Stock Market Today: Optimism on Omicron Gives Stocks a Kick

"Encouraging" preliminary data on the omicron strain's severity sparked every market sector to gains on Monday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

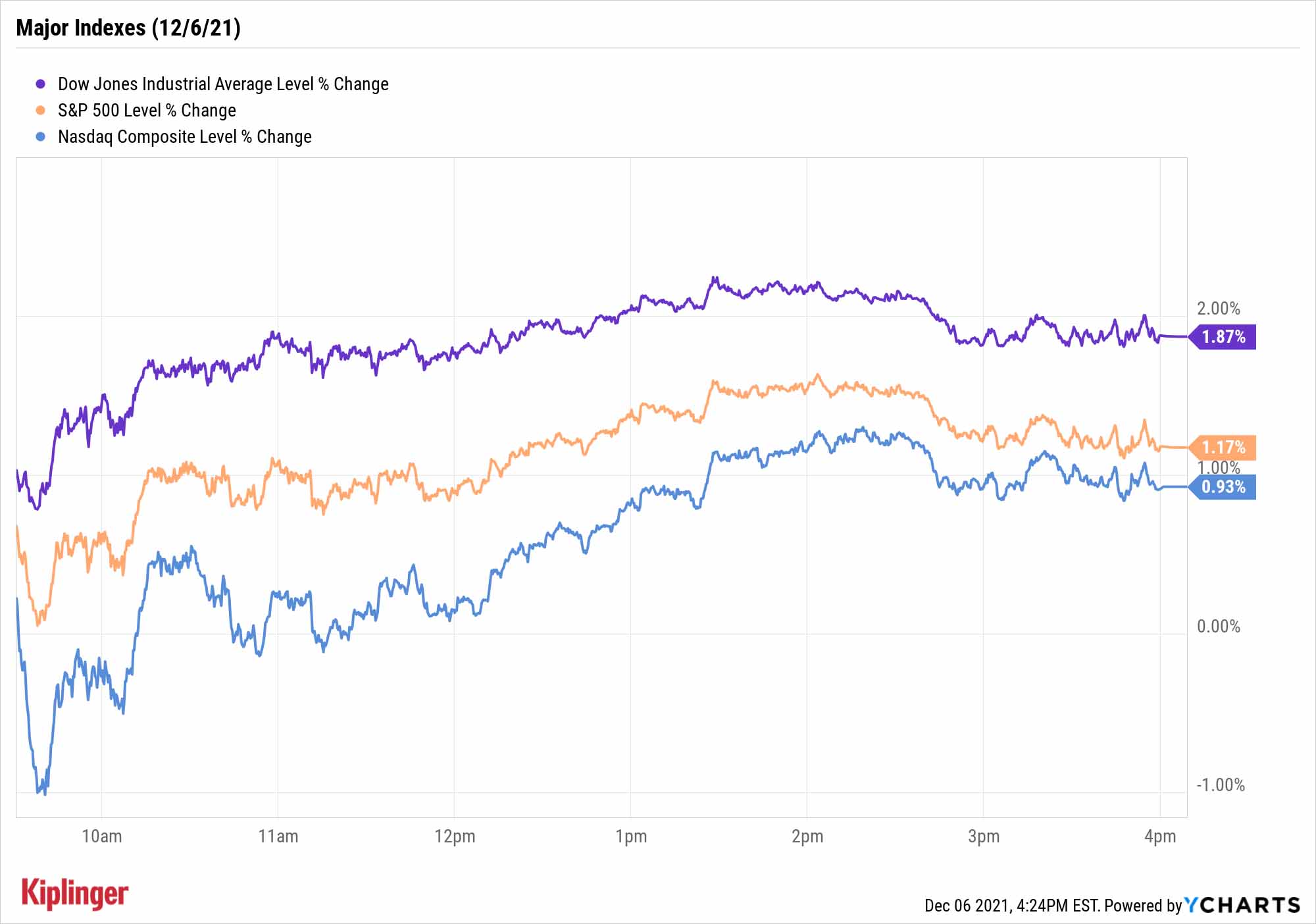

The Dow Jones Industrial Average and the other major indexes enjoyed a caffeinated start to the trading week as some encouraging commentary about the COVID omicron strain went a long way toward re-energizing the bulls.

White House Chief Medical Advisor Anthony Fauci told CNN on Sunday that while preliminary data shows that omicron "has a transmission advantage" in South Africa, "thus far it does not look like there's a great degree of severity to it."

While Fauci added that it's too early to make any definitive statements, Wall Street clearly heard what it wanted, as a widespread rally ensued today.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Unsurprisingly, economically sensitive sectors such as industrials (+1.7%), energy (+1.5%) and financials (+1.5%) benefited the most. Travel-related plays enjoyed a boost as well – Norwegian Cruise Line Holdings (NCLH, +9.5%), United Airlines (UAL, +8.3%), Las Vegas Sands (LVS, +7.2%) and Expedia (EXPE, +6.7%) were among Monday's most noteworthy gainers.

The industrial average led the way with a 1.9% gain to 35,227, while the S&P 500 improved by 1.2% to 4,591. Technology (+0.9%), while up, still lagged most other sectors, limiting the Nasdaq Composite's advance (+0.9% to 15,225).

Other news in the stock market today:

- The small-cap Russell 2000 popped 2.1% to 2,203.

- Easing omicron fears sent U.S. crude futures spiking 4.9% to settle at $69.49 per barrel.

- Gold futures slipped 0.3% to end at $1,779.50 an ounce.

- Bitcoin prices were 8.6% lower from Friday afternoon's prices, though most would consider that a relief, as the digital coin bottomed out around $43,000 over the weekend. "There wasn't a clear catalyst that triggered the selloff with most pointing to deleveraging of risk assets," says Michael Reinking, senior market strategist for the New York Stock Exchange. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Jack in the Box (JACK) sat out today's broad-market move higher, sinking 4.1% after the fast-food chain said it is buying sector peer Del Taco Restaurants (TACO) for $575 million, including debt, or $12.51 per TACO share. TACO jumped 66.1% on the day.

- Buzzfeed (BZFD) is the latest stock to debut on Wall Street. The media company went public via a merger with special purpose acquisition company (SPAC) 890 5th Avenue Partners. BZFD stock opened for trading at a per-share price of $10.95 and reached a session high of $14.77 before turning tail and settling at $8.56 – an 11.0% decline.

- Walgreens Boots Alliance (WBA, +3.8%) was the best Dow stock today after Bloomberg reported late Friday that the pharmacy retail chain is exploring the potential sale of spinoff of Boots, it's U.K.-based drugstore. UBS Global Research analyst Kevin Caliendo says the reports don't come as a total surprise, "given the strategic shift toward healthcare management [WBA] highlighted at its analyst day and the emphasis management placed on the value it thought it had in its various and disparate assets (Boots, China, ABC, etc.)." If the company chooses to divest Boots, Caliendo expects Walgreens to "redeploy any proceeds to offset dilution or perhaps to help fund its Health M&A or Health Organic segments growth." He currently has a Neutral rating on the Dow stock.

Embrace the Volatility?

Up days like today aren't just nice because of the gains – they also help investors take a moment to collect themselves.

The markets have been a volatile mess ever since after Thanksgiving, when news of the omicron strain snatched headlines. We might not be done with the roller coaster, either, but Ryan Detrick, LPL Financial chief market strategist, has some words of encouragement:

"After more than a 110% rally from the March 2020 lows, perhaps investors needed a reminder that stocks can't go up forever and that while volatility might be frustrating, it is perfectly normal," he says. Ultimately, however, "We aren't minimizing the omicron uncertainty, but we remain bullish that the recovery is alive and well, with a very healthy consumer and corporate earnings backdrop leading the way.

"In the end, we expect any lost output due to omicron to simply be pushed out and recovered by early next year."

What should you do until then?

We provide a broad overview in our markets lookahead to 2022, though investors can find a multitude of sector-specific and other tactical picks in our investing outlook.

However, if your comfort zone is the market's biggest, most financially stable companies – regardless of what headlines are whizzing past – look no further than this list of the hedge fund community's favorite blue-chip stocks. The "smart money" has recently filed to reveal their latest comings and goings, and these 25 stocks represent their collective highest-conviction ideas.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.