Stock Market Today: Apple Leads Sweet Start for Stocks in 2022

Apple became the first company to reach $3 trillion in market value Monday, helping to lift the Dow and S&P 500 to new closing highs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Good luck finding fault with how Wall Street kicked off the new year.

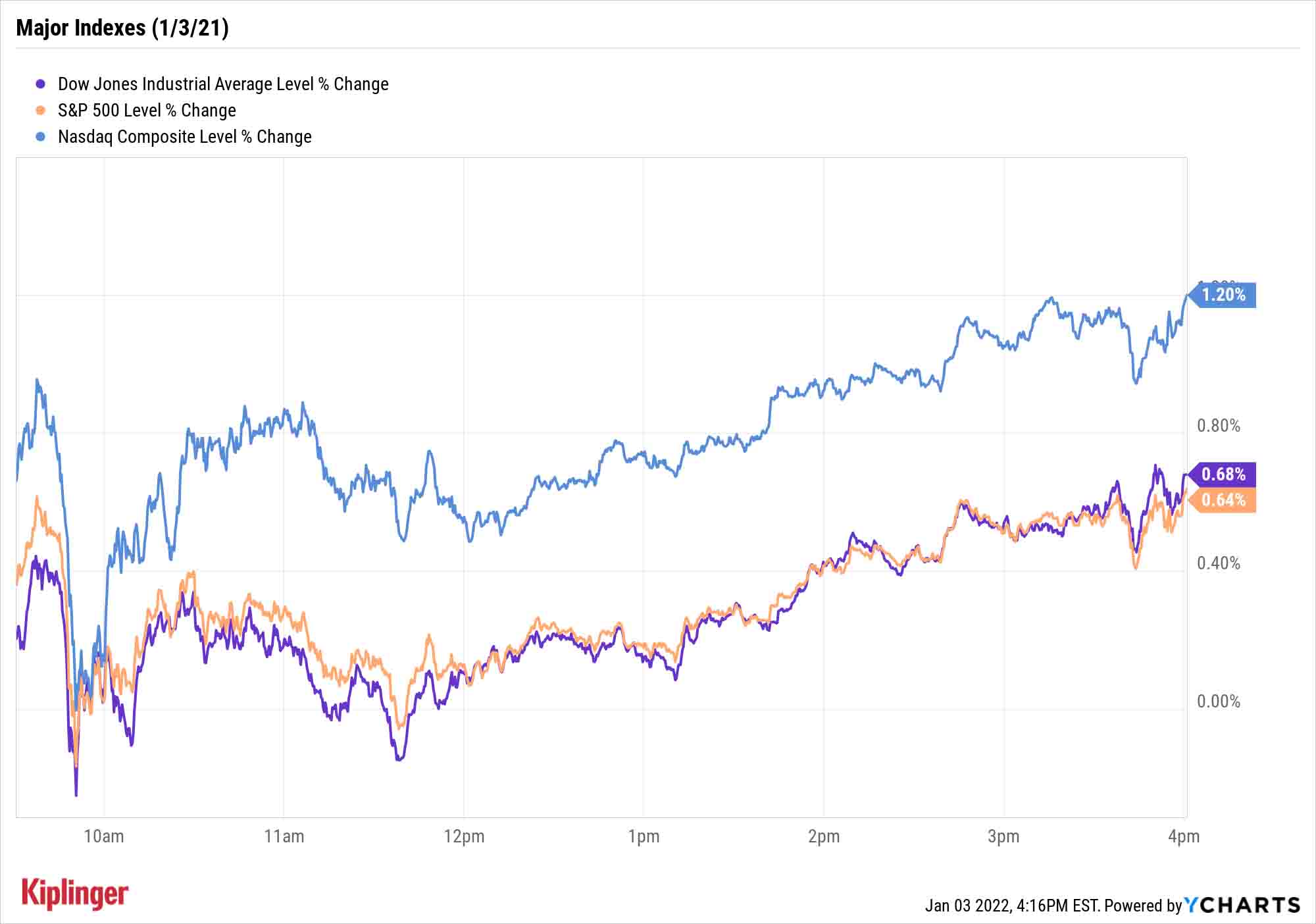

The major indexes all closed out Monday with gains (including fresh closing highs for the Dow and S&P 500) and Wall Street crowned its first $3 trillion-dollar company (albeit briefly).

About the latter: Apple (AAPL) – which became the first company to reach $1 trillion in market capitalization in 2018, then two years later staked the first flag into the $2 trillion mark – momentarily peeked its head above $3 trillion in Monday's session on the back of another bullish note from Wedbush analyst Daniel Ives.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The Street is starting to better appreciate the robust fundamental story for Cook & Co. over the next year," says Ives, who believes high demand will bolster the company's March and June quarters. "Hitting $3 trillion will be another watershed moment for Apple as the company continues to prove the doubters wrong with the renaissance of growth story playing out in Cupertino."

Ives adds that iPhone 13 checks continue to be "much stronger than expected," and that the company believes AAPL sold more than 40 million iPhones during the holiday season, which would mark a record for Apple despite facing chip shortages.

AAPL closed just below the $3 trillion mark, but its 2.5% gain nonetheless helped to lift the major indexes into the green.

The Dow Jones Industrial Average improved by 0.7% to set a new record close of 36,585, while the S&P 500 climbed 0.6% to hit a record-high 4,796. The Nasdaq Composite was the biggest advancer, however, up 1.2% to 15,832. The small-cap Russell 2000 mimicked its larger brethren, climbing 1.2% to 2,272 to kick off the new year.

Other news in the stock market today:

- U.S. crude oil futures enjoyed a nice 1.2% improvement to settle at $76.08 per barrel. That helped energy finish among the market's top sectors, with gains coming from the likes of Schlumberger (SLB, +5.9%) and Exxon Mobil (XOM, +3.8%).

- Gold futures did not participate in the market's larger gains, sliding 1.6% to a two-week low of $1,800.10 per ounce.

- Bitcoin marginally improved since New Year's Eve, to $45,910.34. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Tesla (TSLA) was one of the major drivers of the Nasdaq, up 13.5% to start the new year. The company announced over the weekend that it delivered 308,600 vehicles during the fourth quarter of 2021, beating expectations for 267,000. More over, its full-year tally of 936,172 deliveries (up 87% year-over-year) topped estimates for 897,000.

What Does 2022 Have in Store for Tech?

Apple wasn't the only sector winner in what was a productive day for technology shares. Chipmakers Intel (INTC, +3.3%) and Advanced Micro Devices (AMD, +4.4%), as well as fintech firm Fiserv (FISV, +3.7%), were among other stocks moving the needle Monday.

It's a great start for a sector that both offers high hopes, but faces several hurdles in 2022.

"When we asked our teams what keeps them up at night about their outlooks, our analysts expressed concerns about increasing interest rates and the impact on valuation, regulation, execution risks, spending cycles and competition," say RBC Capital Markets strategists in their 2022 look-ahead.

Nonetheless, "Tech ranks the best among all sectors on our quality metrics, ranking at or near the top for all factors that we evaluated."

Thus, while investors can try to access technology through targeted funds like a few of our best ETFs for 2022, some might be better off trying to identify individual opportunities for the year to come.

You can start your search with our 12 best tech stocks of 2022, which includes everything from recent initial public offerings to technology mega-caps that have been household names for decades.

Kyle Woodley was long AMD as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.