Stock Market Today: Stocks Hang On to Gains After Scorching Inflation Update

The Labor Department's latest report showed consumer prices hit a nearly 40-year high in December.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Inflation was the story of the day on Wall Street, and the latest numbers sparked another choppy session for stocks.

Kiplinger staff economist David Payne previously forecast that inflation would likely end 2021 around a 40-year high, which turned out to be the case.

The Labor Department this morning said its consumer price index – which measures what consumers are paying for goods and services – surged 7% year-over-year in December, marking the fastest annual rise since 1982. Core CPI, which excludes the volatile food and energy sectors, notched an annual increase of 5.5%, which was its highest pace in 30 years.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Barry Gilbert, asset allocation strategist at LPL Financial, called the headline inflation number "eye-popping … but largely expected."

Gilbert added that the numbers are unlikely to shake the Federal Reserve's plan to start hiking interest rates, and that those could start as early as March.

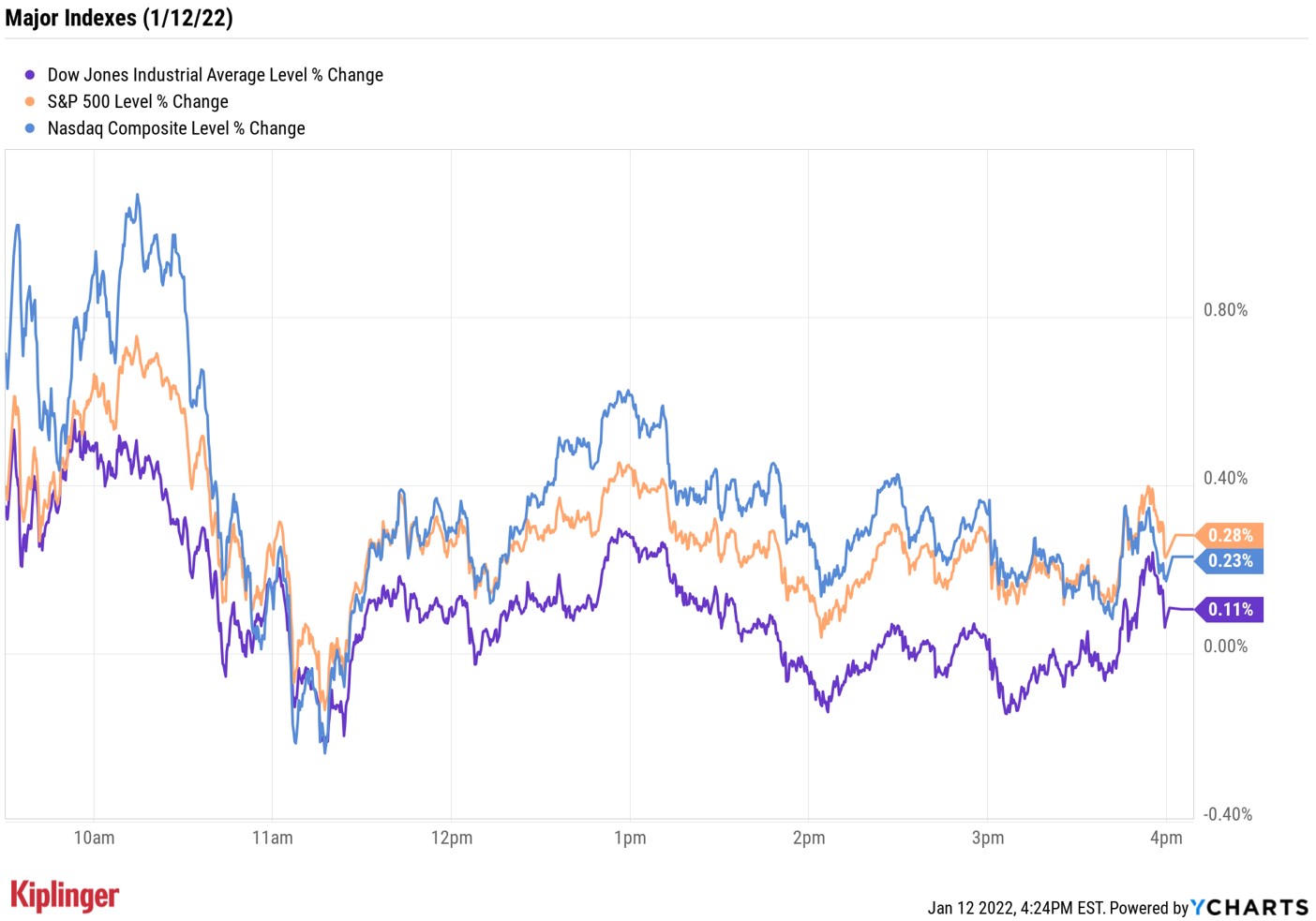

Investors shrugged off the news, with markets jumping out of the gate. However, the buying trend lost steam as the day wore on, with the major benchmarks finishing well off their session peaks.

The Nasdaq Composite, which was up 1% at its intraday high, settled with a more modest 0.2% gain at 15,188 – its third straight win. The S&P 500 Index and Dow Jones Industrial Average also pared their earlier gains, ending up 0.3% at 4,726 and 0.1% at 36,290, respectively.

Other news in the stock market today:

- The small-cap Russell 2000 fell 0.8% to end at 2,176.

- U.S. crude oil futures settled sharply higher, up 1.8% to $82.64 per ounce, after the Energy Information Administration reported a 4.6 million-barrel decline in crude stocks for the week ended Jan. 7. Total supplies of 413.3 million barrels reached a low point last seen in 2018.

- The CPI report was good news for gold futures, which set another year-to-date high, settling up 0.5% to $1,827.30 per ounce.

- Bitcoin jumped 2.9% to $43,845.91. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Tesla (TSLA, +3.9%) enjoyed a robust day of gains in the wake of a few recent upgrades. Goldman Sachs' Mark Delaney called Tesla a "Best Idea" in electric vehicles and hiked his price target to $1,200 from $1,125 previously, citing bullishness on EV adoption broadly. Morgan Stanley's Adam Jonas, who upped his price target to $1,300 from $1,200, compares the EV race to a marathon: "Tesla is in the lead at mile number 21. Everybody else is at mile 2 or still tying their shoes," he says.

- PayPal (PYPL, -2.3%) retreated after a Jefferies downgrade. Analyst Trevor Williams, in exploring the payments space, reiterated positive opinions on Visa (V, +0.6%), Mastercard (MA, +0.3%) and Block (SQ, -2.0%). However, he says that his firm is being more selective about the industry in 2022, and PayPal (Hold) doesn't quite make the cut. "With our expectation for growth to remain sub-20% year-over-year through at least [the second quarter of 2022], we do not see a positive catalyst in the near term," Williams says. "And with valuation still roughly five times above pre-COVID averages, we see little room for expansion.”

Where to Find Yield

Today's muted market reaction to sky-high inflation numbers was likely a sign of relief for many investors who have seen their portfolios take a hit during the recent selling.

And there are certainly plenty of uncertainties still lingering for investors, including when price pressures will start to ease and when the Fed will start raising rates.

This could well create additional volatility in markets, as plenty of experts have warned, and finding space in your portfolio for defensive stocks or income-producing assets could help cushion any potential blows.

"With inflation seemingly likely to hang around," says Simeon Hyman, head of investment strategy at ProShares, "a growing income stream can be especially useful." This is especially true as market valuations remain elevated, he adds. "Against this backdrop, high-quality dividend growth stocks with strong fundamentals like consistent growth of earnings and dividends may take on added importance this year."

Hyman points to the Dividend Aristocrats – companies who have raised their dividend payments annually for the last 25 years – as one area where investors may find yield. Real estate investment trusts (REITs) and healthcare stocks are also dependable income payers.

But you can also consider diversifying your portfolio with closed-end funds (CEFs). These high-yielding funds can offer investors certain advantages compared to their mutual-fund cousins – including the ability to buy the underlying stocks and bonds at a discount. Read on as we take a look at the 10 best CEFs for 2022.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.