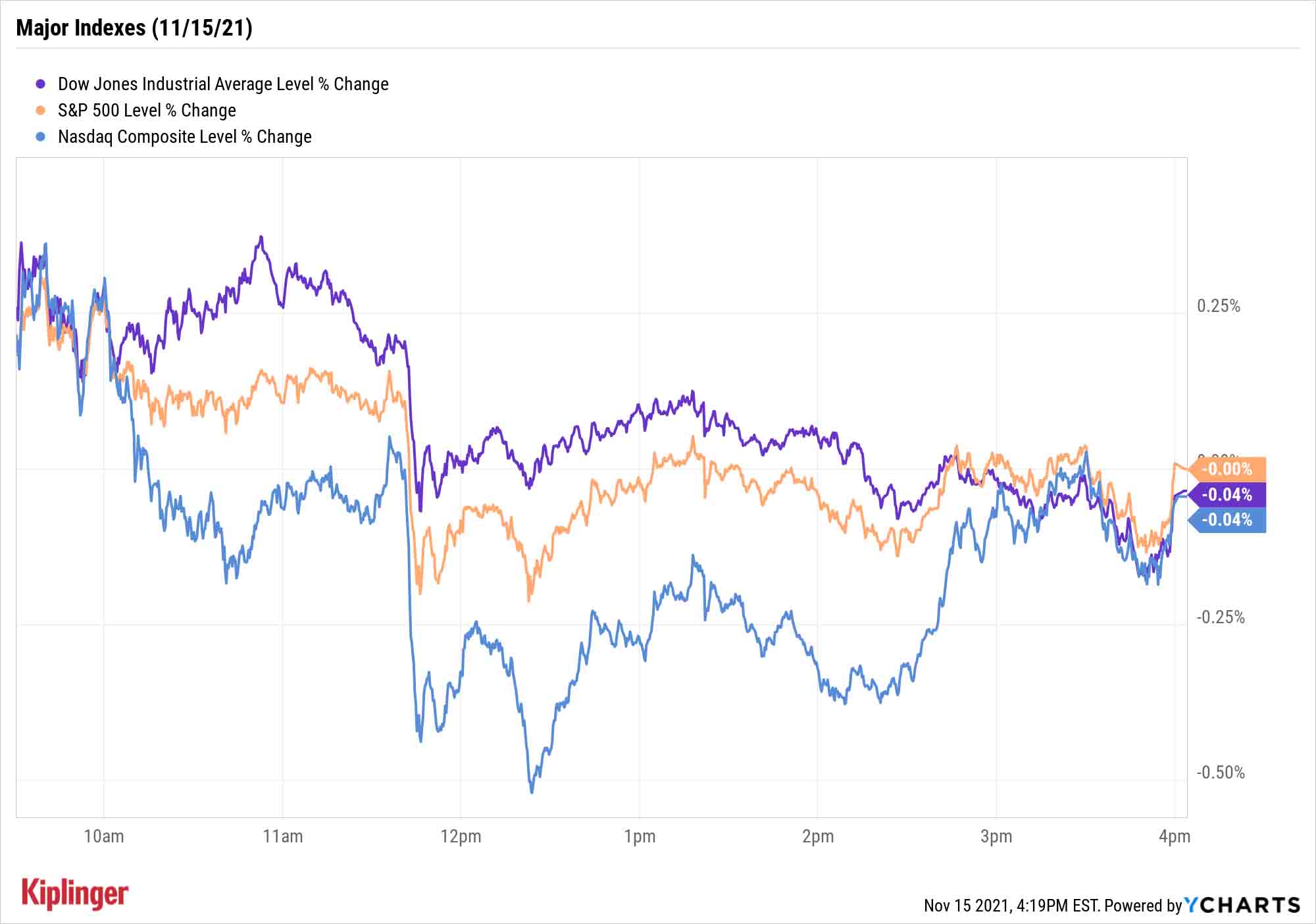

The broader market didn't have much giddy-up to start the week, with stocks mostly flat in the absence of any market-moving news.

But that should change shortly.

This week's earnings calendar features another bevy of pivotal reports – one that's heavy on retailers such as Target (TGT) and Home Depot (HD), but also includes other mega-caps such as Nvidia (NVDA) and Cisco Systems (CSCO). Tuesday morning will bring with it updates on monthly retail sales, industrial production, business inventories and other vital economic data.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

And tonight, investors will learn about the latest changes to the equity portfolio of Warren Buffett's Berkshire Hathaway (BRK.B); readers should check out our investing page for updates this evening.

Standing out Monday were a few single-stock moves.

Tesla (TSLA, -1.9%), which declined considerably last week as CEO Elon Musk sold off billions of dollars worth of shares, fell again Monday after Musk threatened to dump more stock in a weekend Twitter fight with Sen. Bernie Sanders … and as rival EV maker Lucid Group's (LCID, +2.2%) Air sedan won MotorTrend's Car of the Year award.

Meanwhile, Boeing (BA, +5.5%) popped amid reports that China might soon allow the 737 MAX to resume flying, and as a top executive told CNBC that the markets for freighter aircraft "are on fire right now."

The major indexes all finished lower, but by less than a tenth of a percent; the Dow Jones Industrial Average closed at 36,087, the S&P 500 at 4,682 and the Nasdaq Composite at 15,853.

Other news in the stock market today:

- The small-cap Russell 2000 declined by 0.5% to 2,400.

- U.S. crude futures eked out a 0.1% gain to settle at $80.88 per barrel.

- Gold futures slipped 0.1% to end at $1,866.60 an ounce, snapping a seven-day winning streak.

- The CBOE Volatility Index (VIX) improved by 1.8% to 16.59.

- Bitcoin lost a little ground over the weekend, declining 0.6% to $63,794.61. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Oatly Group (OTLY) was one of the first companies on this week's earnings calendar, and the reaction to the oat milk producer's results were not good. In its third quarter, OTLY recorded a per-share loss of 7 cents – slimmer than the 9 cent-loss analysts were expecting – but revenue or $171.1 million fell short of the consensus $185.9 million estimate. Oatly cited supply-chain issues as the main catalyst for its revenue miss and said it expects full-year revenue to come in lower than what analysts are anticipating. OTLY ended the day down 20.8%.

- Dollar Tree (DLTR) stock jumped 14.3% today after a report in the Wall Street Journal late Friday indicated Mantle Ridge has taken a stake of "at least $1.8 billion" – or roughly 5.7% – in the discount retailer. According to people familiar with the matter, the activist investor is pushing for improvements at DLTR's Family Dollar chain in order to increase share price. Oppenheimer analysts Rupesh Parikh and Erica Eiler called the move a "positive," but "believe investors are best to remain on the sidelines for now" due to concerns over the company's ability to "deliver sustained levels of comparables and profit growth."

2022 Winners? Consider the Comeback Kids

As investors begin to peek ahead into 2022, they'll likely be looking for key themes that should dominate attention and drive outperformance. Those include the continued growth of cryptocurrencies, and the emergence of the metaverse – two areas that have seen breakneck growth in 2021 and are expected to do the same next year.

However, 2022 is also expected to see a revival for some of 2020's trend stocks: industries that made gains during COVID-enforced lockdowns (think financial technology or e-commerce companies) but then in 2021 suffered pullbacks as investors turned to reopening plays, infrastructure stocks and other ideas.

The good news? Many of those same industries are poised to resume their long-term upward trends in 2022.

We've just highlighted video game stocks as one area that could see a resurgence; industry revenues have cooled following a banner 2020 but are expected to get back on track next year and beyond. Read on as we explore some of the video game industry's most attractive opportunities.

Kyle Woodley was long BA, NVDA and TSLA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.