Stock Market Today: Stocks Meander Lower in 2021's Penultimate Session

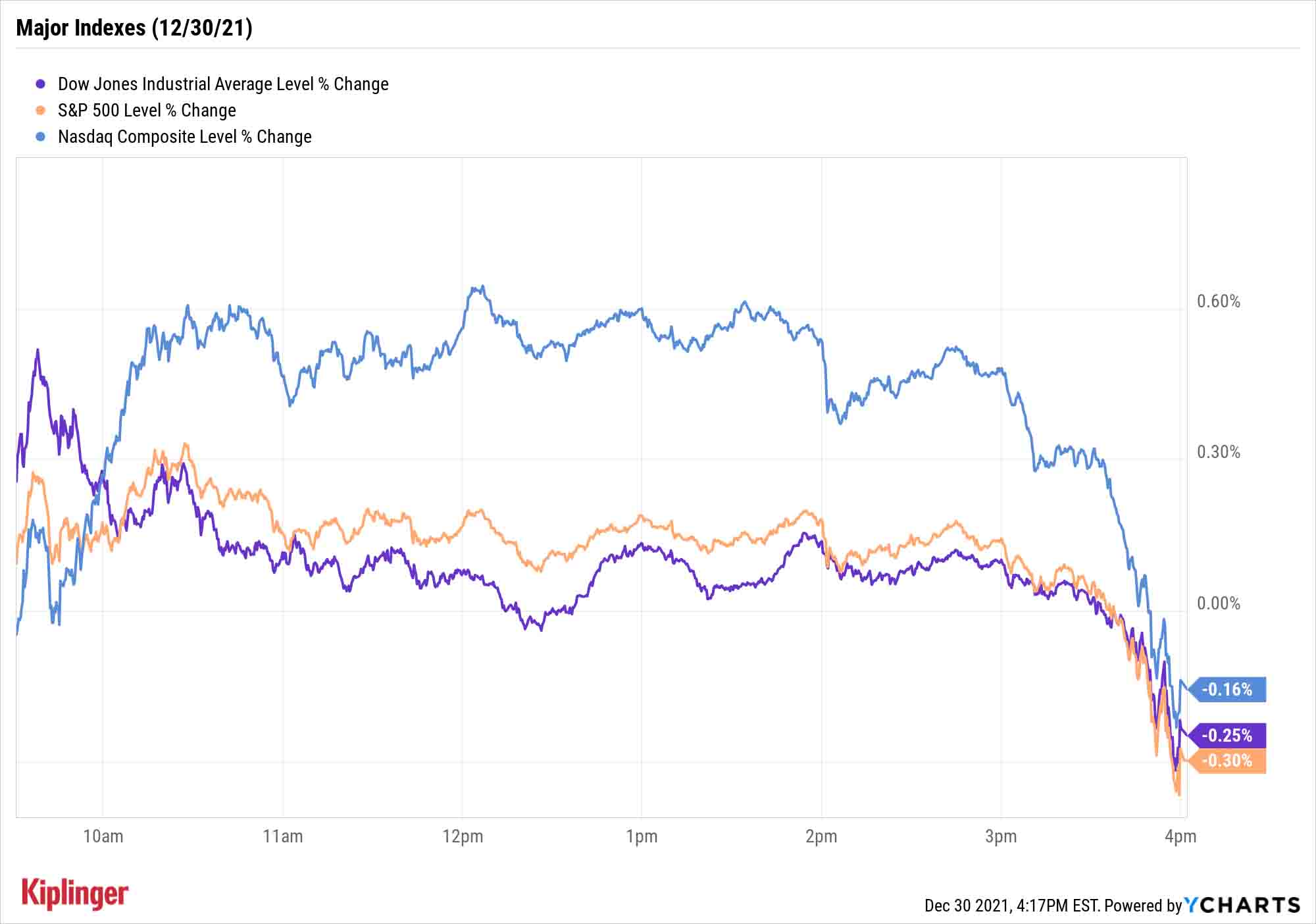

The S&P 500 and Dow, both eying more record-high territory for most of Thursday, retreated in the session's final minutes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The path of least resistance for American equities appeared to be higher for most of a slow-news, low-volume Thursday trading session, but an afternoon swoon resulted in modest losses for the major indexes.

The U.S. on Wednesday set a single-day record of 488,000 new COVID cases, according to the New York Times – a figure suspected to be undercounting the number of actual cases given the rise in at-home tests and the number of asymptomatic cases that have gone undetected.

Wall Street, however, is keeping a stiff upper lip.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Despite global surges in COVID cases, the markets are reflecting the new reality that COVID is here to stay, albeit more on our terms than its," says Kevin Philip, managing director at Bel Air Investment Advisors. "With vaccines, boosters, treatments, and rising herd immunity, it seems more and more like a manageable virus in line with colds and flus than what it originally was."

A Centers for Disease Control and Prevention recommendation that Americans of all vaccination statuses should avoid embarking upon cruises did manage to dent that industry, though. Norwegian Cruise Line (NCLH, -2.6%), Carnival (CCL, -1.3%) and Royal Caribbean (RCL, -1.1%) all finished in the red.

The Dow Jones Industrial Average (-0.3% to 36,398) and S&P 500 (-0.3% to 4,778), poised for most of the day to set new highs, closed slightly lower, as did the Nasdaq Composite, which declined 0.2% to 15,741.

And a reminder: We've got one more day of trading together in 2021, as the stock market is open for New Year's Eve.

Other news in the stock market today:

- The small-cap Russell 2000 just barely slipped into negative territory, suffering a marginal decline to 2,248.

- U.S. crude oil futures kept on climbing for the seventh consecutive session, adding 0.6% to $76.99 per barrel.

- Gold futures recorded a modest 0.5% improvement to $1,1814.10 per ounce.

- Bitcoin prices mirrored the major indexes, declining a slight 0.3% to $47,200.00. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- So about that Biogen (BIIB) gain yesterday ... The biotechnology company soared by more than 9% on Wednesday in the wake of reports that South Korean tech conglomerate Samsung was in talks to buy it. However, BIIB shares dropped 7.1% on Thursday after Samsung denied that it was in any discussions with Biogen.

- Virgin Galactic (SPCE, +6.1%) jumped on Thursday amid the public-markets debut of its satellite-launching spinoff, Virgin Orbit (VORB). The company went public via special-purpose acquisition company (SPAC) NextGen Acquisition Corp. II, and didn't receive much of a warm reception, declining 1.2%.

A Little Advice for New Investors (And Seasoned Ones, Too.)

We're about to enter 2022 with many more investors among our ranks than we started with in 2020 and even 2021. The past two years have seen millions of fresh faces open up brokerages, IRAs and 401(k)s amid 2020's dip-buying opportunities and a sudden realization of the wealth investing can build.

Welcome, to those of you who have joined the investing world … and brace yourselves.

"Those who began investing in the post-COVID environment have only seen an investing climate that was bolstered by unprecedented monetary and fiscal stimuli," says Interactive Brokers Chief Strategist Steve Sosnick, who expects more volatility in 2022 than we've seen since the end of the COVID bear market. "It is said that placid seas make lousy sailors, and these new investors have only sailed through the calm seas with a steady tailwind at their back.

"Many will have to learn whether to adapt their strategies in a period that is likely to be less favorable to the speculative tactics that have worked for so many."

We couldn't agree more – indeed, even veteran retail investors can have difficulties ignoring volatility. So while articles highlighting stock opportunities and fund picks can have plenty of utility for newer investors, it's just as important to learn how to steel yourself mentally for the long haul.

That's why we've recently reached out to several financial professionals for their advice on how beginners can adopt the right mentality for successful investing. Check out their suggestions.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.