Stock Market Today: Stocks Resume Slide on Busy News Day

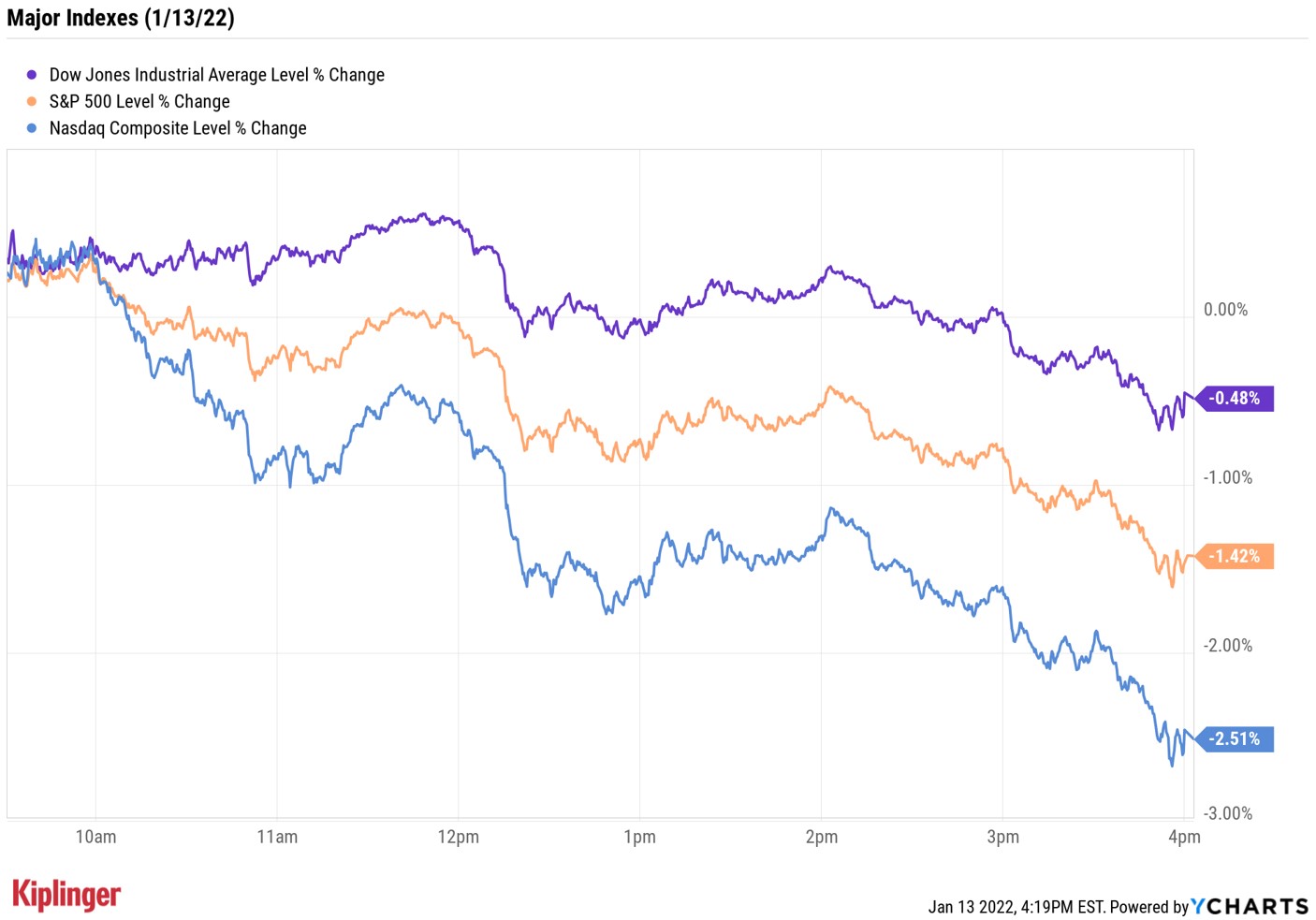

The major benchmarks started the day in positive territory, but were bathed in red ink by the close.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Choppy trading continued on Wall Street as investors balanced good news, bad news headlines.

On the economic front, weekly jobless claims edged up a seasonally adjusted 230,000 last week – more than economists were expecting – though the four-week moving average remained near a record low.

The Labor Department also said that December's producer price index – which measures how much suppliers are charging businesses for goods – was up 9.7% annually and 0.2% sequentially. While the former was the highest annual increase since the year-over-year data were first tracked in 2010, the latter marked the slowest month-over-month rise since November 2020.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Investors also got their first look at the fourth-quarter earnings season, which kicks off in earnest tomorrow morning when several big banks report.

This morning, though, Delta Air Lines (DAL, +2.1%) reported a larger-than-anticipated adjusted profit for its fourth quarter and its highest quarterly revenue since the pandemic began. However, for the current quarter, CEO Ed Bastian warned the omicron variant of COVID-19 "is expected to temporarily delay the demand recovery" into February.

By the close, markets had erased earlier gains to end solidly in the red. The Nasdaq Composite suffered the worst, shedding 2.5% to 14,806. The S&P 500 Index lost 1.4% to 4,659 and the Dow Jones Industrial Average gave back 0.5% to 36,113.

Other news in the stock market today:

- The small-cap Russell 2000 dropped 0.8% to 2,159.

- A day after reporting low crude oil inventories, the Energy Information Administration said gasoline supplies had risen by 8 million barrels, much more than expected. That sent U.S. crude oil futures 0.6% lower to $82.12 per barrel.

- Gold futures snapped a four-day win streak, declining 0.3% to $1,821.40 per ounce.

- Bitcoin wasn't immune to the selling, giving back 2.4% to $42,803.79. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Large-cap technology and tech-esque stocks were among the worst performers of the day. Among notable decliners were ServiceNow (NOW, -9.1%), Tesla (TSLA, -6.8%), Nvidia (NVDA, -5.1%), Microsoft (MSFT, -4.2%), Salesforce.com (CRM, -3.9%), Netflix (NFLX, -3.4%) and Broadcom (AVGO, -4.0%).

- KB Home (KBH, +16.5%) rocketed higher Thursday as Street-beating profits more than overshadowed a miss in revenues. KBH reported fourth-quarter sales growth of 40% year-over-year to $1.68 billion, which was slightly less than estimates for $1.71 billion. That said, profits of $1.91 per share easily topped expectations for $1.76 per share, thanks in large part to a 9% pop in average selling price, to $451,000. "We expect strong demand in 2022 as KBH's pricing power is able to pass on higher costs to higher prices with limited supply," says CFRA analyst Kenneth Leon, who reiterated his Buy rating on KBH shares and raised his price target to $59 per share from $49 previously.

Bumps Equal Opportunities for Investors

Now is the time for conviction. That's according to Scott Wren, senior global market strategist at Wells Fargo Investment Institute.

As we enter the part of the economic cycle where the Federal Reserve is beginning to normalize its policy after years of providing support and concerns over growth begin to emerge, it's understandable if investors feel unnerved.

"Investors need to go through a mental adjustment process and realize that the road ahead is likely to feature a few more bumps than the one traveled over the past 20 months," he says. But bumps, Wren adds, also offer opportunities.

We at Kiplinger have been busy compiling plenty of potential investing ideas for the new year – including the top financial stocks and the best tech names.

We've also highlighted numerous high-conviction picks from the analyst community; most recently, breaking down RBC Capital Markets' top 30 global stock investments for 2022. Despite the numerous hurdles investors are facing in the new year, industry analysts are "generally confident" these picks can clear them. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled, though, as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled, though, as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.