Stock Market Today: Dow Up 6 Straight Days, S&P Sets Another Record

The S&P 500 eked out yet another all-time high Wednesday amid otherwise calm trading in 2021's final week.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The "Santa Claus rally" was back on Wednesday, albeit with little conviction and limited breadth.

Another tame day for the broader indexes shifted the spotlight to individual equities, and interestingly, two very different companies' price moves were tethered to South Korean tech giant Samsung.

Biogen (BIIB, +9.5%) shares popped after the Korean Economic Daily, citing investment banking sources, reported that Samsung is in talks to buy the biotechnology firm for $42 billion – which would be its largest-ever transaction.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also Wednesday, computer-memory maker Micron (MU, +3.5%) enjoyed a decent stock pop after reports that a COVID outbreak in a Chinese factory had forced Samsung – a major rival – to throttle back some production.

The broader market continues to be driven by cautious optimism that the omicron COVID variant's effect on equities will ultimately be modest.

"Viruses tend to get more contagious and less deadly as they evolve; we believe this is happening to the COVID virus," says Paul Zemsky, chief investment officer of multi-asset strategies and solutions at Voya Investment Management. "Markets have determined that Omicron won't have a long-lasting, negative impact on the economy, and therefore won't cause a big sell-off."

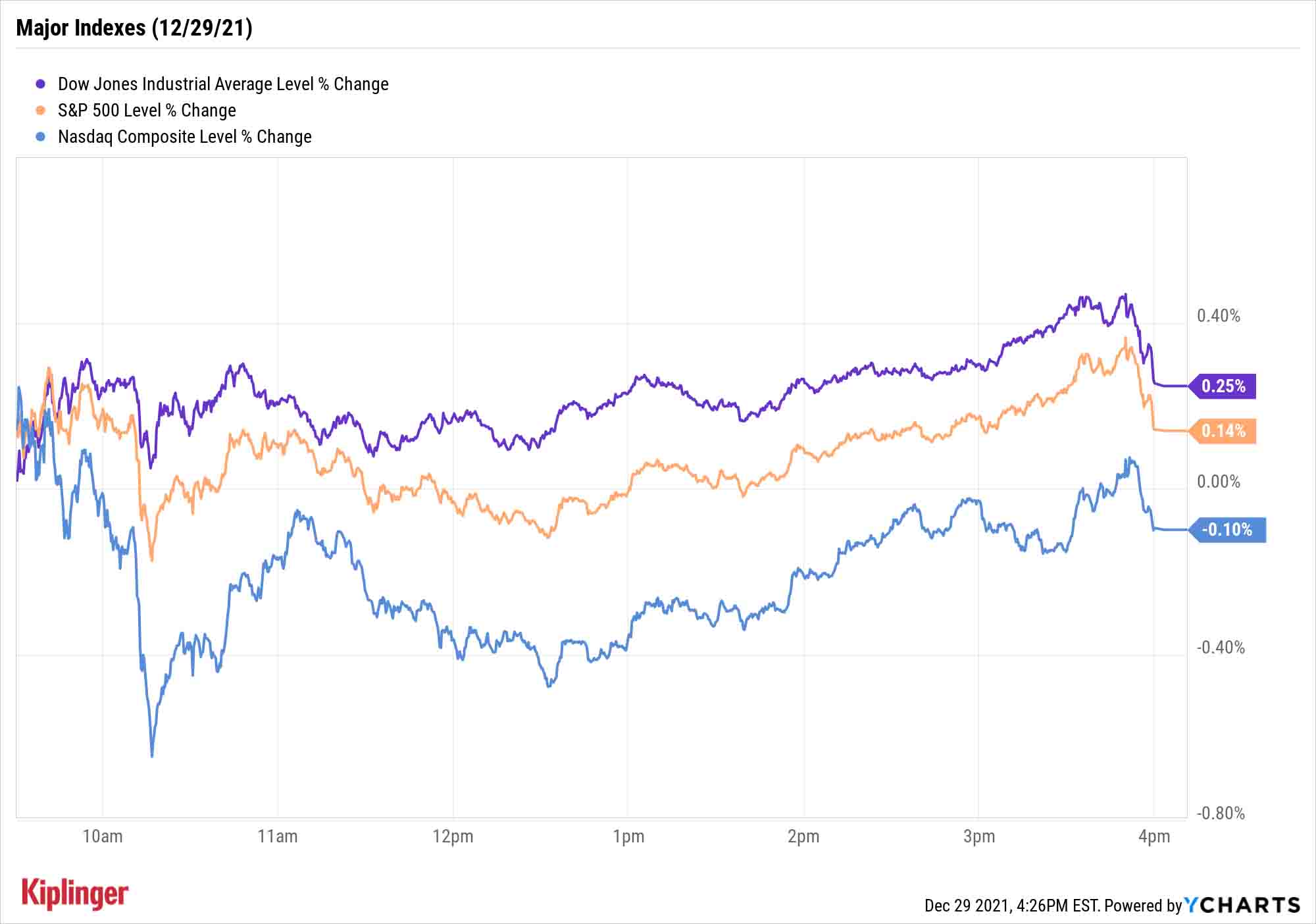

The S&P 500 (+0.1% to 4,793) managed to scratch out its 70th consecutive new high of the year, while the Dow Jones Industrial Average (+0.3% to 36,488) extended its win streak to six sessions. However, the Nasdaq Composite (-0.1% to 15,766) slid for the second straight day.

Other news in the stock market today:

- The small-cap Russell 2000 managed a 0.1% gain to 2,249.

- U.S. crude oil futures rose after Energy Information Administration data showed a slump in U.S. crude inventories, finishing up 0.8% to $76.56 per barrel.

- Gold futures declined by 0.3% to $1,805.80 per ounce.

- Bitcoin was off by just less than 1.0% to $47,361.89. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

The Pros' Top Picks for 2022

2022 will be chock full of attractive investment opportunities, but metaphorically speaking, you might do better with a squirt gun than with a water balloon.

Morgan Stanley is among the more bearish outfits with regards to 2022, saying that "with financial conditions tightening and earnings growth slowing, the 12-month risk/reward for the broad indices looks unattractive at current prices." But they add that "strong nominal GDP growth should continue to provide plenty of good investment opportunities at the stock level for active managers."

We at Kiplinger have already weighed in plenty over the past few months, offering up our best stock ideas for 2022, as well as a long list of value plays for what many predict will be a value-friendly environment. So today, we'll share with you what Wall Street's pros have to say.

Our list of the pros' 22 top stocks to invest in for 2022 is a diverse group of holdings covering most of the 11 sectors – understandable given that analysts aren't exactly unanimous about where the market's gains will come from. Each of these picks enjoys a Strong Buy consensus rating among the covering analysts who have sounded off on these stocks over the past three months.

Check out the link above to discover what these high-conviction picks are, and what about them has Wall Street so excited.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.