Stock Market Today: Stocks Turn Tail Amid November Jobs Miss, Omicron

Wall Street capped off an omicron-inspired zigzag week of trading with a dip after November's headline jobs figure came up short.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

At least momentarily, a mixed November jobs report seemed likelier to lift the market than weigh it down, but that promise quickly vanished Friday as the major indexes slid into the red.

Ahead of the open, the Bureau of Labor Statistics reported that just 210,000 nonfarm jobs were created last month, well shy of estimates for 573,000. Despite that lousy headline showing, some experts pointed to substantive strength elsewhere in the report.

"The unemployment rate dropped to 4.2% – the lowest since February 2020 – and is getting very close to pre-pandemic levels," says Robert Conzo, CEO of registered investment advisory The Wealth Alliance. "In addition, the participation rate (the share of people working or looking for work) rose, which is a good sign for the economy."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Rick Rieder, BlackRock's chief investment officer of global fixed income, points out a couple other encouraging stats. For one, hourly wages jumped 4.80% year-over-year and 0.26% month-over-month, "providing a strong incentive for workers to return to the labor force." And the six-month average for non-seasonally adjusted private payroll gains is an impressive 700,000-plus jobs.

"We currently sit at 97.7% of the pre-COVID (February 2020) level of private employment," he adds. "In many respects, the job market right now is very strong."

Among the labor market's weak spots were leisure, hospitality and retail, which Anu Gaggar, global investment strategist for Commonwealth Financial Network, chalked up to online holiday shopping and, in some states, the winter virus surge.

"As the omicron variant starts to spread, labor force growth in these sectors could remain under pressure," he says.

Ultimately, however, the November jobs report's positives weren't enough to outweigh the negatives for investors, who also saw the COVID-19 omicron variant spreading domestically, with five states recording cases as of Thursday night.

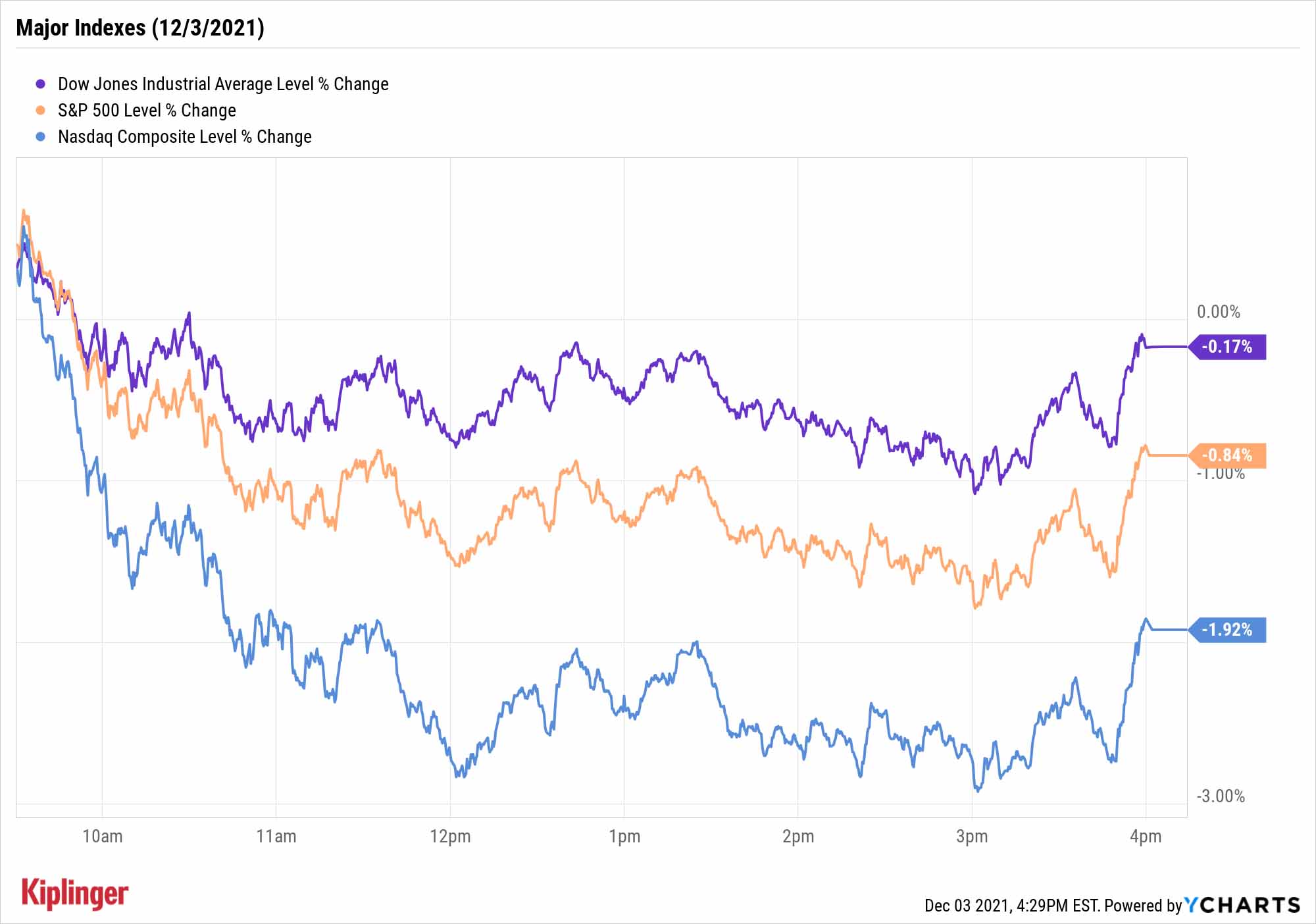

The Dow Jones Industrial Average gained as much as 161 points early on before swinging to a 375-point decline at its nadir; a late-afternoon rally limited its losses to 59 points, or -0.2% to 34,580. The S&P 500 (-0.8% to 4,538) and Nasdaq Composite (-1.9% to 15,085) also flipped from green to red and sustained deeper losses.

Other news in the stock market today:

- The small-cap Russell 2000 sank 2.1% to 2,161.

- U.S. crude futures ended the day down 0.4% at $66.26 per barrel. For the week, oil prices were down 2.8%, marking their sixth straight weekly decline – the longest such streak since November 2018.

Gold futures gained 1.2% to settle at $1,783.90 per ounce. Week-over-week, gold ended marginally lower. - Bitcoin wasn't immune to Friday's weakness, slumping 6.2% to $53,494.33. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- It was a cringe-worthy session for DocuSign (DOCU), which plunged 42.2% after earnings – its biggest single-day drop ever. While the electronic signature company reported adjusted earnings of 58 cents per share on $545.5 million in revenue – more than the 46 cents per share and $531 million analysts were expecting – it forecast fourth-quarter revenue below the consensus estimate and year-over-year growth of 30%, slower than the 40% sales growth it has seen in each of the last six quarters. "While we had expected an eventual step down from the peak levels of growth achieved during the height of the pandemic, the environment shifted more quickly than we anticipated," said CEO Dan Springer in the earnings call. In response, Needham analyst Scott Berg downgraded DOCU to Hold from Buy, expecting it to take time for the company to adjust to sales changes.

- Chinese stocks took it on the chin today. As explained in today's free A Step Ahead e-newsletter, Beijing-based ride-hailing firm Didi Chuxing (DIDI, -22.2%) said it is taking immediate steps to delist from the New York Stock Exchange (NYSE). This sparked uncertainty over other Chinese stocks that remain listed in the U.S., including e-commerce giant Alibaba Group (BABA), which saw its shares slide 8.2%. JD.com (JD, -7.7%), Baidu (BIDU, -7.8%) and Pinduoduo (PDD, -8.2%) were among some of the other notable decliners.

- Toll Brothers (TOL), GameStop (GME) and Costco (COST) headline a light earnings calendar next week.

Virus Uncertainty Looms Over the Market

Not sure what to think about the omicron variant's effects on markets after a week of stocks teeter-tottering? You're not alone – the pros haven't quite made up their minds either.

"We are still awaiting more complete evidence before significantly adjusting any forecasts," says BMO Capital Markets, for instance.

A Jefferies banking outlook casts the threat as a question, too: "Should the omicron variant be a threat to the economic recovery and markets …"

Until more is known about its transmissibility, lethality and ability (or inability) to sidestep vaccines, it's a question mark – which means investors should be at least eyeballing defensive measures.

Bond funds are one classic protective go-to, and despite low rates in the face of high inflation, could see continued interest if our COVID situation worsens. Other hideouts include Friday's two best sectors: utility stocks (+1.0%) and consumer staples (+1.2%).

The U.S. consumer is in sharp focus as we prepare to enter the new year – supply-chain woes and rampant inflation are taking a toll, which could weigh on their discretionary spending. But it's far more difficult for people to forgo everyday basics, providing a level of stability that makes consumer staples companies a prime choice for investment-safety seekers. Read on as we highlight our top 12 consumer staples stocks for 2022:

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

Dow Dives 878 Points on Trump's China Warning: Stock Market Today

Dow Dives 878 Points on Trump's China Warning: Stock Market TodayThe main indexes erased early gains after President Trump said China is becoming "hostile" and threatened to cancel a meeting with President Xi.