Stock Market Today: New S&P, Nasdaq Highs Thanks to Apple, Nvidia

Two of the major indexes enjoyed modest gains Thursday thanks to Nvidia's great Q3 and reports of Apple's renewed automobile ambitions.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

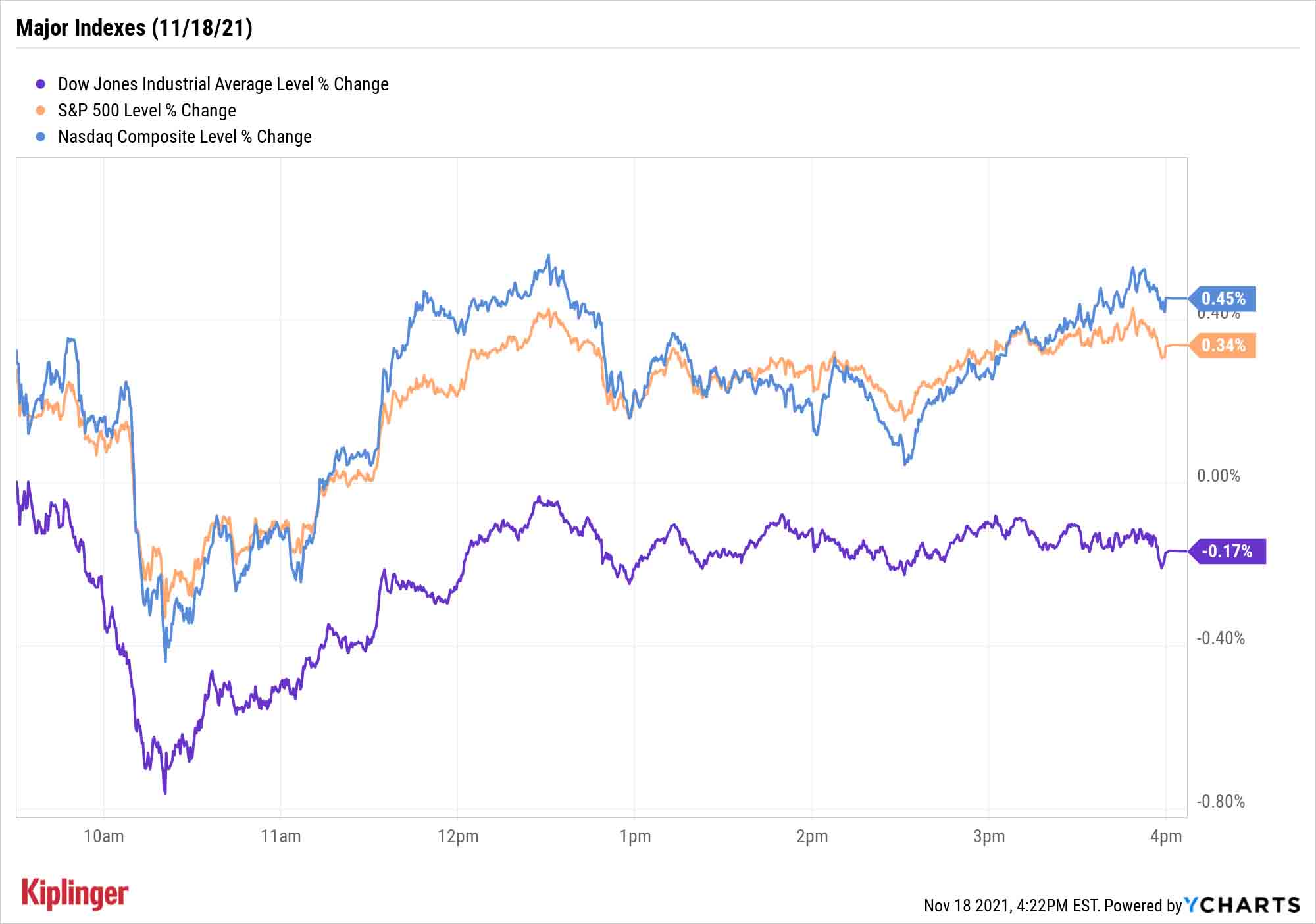

The stock market lumbered through another tame session at the broader-index level Thursday, but a few exciting individual moves in Big Tech were just enough to get the S&P 500 and Nasdaq Composite back into record territory.

Initial unemployment claims for the week ended Nov. 13 didn't seem to affect stocks much. The week's 268,000 filings were just barely more than expected (260,000), but also slightly lower than last week's upwardly revised 269,000.

More encouraging was the Philly Fed, which showed activity jumping to 39.0 in November from 23.8 last month (any reading above zero is indicates growth).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

“The Philly Fed index was the second regional survey this week to blowout expectations,” says Michael Reinking, senior marketing strategist for the New York Stock Exchange. “The regional surveys are the first pieces of November data and this suggests that next Tuesday’s Markit PMI data could also be strong.”

However, a couple mega-cap tech moves were the strongest drivers of Thursday's index action.

Apple (AAPL, +2.9%) shot to record highs amid a Bloomberg report that the company is accelerating the development of a full self-driving electric vehicle, with a possible model reveal by 2025, citing people familiar with the matter. And chipmaker Nvidia (NVDA, +8.3%) resumed its red-hot run after reporting a 50% year-over-year improvement in Q3 revenues and better-than-expected earnings thanks to a big quarter from its gaming and datacenter products.

That resulted in another standout daily performance for tech, which in the bigger picture has broken out to fresh relative highs for the first time since September 2020, according to Scott Brown, technical strategist for LPL Financial.

"Technology continues to be a key enabler of higher productivity and home to many of the fastest-growing companies," he says. "Despite topping all sectors with 9% earnings growth in 2020, earnings growth this year is on track to exceed 30%."

The S&P 500 gained 0.3% to a record 4,704, and the Nasdaq finished up 0.5% to a new high of 15,993. The Dow Jones Industrial Average, however, slipped 0.2% to 35,870; Cisco Systems (CSCO, -5.5%) pulled on the industrial average after delivering weak quarterly guidance.

Other news in the stock market today:

- The small-cap Russell 2000 dipped 0.6% to 2,363.

- U.S. crude futures rose 0.8% to $79.01 per barrel.

- Gold futures slipped 0.5% to settle at $1,861.40 an ounce.

- The CBOE Volatility Index (VIX) climbed 1.6% to 17.40.

- Bitcoin dropped to roughly one-month lows, declining 3.9% to $57,998.79. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- It was a red-hot market debut for Sweetgreen (SG). The Los Angeles-based fast-casual salad chain opened today at $52, well above last night's initial public offering (IPO) price of $28 per share – and more than double the expected range of $23 to $25 per share. SG's opening price gave the company a market value of more than $5.5 billion, though it eventually closed the day just shy of here at $49.50. There's still a handful of names waiting to go public in the final weeks of 2021, capping off what has been a big year for IPOs.

- Macy's (M) was a big winnerpost-earnings, with the retail stock surging 21.2%. In its third quarter, the department store reported higher-than-expected adjusted earnings per share of $1.23 on $5.4 billion in revenue. M also said comparable sales surged 35.6% year-over-year on an owned-plus-licensed basis, while digital sales surged 19%. Still, CFRA Research analyst Zachary Warring maintained a Hold rating on the stock. "We like the improvements to the balance sheet and business model but expect FY 22 to be a peak year for Macy's," he wrote in a note.

2022: The Year of the Stock Picker?

As we head into the final innings of 2021, Morgan Stanley Research is lukewarm about the 12-month risk/reward proposition offered by the broader indexes, but they do think investors can find opportunity in individual equities.

Even then, "while our primary theme for 2022 is to focus more on stocks than sectors and styles, one can't ignore them. We go into year-end favoring earnings stability and undemanding valuation given our view for a tougher operating environment and higher long-end rates," the team says in its 2022 outlook.

That has Morgan Stanley overweighting the healthcare sector, which stands out for its defensive qualities and reasonably priced growth. No small wonder there. Healthcare seems to offer something to everyone, from blue-chip pharmaceutical companies with ample dividends to growthy biotechnology firms.

But if you're looking at the sector with a specific eye toward the new year, look no further. We've begun our annual dive into the market's various slivers with the best healthcare stocks for 2022, where COVID-19 should still be a factor for some potential winners … but not all of them.

Kyle Woodley was long NVDA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.