Stock Market Today: Stocks Slip on NYE, Still Deliver a Terrific 2021

2021's final session had little in the way of fireworks, but stocks nonetheless locked in a stellar year of gains.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Wall Street might have exited 2021 with a whimper, but most investors will look back kindly on a sterling year for stocks.

Friday's action was typical for New Year's Eve: Little news or data meant a low-volume, low-movement session in which just one sector (communication services, off 1.4%) finished with a move of more than 1% in either direction.

Pfizer (PFE, +1.1%) rose after the U.K. approved its Paxlovid COVID-19 antiviral treatment for those older than 18. PFE also got a boost from data published by the Centers for Disease Control and Prevention showing its coronavirus vaccine generated mostly mild side effects in children ages 5 to 11.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

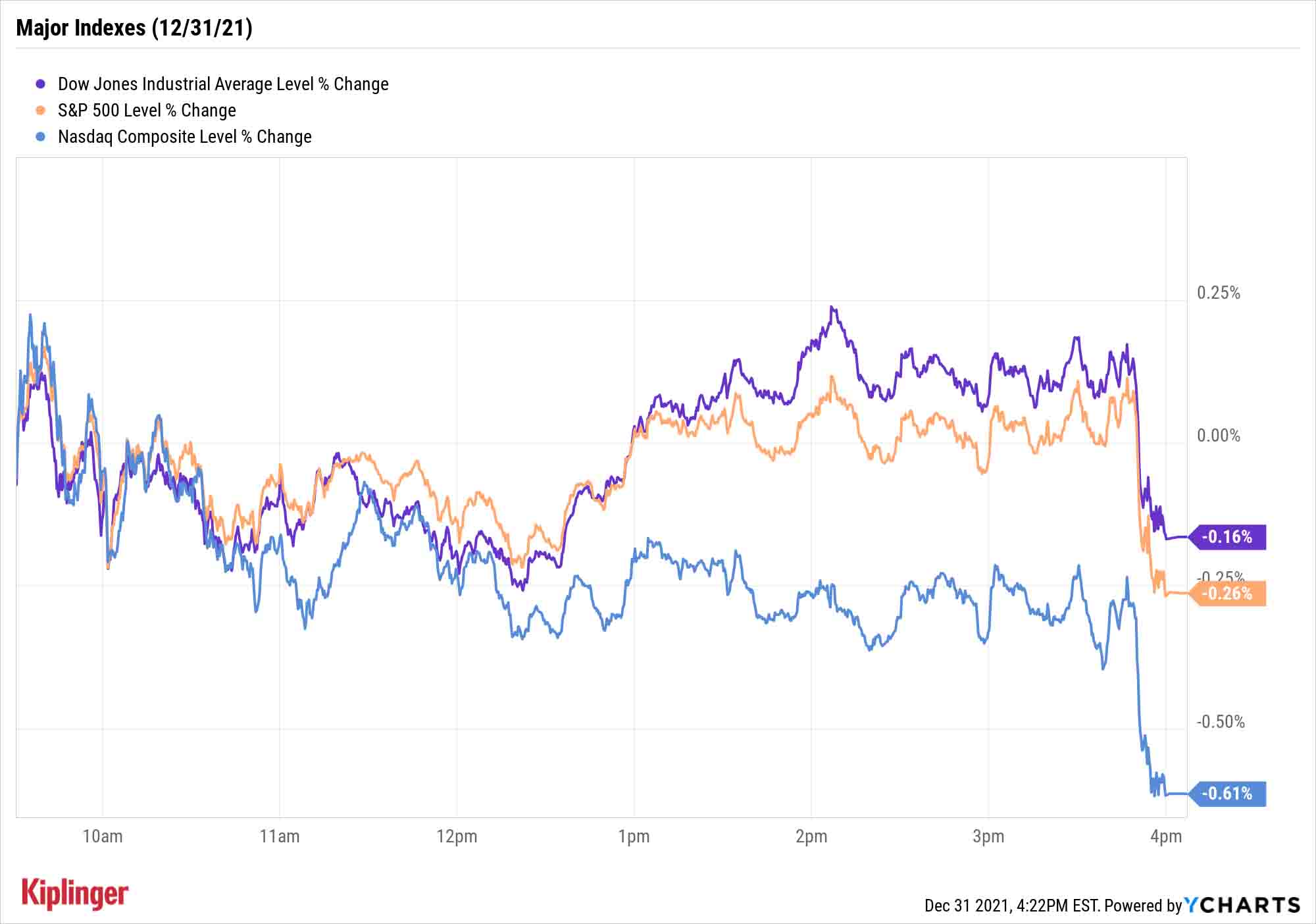

But broadly speaking, stocks merely went through the motions Friday, with a late-day swoon ensuring modest declines for the major indexes. The Dow Jones Industrial Average (-0.2% to 36,338), S&P 500 (-0.3% to 4,766) and Nasdaq Composite (-0.6% to 15,644) all closed in the red. So too did the small-cap Russell 2000, which was off 0.1% to 2,245.

Here's some better news: All of the major indexes enjoyed robust gains in 2021. For the year, the S&P 500 rose 26.9%, the Nasdaq added 21.4%, the DJIA increased 18.7% and the Russell 2000 closed up 13.7%.

We'll do it all over again in 2022, starting Monday, Jan. 3. Unlike other stock market holidays, New Year's Day is observed by Wall Street only if it falls on a weekday.

Other news in the stock market today:

- U.S. crude oil futures dropped sharply, by 2.3%, to $75.21 per barrel, but still closed out 2021 with returns of more than 55%.

- Gold futures posted a 0.8% gain to $1,828.60 per ounce on Friday, but finished the year with a 3.6% decline.

- Bitcoin prices stumbled into the finish, declining 2.8% to $45,879.97 on New Year's Eve. That said, Bitcoin gained more than 58% in 2021. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- A couple of the S&P 500's worst stocks came from the media industry, with Discovery (DISCA, -3.7%) and Viacom (VIAC, -3.0%) posting moderate losses on no news.

- Mohawk Industries (MHK, +2.4%) and Bio-Techne (TECH, +1.7%) were among the index's top stocks Friday.

Looking Back at a Phenomenal 2021

When 2022 arrives, we'll resume our examinations of the best investing opportunities for the new year. But for now, let's take a moment to celebrate the fruits of 2021.

"This year will go down as one of the best ever for the bulls," says Ryan Detrick, chief market strategist for LPL Financial. "The fact that 2021 had the second most all-time highs ever [at 70 for the S&P 500, only behind 1995's 77] probably tells the story better than nearly any other. The S&P 500 had only one 5% pullback all year, and that was during the Evergrande worries in September/October."

Detrick adds that every single month of 2021 included a new all-time high – only the second time that's ever happened, with the first coming in 2014 – and that the current bull market has doubled faster than any other.

As for individual stocks, more than two-thirds of the Dow finished 2021 in positive territory. Our look at the industrial average's best and worst components shows that the top performers finished the year with gains of more than 50%.

And yet as stunning as those returns might be, they're nowhere close to those generated by the best-performing stocks of the much broader Russell 1000, which encompasses the market's 1,000 largest stocks. The 25 best bets recorded gains of at least 93% in 2021. Most of the names at least doubled, while shareholders in 2021's market leader enjoyed eye-popping returns of more than 700%.

Read on as we look at the 25 best-performing stocks of 2021.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.