Stock Market Today: Tech Stocks Lead in Broad-Market Bounce

Tesla and Microsoft were two notable gainers, while semiconductor stocks also made a big move higher.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Cooler heads prevailed to start the new trading week, with stocks rebounding from Friday's Omicron-related selloff.

While a fuller picture on the latest COVID-19 variant will likely take weeks to emerge, President Joe Biden said this afternoon that Omicron is "not a cause for panic." Additionally, despite several countries putting travel restrictions in place, the market is likely taking solace in a lack of widespread lockdowns, says Michael Reinking, senior market strategist for the New York Stock Exchange.

"In fact, equities extended gains this afternoon following comments from President Biden that lockdowns were not on the table at this point," he adds.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

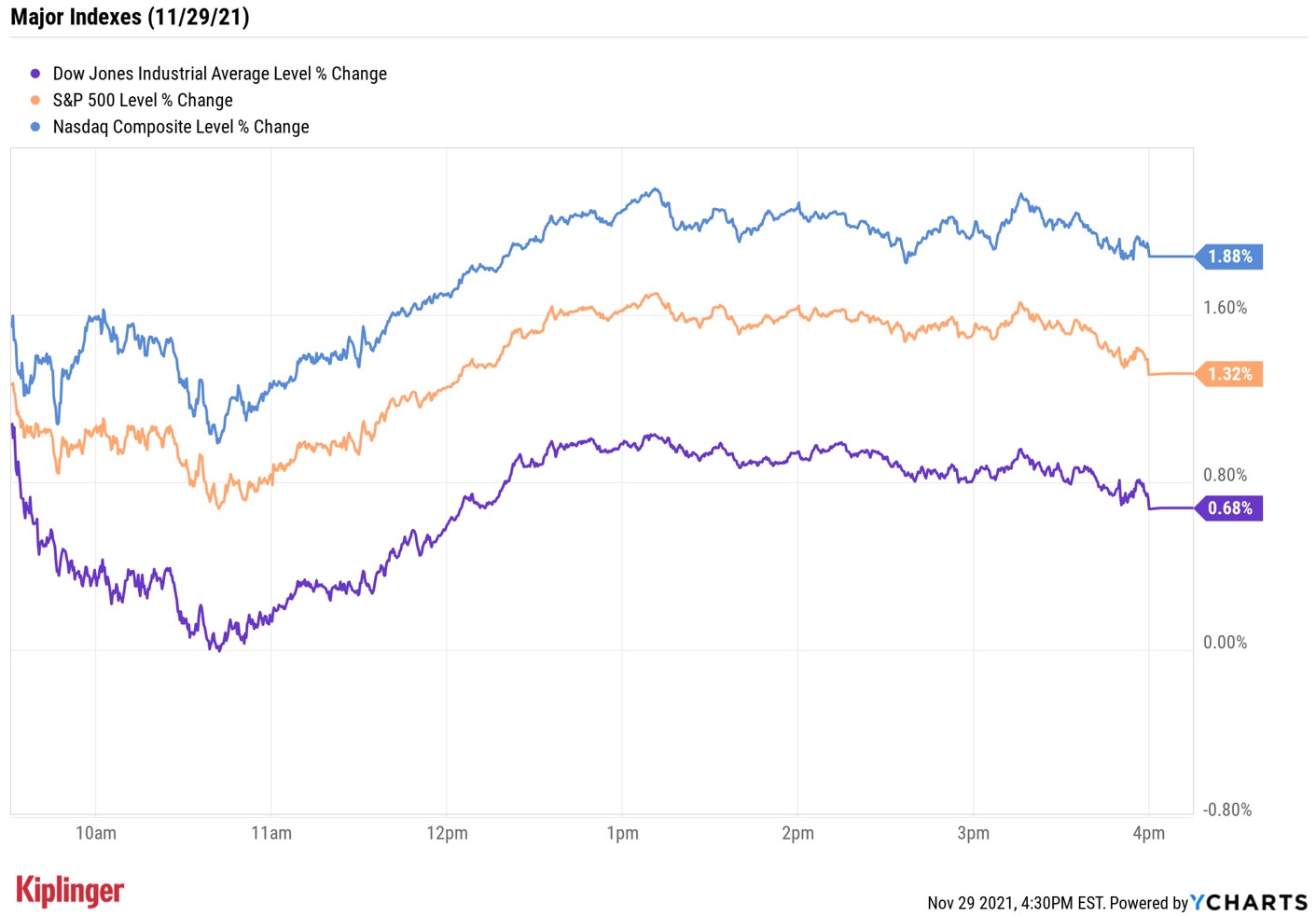

Indeed, after a slow start, the Dow Jones Industrial Average closed up 0.7% at 35,135 and the S&P 500 Index added 1.3% to 4,655.

However, it was the Nasdaq Composite that turned in the best performance of the day, gaining 1.9% to 15,782 amid strength in mega-cap tech stocks Tesla (TSLA, +5.1%) and Microsoft (MSFT, +2.1%), as well as a big rally in semiconductors (+3.5%).

Other news in the stock market today:

- The small-cap Russell 2000 slipped 0.2% to 2,241.

- Gold futures slipped 0.2% to settle at $1,785.20 an ounce.

- Bitcoin jumped 7.1% to $58,125.20. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Twitter (TWTR) shares initially spiked after the company announced founder and CEO Jack Dorsey would be stepping down from his post. He will be replaced at the helm immediately by Chief Technology Officer Parag Agrawal, who has been with the company for more than a decade. "Dorsey's trust in Agrawal is one of the reasons Dorsey felt comfortable making this transition now," says Scott Kessler, vice president and global lead at investment research firm Third Bridge. Agrawal has been with Twitter for more than a decade and has been involved in the key decisions that led to the company's turn-around. Salesforce.com (CRM) President and Chief Operating Officer Bret Taylor will become Twitter's chairman of the board, and Dorsey will remain on the board until the 2022 shareholder meeting. However, TWTR ended the day down 2.8%.

- Merck (MRK, -5.4%) slumped Monday on the back of disappointing news announced late last week that its antiviral drug, molnupiravir, only reduced risk of hospitalization and death among high-risk COVID-19 patients by 30%; it had previously estimated 50%. An FDA advisory panel will meet tomorrow to determine whether it will recommend authorizing the drug. Also Monday, Citi analysts downgraded MRK shares to Neutral from Buy, in part because they believe regulatory concerns could prompt Merck to give up on the clinical advancement of HIV drug islatravir. "We expect the diminishing outlook for islatravir to further expedite Merck's business development efforts," Citi says.

Keep an Eye on Oil

U.S. crude futures closed up 2.6% today to settle at $69.95 per barrel, but remain more than 17% below their late-October highs near the $85 per-barrel mark.

Part of this is due to Friday's drubbing, when futures plummeted more than 13% on fears the Omicron variant would impact global demand.

But Austin Pickle, investment strategy analyst at Wells Fargo Investment Institute, also points to "market anticipation" ahead of last week's announcement from several countries, including the U.S. and China, to tap strategic oil reserves in a coordinated effort to ease price pressures as a catalyst for the recent selloff.

And this week's meeting between the Organization of the Petroleum Exporting Countries and its allies – where the group could reconsider its current 400,000-barrels-per-day production boost – "will have obvious near-term oil price and geopolitical implications," says Pickle. Still, the analyst sees "higher prices by year-end 2022."

Not only would a continued rise in oil prices spell good news for master limited partnerships (MLPs) – which offer the added benefit of higher yields – but also traditional energy stocks. Here's a list of 10 energy stocks that are among the top-rated on Wall Street and could be worth watching should oil prices extend today's surge.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.