Stock Market Today: Dow Closes Up, But Turbulent Tech Trips Up Nasdaq

Energy made a surprising move higher Tuesday despite President Biden ordering oil released from America's strategic reserves.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The market continued its recent split, with cyclical sectors such as energy (+3.0%) and financials (+1.5%) building upon yesterday's gains while mega-cap technology and tech-esque stocks receded again.

President Joe Biden on Tuesday announced the release of 50 million barrels of oil from the nation's strategic reserves to rein in high gas prices. And yet, U.S. crude oil futures jumped 2.3% to $78.50 per barrel, buoying most of the energy sector, especially exploration and production plays such as Occidental Petroleum (OXY, +6.4%) and EOG Resources (EOG, +5.8%).

Michael Reinking, senior market strategist for the New York Stock Exchange, lays out three potential reasons for the counterintuitive move:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"First, there is the 'sell the rumor, buy the news'; second, there is the belief that this will not have a long-term impact on prices; and lastly, there is some concern that this could lead to a showdown with OPEC+, who warned there would be a response if this action was taken," he says.

Also Tuesday, IHS Market's flash purchasing managers' index for November showed slowing but still strong private-sector growth in November, with its reading declining to 56.5 from 57.6 in October. (Any reading above 50 indicates expansion.)

Rising Treasury rates – the 10-year T-note's yield climbed to just under 1.67% – helped keep financials such as Bank of America (BAC, +2.6%) and JPMorgan Chase (JPM, +2.4%) aloft. But they weighed on tech names such as Advanced Micro Devices (AMD, -1.7%) and Adobe (ADBE, -1.3%).

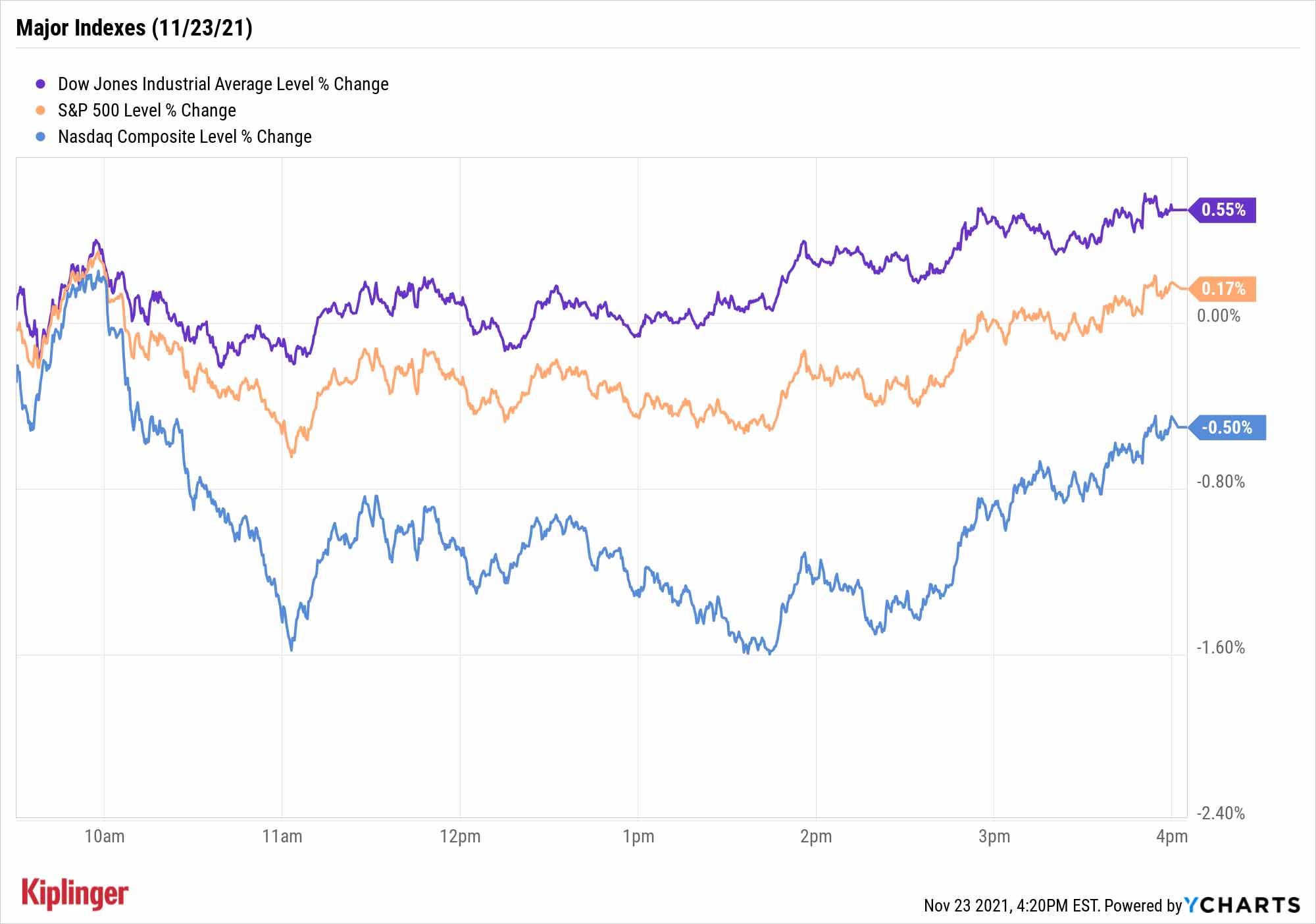

The end result was a 0.6% gain to 35,813 for the Dow Jones Industrial Average, and a more modest 0.2% improvement to 4,690 for the S&P 500. Tech weakness, and a 4.1% shot to Tesla (TSLA), pulled the Nasdaq Composite 0.5% lower to 15,775.

Other news in the stock market today:

- The small-cap Russell 2000 declined 0.2% to 2,327.

- Gold futures notched a fourth straight loss, falling 1.2% to settle at $1,783.80 an ounce.

- Bitcoin finally gained some footing, rebounding 3.7% to $57,886.03. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Zoom Video Communications (ZM) slumped after the video conferencing company reported earnings after Monday's close. In its third quarter, ZM recorded adjusted earnings of $1.11 per share on $1.05 billion in revenue, both figures higher than analysts were expecting. However, "Revenue from customers with under 10 employees was down sequentially in the third quarter and should be again in the fourth quarter," says UBS analyst Karl Keirstead. He also pointed to concerns over deferred revenue for the fourth quarter, after Kelly Steckelberg, Zoom's chief financial officer, said in the earnings call that growth in this segment should fall to the mid-20s in Q4 after being up by 39% in Q3. While the analyst maintained his Neutral (Hold) rating on ZM, he joined several other firms in lowering his price target – specifically, to $250 from $285. ZM closed today down 14.7% to $206.64.

- Best Buy (BBY) was another post-earnings loser, sinking 12.3% in the wake of its results. The big-box retailer reported higher than anticipated adjusted earnings of $2.08 per share and revenue of $11.91 billion in its third quarter and lifted its full-year revenue forecast, now expecting sales to arrive between $51.8 billion and $52.3 billion compared to its previous forecast for $51 billion and $52 billion. As for today's selloff? "BBY's comparable sales year-over-year were disappointing, up only 2.0%, as online sales were 10.2% lower," says CFRA Research analyst Kenneth Leon. "There was also a sales drag from Best Buy's largest product category, computing and mobile phones." Leon also pointed to declining gross margins in the quarter as he downgraded the stock to Hold from Buy.

The Best Mutual Funds in 401(k) Plans

Make today the day you firmly grip the reins of your 401(k).

While simply routing money from your regular paycheck into your retirement portfolio is half the battle, a critical next step is ensuring you're invested in the best mutual funds that your workplace plan provides.

That's precisely why, every year around this time, we take a deep dive into the nation's most popular mutual funds in 401(k) plans.

Over the past few weeks, we've delved into a range of options served up by some of Wall Street's top fund providers: Vanguard, Fidelity, T. Rowe Price and American Funds. And today, we present the capstone of our 401(k) series – the crème de la crème of the 100 most popular retirement-plan offerings, regardless of fund family.

Whatever your goal, and however you're trying to get there, this list of 30 Buy-rated actively managed mutual funds examines the tools most likely to be at your disposal.

Kyle Woodley was long AMD and TSLA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.