Stock Market Today: Dow Loses 532 Points as Goldman, Home Depot Slide

Fed Governor Christopher Waller said March's scheduled central bank gathering could be a "live meeting."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

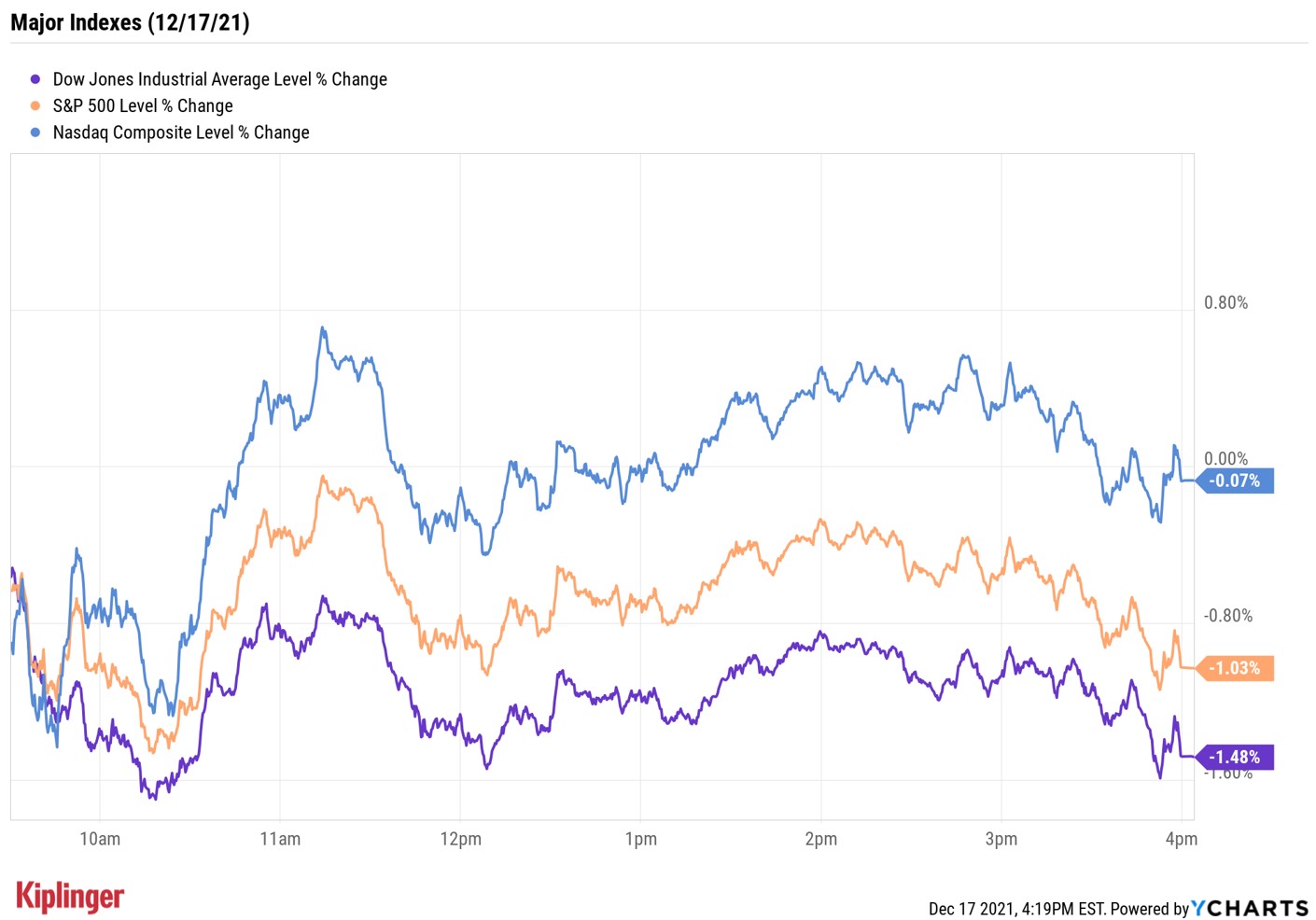

The major indexes put some distance between one another Friday in a volatile finish to a wild week.

Two days after hearing the Federal Reserve's latest decisions on fiscal policy, Fed Governor Christopher Waller told the Forecasters Club of New York that by ending its bond-buying program sooner rather than later, the central bank is "providing flexibility for other adjustments to monetary policy, if needed, as early as spring." He also called March's scheduled Fed gathering a "live meeting," meaning it is one in which a rate-hike could be issued.

Also stoking volatility was "quadruple-witching expiration," which is when index futures, index options, stock options and individual-stock futures all expire at once. This happens four times a year – on the third Friday in March, June, September and December – and sometimes leads to heavy volume and erratic moves in parts or all of the market.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"For some time, markets have ignored increasing signals that should have been causes for concern: valuations high in both stock and bond markets, profit margins under pressure, poor market breadth especially for the Nasdaq Composite and a Fed taking a hugely hawkish pivot," says Gene Goldman, chief investment officer of Cetera Investment Management. "The markets need a healthy pullback/correction and are giving back the gains from Wednesday's post-FOMC reaction."

The Dow Jones Industrial Average was the biggest loser on a day that saw several swings, shedding 532 points, or 1.5%, to 35,365, on sharp losses for Goldman Sachs (GS, -3.9%) and Home Depot (HD, -2.9%).

The S&P 500 Index's 1.0% decline to 4,620 wasn't as deep, while the Nasdaq Composite managed to escape with a marginal loss to 15,169.

Other news in the stock market today:

- The small-cap Russell 2000 jumped 1.0% to 2,173.

- U.S. crude oil futures also secured a weekly loss, dropping 2.1% Friday to $70.86 per barrel, which was good for a five-day loss of 1.1%.

- Gold futures, on the other hand, were up 1.1% on the week. Contracts for February climbed 0.4% on Friday to $1,804.90 per ounce.

- FedEx (FDX, +5.0%) shares were one of the day’s few bright spots, jumping on the back of healthy fiscal Q2 earnings report. The company announced revenues of $23.5 billion and adjusted earnings of $4.83 per share, both of which easily topped Wall Street expectations. Also of particular interest were operating margins, which came to 7.1% to beat out estimates for 6.7%. (Remember: FDX shares were clobbered last quarter after warning on margins.) FedEx also raised guidance for full-year earnings and announced a $5 billion share repurchase program.

- Rivian (RIVN, -10.3%) shares are now trading at their lowest point since the electric vehicle maker’s initial public offering in early November, following the company’s first earnings report as a publicly traded company. Rivian announced a mere $1 million in revenues for its most recent quarter. While that still was above the consensus view, earnings missed by a mile, with a $12.21-per-share loss coming in far deeper than the $1.33 in expected red ink. Rivian also said that 2021 production is likely to miss its target for 1,200 vehicles.

- Bitcoin was off 3.6% to $46,177.41. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

Is Defense the Name of the Game?

Stocks are on increasingly shaky ground as we head into 2022.

The major benchmarks all posted notable weekly losses: The Dow shed 1.7%, the S&P 500 lost 1.9% and the Nasdaq gave back 2.9%.

"Investors around the world are showing their concern over central bank policy after this week's Federal Open Market Committee and Bank of England developments," says Dan Wantrobski, technical strategist and associate director of research at Janney Montgomery Scott. "Technical studies indicate that the U.S. markets are still vulnerable to volatility, even after the recent correction that occurred in November."

The name of the game for some, then, might be defense. We've recently highlighted our picks in Wall Street's traditional equity safety zones – utilities, real estate investment trusts (REITs) and consumer staples stocks – but don't forget to look to the bond market for cover.

The market's best bond funds can help cushion the blow of broad-market pullbacks. Yes, the fixed-income market looks primed to face many of the same challenges as its equity counterpart in 2022, but these seven bond funds – spanning a variety of different categories – look better positioned than most to help investors protect their portfolio in the year ahead.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market Today

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market TodayTaiwan Semiconductor's strong earnings sparked a rally in tech stocks on Thursday, while Goldman Sachs' earnings boosted financials.

-

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market Today

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market TodayThe S&P 500 rallied but failed to turn the "Santa Claus Rally" indicator positive for 2026.