Stock Market Today: Tech Takes the Reins as Stocks Soar Again

The technology sector was the day's biggest gainer on strength in semiconductor stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

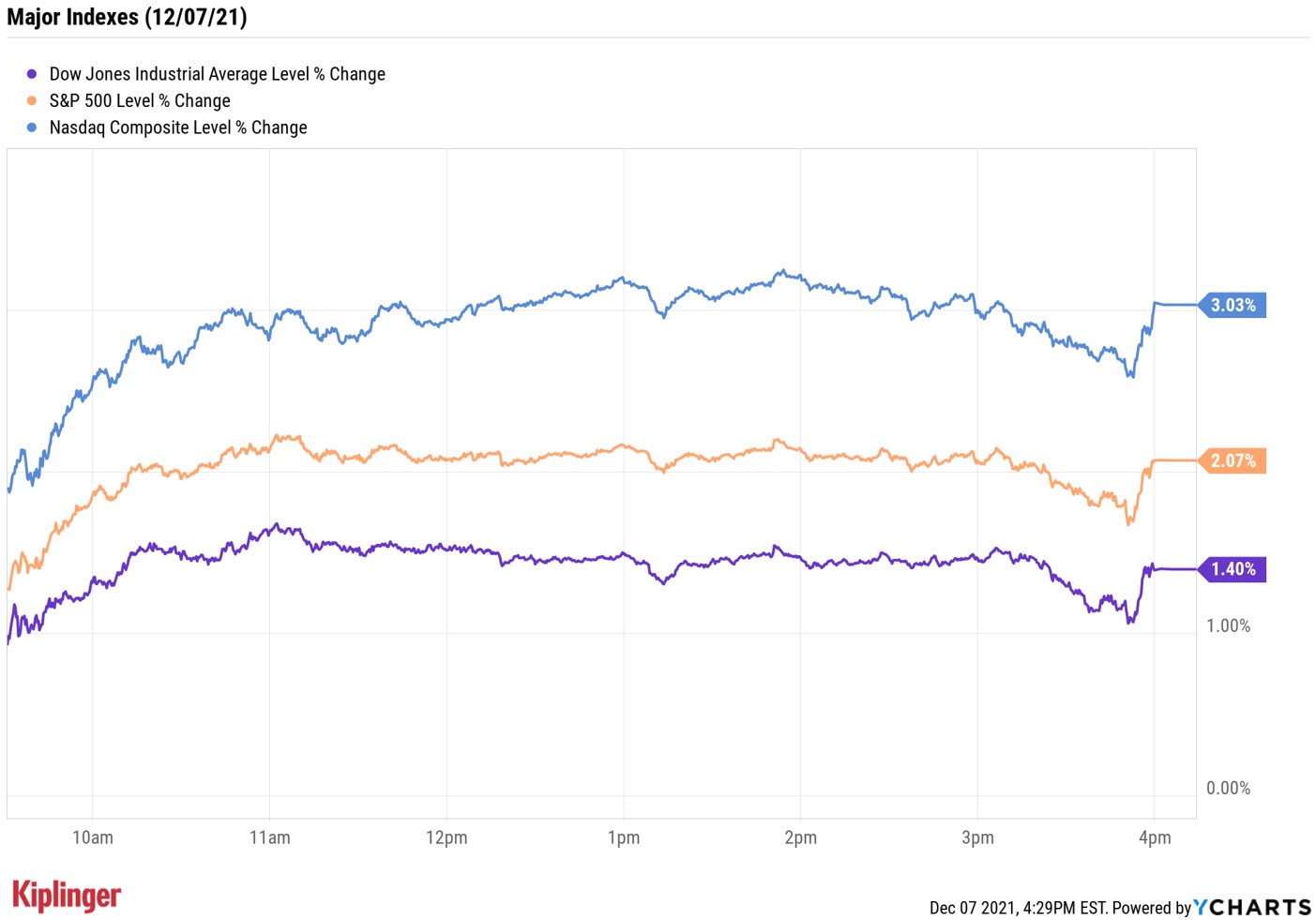

Stocks saw a second straight day of sharp gains as Wall Street continued to bet that the omicron variant of COVID-19 will be less disruptive than investors initially feared.

While today's rally was broad-based, growth-oriented sectors like energy (+2.3%) and consumer discretionary (+2.3%) saw some of the biggest gains.

However, tech (+3.5%) led the way, with semiconductor stocks Nvidia (NVDA, +8.0%) and Applied Materials (AMAT, +6.5%) among two of the day's biggest advancers. CFRA Research analyst Sam Stovall thinks tech's surge has legs, and lifted his outlook on the sector to Overweight (Buy).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In addition to the omicron-induced selloff having "likely run its course," Stovall says the recent "pullback in prices" has made "the group more attractive relative to other sectors."

Investors certainly showed a willingness to buy the dip today. At the close, the Nasdaq Composite was up 3.0% at 15,686, the S&P 500 Index was 2.1% higher at 4,686 and the Dow Jones Industrial Average had gained 1.4% to end at 35,719.

Other news in the stock market today:

- The small-cap Russell 2000 soared 2.3% to 2,253.

- U.S. crude oil futures jumped 3.7% to $72.05 per barrel.

- Gold futures also headed higher, up 0.3% to $1,784.70 an ounce.

- Bitcoin prices rose 3.2% to $50,473.87. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- One of the few flashes of red today was generated by Comcast (CMCSA, -5.3%), which took a dive after the company produced disappointing broadband subscription figures. On Tuesday, Dave Watson, president and CEO of Comcast Cable, said at the UBS Global TMT Virtual Conference that Comcast should add 1.3 million broadband internet customers in 2021, below expectations for 1.4 million. Competitor Charter Communications (CHTR, -3.3%) also dipped on the news.

- AutoZone (AZO, +7.6%) wasn't just caught up in a rising tide – it also delivered a healthy earnings beat. The auto-parts retailer reported first-quarter revenues of $3.67 billion and earnings of $25.69 per share, topping estimates of $3.37 billion and $20.98 per share, respectively. Same-store sales jumped by almost 14%. Despite the good news, CFRA analyst Garrett Nelson maintained his Hold position, but upped his price target to $2,000 per share from $1,925 previously. "The record-high U.S. vehicle age remains a powerful driver of AZO's strong results," he says. "But in our view, AZO will eventually need to provide more information about its long-term plans strategy on the rise of EVs, which require half the maintenance costs of internal combustion engine vehicles and should impact retail aftermarket demand. We maintain Hold on valuation."

Where to Invest in 2022

What a year it has been. "The U.S. economy bounced back from its worst year since the Great Depression in 2020 with one of the best years of growth in nearly 40 years," says Ryan Detrick, chief market strategist at LPL Financial.

What's more, Detrick and a team of strategists at LPL expect "solid economic and earnings growth in 2022 to help U.S. stocks deliver additional gains next year," with consumers, productivity, small businesses and capital investments all having a role in the "next stage of economic growth."

In terms of equities, they favor domestic over international stocks, value over growth, and cyclical over defensive.

As for Kiplinger's own forecast, it's for "more-normalized stock market returns," likely in the "high single digits between one and two points in dividends," with a preference for stocks over bonds.

If you want to know more about our thoughts on the year ahead, check out our coverage of where to invest in 2022. Investors will have to pick carefully, but there are certainly plenty of opportunities to be found.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.