Stock Market Today: Stocks Retreat Late After Cheering Powell Nomination

President Joe Biden nominated Fed Chair Jerome Powell for a second term Monday: a move that was welcome by investors ... at least for a few hours.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

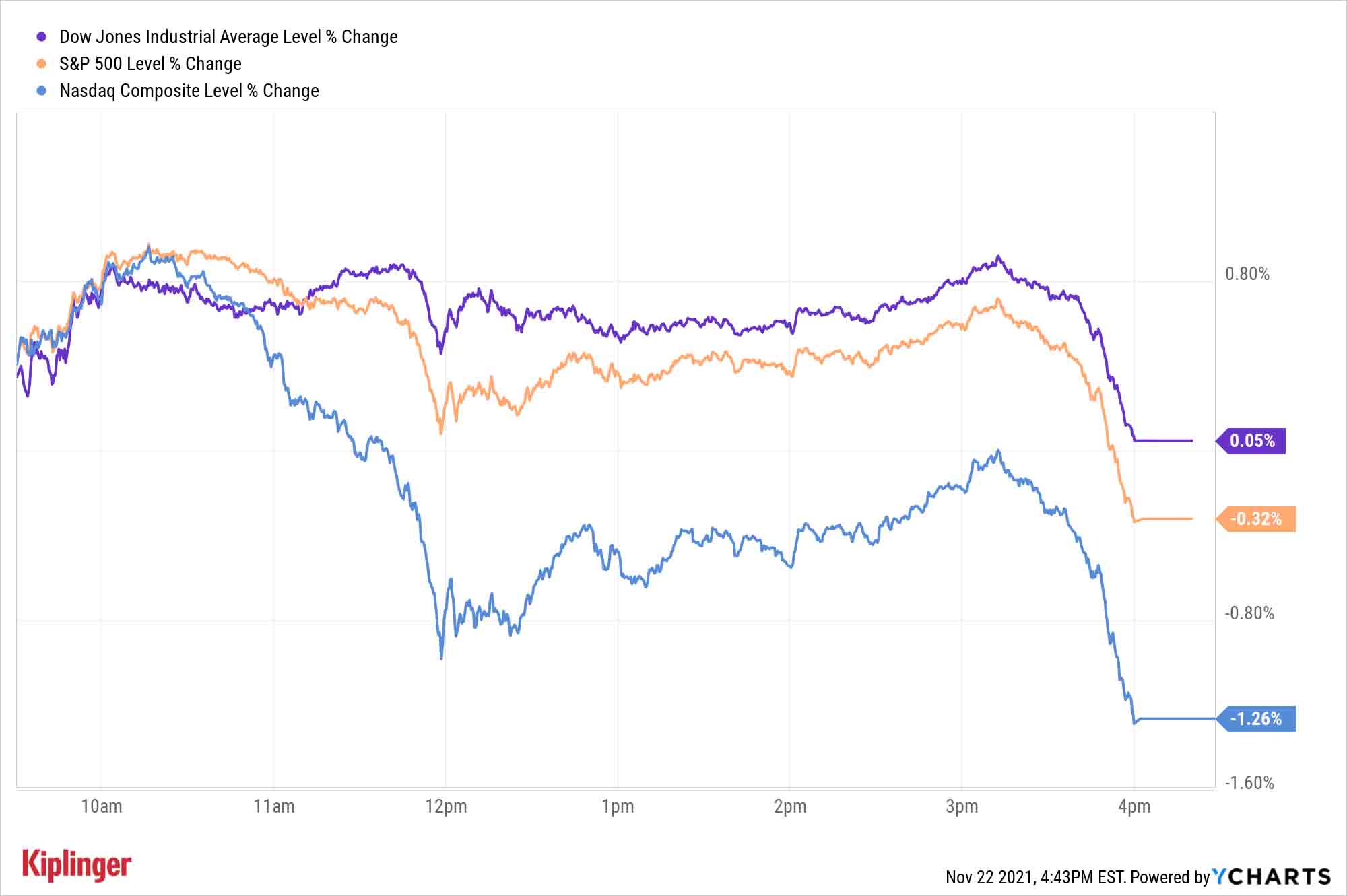

The markets kicked off a holiday-shortened trading week by celebrating the likely continuation of Jerome Powell as the Federal Reserve's chair, but the party streamers ran out by the closing bell.

President Joe Biden did what pundits largely expected Monday, nominating Powell for another four-year term as the head of America's central bank as it navigates a period of rising inflation. That sent a jolt through several areas of the market in the morning, most noticeably financials (+1.4%) and energy (+1.8%).

"Powell's renomination removes a potential negative from the markets and provides the certainty that investors crave. Powell is sound, tested, respected and familiar to markets," says George Ball, chairman of investment firm Sanders Morris Harris.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Looking ahead, BMO Capital Markets Senior Economist Jennifer Lee notes that "with the possibility of an even more dovish Fed Chair now off the table (Lael Brainard will be vice-chair), the possibility of a sooner Fed rate hike in 2022 has risen."

However, all of the major indices turned tail late in the session, giving up most or all of their early gains. The Dow Jones Industrial Average squeaked by with a marginal gain to 35,619. The S&P 500 – on pace to set a new record high for most of the day – lost 0.3% to 4,682, and the Nasdaq coughed up 1.3% to finish at 15,854.

The Nasdaq might have been even worse if not for strong performances from some of its mega-caps, including Tesla (TSLA), which finished up 1.7%. Indeed, the "FAANGs" and other very large Nasdaq stocks have been papering over difficult years for many of the composite's smaller members.

Liz Ann Sonders, chief investment strategist at Charles Schwab, notes on Twitter that the average maximum year-to-date drawdown for Nasdaq components has reached 40%. And year-to-date, just 63% of the Nasdaq's stocks are sitting on positive year-to-date returns, versus 83% of the S&P 500.

Other news in the stock market today:

- The small-cap Russell 2000 declined 0.5% to 2,331.

- U.S. crude futures rose 1.1% to settle at $76.75 per barrel.

- Gold futures fell 2.4% to finish at $1,806.30 an ounce.

- Bitcoin dropped alongside equities, declining 3.6% to $55,794.50. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- General Motors (GM) popped 3.7% on news it took a 25% stake in Pure Watercraft. The Seattle-based startup makes all-electric outboard motors for boats. As part of the deal, GM will supply the company with parts and will provide advice on engineering, design and manufacturing.

- Blink Charging (BLNK) plunged 11.3% after Cowen analyst Gabe Daoud downgraded the electric vehicle (EV) charging equipment stock to Market Perform from Outperform (the equivalents of Neutral and Buy, respectively). The analyst cited BLNK's valuation as a reason for the downgrade, with shares rallying nearly 62% from early October through last Friday's close to trade at a price-to-earnings (P/E) ratio of 110.9.

Don't Just Collect More Income ... Collect It More Often

Income is a vital component to just about any retirement investing strategy. You'll be hard-pressed to find anyone who challenges that concept … and you don't need to worry, because we're not about to, either.

But chances are many retirement planners and retirees could better tailor their holdings to their needs.

When people call it a career, little changes about their bills – the mortgage, the power bill, the car payment still come each and every month. But their income is another story. If you take a look at most dividend stocks – even the vast majority of the creme de la creme, the Dividend Aristocrats – they tend to only pay once a quarter, or in some cases even once or twice a year. That forces many retirees to build complicated portfolios, mixing and matching stocks in a particular way just to ensure an even monthly dividend check.

But a few investments take the load off your shoulders. For one, bond funds are much more likely than stock funds to deliver monthly distributions. And if you do crave the mix of dividends and growth you can get from equities, you can indeed collect income every 30 days or so from a small number of monthly dividend stocks.

We've recently highlighted a dozen monthly dividend payers, and for the most part, there's nothing fundamentally different about them – management simply sees the value in rewarding shareholders every month, which provides a type of income stability few other investments can.

Kyle Woodley was long TSLA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks Extend Losing Streak After Fed Minutes: Stock Market Today

Stocks Extend Losing Streak After Fed Minutes: Stock Market TodayThe Santa Claus Rally is officially at risk after the S&P 500's third straight loss.