Stock Market Today: Stocks Struggle as Rally Loses Steam

Weekly jobless claims hit a 52-year low, but omicron worries weighed on investor sentiment.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Markets opened lower following three straight days of gains.

Today's focus was the latest update on weekly jobless claims, which showed the number of initial applicants for unemployment benefits fell to 184,000 last week. Not only was this well below the 227,000 recorded the week prior, but it was the lowest amount since September 1969, according to the Labor Department.

Investors also kept a cautious eye trained on omicron-related headlines.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

While several pharmaceutical firms this week – including Pfizer (PFE, +1.3%) and BioNTech (BNTX, -2.7%) – have said their vaccines help neutralize the newest COVID-19 strain, the U.K. on Wednesday imposed a mask mandate for certain indoor settings and a work-from-home order after data showed "rapid increases" in case counts, said British Prime Minister Boris Johnson.

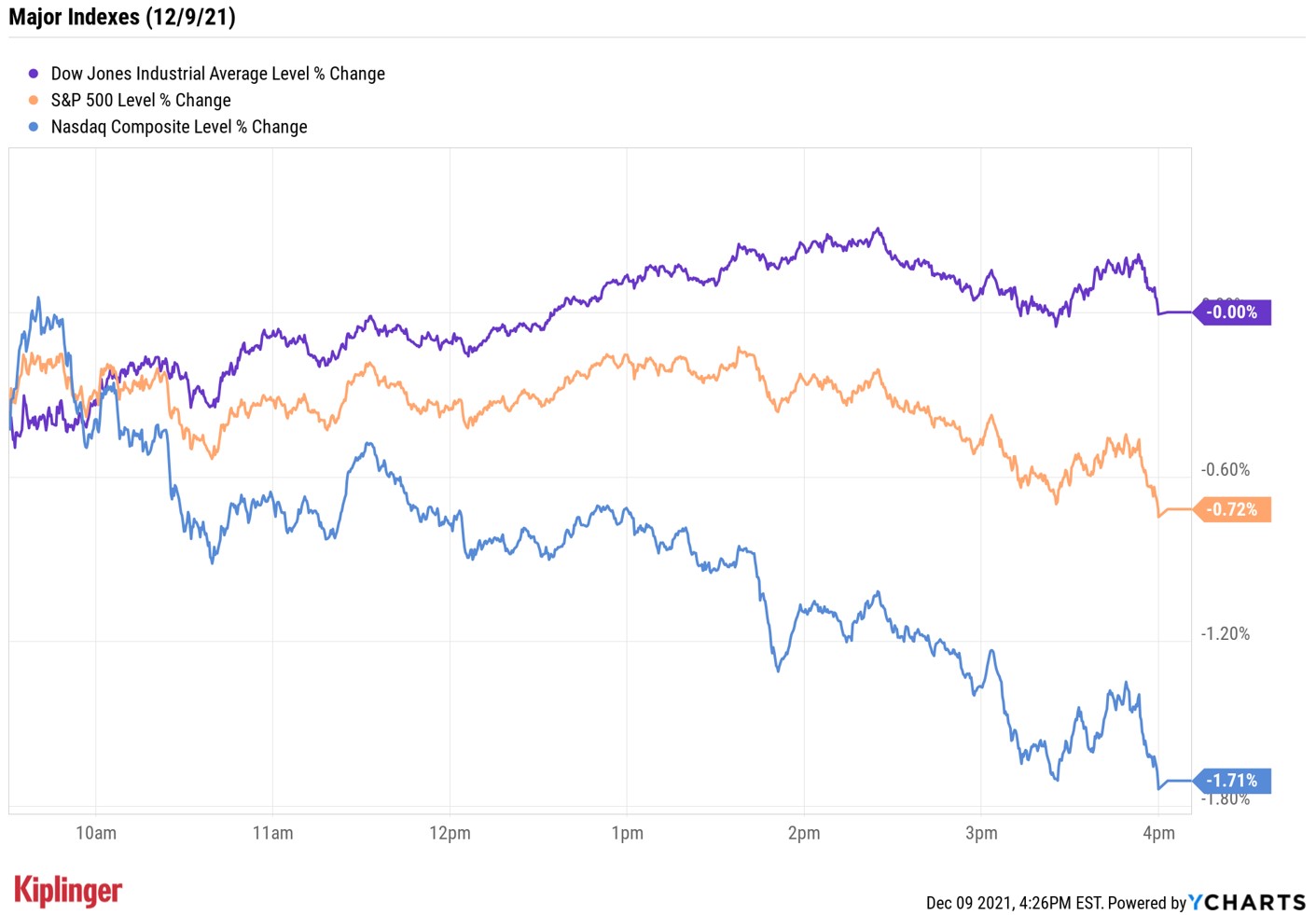

Tech stocks were the biggest losers today, with sharp losses for Tesla (TSLA, -6.1%) and Advanced Micro Devices (AMD, -4.9%) sending the Nasdaq Composite down 1.7% to 15,517.

The S&P 500 Index was also in the red at the close, off 0.7% to 4,667. The Dow Jones Industrial Average, meanwhile, spent most of the afternoon modestly higher on strength in Walgreens Boots Alliance (WBA, +1.4%), but succumbed to a marginal loss in the final minutes of trading, ending at 35,754.

Other news in the stock market today:

- The small-cap Russell 2000 slumped 2.3% to end at 2,220.

- U.S. crude oil futures ended their three-day win streak amid pessimism over re-emerging COVID travel curbs, dropping 2.0% to settle at $70.94 per barrel.

- Gold futures also declined, by 0.5% to $1,776.70 per ounce.

- Bitcoin retreated 6% to $47,685.18. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- CVS Health (CVS, +4.5%) jumped after delivering a multitude of good news at its investor-day event. The pharmaceutical chain expects to earn an adjusted $8.00 per share on $290.3 billion this year, higher than its previous guidance of $7.90 to $8.00 per share in adjusted profits and $286.5 billion to $290.3 billion in revenues. It also expects to grow adjusted earnings per share to between $8.10 to $8.30 per share in fiscal 2022, on sales of between $304 billion to $309 billion. CVS Health also announced a 10% hike in its quarterly dividend, to 55 cents per share from 50 cents previously, and said it would resume stock buybacks next year via a $10 billion share repurchase program.

- Warren Buffett holding RH (RH, +5.5%), which many know as Restoration Hardware, jumped Thursday on the back of a beat-and-raise quarterly report. Third-quarter revenues of $1.01 billion were up 19.7% year-over-year and beat expectations for $981.9 million, while adjusted earnings of $7.03 per share grew 13.4% and topped estimates for $6.61. "Notably, the company indicated that it had not seen a material slowdown in demand and deferred revenue, with customer deposits and other current liabilities sequentially increasing 6%, supporting that view," says Wedbush analyst Seth Basham, who reiterated his Outperform rating (equivalent of Buy) and upped his 12-month price target to $650 per share from $600. "Moreover, the fact that RH does not expect to fully unwind its backlog to normal levels in 2022 suggests the company expects continued strong (if not growing) demand."

Forecasts Call for a Fruitful 2022

Today's jobs data underscores a continuing theme of economic recovery, and consensus estimates are for the rebound to accelerate through 2022.

"A combination of record stimulus, a healthy consumer, an accommodative Federal Reserve (Fed), vaccinations and reopening of businesses all contributed to a big year in 2021," LPL Research says. "As the U.S. economy moves more to mid-cycle our 2022 forecast is for 4.0%-4.5% GDP growth in 2022."

While the firm admits this is a slowdown from 2021's 5.5% growth forecast, it's still a "very solid number."

Not surprisingly, many strategists making their top stock picks for 2022 are doing so with names from cyclical sectors like consumer discretionary and technology.

An accelerated economic recovery is certainly something we at Kiplinger kept in mind as we compiled our list of the best stocks for 2022. Several of these picks are set to outperform as the economy continues to rebound.

However, given how unpredictable the market is – as evidenced by the pandemic-related disruptions we've seen over the last two years – others are more defensive in nature, able to withstand volatility through stable long-term growth and attractive dividend yields.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.