Stock Market Today: Dow Leads Broad-Market Rally as Boeing Soars

Boeing was the best blue chip today after Chinese regulators cleared the 737 Max for flight.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors returned to a buying mood following two days of sharp selling, fueling a broad rally that saw every sector close in the green.

Wall Street's mood brightened Thursday after Soumya Swaminathan, chief scientist at the World Health Organization (WHO), said Wednesday that vaccines would likely provide some protection against the omicron variant of COVID-19.

Also in focus was this morning's weekly jobless claims report, which showed initial applications for unemployment rose to 222,000 Thanksgiving week – climbing off the 52-week low of 194,000 hit in the week prior, but below the 240,000 claims expected by economists.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

And notably, the number of people already collecting jobless benefits fell below 2 million for the first time since the week ended March 14, 2020.

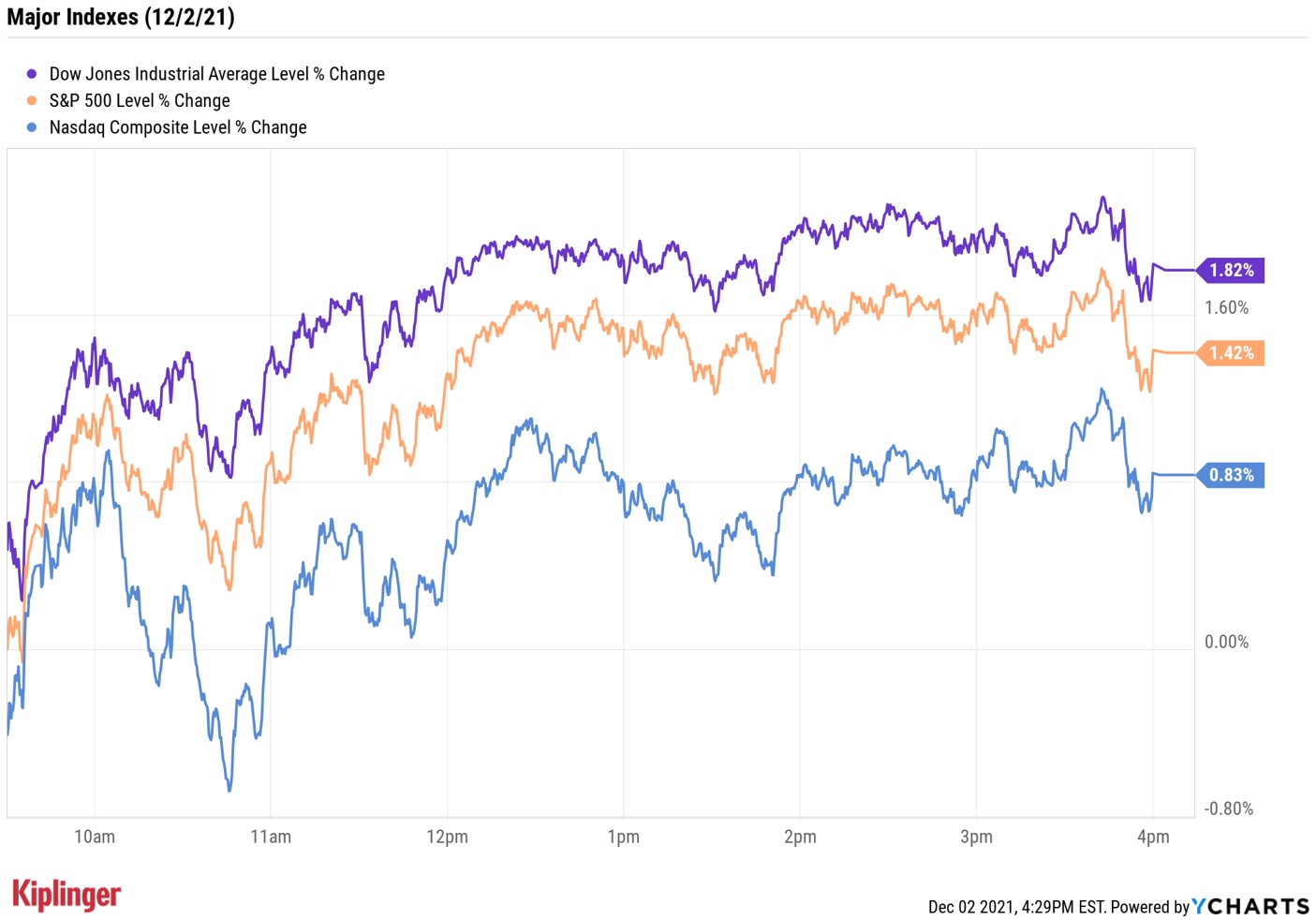

Financials (+3.0%) and industrials (+3.0%) were two of the biggest gainers. The Dow Jones Industrial Average led the other major indexes, surging 1.8% to 34,639 amid strength from Boeing (BA, +7.5%). The aerospace giant jumped on news that Chinese regulators have given approval for Boeing's 737 Max to resume flights – the last major market to do so.

The S&P 500 Index (+1.4% to 4,577) and the Nasdaq Composite (+0.8% to 15,381) finished notably higher as well.

Other news in the stock market today:

- The small-cap Russell 2000 surged 2.7% to 2,206.

- U.S. crude futures rose 1.4% to settle at $66.50 per barrel.

- Gold futures retreated 1.2% to end at $1,762.70 an ounce.

- Bitcoin rose 0.6% to $57,022.10. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Kroger (KR, +11.0%) was a big winner post-earnings – good news for the Berkshire Hathaway portfolio. The grocery chain reported higher-than-expected adjusted earnings of 78 cents per share in its third quarter, while revenue of $31.9 billion also surpassed analysts' consensus estimate. KR also upped its full-year earnings per share forecast to a range of $3.40 to $3.50 versus its prior guidance for earnings of $3.25-$3.35 per share. Still, CFRA Research analyst Arun Sundaram kept a Sell rating on Kroger. "KR has performed better than we anticipated since our downgrade earlier this year, partly due to robust eating-at-home trends and rising food prices, but also admittedly from strong execution amid a volatile operating environment," he wrote in a note. "That said, we continue to question the sustainability of recent results, particularly if the top line loses momentum due to inflation receding or volumes declining. Other headwinds include higher shrink/wastage, price investments, wage pressures, higher warehousing/transportation expenses and rising competition

- Snowflake (SNOW) – another Warren Buffett stock – also got a lift after earnings, spiking 15.9%. In its third quarter, the cloud-based data platform recorded adjusted earnings of 4 cents per share on revenues of $334.4 million, both more than analysts were expecting. A major contributor to total revenues was the company's product revenues, which jumped 110.4% year-over-year to $312.5 million. "We see a long trajectory of rapid revenue increases for the next few years fueled by an IT shift to a cloud-centric model, digital transformation, and higher spend on machine learning (ML) and data science," says Oppenheimer analyst Ittai Kidron, who has an Outperform (Buy) rating on the stock.

"Get Ready for Accelerated Disruption"

So says RBC Capital Markets' directors of research in their latest research report "Preparing for Hyperdrive," which explores investing trends.

Among the five themes they see playing out?

There's "The Quest for Immortality," in which numerous factors, from biopharmaceutical innovations to space exploration, extend human life expectancy.

There's also "Artificial Intelligence Activated," in which artificial intelligence becomes an increasingly critical part of most businesses – which brings with it opportunities, but also risks.

One business that seems to have a role across multiple themes is the cybersecurity industry, which will become increasingly critical to governments and corporate entities alike as the world's digital transformation continues.

But many who want to participate balk at the high nominal stock prices in the industry – not a hurdle for all, but certainly for beginner investors and others with little capital to work with. Here, we've analyzed an accessible trio of cybersecurity stocks – each of which have glowing prospects, and each of which trade for less than a hundred bucks per share.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax Season

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax SeasonTax Law A new Trump lawsuit and warnings from a tax-industry watchdog point to an IRS under strain, just as millions of taxpayers begin filing their 2025 returns.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market Today

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market TodayThe major stock market indexes do not yet reflect the bullish tendencies of sector rotation and broadening participation.

-

Small Caps Hit a New High on Rate-Cut Hope: Stock Market Today

Small Caps Hit a New High on Rate-Cut Hope: Stock Market TodayOdds for a December rate cut remain high after the latest batch of jobs data, which helped the Russell 2000 outperform today.

-

Stocks Bounce Back With Tech-Led Gains: Stock Market Today

Stocks Bounce Back With Tech-Led Gains: Stock Market TodayEarnings and guidance from tech stocks and an old-school industrial lifted all three main U.S. equity indexes back into positive territory.